Market brief 29/03/2022

VIETNAM STOCK MARKET

1,497.76

1D 0.98%

YTD -0.03%

1,500.57

1D 1.11%

YTD -2.29%

461.24

1D 1.40%

YTD -2.69%

117.37

1D 1.17%

YTD 4.16%

24.03

1D 0.00%

YTD 0.00%

29,267.50

1D -26.30%

YTD -5.81%

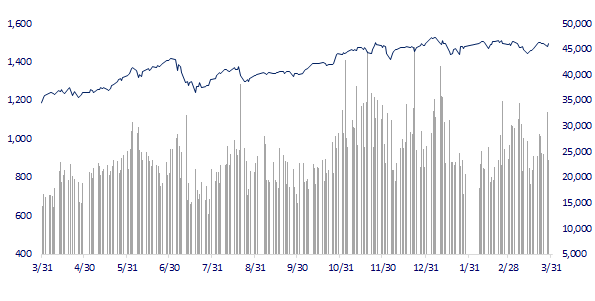

At the end of today's session, a series of large stocks simultaneously gained strongly and contributed to the green color of the indexes, in which, CTD and FPT were both pulled to the ceiling price. Besides, BVH increased by 5%, VNM by 2.9%, TPB by 2.2%, and VHM by 2.1%.

ETF & DERIVATIVES

25,140

1D 0.04%

YTD -2.67%

17,600

1D 0.86%

YTD -2.71%

18,420

1D 3.43%

YTD -3.05%

22,000

1D -0.45%

YTD -3.93%

22,340

1D 1.96%

YTD -0.62%

29,520

1D 1.44%

YTD 5.24%

19,800

1D 0.15%

YTD -7.82%

1,489

1D 0.80%

YTD 0.00%

1,489

1D 0.87%

YTD 0.00%

1,472

1D 0.00%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

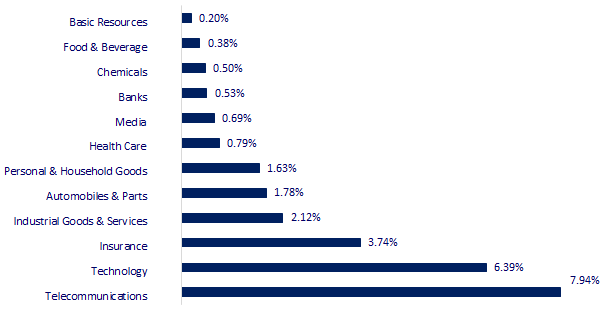

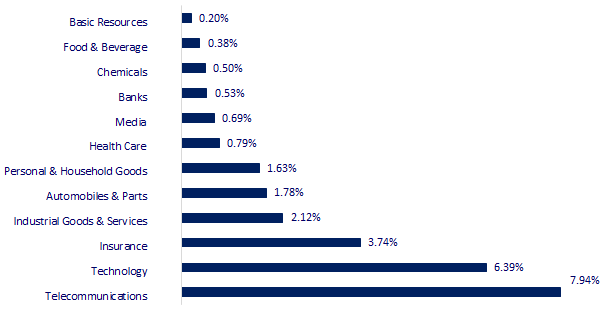

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,252.42

1D 0.19%

YTD -1.87%

3,203.94

1D -0.33%

YTD -11.97%

2,741.07

1D 0.42%

YTD -7.95%

21,890.00

1D 0.23%

YTD -6.44%

3,433.90

1D 0.59%

YTD 9.93%

1,689.74

1D 0.32%

YTD 1.94%

107.20

1D 2.78%

YTD 40.13%

1,911.85

1D -0.91%

YTD 5.00%

Asian stocks mostly rose, oil prices continued to fall. In Japan, the Nikkei 225 gained 0.19%. Investors keep an eye on the Japanese yen - which is nearing a 6-year low. The Chinese market fell with Shanghai Composite down 0.33%, Shenzhen Component down 0.46%. Hong Kong's Hang Seng rose 0.23%.

VIETNAM ECONOMY

2.08%

1D (bps) -5

YTD (bps) 127

5.60%

1.91%

1D (bps) 1

YTD (bps) 90

2.43%

YTD (bps) 43

23,085

1D (%) 0.28%

YTD (%) 0.63%

25,699

1D (%) -0.70%

YTD (%) -2.91%

3,660

1D (%) -0.11%

YTD (%) 0.05%

State budget revenue from the beginning of the year to March 15, 2022 reached 25.5% of the yearly estimate. State budget expenditure reached 15.6% of the annual estimate, ensuring the needs of socio-economic development, defense, security, state management, payment of due debts as well as timely payment for specified objects.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Total state budget revenue in the first 3 months of 2022 reached VND 359.9 trillion

- Overcoming epidemic difficulties, Vietnam's GDP in the first quarter increased by 5.03%

- Vietnam has a trade surplus of more than 800 million USD in the first quarter

- The EU has set a time when it can be independent from Russian gas supplies

- Japan bans the export of luxury cars and other luxury goods to Russia

- Russian delegation arrives in Turkey for talks with Ukraine

VN30

BANK

81,900

1D -0.61%

5D -3.53%

Buy Vol. 1,693,500

Sell Vol. 1,736,400

42,400

1D 1.92%

5D -2.53%

Buy Vol. 3,546,700

Sell Vol. 2,692,100

32,000

1D 0.63%

5D -3.03%

Buy Vol. 6,341,000

Sell Vol. 6,095,200

48,900

1D 0.20%

5D -2.00%

Buy Vol. 6,992,900

Sell Vol. 7,348,000

36,400

1D 0.41%

5D -1.22%

Buy Vol. 11,383,600

Sell Vol. 13,374,200

32,000

1D 1.59%

5D -1.39%

Buy Vol. 14,402,800

Sell Vol. 12,354,100

27,550

1D 0.55%

5D -2.65%

Buy Vol. 4,065,800

Sell Vol. 3,487,900

40,300

1D 2.15%

5D -0.49%

Buy Vol. 7,339,000

Sell Vol. 8,667,600

32,300

1D 1.41%

5D -5.14%

Buy Vol. 22,481,900

Sell Vol. 20,135,700

32,350

1D 0.00%

5D -2.85%

Buy Vol. 5,998,900

Sell Vol. 5,967,000

TCB: On March 28, Techcombank was honored by The Asian Banker as "The most favorite retail bank in Vietnam", and "The bank that deploys payment solutions for businesses" the best in Vietnam”.

REAL ESTATE

82,500

1D 0.00%

5D -1.90%

Buy Vol. 6,140,400

Sell Vol. 5,457,400

53,400

1D 0.95%

5D 1.14%

Buy Vol. 2,318,900

Sell Vol. 1,927,600

92,000

1D -1.08%

5D 0.77%

Buy Vol. 3,733,100

Sell Vol. 4,134,500

PDR: implemented the plan to issue nearly 179m shares, ratio 36.3% to pay dividends. After the issuance, the charter capital of the enterprise will increase to VND 6,717 billion.

OIL & GAS

111,900

1D 1.27%

5D -2.70%

Buy Vol. 1,309,300

Sell Vol. 1,174,600

16,250

1D 1.25%

5D -1.52%

Buy Vol. 13,776,600

Sell Vol. 14,544,100

56,400

1D 0.71%

5D -0.70%

Buy Vol. 2,674,900

Sell Vol. 3,727,900

PLX: The Group proposed to the Prime Minister and the Government to consider "opening the room" for foreign investors in Petrolimex from the current 20% rate to 35%.

VINGROUP

80,800

1D 0.37%

5D -1.70%

Buy Vol. 3,904,300

Sell Vol. 5,755,000

76,500

1D 2.14%

5D -1.92%

Buy Vol. 4,772,500

Sell Vol. 4,589,500

32,550

1D 1.72%

5D -1.96%

Buy Vol. 5,186,200

Sell Vol. 5,053,400

VHM: Launched 3 projects this year, including Vinhomes Dream City (Van Giang, Hung Yen), Vinhomes Wonder Park (Dan Phuong, Hanoi) and Vinhomes Co Loa (Dong Anh, Hanoi).

FOOD & BEVERAGE

75,500

1D 2.86%

5D -1.82%

Buy Vol. 3,970,200

Sell Vol. 3,619,000

144,000

1D -1.10%

5D -3.03%

Buy Vol. 1,132,700

Sell Vol. 1,195,200

158,000

1D 0.25%

5D 2.60%

Buy Vol. 252,700

Sell Vol. 313,000

VIC: Vingroup announced it has transferred shares in One Mount Group, a business built on cooperation with Techcombank and Masan.

OTHERS

142,900

1D 1.49%

5D 1.49%

Buy Vol. 1,255,200

Sell Vol. 1,294,300

142,900

1D 1.49%

5D 1.49%

Buy Vol. 1,255,200

Sell Vol. 1,294,300

104,900

1D 6.93%

5D 8.82%

Buy Vol. 12,549,100

Sell Vol. 10,741,900

146,500

1D 1.74%

5D 8.36%

Buy Vol. 3,856,700

Sell Vol. 4,047,900

110,500

1D 2.13%

5D 3.27%

Buy Vol. 2,032,800

Sell Vol. 3,005,300

34,500

1D 1.92%

5D -0.43%

Buy Vol. 2,377,800

Sell Vol. 2,386,500

42,650

1D 0.95%

5D -3.83%

Buy Vol. 7,688,000

Sell Vol. 8,014,900

45,850

1D -0.11%

5D -2.24%

Buy Vol. 20,064,600

Sell Vol. 24,153,800

PNJ plans to issue shares under the Employee Options Program (ESOP) at the rate of 2%/total outstanding shares at the time of issuance. In parallel, PNJ plans to issue more than 82 million shares from equity at a ratio of 3:1, equivalent to owning 3 shares and receiving 1 new share. If successful, PNJ's charter capital is expected to increase from VND 2,276 billion to VND 3,282 billion.

Market by numbers

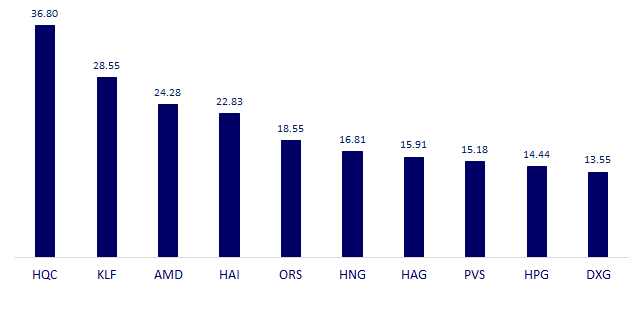

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

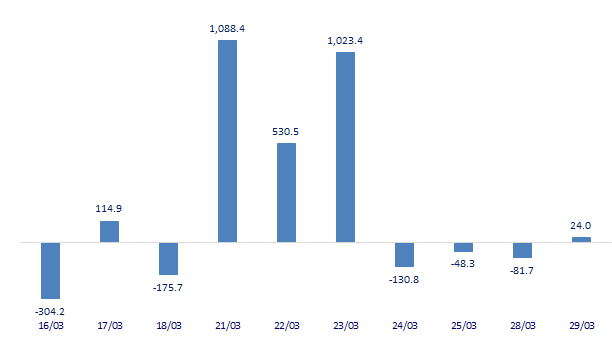

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

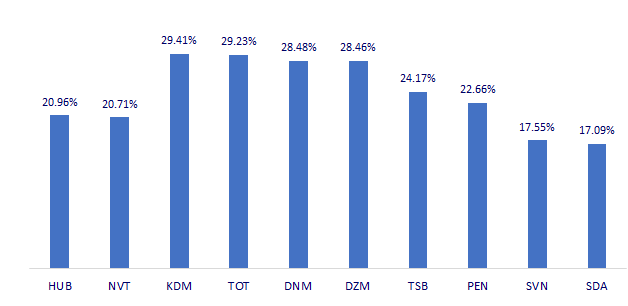

TOP INCREASES 3 CONSECUTIVE SESSIONS

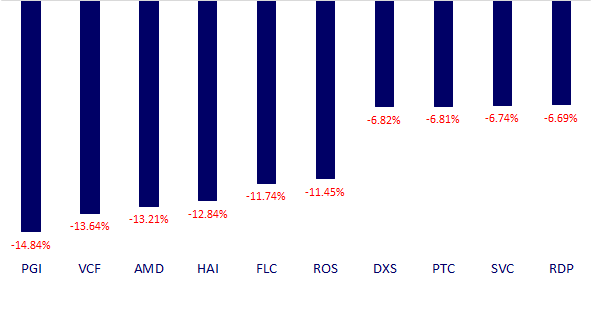

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.