Market brief 08/04/2022

VIETNAM STOCK MARKET

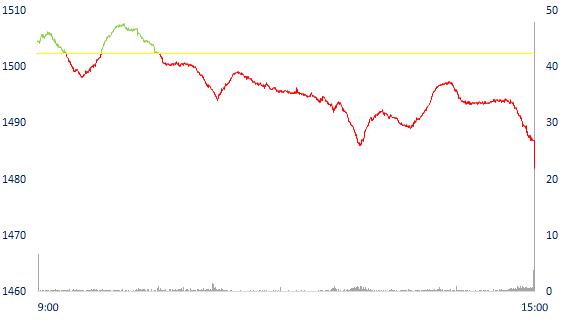

1,482.00

1D -1.35%

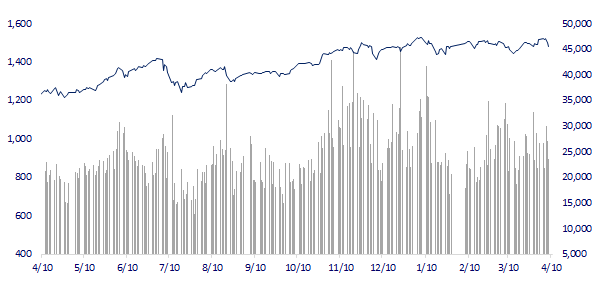

YTD -1.09%

1,524.31

1D -1.14%

YTD -0.74%

432.02

1D -2.17%

YTD -8.85%

113.84

1D -1.70%

YTD 1.03%

-309.76

1D 0.00%

YTD 0.00%

27,935.70

1D -13.11%

YTD -10.09%

Foreign investors continued to net sell 310 billion dong in session 8/4. Foreign investors on HoSE were the strongest net sellers of VHM with 103 billion dong. STB and VND are behind with a net selling value of VND 85 billion and VND 64 billion, respectively. Meanwhile, MSN was bought the most with 54 billion dong. VIC and TPB were net bought at 31 billion dong and 25 billion dong, respectively.

ETF & DERIVATIVES

25,880

1D 0.47%

YTD 0.19%

18,000

1D -0.11%

YTD -0.50%

18,660

1D 4.77%

YTD -1.79%

22,400

1D -0.88%

YTD -2.18%

22,300

1D 1.32%

YTD -0.80%

30,690

1D 0.13%

YTD 9.41%

20,400

1D -0.15%

YTD -5.03%

1,519

1D -0.11%

YTD 0.00%

1,520

1D -0.33%

YTD 0.00%

1,524

1D -0.30%

YTD 0.00%

1,524

1D -0.39%

YTD 0.00%

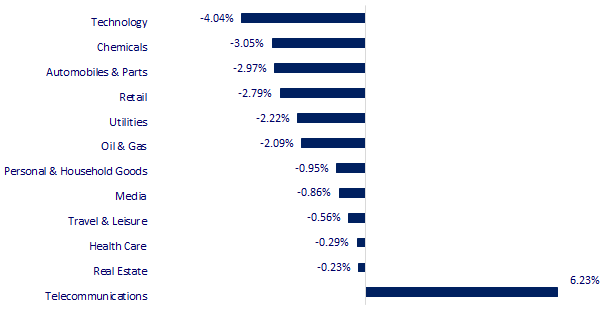

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

26,985.80

1D 0.53%

YTD -6.27%

3,251.85

1D 0.47%

YTD -10.66%

2,700.39

1D 0.17%

YTD -9.31%

21,872.01

1D 0.48%

YTD -6.52%

3,383.28

1D -0.62%

YTD 8.31%

1,686.00

1D 0.21%

YTD 1.71%

96.06

1D -0.60%

YTD 25.57%

1,933.40

1D 0.06%

YTD 6.18%

Asian stocks mostly rose. In Japan, the Nikkei 225 gained 0.53%. The Chinese market rose with the Shanghai Composite up 0.47%. Hong Kong's Hang Seng rose 0.48%. South Korea's Kospi index rose 0.17%.

VIETNAM ECONOMY

2.11%

1D (bps) 1

YTD (bps) 130

5.60%

2.14%

1D (bps) 2

YTD (bps) 113

2.64%

1D (bps) -2

YTD (bps) 64

23,080

1D (%) 0.36%

YTD (%) 0.61%

25,325

1D (%) -0.96%

YTD (%) -4.32%

3,662

1D (%) 0.03%

YTD (%) 0.11%

In 2021, the total bilateral trade turnover between Vietnam and Australia for the first time exceeded the threshold of 12.4 billion USD, an increase of more than 49% compared to 2020. In which, Vietnam's exports to Australia reached more than 4.45 billion USD, an increase of more than 23% and Vietnam's import turnover from Australia reached nearly 8 billion USD, an increase of approximately 70%, compared to 2020.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnamese enterprises welcome the trend of investment cooperation with Australia

- The State Bank tightens the granting of credit to real estate and securities

- The Ministry of Finance regulates audit firms' activities

- EU approves fifth package of sanctions against Russia, blocking about 10 billion euros in exports

- European Union approves ban on Russian coal imports

- Japan lifts entry restrictions for most Asian countries

VN30

BANK

83,000

1D 0.00%

5D 0.24%

Buy Vol. 1,343,000

Sell Vol. 1,553,600

41,900

1D -2.67%

5D -5.52%

Buy Vol. 4,822,900

Sell Vol. 5,109,500

32,050

1D -1.54%

5D -3.03%

Buy Vol. 8,827,200

Sell Vol. 8,627,700

48,850

1D -0.91%

5D -2.88%

Buy Vol. 10,568,900

Sell Vol. 11,607,900

38,800

1D -2.51%

5D 0.52%

Buy Vol. 34,740,300

Sell Vol. 41,356,300

33,200

1D -1.48%

5D -0.30%

Buy Vol. 18,322,600

Sell Vol. 23,827,000

28,250

1D -2.25%

5D -4.07%

Buy Vol. 4,708,600

Sell Vol. 6,270,700

40,200

1D -1.95%

5D -2.55%

Buy Vol. 5,067,900

Sell Vol. 8,614,200

31,000

1D -2.82%

5D -3.73%

Buy Vol. 25,245,200

Sell Vol. 27,960,400

33,850

1D 0.74%

5D 1.35%

Buy Vol. 13,088,100

Sell Vol. 15,281,600

ACB: In terms of business results in the first quarter of 2022, the bank's credit information in the first three months of the year increased by about 5.2%; Deposits increased by 1.6% and demand deposit ratio (CASA) improved to 27%. Consolidated profit is about 4,200 billion VND, up 35% over the same period. Notably, non-interest income in the first quarter was about VND 1,300 billion, up 37%. In which, bancassurance activities contributed 390 billion in revenue. According to Mr. Tu Tien Phat, General Director of ACB, the bank is in the top position in terms of insurance business.

REAL ESTATE

85,400

1D 0.95%

5D 3.39%

Buy Vol. 9,626,000

Sell Vol. 9,016,100

50,900

1D -0.39%

5D -5.04%

Buy Vol. 1,434,300

Sell Vol. 1,683,800

91,000

1D -1.73%

5D -1.83%

Buy Vol. 3,630,200

Sell Vol. 4,158,200

KDH: From April 13 to May 12, entities related to Board members Nguyen Thi Dieu Phuong and Vuong Hoang Thao Linh registered to buy KDH shares with a total amount of 480,000 shares.

OIL & GAS

110,200

1D -2.30%

5D 0.46%

Buy Vol. 897,500

Sell Vol. 1,155,000

16,200

1D -2.70%

5D 1.25%

Buy Vol. 16,803,400

Sell Vol. 26,125,700

56,200

1D -0.71%

5D 2.00%

Buy Vol. 2,681,000

Sell Vol. 3,610,400

Doubts about Russia sanctions, oil prices fall. Brent oil futures fell 49 cents, or 0.5%, to $100.58 per barrel. WTI oil futures fell 20 cents, to $96.03 per barrel.

VINGROUP

81,700

1D 2.77%

5D -0.49%

Buy Vol. 8,242,100

Sell Vol. 9,298,700

75,100

1D 0.13%

5D -1.44%

Buy Vol. 6,810,300

Sell Vol. 7,929,300

32,200

1D -1.38%

5D -5.43%

Buy Vol. 6,443,400

Sell Vol. 5,920,600

VIC: VinFast Trading & Investment Pte. Ltd., a subsidiary of Vingroup, announced that it had submitted a preliminary listing application form F-1 to the US Securities Commission.

FOOD & BEVERAGE

77,300

1D -1.53%

5D -5.39%

Buy Vol. 4,714,900

Sell Vol. 4,950,800

148,500

1D 18.02%

5D 21.64%

Buy Vol. 1,689,500

Sell Vol. 2,039,500

164,200

1D -1.38%

5D -0.67%

Buy Vol. 536,000

Sell Vol. 207,000

MSN: PAT in 2022 is expected to be 6,900 - 8,500 billion VND, down from 15.8% - 31.6% compared to the same period last year. MSN plans to issue 142.3 million individual shares at the rate of 12%.

OTHERS

138,400

1D 1.02%

5D -1.77%

Buy Vol. 876,900

Sell Vol. 860,100

138,400

1D 1.02%

5D -1.77%

Buy Vol. 876,900

Sell Vol. 860,100

108,500

1D -4.24%

5D -2.25%

Buy Vol. 6,302,300

Sell Vol. 6,979,700

150,000

1D -3.23%

5D -3.85%

Buy Vol. 3,267,000

Sell Vol. 3,442,500

114,500

1D -0.52%

5D -2.30%

Buy Vol. 1,824,700

Sell Vol. 1,481,700

34,850

1D -3.99%

5D 0.87%

Buy Vol. 4,561,100

Sell Vol. 5,547,400

43,000

1D -2.38%

5D 0.23%

Buy Vol. 11,769,200

Sell Vol. 14,029,500

46,400

1D -0.32%

5D 1.53%

Buy Vol. 20,740,900

Sell Vol. 26,994,600

FPT: When asked by a shareholder of FPT or a subsidiary of FPT that has some real estate projects about to be carried out, Mr. Nguyen The Phuong, Deputy General Director of FPT shared that the company will not invest in this segment. this business. Real estate transactions in the past time only serve the fields of information technology or education.

Market by numbers

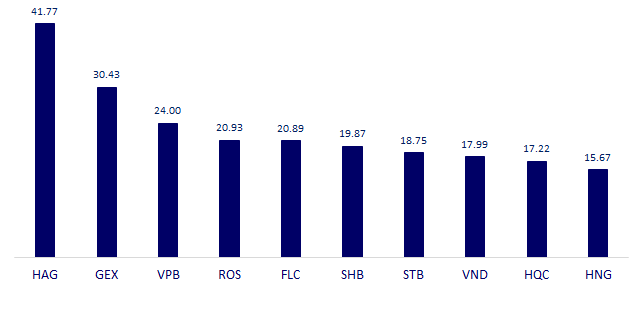

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

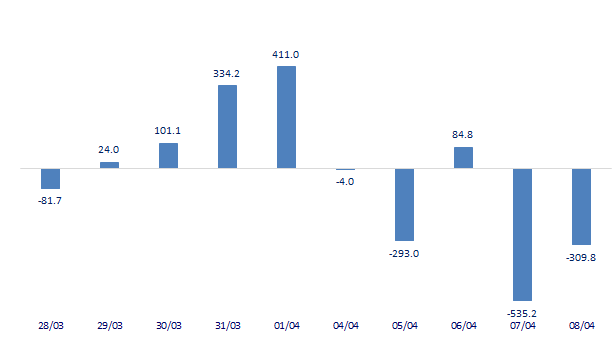

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

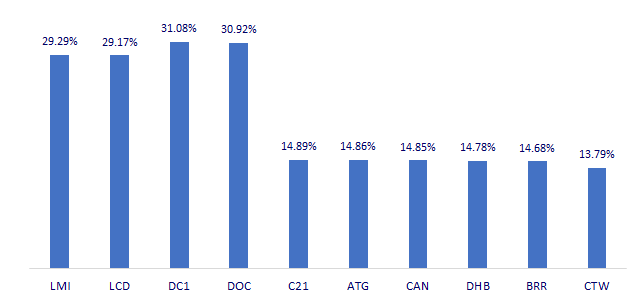

TOP INCREASES 3 CONSECUTIVE SESSIONS

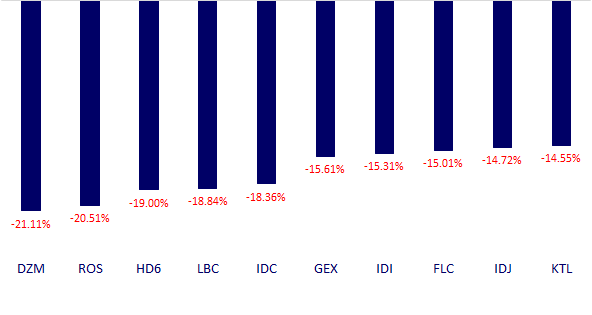

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.