Market brief 12/04/2022

VIETNAM STOCK MARKET

1,455.25

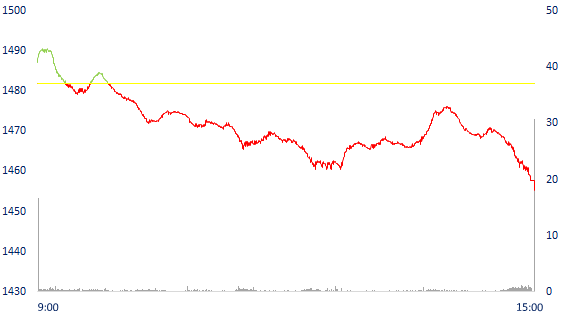

1D -1.80%

YTD -2.87%

1,507.20

1D -1.12%

YTD -1.86%

421.01

1D -2.55%

YTD -11.18%

112.53

1D -1.15%

YTD -0.13%

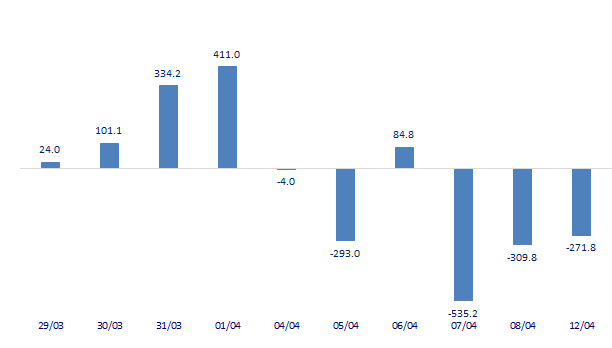

-271.78

1D 0.00%

YTD 0.00%

25,176.84

1D -9.88%

YTD -18.97%

Foreign investors continued to be net sellers of 272 billion dong in the session, VN-Index lost nearly 27 points. VPB was sold the most by foreign investors on HoSE with a value of 82 billion dong. HPG and VHM are behind with a net selling value of over 59 billion dong. Meanwhile, ETF certificates including E1VFVN30, FUESSVFL and FUEVFVND were all strongly net bought today.

ETF & DERIVATIVES

25,900

1D 0.08%

YTD 0.27%

17,760

1D -1.33%

YTD -1.82%

18,770

1D 5.39%

YTD -1.21%

22,000

1D -1.79%

YTD -3.93%

22,170

1D -0.58%

YTD -1.38%

30,000

1D -2.25%

YTD 6.95%

20,000

1D -1.96%

YTD -6.89%

1,503

1D -1.05%

YTD 0.00%

1,506

1D -0.91%

YTD 0.00%

1,508

1D -1.02%

YTD 0.00%

1,509

1D -0.95%

YTD 0.00%

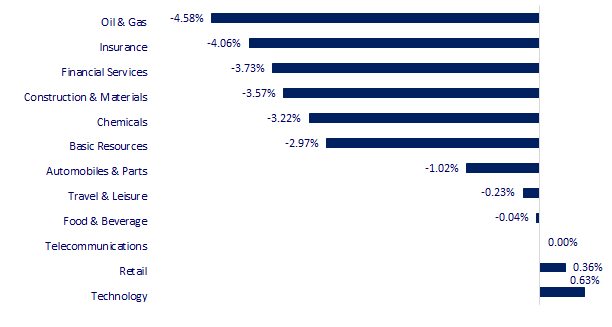

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

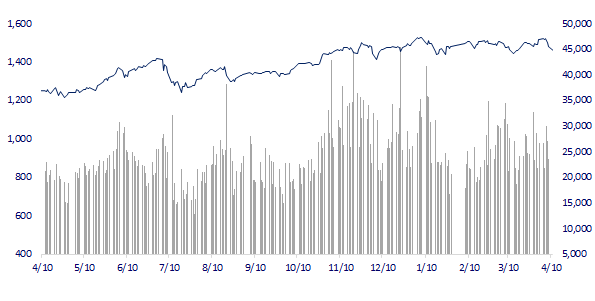

VNINDEX (12M)

GLOBAL MARKET

26,334.98

1D -0.49%

YTD -8.53%

3,213.33

1D -1.18%

YTD -11.72%

2,666.76

1D -1.25%

YTD -10.44%

21,319.13

1D 0.40%

YTD -8.88%

3,330.25

1D -1.57%

YTD 6.61%

1,674.34

1D -0.69%

YTD 1.01%

98.00

1D 2.32%

YTD 28.10%

1,955.00

1D 0.12%

YTD 7.37%

Asian stocks mixed, investors waited for US CPI. In Japan, the Nikkei 225 fell 0.49%. The Chinese market fell further with the Shanghai Composite down 1.18% Hong Kong's Hang Seng up 0.4%. South Korea's Kospi index fell 1.25%.

VIETNAM ECONOMY

2.11%

YTD (bps) 130

5.60%

2.28%

1D (bps) 14

YTD (bps) 127

2.82%

1D (bps) 18

YTD (bps) 82

23,105

1D (%) 0.44%

YTD (%) 0.72%

25,318

1D (%) -1.02%

YTD (%) -4.34%

3,663

1D (%) 0.16%

YTD (%) 0.14%

According to the Vietnam Food Association (VFA), within the past two weeks, the price of Vietnam's 100% broken rice export has been adjusted up three times, with the total increase in all three phases up to 17 USD/ton. The price of 100% broken rice in Vietnam is being sold at 355 USD/ton, about 7 USD/ton higher than the same rice in Pakistan. Prices of 5% broken and 25% broken rice in Vietnam remained stable at $415 and $395/ton.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Interest rates on personal deposits increased again in early April

- Export price of rice increased sharply

- IFC will support Vietnam in promoting the development of the private sector

- OPEC: Can't Replace Russia's Lost Oil Supply

- WTO warns Russia-Ukraine tensions greatly affect global trade

- The global economy is facing the "double worry" of inflation and recession

VN30

BANK

82,400

1D -0.72%

5D -0.72%

Buy Vol. 1,244,600

Sell Vol. 1,434,200

40,450

1D -3.46%

5D -6.58%

Buy Vol. 5,287,300

Sell Vol. 4,884,300

31,000

1D -3.28%

5D -4.17%

Buy Vol. 7,732,400

Sell Vol. 9,566,400

48,000

1D -1.74%

5D -2.14%

Buy Vol. 11,319,000

Sell Vol. 12,704,500

39,000

1D 0.52%

5D 1.83%

Buy Vol. 35,260,300

Sell Vol. 41,096,600

32,250

1D -2.86%

5D -1.23%

Buy Vol. 23,983,200

Sell Vol. 24,598,300

27,800

1D -1.59%

5D -3.30%

Buy Vol. 4,307,100

Sell Vol. 5,700,600

38,050

1D -5.35%

5D -6.74%

Buy Vol. 4,651,200

Sell Vol. 5,332,400

30,800

1D -0.65%

5D -3.14%

Buy Vol. 16,927,500

Sell Vol. 15,694,000

33,450

1D -1.18%

5D 1.36%

Buy Vol. 6,759,500

Sell Vol. 9,359,600

VCB: According to the document of the annual shareholder meeting in 2022, Vietcombank plans to increase its profit before tax by at least 12% compared to the previous year, equivalent to at least 30,675 billion VND. Total assets increased by 8%, capital mobilization is expected to be 9% higher, in line with credit growth. Loan balance is expected to increase by 15%, NPL ratio is set to be lower than 1.5%. The bank plans to issue 856 million dividend-paying shares with an issue rate of 18.1%.

REAL ESTATE

85,000

1D -0.47%

5D -3.08%

Buy Vol. 5,356,700

Sell Vol. 6,596,500

50,100

1D -1.57%

5D -3.65%

Buy Vol. 938,000

Sell Vol. 1,397,400

90,000

1D -1.10%

5D -3.23%

Buy Vol. 3,965,000

Sell Vol. 4,115,200

PDR: On April 21, PDR will close the list of shareholders to issue more than 178.8 million shares to pay dividends in 2021. Issuance rate 36.3%.

OIL & GAS

108,900

1D -1.18%

5D -4.72%

Buy Vol. 938,500

Sell Vol. 1,048,300

15,600

1D -3.70%

5D -4.59%

Buy Vol. 16,482,200

Sell Vol. 24,990,000

54,600

1D -2.85%

5D -2.67%

Buy Vol. 2,110,400

Sell Vol. 2,515,100

POW: Nhon Trach 3 & 4 are the first two thermal power projects using LNG fuel in Vietnam, implemented by POW, with many difficulties.

VINGROUP

81,300

1D -0.49%

5D -1.22%

Buy Vol. 3,449,700

Sell Vol. 4,720,500

73,000

1D -2.80%

5D -4.45%

Buy Vol. 5,585,000

Sell Vol. 7,083,600

31,100

1D -3.42%

5D -7.58%

Buy Vol. 7,415,000

Sell Vol. 7,244,800

In the week from April 4 to 8, VHM and VIC were both strongly sold by foreign investors with a value of 292 billion dong and 124 billion dong, respectively.

FOOD & BEVERAGE

76,800

1D -0.65%

5D -4.48%

Buy Vol. 3,258,700

Sell Vol. 3,354,600

125,400

1D 1.34%

5D -0.73%

Buy Vol. 1,850,500

Sell Vol. 2,225,700

163,300

1D -0.55%

5D -1.74%

Buy Vol. 254,600

Sell Vol. 219,300

MSN: Masan expects a net profit of at least VND 4,800 billion in 2022, private placement of 142.3 million shares and $500 million of convertible bonds.

OTHERS

138,000

1D -0.29%

5D -2.47%

Buy Vol. 957,400

Sell Vol. 1,018,200

138,000

1D -0.29%

5D -2.47%

Buy Vol. 957,400

Sell Vol. 1,018,200

109,800

1D 1.20%

5D 0.73%

Buy Vol. 5,051,700

Sell Vol. 4,586,000

152,700

1D 1.80%

5D -1.61%

Buy Vol. 4,246,600

Sell Vol. 4,242,000

112,400

1D -1.83%

5D -4.58%

Buy Vol. 2,032,800

Sell Vol. 1,952,900

33,000

1D -5.31%

5D -9.34%

Buy Vol. 3,763,800

Sell Vol. 4,368,500

41,800

1D -2.79%

5D -5.64%

Buy Vol. 10,955,900

Sell Vol. 12,928,800

45,100

1D -2.80%

5D -2.17%

Buy Vol. 27,135,600

Sell Vol. 31,366,100

VJC: In 2021, Vietjet's freight activities will reach VND 2,954 billion, in which the revenue of in-trip freight will reach VND 2,654 billion, Vietjet continues to record rapid growth, with increased revenue from cargo. turnover increased sharply by over 200% over the same period. In the fourth quarter alone, freight revenue reached 1,446 billion dong, up 1,000 billion dong over the same period.

Market by numbers

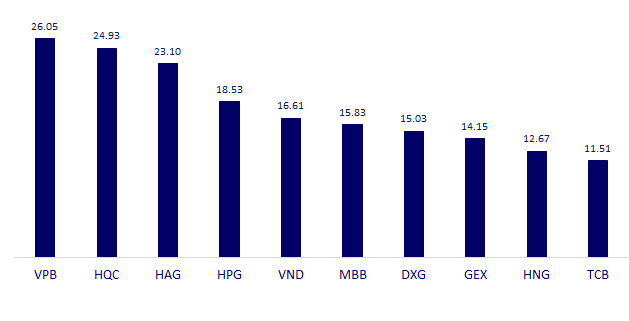

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

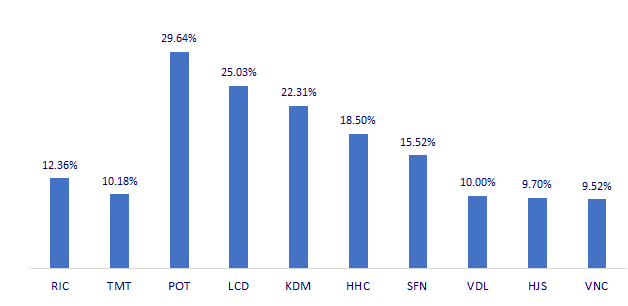

TOP INCREASES 3 CONSECUTIVE SESSIONS

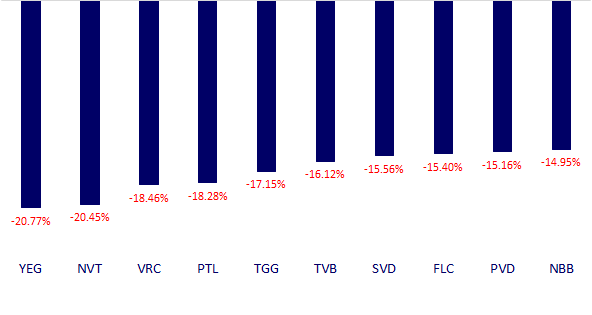

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.