Market brief 30/03/2022

VIETNAM STOCK MARKET

1,490.51

1D -0.48%

YTD -0.52%

1,500.23

1D -0.02%

YTD -2.31%

451.19

1D -2.18%

YTD -4.81%

116.88

1D -0.42%

YTD 3.73%

101.12

1D 0.00%

YTD 0.00%

35,367.26

1D 20.84%

YTD 13.82%

Foreign investors continued to be net buyers of 101 billion dong in session 30/3. DGC was still bought the most by foreign investors on HoSE with 180 billion dong. Fund certificates FUEVFVND net bought 75 billion dong. DXG and HDB were net bought at 65 billion dong and 63 billion dong respectively. On the other side, VHM was sold the most on this floor with 51 billion dong, VIC was also net sold 46 billion dong.

ETF & DERIVATIVES

25,150

1D 0.04%

YTD -2.63%

17,600

1D 0.00%

YTD -2.71%

18,300

1D 2.75%

YTD -3.68%

22,000

1D 0.00%

YTD -3.93%

21,860

1D -2.15%

YTD -2.76%

29,600

1D 0.27%

YTD 5.53%

19,830

1D 0.15%

YTD -7.68%

1,487

1D -0.13%

YTD 0.00%

1,488

1D -0.08%

YTD 0.00%

1,489

1D -0.19%

YTD 0.00%

1,490

1D -0.24%

YTD 0.00%

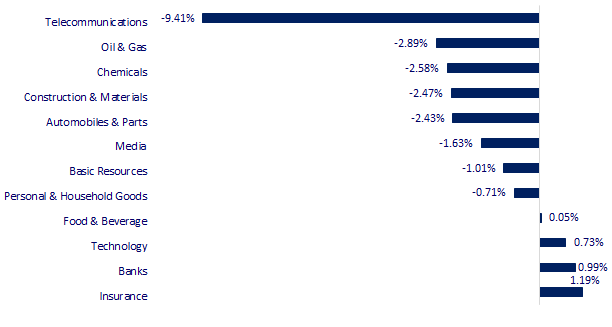

CHANGE IN PRICE BY SECTOR

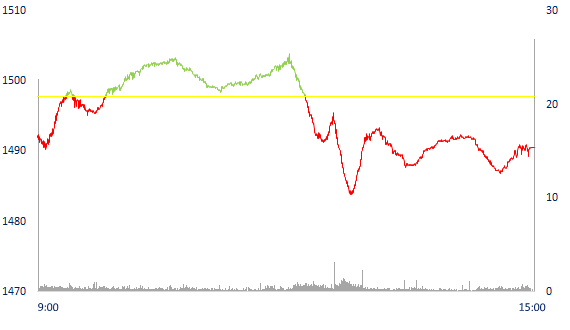

INTRADAY VNINDEX

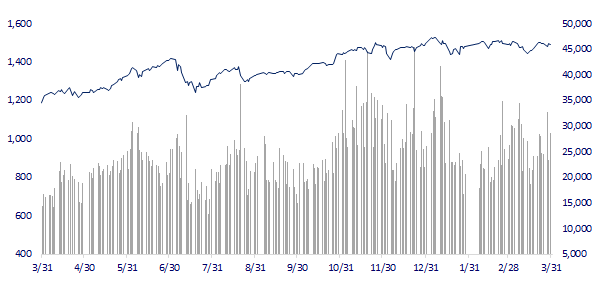

VNINDEX (12M)

GLOBAL MARKET

28,027.25

1D -0.02%

YTD -2.66%

3,266.60

1D 1.96%

YTD -10.25%

2,746.74

1D 0.21%

YTD -7.75%

22,232.03

1D 0.17%

YTD -4.98%

3,442.61

1D 0.25%

YTD 10.21%

1,698.40

1D 0.51%

YTD 2.46%

106.69

1D 1.77%

YTD 39.46%

1,922.30

1D 0.14%

YTD 5.57%

Asian stocks mixed, investors waited for developments related to Ukraine. In Japan, the Nikkei 225 fell 0.02%. The Chinese market rose with Shanghai Composite up 1.96%, Shenzhen Component up 3.1%. Hong Kong's Hang Seng rose 0.17%. South Korea's Kospi index rose 0.21%.

VIETNAM ECONOMY

2.03%

1D (bps) -5

YTD (bps) 122

5.60%

1.92%

1D (bps) 1

YTD (bps) 91

2.44%

1D (bps) 1

YTD (bps) 44

23,075

1D (%) -0.04%

YTD (%) 0.59%

25,898

1D (%) 0.77%

YTD (%) -2.15%

3,668

1D (%) 0.22%

YTD (%) 0.27%

According to data from the GSO, the total registered FDI capital into Vietnam from the beginning of the year to March 20 reached 8.91b USD, down more than 12% over the same period last year. This is the second consecutive month that Vietnam recorded a decrease in total newly registered FDI capital. Among them, the number of newly registered projects reached USD 3.21b, up nearly 38% in number of projects but decreased by nearly 56% in capital compared to YoY.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Newly registered FDI capital decreased for the 2nd consecutive month

- The whole country has completed the allocation of public investment capital this year

- Businesses returning to operation in the first quarter increased by nearly 74% over the same period

- Fear of inflation looms over Asia

- Russia is preparing to pay a debt of 2 billion USD

- Russian ruble appreciates again

VN30

BANK

82,000

1D 0.12%

5D -3.42%

Buy Vol. 1,713,700

Sell Vol. 1,300,500

43,550

1D 2.71%

5D 0.35%

Buy Vol. 5,681,000

Sell Vol. 6,725,600

32,050

1D 0.16%

5D -2.44%

Buy Vol. 8,801,900

Sell Vol. 9,250,500

49,150

1D 0.51%

5D -0.91%

Buy Vol. 8,435,400

Sell Vol. 10,689,900

36,800

1D 1.10%

5D 0.41%

Buy Vol. 26,462,200

Sell Vol. 30,977,700

32,650

1D 2.03%

5D 1.56%

Buy Vol. 46,003,600

Sell Vol. 50,196,900

28,300

1D 2.72%

5D 1.07%

Buy Vol. 10,221,500

Sell Vol. 10,466,700

40,000

1D -0.74%

5D -0.12%

Buy Vol. 8,187,800

Sell Vol. 11,355,600

32,250

1D -0.15%

5D -5.15%

Buy Vol. 32,687,800

Sell Vol. 26,084,900

32,600

1D 0.77%

5D -1.81%

Buy Vol. 7,168,700

Sell Vol. 8,296,100

Data from the VSD shows that there are currently about 16 banks with foreign ownership ratio above 15%. In which, 7 banks have closed or nearly closed the rate of foreign ownership: ACB, MBB, MSB, VIB, OCB, Techcombank, TPBank. The common point of these banks is that they have a high profit growth rate and have the leading profitability in the system. In addition, some banks also maintain foreign ownership ratios lower than the prescribed maximum to create room for capital mobilization such as VIB (20.5%), OCB (22%), Techcombank (22). ,47%), MB (23.23%).

REAL ESTATE

80,000

1D -3.03%

5D -4.53%

Buy Vol. 8,682,100

Sell Vol. 8,117,700

52,600

1D -1.50%

5D -0.75%

Buy Vol. 1,715,000

Sell Vol. 1,972,800

90,700

1D -1.41%

5D 0.44%

Buy Vol. 3,573,600

Sell Vol. 4,125,900

NVL: Novaland plans a profit of 6,500 billion dong in 2022, with a 35% share bonus. In addition, Novaland also plans to issue an ESOP of up to 1.5% of outstanding shares.

OIL & GAS

110,100

1D -1.61%

5D -1.96%

Buy Vol. 1,097,500

Sell Vol. 976,300

15,950

1D -1.85%

5D -5.62%

Buy Vol. 18,704,700

Sell Vol. 21,773,600

55,000

1D -2.48%

5D -1.79%

Buy Vol. 3,256,000

Sell Vol. 4,184,300

The environmental protection tax on gasoline has officially been reduced by 2,000 VND/liter from April 1, but the gasoline price is calculated to be lower than this level.

VINGROUP

81,100

1D 0.37%

5D -0.37%

Buy Vol. 4,488,500

Sell Vol. 7,612,000

75,800

1D -0.92%

5D -1.81%

Buy Vol. 6,464,700

Sell Vol. 6,711,300

32,500

1D -0.15%

5D -1.07%

Buy Vol. 5,316,300

Sell Vol. 6,890,200

VIC: VinFast and North Carolina state signed a memorandum of understanding on the construction of a factory with an investment of 2 billion USD in phase 1, announced on March 29.

FOOD & BEVERAGE

76,200

1D 0.93%

5D 0.13%

Buy Vol. 5,507,400

Sell Vol. 6,107,500

144,000

1D 0.00%

5D -2.04%

Buy Vol. 1,249,700

Sell Vol. 1,051,600

157,900

1D -0.06%

5D 0.25%

Buy Vol. 201,300

Sell Vol. 237,500

VNM: SCIC has just registered to buy 200,000 VNM shares. VNM stock is down 11% since the beginning of 2022 and is 30% below its 3-year peak reached in mid-January 2021.

OTHERS

140,500

1D -1.68%

5D -0.35%

Buy Vol. 986,800

Sell Vol. 933,100

140,500

1D -1.68%

5D -0.35%

Buy Vol. 986,800

Sell Vol. 933,100

106,000

1D 1.05%

5D 9.84%

Buy Vol. 5,099,800

Sell Vol. 5,942,000

144,400

1D -1.43%

5D 6.96%

Buy Vol. 3,197,700

Sell Vol. 3,124,100

108,300

1D -1.99%

5D 3.04%

Buy Vol. 1,666,200

Sell Vol. 2,533,900

33,850

1D -1.88%

5D -4.38%

Buy Vol. 3,063,200

Sell Vol. 3,061,300

42,300

1D -0.82%

5D -4.30%

Buy Vol. 12,495,500

Sell Vol. 12,414,000

45,500

1D -0.76%

5D -2.78%

Buy Vol. 27,756,600

Sell Vol. 27,707,900

FPT: In just 2 trading weeks in the second half of March, FPT has increased by more than 15%, thereby pushing the market capitalization to approximately 100,000 billion dong, nearly 60% higher than a year ago. The growth rate outperformed the VN-Index.

Market by numbers

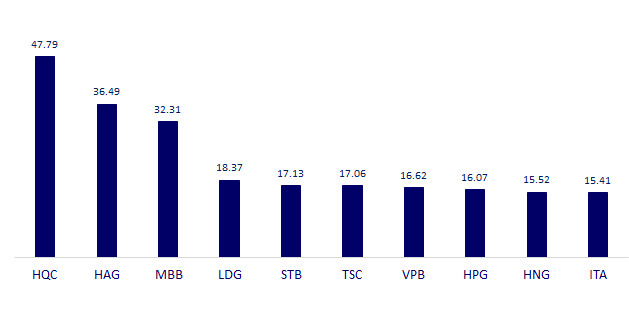

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

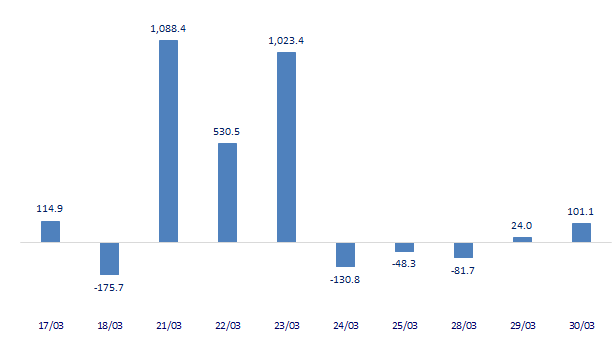

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

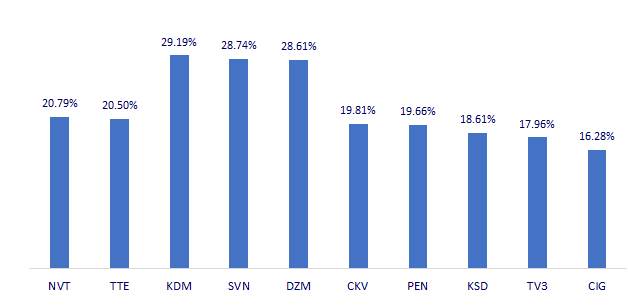

TOP INCREASES 3 CONSECUTIVE SESSIONS

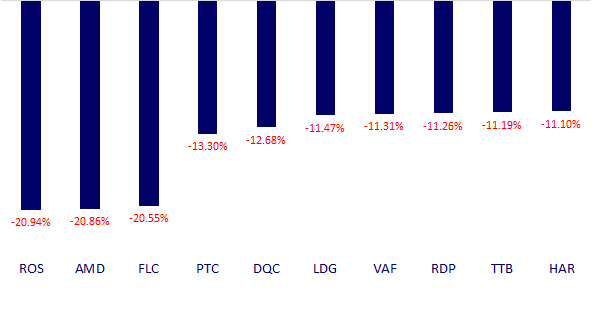

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.