Market brief 07/04/2022

VIETNAM STOCK MARKET

1,502.35

1D -1.35%

YTD 0.27%

1,541.96

1D -0.97%

YTD 0.41%

441.61

1D -1.17%

YTD -6.83%

115.81

1D -0.88%

YTD 2.78%

-535.20

1D 0.00%

YTD 0.00%

32,149.05

1D -9.87%

YTD 3.47%

According to data published by the VSD, the total number of securities accounts in the Vietnamese market by the end of March 2022 was nearly 5 million accounts, an increase of nearly 271,000 accounts compared to the end of March. last month. In which, domestic individual investors opened 270,011 new accounts, accumulating 4.93 million accounts by the end of March.

ETF & DERIVATIVES

25,760

1D -0.16%

YTD -0.27%

18,020

1D -0.28%

YTD -0.39%

18,660

1D 4.77%

YTD -1.79%

22,600

1D -1.09%

YTD -1.31%

22,010

1D 0.05%

YTD -2.09%

30,650

1D -4.07%

YTD 9.27%

20,430

1D -0.63%

YTD -4.89%

1,521

1D -0.49%

YTD 0.00%

1,525

1D -0.62%

YTD 0.00%

1,529

1D -0.74%

YTD 0.00%

1,530

1D -0.68%

YTD 0.00%

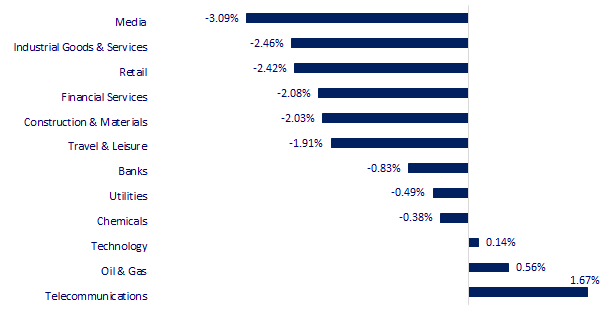

CHANGE IN PRICE BY SECTOR

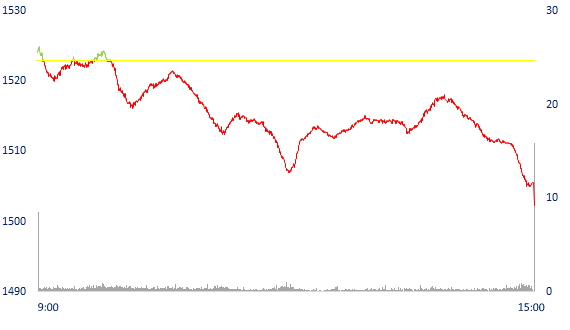

INTRADAY VNINDEX

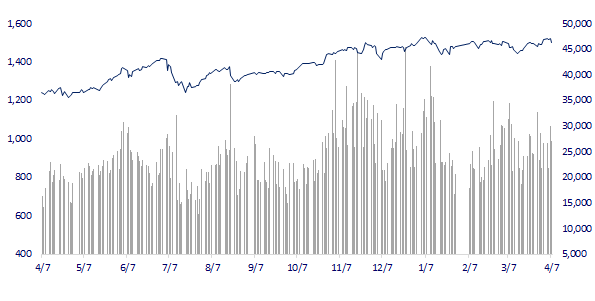

VNINDEX (12M)

GLOBAL MARKET

26,888.57

1D 0.10%

YTD -6.61%

3,236.70

1D -1.42%

YTD -11.07%

2,695.86

1D -1.43%

YTD -9.46%

21,808.98

1D -1.26%

YTD -6.79%

3,404.23

1D -0.55%

YTD 8.98%

1,682.41

1D -1.10%

YTD 1.50%

98.64

1D 0.80%

YTD 28.94%

1,931.50

1D 0.43%

YTD 6.08%

Asian stocks fell after the Fed released the minutes of its March meeting. In Japan, the Nikkei 225 gained 0.1%. The Chinese market fell with Shanghai Composite down 1.42%, Shenzhen Component down 1.65%. Hong Kong's Hang Seng fell 1%.26. South Korea's Kospi Index drops 1.43%

VIETNAM ECONOMY

2.10%

YTD (bps) 129

5.60%

2.12%

1D (bps) 21

YTD (bps) 111

2.66%

1D (bps) 23

YTD (bps) 66

23,075

1D (%) 0.30%

YTD (%) 0.59%

25,336

1D (%) -1.31%

YTD (%) -4.28%

3,662

1D (%) -0.08%

YTD (%) 0.11%

Vietnam's import-export turnover in the first quarter of 2022 recorded a high growth compared to the same period last year, estimated at 176.35 billion USD, up 14.37% over the same period last year. Merchandise trade in the first quarter of 2022 was estimated to have a trade surplus of US$809 million.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Rice exports to the EU increased 4 times thanks to the push from EVFTA

- Expenses for import and export prices: Businesses struggle

- Import and export increased by nearly 15%, had a trade surplus of 809 million USD in the first quarter

- IEA discharges a large amount of stock, oil prices hit a 3-week low

- Fed plans to reduce balance sheet size by $95 billion/month

- Russia warns of cutting ties with the West

VN30

BANK

83,000

1D -1.89%

5D 1.10%

Buy Vol. 1,358,800

Sell Vol. 2,060,500

43,050

1D -1.03%

5D -1.03%

Buy Vol. 4,389,500

Sell Vol. 7,329,500

32,550

1D -0.15%

5D 0.31%

Buy Vol. 9,566,600

Sell Vol. 11,874,400

49,300

1D -1.20%

5D -0.50%

Buy Vol. 8,423,900

Sell Vol. 12,390,200

39,800

1D -0.38%

5D 6.99%

Buy Vol. 42,389,900

Sell Vol. 53,364,800

33,700

1D 1.05%

5D 2.28%

Buy Vol. 36,939,900

Sell Vol. 49,450,100

28,900

1D -0.34%

5D 1.94%

Buy Vol. 15,637,300

Sell Vol. 14,573,300

41,000

1D -0.36%

5D 2.12%

Buy Vol. 12,414,300

Sell Vol. 14,363,800

31,900

1D -1.39%

5D 0.63%

Buy Vol. 18,654,300

Sell Vol. 23,234,700

33,600

1D 1.20%

5D 1.66%

Buy Vol. 14,861,300

Sell Vol. 16,250,600

ACB: In 2022, ACB targets total assets of 558,187 billion dong, up 11% compared to 2021. Customer deposits reach 421.897 billion dong, also up 11%. Outstanding loans reached VND 398,299 billion, up 10% and will be adjusted to a higher level upon approval of the State Bank (SBV). Profit before tax is set to increase by 25%, expected to reach VND 15,018 billion. NPL ratio is controlled below 2%.

REAL ESTATE

84,600

1D -1.97%

5D 5.62%

Buy Vol. 9,242,500

Sell Vol. 7,669,700

51,100

1D 0.20%

5D -3.22%

Buy Vol. 1,464,000

Sell Vol. 947,100

92,600

1D -0.43%

5D 3.46%

Buy Vol. 3,298,900

Sell Vol. 3,682,600

KDH: Negative business cash flow, Khang Dien (KDH) sets profit target to increase 16%, issues 9.6 million ESOP shares in 2022

OIL & GAS

112,800

1D -0.79%

5D 4.16%

Buy Vol. 1,279,500

Sell Vol. 1,284,200

16,650

1D 1.52%

5D 5.05%

Buy Vol. 53,843,800

Sell Vol. 59,251,400

56,600

1D 1.07%

5D 2.54%

Buy Vol. 6,095,300

Sell Vol. 5,281,800

PLX: Eneos Corporation transferred all 65.7 million shares of PLX to Eneos Vietnam Co., Ltd., helping to increase its holdings to 169.23 million shares, accounting for 13.08% of the capital.

VINGROUP

79,500

1D -1.24%

5D -2.09%

Buy Vol. 6,040,000

Sell Vol. 6,957,000

75,000

1D -1.70%

5D -1.06%

Buy Vol. 7,069,800

Sell Vol. 8,325,900

32,650

1D -2.83%

5D -2.39%

Buy Vol. 7,231,600

Sell Vol. 7,620,200

VIC: VinES Battery Factory is a big project with a total investment of phase 1 of VND 4,000 billion, expected to be completed in the third quarter of 2022.

FOOD & BEVERAGE

78,500

1D -1.01%

5D -2.97%

Buy Vol. 3,281,700

Sell Vol. 3,668,700

151,000

1D -1.82%

5D 6.19%

Buy Vol. 1,721,200

Sell Vol. 2,196,700

166,500

1D -1.77%

5D 4.72%

Buy Vol. 128,100

Sell Vol. 189,400

SAB: In 2022, SAB targets net revenue and profit after tax of VND 34,791 billion and VND 4,581 billion, up 32% and 17% respectively compared to the implementation level in 2021.

OTHERS

137,000

1D -2.84%

5D -2.49%

Buy Vol. 880,800

Sell Vol. 996,000

137,000

1D -2.84%

5D -2.49%

Buy Vol. 880,800

Sell Vol. 996,000

113,300

1D 0.27%

5D 5.89%

Buy Vol. 6,758,000

Sell Vol. 7,711,400

155,000

1D -2.39%

5D 6.31%

Buy Vol. 4,542,500

Sell Vol. 5,174,900

115,100

1D -2.54%

5D 4.16%

Buy Vol. 3,123,200

Sell Vol. 3,179,700

36,300

1D -1.89%

5D 6.76%

Buy Vol. 5,375,400

Sell Vol. 9,418,200

44,050

1D -1.23%

5D 4.88%

Buy Vol. 14,473,400

Sell Vol. 20,901,800

46,550

1D -1.48%

5D 3.22%

Buy Vol. 22,507,500

Sell Vol. 31,300,300

FPT: The group's first quarter revenue reached 9,500 billion, up 26% over the same period last year. Profit was in the range of VND 1,700 - 1,800 billion, up 26 - 28% compared to the first quarter of last year. Shareholders approved the 2022 revenue plan to reach VND 42,420 billion, up 19% compared to the previous year. Target profit before tax increased by 20.2% to VND 7,618 billion.

Market by numbers

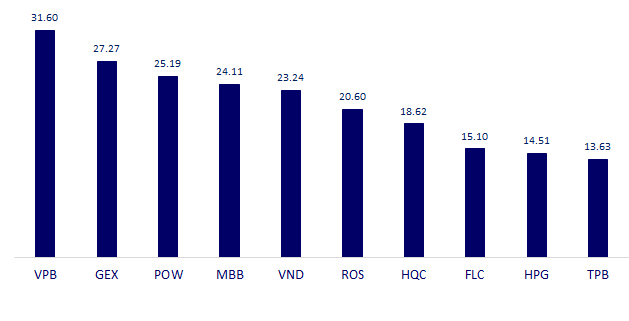

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

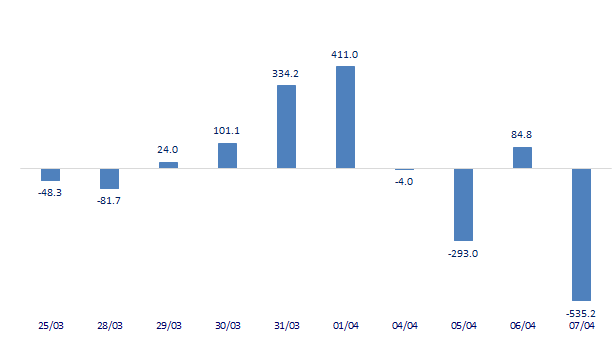

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

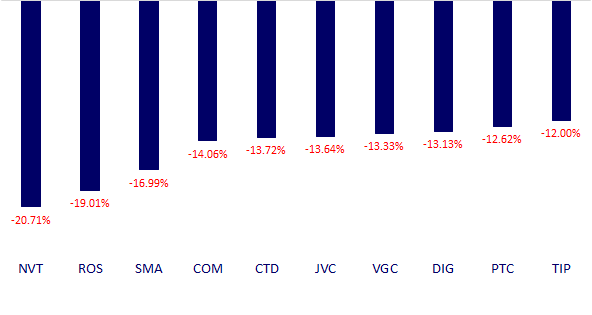

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.