Market brief 31/03/2022

VIETNAM STOCK MARKET

1,492.15

1D 0.11%

YTD -0.41%

1,508.53

1D 0.55%

YTD -1.77%

449.62

1D -0.35%

YTD -5.14%

117.04

1D 0.14%

YTD 3.87%

334.24

1D 0.00%

YTD 0.00%

29,176.52

1D -17.50%

YTD -6.10%

Foreign investors boosted their net buying of 334 billion dong on March 31. VNM topped the list of foreign investors' net buying on HoSE with 218 billion dong. DGC is behind with a net buying value of 182 billion dong. Meanwhile, VHM was sold the most on this floor with 156 billion dong. MSN and PDR were net sold 39 billion dong and 31 billion dong respectively.

ETF & DERIVATIVES

25,300

1D 0.60%

YTD -2.05%

17,750

1D 0.85%

YTD -1.88%

18,700

1D 5.00%

YTD -1.58%

22,000

1D 0.00%

YTD -3.93%

22,010

1D 0.69%

YTD -2.09%

30,080

1D 1.62%

YTD 7.24%

19,970

1D 0.71%

YTD -7.03%

1,491

1D 0.30%

YTD 0.00%

1,495

1D 0.46%

YTD 0.00%

1,494

1D 0.38%

YTD 0.00%

1,496

1D 0.42%

YTD 0.00%

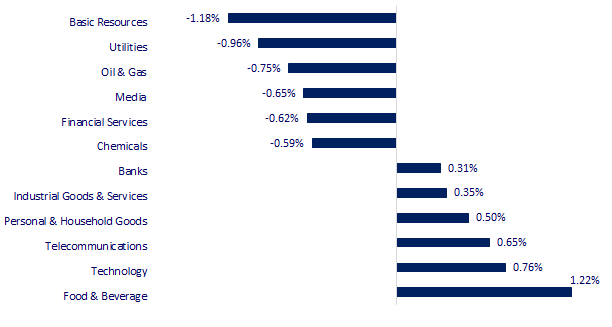

CHANGE IN PRICE BY SECTOR

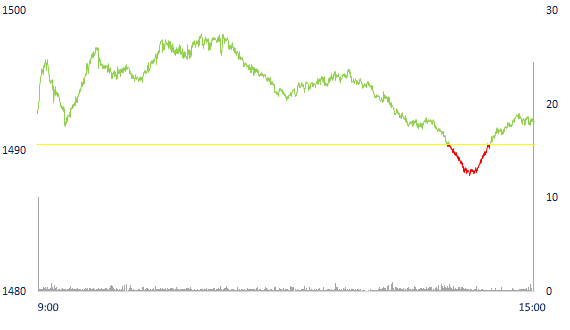

INTRADAY VNINDEX

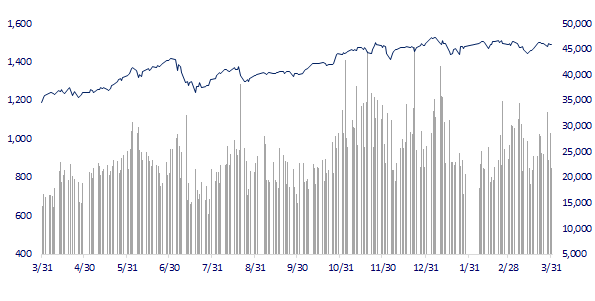

VNINDEX (12M)

GLOBAL MARKET

27,821.43

1D -0.83%

YTD -3.37%

3,252.20

1D -0.44%

YTD -10.65%

2,757.65

1D 0.40%

YTD -7.39%

22,062.00

1D 0.02%

YTD -5.71%

3,408.52

1D -0.99%

YTD 9.12%

1,695.24

1D -0.19%

YTD 2.27%

101.27

1D -1.66%

YTD 32.38%

1,924.70

1D -0.17%

YTD 5.71%

China's manufacturing fell in March, Asian stocks mixed. In Japan, the Nikkei 225 fell 0.83%. The Chinese market fell with Shanghai Composite down 0.44%, Shenzhen Component down 1.187%. Hong Kong's Hang Seng rose 0.02%. China's manufacturing activity declined in March with the manufacturing purchasing managers' index (PMI) of 49.5 points, lower than February's 50.2 points. PMI above 50 points reflects openness. wide and vice versa.

VIETNAM ECONOMY

2.01%

1D (bps) -2

YTD (bps) 120

5.60%

1.92%

YTD (bps) 91

2.43%

1D (bps) -1

YTD (bps) 43

23,060

1D (%) 0.27%

YTD (%) 0.52%

25,794

1D (%) -1.83%

YTD (%) -2.55%

3,671

1D (%) 0.00%

YTD (%) 0.36%

The State Bank of Vietnam has recently requested strict control of credit in potentially risky areas. Some banks are also temporarily suspending disbursement with real estate loans, and at the same time focusing on directing credit to production and business areas.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Shrimp and pangasius contribute 64% of total seafood export turnover

- Banks began to tighten real estate lending

- Foreign investors still put their faith in Vietnam

- The US considers a record oil discharge of 180 million barrels

- Russia has just made a move to help millions of Germans escape the risk of freezing: Allowing payment for gas purchases in euros

- The worst scenario if China persists with Zero COVID: Economic losses of at least 46 billion USD/month, GDP at risk of plunge

VN30

BANK

82,100

1D 0.12%

5D -1.68%

Buy Vol. 1,028,500

Sell Vol. 867,000

43,500

1D -0.11%

5D 0.93%

Buy Vol. 2,262,600

Sell Vol. 5,036,300

32,450

1D 1.25%

5D -0.31%

Buy Vol. 8,716,300

Sell Vol. 10,200,200

49,550

1D 0.81%

5D 0.51%

Buy Vol. 7,545,000

Sell Vol. 8,865,300

37,200

1D 1.09%

5D 2.34%

Buy Vol. 13,178,500

Sell Vol. 21,907,700

32,950

1D 0.92%

5D 2.81%

Buy Vol. 20,248,100

Sell Vol. 28,909,400

28,350

1D 0.18%

5D 0.89%

Buy Vol. 9,528,800

Sell Vol. 7,593,000

40,150

1D 0.38%

5D 0.12%

Buy Vol. 3,614,200

Sell Vol. 6,429,200

31,700

1D -1.71%

5D -5.79%

Buy Vol. 17,440,000

Sell Vol. 17,198,000

33,050

1D 1.38%

5D 0.46%

Buy Vol. 10,010,200

Sell Vol. 9,048,000

MBB: In 2022, the bank aims to increase pre-tax profit by 23%. Total assets increased by 15%, credit outstanding increased by 16% and adjusted according to the allowable limit of the State Bank. The bank will also control the bad debt ratio below 1.5%. Besides, the bank expects charter capital to increase by 19.4%.

REAL ESTATE

80,100

1D 0.13%

5D -3.26%

Buy Vol. 4,611,500

Sell Vol. 3,904,700

52,800

1D 0.38%

5D -0.56%

Buy Vol. 1,486,700

Sell Vol. 1,305,300

89,500

1D -1.32%

5D -4.69%

Buy Vol. 3,480,800

Sell Vol. 3,760,200

PDR: mobilized 300 billion dong of bonds for real estate projects. The bond's term is 2 years from the date of issue, with an interest rate of 11.2%/year at a selling price of VND 100 million/bond.

OIL & GAS

108,300

1D -1.63%

5D -3.56%

Buy Vol. 758,800

Sell Vol. 710,400

15,850

1D -0.63%

5D -5.65%

Buy Vol. 12,113,700

Sell Vol. 16,180,800

55,200

1D 0.36%

5D -1.43%

Buy Vol. 3,464,700

Sell Vol. 3,139,500

Concerned about tight supply, oil prices increased by 3%. Closing session 30/3, Brent oil futures price increased by 3.22 USD, to 113.45 USD/barrel.

VINGROUP

81,200

1D 0.12%

5D 0.25%

Buy Vol. 2,689,300

Sell Vol. 3,876,200

75,800

1D 0.00%

5D 0.13%

Buy Vol. 5,273,800

Sell Vol. 5,842,200

33,450

1D 2.92%

5D 1.98%

Buy Vol. 8,069,100

Sell Vol. 11,844,300

VIC: After transfer of shares in One Mount Group, Vingroup also established of Genestory Joint Stock Company with charter capital of more than 102 billion VND, 99% contributed by Vingroup.

FOOD & BEVERAGE

80,900

1D 6.17%

5D 7.01%

Buy Vol. 14,263,100

Sell Vol. 15,143,400

142,200

1D -1.25%

5D -3.00%

Buy Vol. 1,157,600

Sell Vol. 1,076,300

159,000

1D 0.70%

5D 0.76%

Buy Vol. 311,000

Sell Vol. 340,400

VNM: Vinamilk CEO assessed that the dairy industry will continue to face difficulties in 2022 due to the high price of raw materials, mainly agricultural products and food.

OTHERS

140,500

1D 0.00%

5D -2.43%

Buy Vol. 779,000

Sell Vol. 767,700

140,500

1D 0.00%

5D -2.43%

Buy Vol. 779,000

Sell Vol. 767,700

107,000

1D 0.94%

5D 11.46%

Buy Vol. 6,449,400

Sell Vol. 6,258,300

145,800

1D 0.97%

5D 8.81%

Buy Vol. 3,428,600

Sell Vol. 3,734,600

110,500

1D 2.03%

5D 3.27%

Buy Vol. 1,128,300

Sell Vol. 1,467,100

34,000

1D 0.44%

5D -2.58%

Buy Vol. 3,363,000

Sell Vol. 2,806,000

42,000

1D -0.71%

5D -4.11%

Buy Vol. 6,570,700

Sell Vol. 8,538,900

45,100

1D -0.88%

5D -2.80%

Buy Vol. 30,105,000

Sell Vol. 32,001,700

HPG: For more than a year now, Hoa Phat has proposed many projects in localities such as Thua Thien Hue, Khanh Hoa, Hai Duong in areas such as building a modern urban area in Hue; planning zoning along both banks of the Cai River and developing projects in Nha Trang City, building a city combined with an industrial park in Ninh Hoa in Ninh Xuan, Ninh Sim and Ninh Tay communes; 385 ha golf course in Hai Duong, etc.

Market by numbers

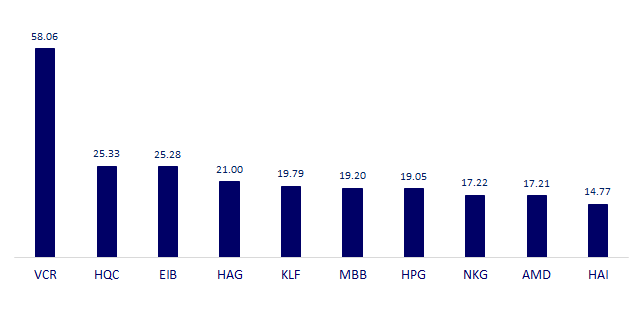

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

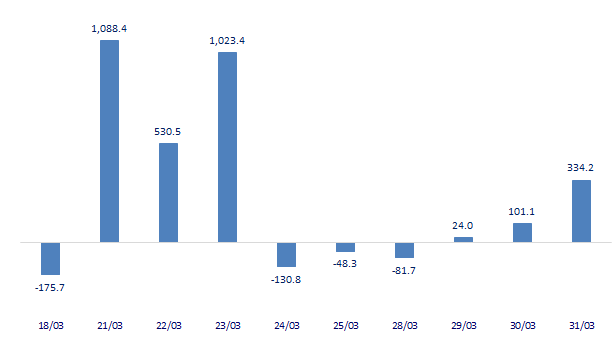

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

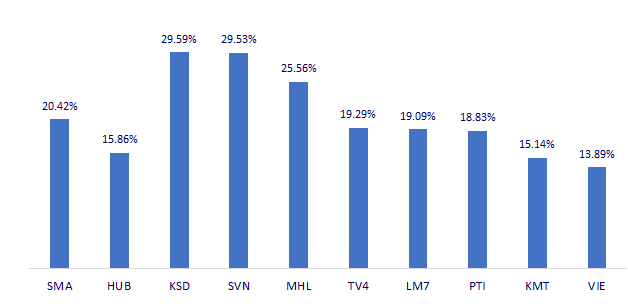

TOP INCREASES 3 CONSECUTIVE SESSIONS

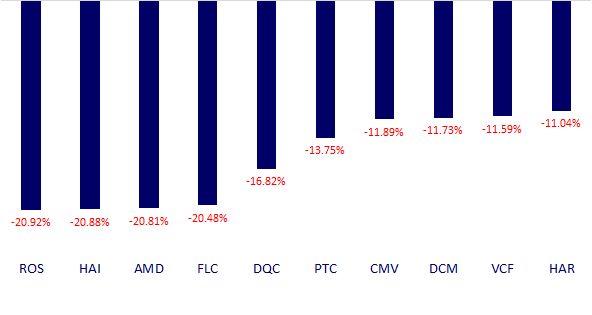

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.