Market brief 15/04/2022

VIETNAM STOCK MARKET

1,472.12

1D -0.34%

YTD -1.75%

1,518.01

1D -0.48%

YTD -1.15%

423.69

1D -0.88%

YTD -10.61%

113.41

1D 0.10%

YTD 0.65%

-225.30

1D 0.00%

YTD 0.00%

21,134.98

1D -18.77%

YTD -31.98%

Session April 15: Foreign investors net bought back 105 billion dong. HPG continued to be sold with 187 billion dong. SSI and VND were net sold of VND 67 billion and VND 43 billion respectively. Meanwhile, VPB was net sold with the strongest with VND 76 billion. CTG and DPM were bought by VND 64 billion and VND 55 billion respectively

ETF & DERIVATIVES

25,520

1D -1.47%

YTD -1.20%

17,860

1D -0.50%

YTD -1.27%

18,560

1D 4.21%

YTD -2.32%

22,060

1D -3.20%

YTD -3.67%

22,150

1D 0.45%

YTD -1.47%

31,080

1D 0.91%

YTD 10.80%

19,910

1D -0.10%

YTD -7.31%

1,504

1D -0.48%

YTD 0.00%

1,511

1D -0.28%

YTD 0.00%

1,511

1D -0.46%

YTD 0.00%

1,513

1D -0.47%

YTD 0.00%

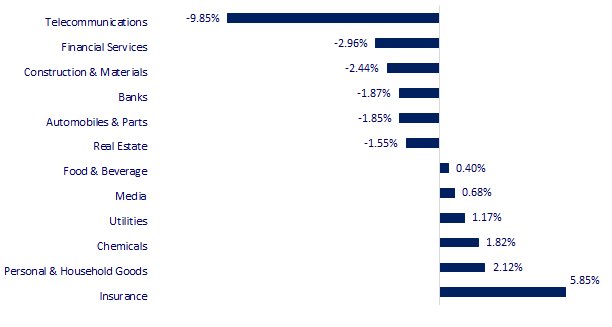

CHANGE IN PRICE BY SECTOR

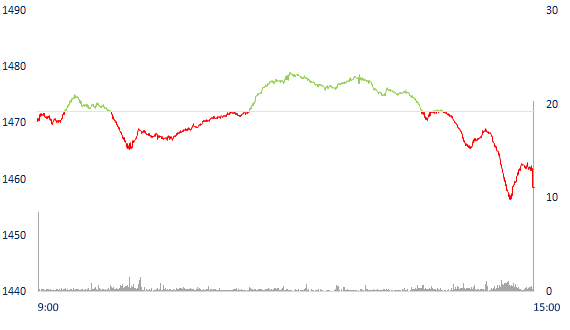

INTRADAY VNINDEX

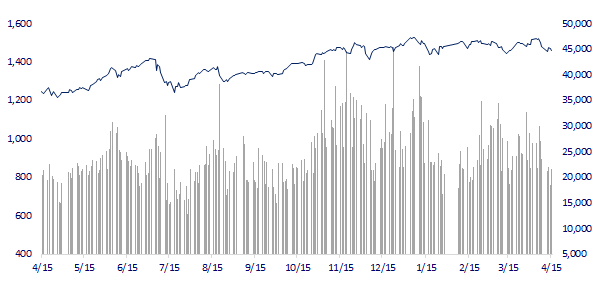

VNINDEX (12M)

GLOBAL MARKET

27,172.00

1D 1.22%

YTD -5.63%

3,225.64

1D 1.22%

YTD -11.38%

2,716.71

1D 0.01%

YTD -8.76%

21,518.08

1D 0.67%

YTD -8.03%

3,335.85

1D -0.19%

YTD 6.79%

1,674.34

1D 0.00%

YTD 1.01%

102.83

1D 0.24%

YTD 34.42%

1,970.20

1D -0.39%

YTD 8.21%

China suddenly does not lower interest rates, Asian stocks are mostly reduced. In Japan, Nikkei 225 decreased by 0.29%, Topix fell 0.62%. The Chinese market goes down with Shanghai Composite down 0.45%, Shenzhen Component decreased by 0.56%. The Chinese market was strongly underged in recent weeks when the country had to deal with the worst Covid-19 outbreak since Wuhan.

VIETNAM ECONOMY

2.11%

YTD (bps) 130

5.60%

2.36%

1D (bps) 8

YTD (bps) 135

2.98%

1D (bps) 16

YTD (bps) 98

-

1D (%) -

YTD (%) -

25,721

1D (%) 0.70%

YTD (%) -2.82%

3,664

1D (%) -0.03%

YTD (%) 0.16%

Vietnam Logistics Business Association proposes to develop early container fleet for import and export. Specifically, according to the proposal, the first phase in 3 - 5 years will focus on investing in container fleet for domestic transit routes such as China, Korea, Japan, Malaysia, India, Singapore, Central East ..., will need to spend 1.5 billion USD for new construction or acquiring old vessels and investing - buying containers.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Logistics Vietnam Service Association proposes to develop early container fleet

- Grant vaccine passports across the country from April 15

- Export of a record increase, enterprises face a lot of worries

- Singapore continues to tighten monetary policy to cope with inflation

- European Central Bank maintains a record low interest rate

- WHO: Covid-19 is still an emergency of global public health

VN30

BANK

81,000

1D -1.70%

5D -2.41%

Buy Vol. 2,313,000

Sell Vol. 1,613,200

40,500

1D -0.98%

5D -5.92%

Buy Vol. 2,870,200

Sell Vol. 3,580,600

31,200

1D -0.95%

5D -4.15%

Buy Vol. 5,404,800

Sell Vol. 6,919,600

47,300

1D -1.46%

5D -4.06%

Buy Vol. 12,554,700

Sell Vol. 12,472,200

39,500

1D 1.28%

5D -0.75%

Buy Vol. 39,471,300

Sell Vol. 43,994,000

32,300

1D -0.92%

5D -4.15%

Buy Vol. 13,637,300

Sell Vol. 16,142,300

27,300

1D -2.50%

5D -5.54%

Buy Vol. 8,574,100

Sell Vol. 6,529,700

39,050

1D -2.38%

5D -4.76%

Buy Vol. 3,863,600

Sell Vol. 5,660,700

30,800

1D -1.75%

5D -3.45%

Buy Vol. 10,516,300

Sell Vol. 13,869,700

33,800

1D 0.45%

5D 0.60%

Buy Vol. 7,251,100

Sell Vol. 10,837,200

CTG: Resolution of the Board of Directors approving the overall issuance plan of granted capital in a separate form. Term from 6 years to 15 years with par value of VND 100,000, the price issued by 100% of par value. The total bond value issued by par value is VND 15,000 billion.

REAL ESTATE

85,000

1D -1.73%

5D 0.47%

Buy Vol. 8,782,600

Sell Vol. 10,115,400

50,100

1D -0.99%

5D -1.96%

Buy Vol. 1,404,100

Sell Vol. 1,746,200

89,500

1D -1.65%

5D -3.35%

Buy Vol. 3,416,300

Sell Vol. 3,724,300

NVL: The plan to pay dividends with shares with par value of VND 10,000 / share, the execution rate is expected to be 1: 0.1. Number of shares expected to be issued was 193,042,132 shares

OIL & GAS

111,600

1D 1.36%

5D -1.06%

Buy Vol. 662,900

Sell Vol. 964,000

15,550

1D -0.96%

5D -6.61%

Buy Vol. 11,889,600

Sell Vol. 13,189,400

54,700

1D 0.00%

5D -3.36%

Buy Vol. 1,712,600

Sell Vol. 2,157,800

GAS: Setting a revenue plan is VND 80,000 billion, profit after tax is VND 7,039 billion, respectively decreasing by 0.2% and 20.5% in turn in 2021

VINGROUP

81,700

1D -0.61%

5D 2.77%

Buy Vol. 2,693,500

Sell Vol. 3,708,400

72,300

1D -1.09%

5D -3.60%

Buy Vol. 5,551,200

Sell Vol. 5,761,600

31,850

1D 0.00%

5D -2.45%

Buy Vol. 4,284,900

Sell Vol. 4,405,000

VIC: Vinfast cooperates with Amazon integrated Alexa voice assistant to smart electric cars

FOOD & BEVERAGE

76,300

1D -1.17%

5D -2.80%

Buy Vol. 3,209,800

Sell Vol. 3,516,500

125,700

1D -0.95%

5D -0.10%

Buy Vol. 1,318,200

Sell Vol. 1,337,500

166,900

1D 2.08%

5D 0.24%

Buy Vol. 387,700

Sell Vol. 170,000

MSN: Expected to submit to the Congress through the 2022 business plan with net revenue by 1.5% - 12.8%, but the goal of after-tax profit is 15.9% - 31.7 %

OTHERS

136,900

1D -0.87%

5D -0.07%

Buy Vol. 768,900

Sell Vol. 904,900

136,900

1D -0.87%

5D -0.07%

Buy Vol. 768,900

Sell Vol. 904,900

116,600

1D 1.30%

5D 2.91%

Buy Vol. 5,169,100

Sell Vol. 6,880,100

159,500

1D 2.11%

5D 2.90%

Buy Vol. 4,822,900

Sell Vol. 5,607,300

117,000

1D 0.86%

5D 1.65%

Buy Vol. 2,002,400

Sell Vol. 3,414,300

34,550

1D 0.14%

5D -4.82%

Buy Vol. 2,537,100

Sell Vol. 3,141,800

42,000

1D -1.29%

5D -4.65%

Buy Vol. 7,233,900

Sell Vol. 10,034,400

44,900

1D -0.66%

5D -3.54%

Buy Vol. 20,901,500

Sell Vol. 19,966,000

PNJ: Expected to issue 3.6 ESOP shares, equivalent to 1.5% of the stocks that are circulating the par value of VND 10,000 / share. The time is expected to be issued in the second quarter of 220, after being approved by the State Securities Commission.

Market by numbers

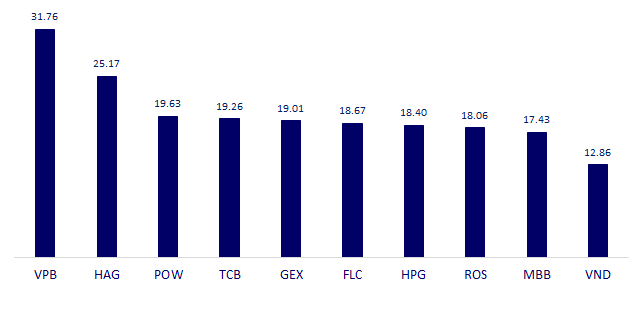

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

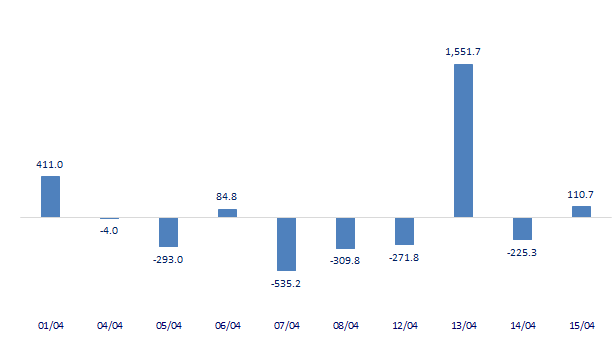

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

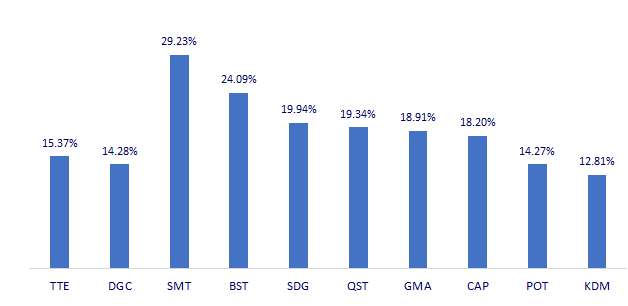

TOP INCREASES 3 CONSECUTIVE SESSIONS

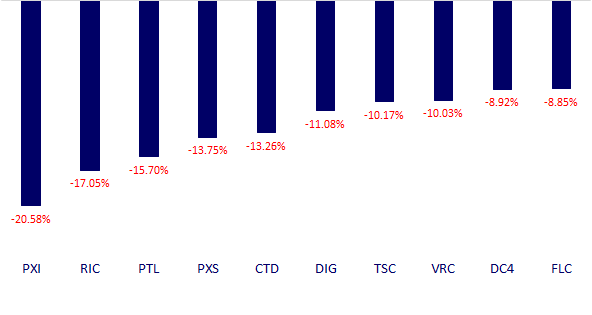

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.