Market brief 19/04/2022

VIETNAM STOCK MARKET

1,406.45

1D -1.83%

YTD -6.13%

1,440.61

1D -1.88%

YTD -6.19%

392.69

1D -2.59%

YTD -17.15%

108.32

1D -1.71%

YTD -3.87%

272.83

1D 0.00%

YTD 0.00%

26,436.61

1D -12.11%

YTD -14.92%

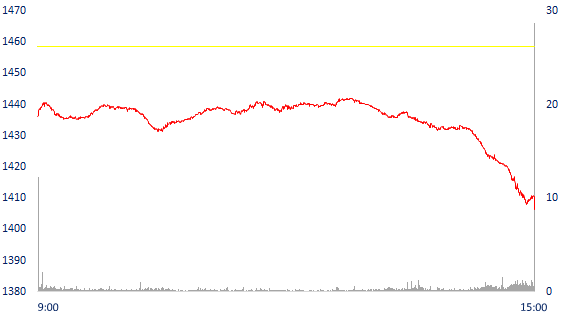

Foreign investors boosted their net buying of 273 billion dong in the session. VN-Index gradually retreated to 1,400 points. DPM topped HoSE's net buying list with 94 billion dong. GEX and KBC were net bought at 85 billion dong and 61 billion dong respectively. On the other side, DGC was sold the most on this floor with 136 billion dong. SSI and HPG were net sold 75 billion dong and 38 billion dong respectively.

ETF & DERIVATIVES

24,950

1D -1.38%

YTD -3.41%

17,000

1D -1.96%

YTD -6.03%

18,370

1D 3.14%

YTD -3.32%

21,400

1D -1.38%

YTD -6.55%

20,500

1D -4.61%

YTD -8.81%

29,800

1D -2.61%

YTD 6.24%

19,000

1D -4.71%

YTD -11.55%

1,455

1D -1.24%

YTD 0.00%

1,460

1D -1.22%

YTD 0.00%

1,458

1D -1.43%

YTD 0.00%

1,454

1D -1.29%

YTD 0.00%

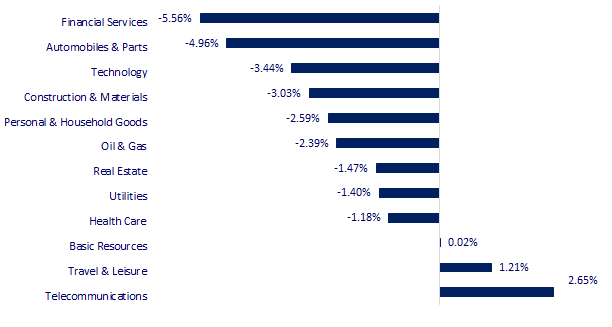

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

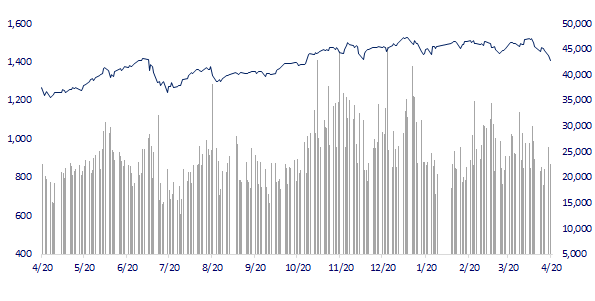

VNINDEX (12M)

GLOBAL MARKET

26,985.09

1D 0.29%

YTD -6.27%

3,194.03

1D -0.05%

YTD -12.25%

2,718.89

1D 0.95%

YTD -8.69%

21,027.76

1D 0.22%

YTD -10.13%

3,307.13

1D 0.12%

YTD 5.87%

1,675.62

1D 0.45%

YTD 1.09%

106.13

1D -1.11%

YTD 38.73%

1,978.15

1D -0.15%

YTD 8.64%

Asian stocks mostly rallied in early trading on April 19 as investors awaited a market reaction following the People's Bank of China's announcement of financial support measures for the key sectors. affected by Covid-19. The Nikkei 225 index rose 0.29%. South Korea's Kospi index rose 0.95%.

VIETNAM ECONOMY

2.11%

1D (bps) -1

YTD (bps) 130

5.60%

2.44%

1D (bps) 6

YTD (bps) 143

2.98%

1D (bps) -2

YTD (bps) 98

23,175

1D (%) 0.48%

YTD (%) 1.02%

25,218

1D (%) -0.88%

YTD (%) -4.72%

3,667

1D (%) -0.11%

YTD (%) 0.25%

Data from the General Department of Customs shows that, in the first quarter of 2022, Vietnam exported more than 1.5 million tons of rice, with a turnover of more than 730.7 million USD, up 26.3% in volume and up. 12.9% in value over the same period. Particularly in March 2022, rice exports reached 531,000 tons, with a turnover of nearly 263 million USD, up 13.3% and 17.7% respectively compared to February 2022.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- World demand increased, Vietnam's rice exports grew by double digits in both volume and value

- Businesses simultaneously asked to delay the minimum wage increase due to difficulties

- Long An reopens import-export activities at all border gates and openings

- America and Europe struggle with record gas prices

- China's real estate market will improve, no longer hot

- Sri Lanka asks IMF for urgent support

VN30

BANK

77,700

1D 0.00%

5D -5.70%

Buy Vol. 1,430,100

Sell Vol. 1,418,200

37,950

1D 0.00%

5D -6.18%

Buy Vol. 3,891,400

Sell Vol. 4,173,700

28,750

1D -1.54%

5D -7.26%

Buy Vol. 7,292,300

Sell Vol. 8,069,900

43,700

1D -2.56%

5D -8.96%

Buy Vol. 9,796,500

Sell Vol. 11,885,000

35,800

1D -2.32%

5D -8.21%

Buy Vol. 35,199,900

Sell Vol. 36,334,100

29,300

1D -3.30%

5D -9.15%

Buy Vol. 17,619,300

Sell Vol. 20,808,700

25,900

1D -0.38%

5D -6.83%

Buy Vol. 5,532,000

Sell Vol. 5,502,000

36,200

1D -4.49%

5D -4.86%

Buy Vol. 2,783,800

Sell Vol. 3,693,200

27,500

1D -5.17%

5D -10.71%

Buy Vol. 21,614,600

Sell Vol. 26,292,800

31,650

1D -3.51%

5D -5.38%

Buy Vol. 6,614,700

Sell Vol. 9,163,400

ACB: approved the plan to pay dividends in shares at the rate of 25%. The bank plans to issue 675 million shares. After completing the issuance, ACB's charter capital is expected to increase from more than 27,000 billion VND to 33,774 billion VND. In 2022, ACB targets pre-tax profit at VND 15,018 billion, up 25%. Total assets stood at VND 588,187 billion, up 11%. Outstanding loans to customers are expected to increase by 10% to VND 398,299 billion, according to the target assigned by the State Bank and will be adjusted higher upon approval. NPL ratio is controlled below 2%.

REAL ESTATE

82,000

1D -0.24%

5D -3.53%

Buy Vol. 4,206,500

Sell Vol. 4,036,700

50,100

1D 1.62%

5D 0.00%

Buy Vol. 2,064,300

Sell Vol. 2,336,800

85,800

1D -2.28%

5D -4.67%

Buy Vol. 3,004,700

Sell Vol. 3,365,100

NVL: The Board of Directors submitted a net revenue plan of 35,974 billion VND, up 141% compared to the previous year; profit after tax is 6,500 billion dong, up 88%.

OIL & GAS

113,900

1D -1.21%

5D 4.59%

Buy Vol. 1,131,200

Sell Vol. 1,951,100

13,500

1D -6.90%

5D -13.46%

Buy Vol. 18,328,600

Sell Vol. 23,898,900

51,000

1D -3.59%

5D -6.59%

Buy Vol. 2,326,700

Sell Vol. 2,498,800

POW: POW's investment capital in 2022 is VND4,989b, of which investment in capital construction is VND3,933b, procurement of equipment is VND799b and capital contribution is VND257b.

VINGROUP

78,800

1D -0.88%

5D -3.08%

Buy Vol. 2,432,800

Sell Vol. 3,033,100

68,900

1D -1.29%

5D -5.62%

Buy Vol. 4,373,000

Sell Vol. 5,253,300

30,850

1D -1.59%

5D -0.80%

Buy Vol. 4,803,100

Sell Vol. 5,615,900

VIC: Vinfast cooperates with Electrify America (EA) to provide charging solutions for electric vehicles. By end of 2021, EA owns about 800 charging stations and 3,500 individual charging ports.

FOOD & BEVERAGE

76,000

1D -1.30%

5D -1.04%

Buy Vol. 2,869,300

Sell Vol. 3,539,100

120,500

1D -2.82%

5D -3.91%

Buy Vol. 1,247,300

Sell Vol. 1,688,900

168,900

1D -0.65%

5D 3.43%

Buy Vol. 404,900

Sell Vol. 652,300

MSN: Chairman Masan said that Masan is about to move into the content and entertainment segment, the consumer segment bets on mini mall

OTHERS

143,100

1D 3.47%

5D 3.70%

Buy Vol. 1,375,200

Sell Vol. 1,287,800

143,100

1D 3.47%

5D 3.70%

Buy Vol. 1,375,200

Sell Vol. 1,287,800

112,000

1D -3.03%

5D 2.00%

Buy Vol. 6,845,000

Sell Vol. 7,664,000

156,000

1D -2.62%

5D 2.16%

Buy Vol. 5,468,300

Sell Vol. 5,148,900

118,900

1D -3.72%

5D 5.78%

Buy Vol. 1,746,600

Sell Vol. 2,684,800

35,000

1D -4.89%

5D 6.06%

Buy Vol. 4,311,900

Sell Vol. 7,590,800

35,000

1D -6.67%

5D -16.27%

Buy Vol. 18,940,200

Sell Vol. 19,455,200

43,300

1D 1.52%

5D -3.99%

Buy Vol. 31,234,900

Sell Vol. 26,464,000

SSI: submit to the General Meeting of Shareholders a plan to offer up to more than 104 million individual shares to strategic investors and/or professional securities investors. The offering price must not be lower than 90% of the average closing price of 10 consecutive trading days before the date the Board of Directors decides to approve the detailed issuance plan. After the issuance, charter capital is expected to increase from VND 14,921 billion to VND 15,962 billion.

Market by numbers

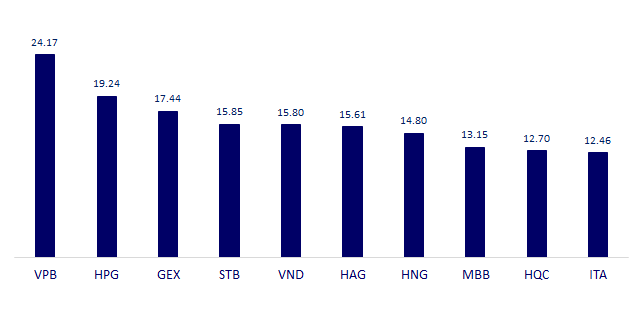

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

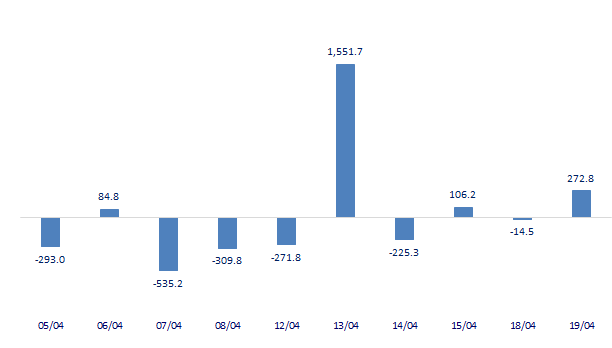

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

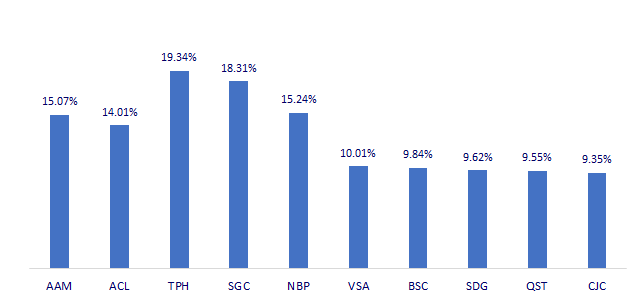

TOP INCREASES 3 CONSECUTIVE SESSIONS

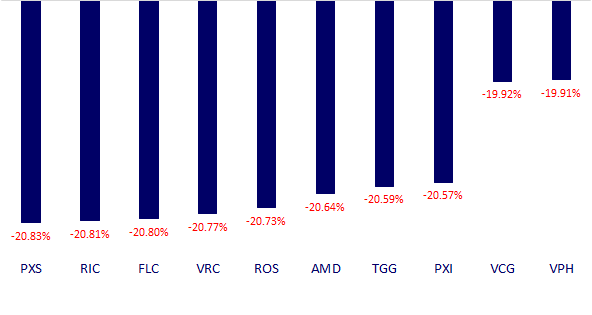

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.