Market brief 25/03/2022

VIETNAM STOCK MARKET

1,498.50

1D 0.02%

YTD 0.01%

1,498.36

1D 0.06%

YTD -2.43%

461.75

1D -0.23%

YTD -2.58%

117.00

1D -0.23%

YTD 3.83%

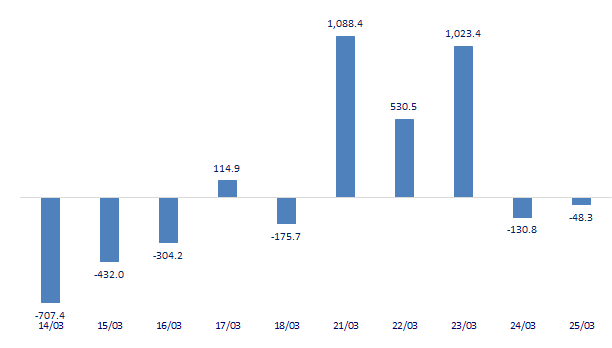

-48.27

1D 0.00%

YTD 0.00%

30,244.76

1D -0.71%

YTD -2.66%

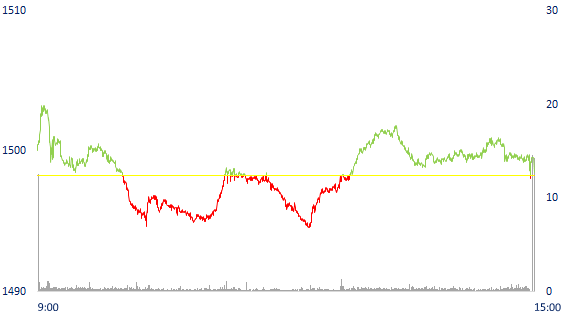

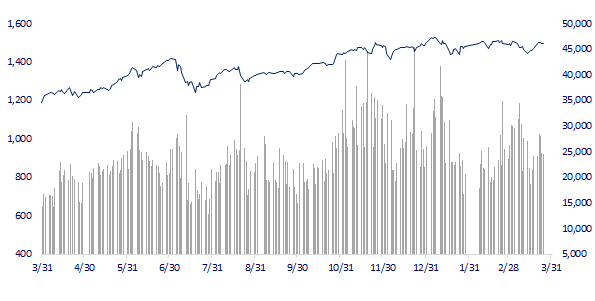

Textile and retail stocks raced to break out, VN-Index gained slightly. Market liquidity decreased slightly compared to the previous session. The total matched value reached 27,759 billion dong, down 2.4%, of which, the matched value on HoSE alone decreased 4% to 22,665 billion dong. Foreign investors net sold slightly more than 48 billion dong on HoSE.

ETF & DERIVATIVES

25,180

1D 0.12%

YTD -2.52%

17,600

1D 0.11%

YTD -2.71%

18,460

1D 3.65%

YTD -2.84%

22,100

1D -0.50%

YTD -3.49%

21,810

1D -1.31%

YTD -2.98%

29,000

1D 1.22%

YTD 3.39%

19,900

1D 0.00%

YTD -7.36%

1,491

1D 0.36%

YTD 0.00%

1,489

1D -0.06%

YTD 0.00%

1,472

1D 0.00%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

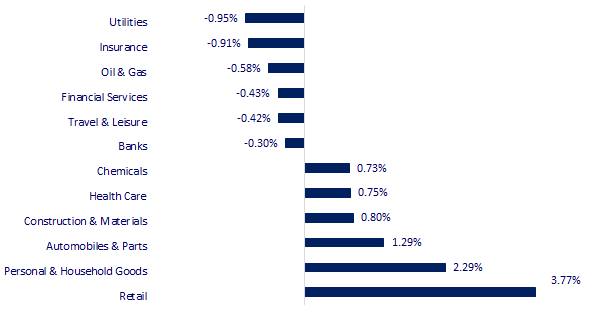

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,149.84

1D 0.10%

YTD -2.23%

3,212.24

1D -1.17%

YTD -11.75%

2,729.98

1D 0.01%

YTD -8.32%

21,404.88

1D -2.10%

YTD -8.52%

3,413.69

1D 0.41%

YTD 9.28%

1,676.80

1D -0.24%

YTD 1.16%

111.17

1D -0.91%

YTD 45.32%

1,954.35

1D -0.41%

YTD 7.33%

Asian stocks, oil prices mixed. In Japan, the Nikkei 225 gained 0.1%. The data shows that the core consumer price index in March in Japan is the highest in two years, according to Reuters. The Chinese market fell with Shanghai Composite up 1.17%, Shenzhen Component down 1.89%. Hong Kong's Hang Seng fell 2.1%. South Korea's Kospi index rose 0.012%.

VIETNAM ECONOMY

2.18%

1D (bps) -1

YTD (bps) 137

5.60%

1.88%

1D (bps) 1

YTD (bps) 87

2.38%

1D (bps) -3

YTD (bps) 38

23,085

1D (%) 0.33%

YTD (%) 0.63%

25,601

1D (%) -1.35%

YTD (%) -3.28%

3,664

1D (%) 0.00%

YTD (%) 0.16%

By 2030, Vietnam will be a country with modern industry, belonging to the group of countries with high industrial competitiveness, supporting industries to meet 70% of domestic demand. Along with that, the Ministry of Industry and Trade also set a target, having at least 20 products with competitive advantages to build brands in the international arena and improve their position in the global value chain; the localization rate of industries reached over 45%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Businesses are worried about seaport fees

- State-owned enterprises contribute more than 29% of GDP

- Set the target of supporting industry to meet 70% of domestic demand

- The US plans to increase the supply of liquefied natural gas to the EU

- US sanctions Russia's $130 billion gold vault

- Russia considers selling oil and gas for bitcoin

VN30

BANK

82,500

1D -1.20%

5D -2.02%

Buy Vol. 2,255,700

Sell Vol. 1,685,200

43,450

1D 0.81%

5D -1.03%

Buy Vol. 3,631,100

Sell Vol. 3,650,000

32,200

1D -1.08%

5D -1.83%

Buy Vol. 9,617,600

Sell Vol. 9,673,500

49,250

1D -0.10%

5D 0.10%

Buy Vol. 5,740,700

Sell Vol. 6,382,800

36,750

1D 1.10%

5D 1.38%

Buy Vol. 16,419,400

Sell Vol. 15,153,100

31,800

1D -0.78%

5D -0.93%

Buy Vol. 12,049,400

Sell Vol. 15,209,000

27,950

1D -0.53%

5D 1.27%

Buy Vol. 3,929,500

Sell Vol. 5,407,700

39,900

1D -0.50%

5D 1.01%

Buy Vol. 3,174,800

Sell Vol. 4,432,500

33,650

1D 0.00%

5D 1.66%

Buy Vol. 25,426,900

Sell Vol. 24,144,400

32,700

1D -0.61%

5D -0.30%

Buy Vol. 5,426,000

Sell Vol. 6,127,300

One of the tasks given by the State Bank in the latest action plan is to increase charter capital from after-tax profits, after setting aside funds for the period 2021-2023 for three state-owned joint stock commercial banks, namely Vietcombank, VietinBank, and BIDV and from the state budget for Agribank.

REAL ESTATE

83,600

1D 0.97%

5D 8.43%

Buy Vol. 8,348,000

Sell Vol. 7,397,500

53,300

1D 0.38%

5D 4.51%

Buy Vol. 2,248,800

Sell Vol. 2,216,200

94,200

1D 0.32%

5D 10.82%

Buy Vol. 4,391,100

Sell Vol. 5,421,700

PDR: ACA decided to invest USD 30 million in PDR through an unsecured loan with the right to convert into common shares.

OIL & GAS

110,700

1D -1.42%

5D 1.65%

Buy Vol. 1,124,100

Sell Vol. 830,400

16,600

1D -1.19%

5D 3.11%

Buy Vol. 19,251,800

Sell Vol. 22,522,900

56,000

1D 0.00%

5D 0.18%

Buy Vol. 2,787,000

Sell Vol. 2,962,600

GAS: GAS lowered its after-tax profit target by 20% in 2022, to VND 7,039 billion and revenue was flat, more than VND 80,000 billion.

VINGROUP

81,000

1D 0.00%

5D 2.79%

Buy Vol. 3,193,400

Sell Vol. 4,464,600

75,900

1D 0.26%

5D 1.74%

Buy Vol. 4,429,500

Sell Vol. 4,706,900

32,700

1D -0.30%

5D -0.91%

Buy Vol. 3,277,800

Sell Vol. 5,391,100

VHM: proposed to finance detailed planning in the western area of Zone 2 - Central urban area of Vung Ang Economic Zone, Ky Trinh ward, Ky Anh town with a scale of more than 80 hectares.

FOOD & BEVERAGE

75,200

1D -0.53%

5D -1.05%

Buy Vol. 5,531,000

Sell Vol. 4,289,800

146,400

1D -0.14%

5D 7.10%

Buy Vol. 991,500

Sell Vol. 1,034,600

157,500

1D -0.19%

5D 3.96%

Buy Vol. 215,000

Sell Vol. 236,500

VNM: The dominant position in market share turned out to be an obstacle to Vinamilk's growth, not to mention the pressure of being chased from behind by competitors.

OTHERS

143,000

1D -0.69%

5D -3.51%

Buy Vol. 964,300

Sell Vol. 1,112,100

143,000

1D -0.69%

5D -3.51%

Buy Vol. 964,300

Sell Vol. 1,112,100

95,700

1D -0.31%

5D 0.63%

Buy Vol. 1,971,000

Sell Vol. 2,642,100

138,900

1D 3.66%

5D 5.55%

Buy Vol. 6,028,900

Sell Vol. 6,148,600

108,200

1D 1.12%

5D 4.54%

Buy Vol. 1,188,500

Sell Vol. 1,671,300

34,700

1D -0.57%

5D 2.06%

Buy Vol. 2,648,600

Sell Vol. 2,604,400

43,450

1D -0.80%

5D -0.80%

Buy Vol. 12,861,200

Sell Vol. 12,604,600

46,400

1D 0.00%

5D -0.22%

Buy Vol. 26,096,100

Sell Vol. 27,856,300

MWG: set a target of net revenue of 2022 of VND 140,000 billion and profit after tax of VND 6,350 billion, up 14% and 30% respectively compared to the previous year. This is the highest goal ever of MWG.

Market by numbers

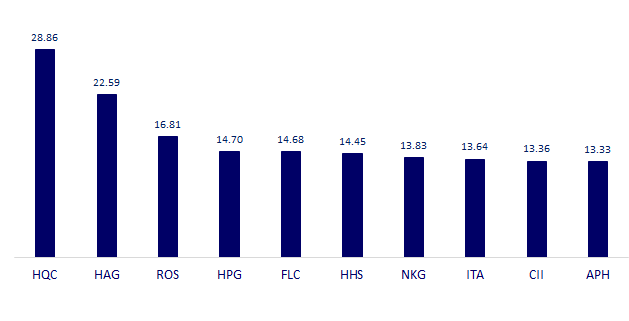

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

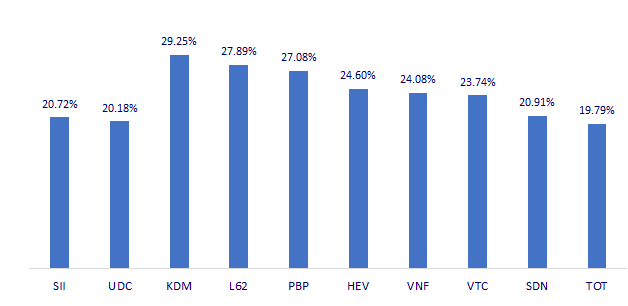

TOP INCREASES 3 CONSECUTIVE SESSIONS

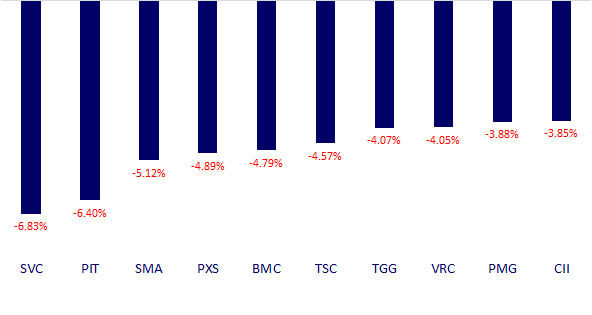

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.