Market brief 28/03/2022

VIETNAM STOCK MARKET

1,483.18

1D -1.02%

YTD -1.01%

1,484.16

1D -0.95%

YTD -3.36%

454.89

1D -1.49%

YTD -4.03%

116.01

1D -0.85%

YTD 2.96%

-81.72

1D 0.00%

YTD 0.00%

39,709.40

1D 31.29%

YTD 27.80%

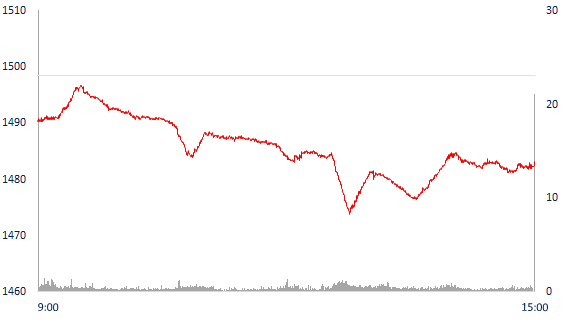

A series of speculative stocks plunged, VN-Index fell over 15 points. Market liquidity remained at a high level with a total matched value of 19,883 billion dong, up 29%, of which, matched value on HoSE alone increased by 32% to 16,421 billion dong. Foreign investors net bought back 51 billion dong on HoSE.

ETF & DERIVATIVES

25,130

1D -0.20%

YTD -2.71%

17,450

1D -0.85%

YTD -3.54%

18,310

1D 2.81%

YTD -3.63%

22,100

1D 0.00%

YTD -3.49%

21,910

1D 0.46%

YTD -2.54%

29,100

1D 0.34%

YTD 3.74%

19,770

1D -0.65%

YTD -7.96%

1,477

1D -0.93%

YTD 0.00%

1,476

1D -0.87%

YTD 0.00%

1,472

1D 0.00%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

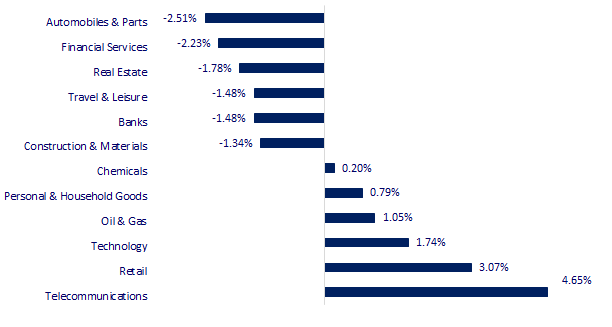

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

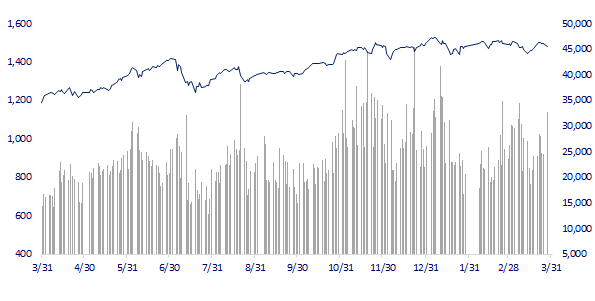

VNINDEX (12M)

GLOBAL MARKET

27,943.89

1D -0.10%

YTD -2.94%

3,214.50

1D 0.07%

YTD -11.68%

2,729.56

1D -0.02%

YTD -8.33%

21,684.97

1D 1.72%

YTD -7.32%

3,413.69

1D 0.00%

YTD 9.28%

1,684.30

1D 0.45%

YTD 1.61%

108.44

1D -1.89%

YTD 41.75%

1,930.40

1D -0.79%

YTD 6.02%

Asian stocks were mixed, oil prices plunged nearly 3%. In Japan, the Nikkei 225 fell 0.1%. China's stock market rallied with the Shanghai Composite up 0.07%. Hong Kong's Hang Seng Index rose 1.72%. Data released late last week showed that China's industrial profits rose 5% in the first two months of this year compared with the same period a year ago.

VIETNAM ECONOMY

2.13%

1D (bps) -5

YTD (bps) 132

5.60%

1.90%

1D (bps) 2

YTD (bps) 89

2.43%

1D (bps) 5

YTD (bps) 43

23,100

1D (%) 0.41%

YTD (%) 0.70%

25,581

1D (%) -1.01%

YTD (%) -3.35%

3,663

1D (%) 0.03%

YTD (%) 0.14%

New data released by the State Bank of Vietnam shows that the total of payment of the whole economy increased by 2.59% in January, equivalent to an expansion of the money supply by VND 346,643 billion. This is nearly 3.8 times the size of the increased money supply in January 2021. In which, the amount of cash in circulation increased by more than 20%, equivalent to an expansion of 307,410 billion VND.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The amount of cash in the economy increased by more than 307,000 billion in just 1 month

- Hanoi spends nearly 2,000 billion VND for production recovery loans

- Proposal to delay tax payment for businesses and business households

- US companies are buying back shares in record volume

- Russia allied with India on currency to counter US sanctions

- Ukraine-Russia crisis causes oil trade to change direction

VN30

BANK

82,400

1D -0.12%

5D -2.94%

Buy Vol. 1,261,600

Sell Vol. 1,362,700

41,600

1D -4.26%

5D -5.02%

Buy Vol. 6,263,100

Sell Vol. 6,211,700

31,800

1D -1.24%

5D -3.20%

Buy Vol. 10,135,000

Sell Vol. 10,889,900

48,800

1D -0.91%

5D -1.31%

Buy Vol. 9,992,000

Sell Vol. 10,844,300

36,250

1D -1.36%

5D -1.49%

Buy Vol. 16,591,900

Sell Vol. 17,660,500

31,500

1D -0.94%

5D -2.17%

Buy Vol. 19,645,300

Sell Vol. 19,698,100

27,400

1D -1.97%

5D -3.18%

Buy Vol. 5,600,800

Sell Vol. 5,718,200

39,450

1D -1.13%

5D -1.13%

Buy Vol. 5,022,500

Sell Vol. 5,809,800

31,850

1D -5.35%

5D -3.78%

Buy Vol. 57,667,100

Sell Vol. 58,492,900

32,350

1D -1.07%

5D -1.82%

Buy Vol. 7,098,500

Sell Vol. 7,961,900

MBB: Management of MB Investment Fund (MB Capital) and Japan Asia Investment Fund MB Capital (JAMBF) registered to sell all nearly 8.74 million MIG shares of Military Insurance Corporation (MIC, HoSE:MIG) for portfolio structuring. In which, MB Capital registered to sell more than 4.23 million shares, ratio 2.96% and JAMBF registered to sell more than 4.5 million shares, rate 3.15%. The transaction is expected to be carried out by the method of agreement and order matching from March 25 to April 22. If the transaction is successful, both entities will no longer own any MIG shares.

REAL ESTATE

82,500

1D -1.32%

5D 0.12%

Buy Vol. 9,307,400

Sell Vol. 7,652,200

52,900

1D -0.75%

5D -0.75%

Buy Vol. 1,727,500

Sell Vol. 1,958,800

93,000

1D -1.27%

5D 2.31%

Buy Vol. 5,730,000

Sell Vol. 5,664,200

PDR: With a pre-tax profit target of VND3,635 billion, equivalent to an increase of 55% compared to the results in 2021, 2022 is the first year PDR surpasses the profit threshold of VND3,500 billion.

OIL & GAS

110,500

1D -0.18%

5D -3.07%

Buy Vol. 748,100

Sell Vol. 812,300

16,050

1D -3.31%

5D -0.93%

Buy Vol. 30,002,900

Sell Vol. 30,665,300

56,000

1D 0.00%

5D 0.00%

Buy Vol. 3,152,800

Sell Vol. 4,233,800

POW: POW was fined nearly 200 million VND due to delay in information disclosure and failure to ensure the structure of the Board of Directors

VINGROUP

80,500

1D -0.62%

5D -0.62%

Buy Vol. 3,569,300

Sell Vol. 5,019,600

74,900

1D -1.32%

5D -3.35%

Buy Vol. 5,863,500

Sell Vol. 5,574,400

32,000

1D -2.14%

5D -3.61%

Buy Vol. 5,536,000

Sell Vol. 7,291,100

VHM: As of September 30, 2021, Vinhomes has 16,800 hectares of land fund, including 13,000 hectares of residential, office and 3,800 hectares of industrial land.

FOOD & BEVERAGE

73,400

1D -2.39%

5D -5.41%

Buy Vol. 6,213,900

Sell Vol. 6,563,700

145,600

1D -0.55%

5D 0.41%

Buy Vol. 1,321,300

Sell Vol. 1,054,400

157,600

1D 0.06%

5D 3.55%

Buy Vol. 168,200

Sell Vol. 155,600

VNM: The parent company's own domestic revenue grew by 7%, reaching VND 11,674 billion with modern sales channels being the main growth driver.

OTHERS

140,800

1D -1.54%

5D -1.74%

Buy Vol. 869,500

Sell Vol. 995,300

140,800

1D -1.54%

5D -1.74%

Buy Vol. 869,500

Sell Vol. 995,300

98,100

1D 2.51%

5D 2.94%

Buy Vol. 6,449,500

Sell Vol. 6,234,400

144,000

1D 3.67%

5D 6.75%

Buy Vol. 5,792,800

Sell Vol. 5,671,400

108,200

1D 0.00%

5D 2.46%

Buy Vol. 1,620,600

Sell Vol. 2,274,500

33,850

1D -2.45%

5D -2.17%

Buy Vol. 3,384,800

Sell Vol. 3,924,900

42,250

1D -2.76%

5D -4.63%

Buy Vol. 16,553,000

Sell Vol. 16,678,400

45,900

1D -1.08%

5D -2.03%

Buy Vol. 30,734,500

Sell Vol. 33,301,200

MWG: MWG announced its business results for the first 2 months of the year with revenue of VND 25,383 billion, up 17% compared to the same period last year and fulfilling 18% of the plan. Profit after tax is 1,077 billion dong, up 8% and fulfilling 17% of the year plan. MWG believes that this result continues to grow from the very high comparability of the 2021 Tet season.

Market by numbers

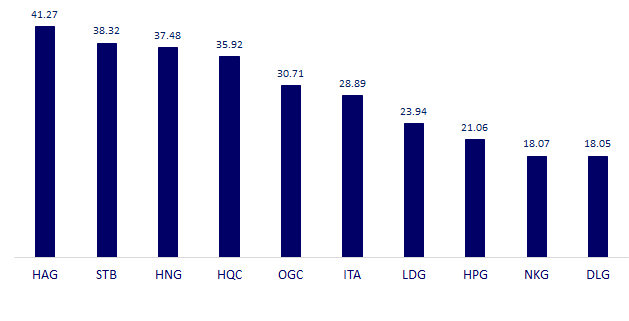

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

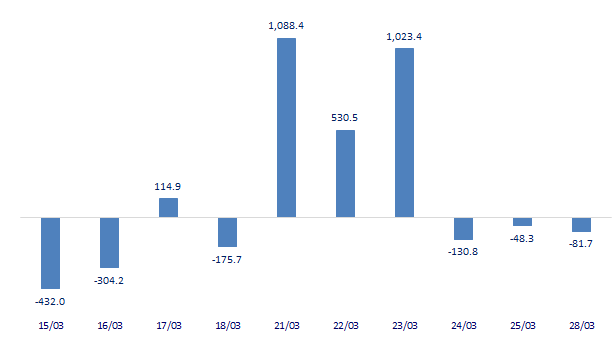

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

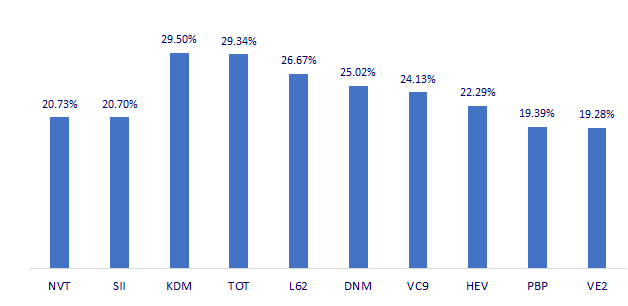

TOP INCREASES 3 CONSECUTIVE SESSIONS

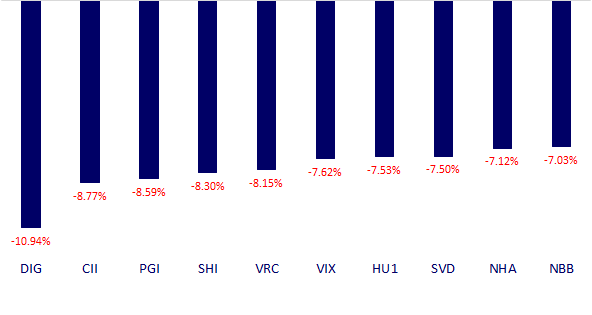

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.