Market brief 20/04/2022

VIETNAM STOCK MARKET

1,384.72

1D -1.55%

YTD -7.58%

1,435.50

1D -0.35%

YTD -6.53%

380.04

1D -3.22%

YTD -19.82%

106.40

1D -1.77%

YTD -5.57%

461.27

1D 0.00%

YTD 0.00%

24,218.45

1D -8.39%

YTD -22.06%

Foreign investors net bought 461 billion dong on April 20. DGC was still sold the most by foreign investors on HoSE with 117 billion dong. VHM and CII are behind with a net selling value of VND 62 billion and VND 42 billion, respectively. On the other hand, GEX was the strongest net bought with 76 billion dong. DPM and STB were net bought 75.7 billion dong and 65 billion dong respectively.

ETF & DERIVATIVES

24,800

1D -0.60%

YTD -3.99%

16,910

1D -0.53%

YTD -6.52%

17,900

1D 0.51%

YTD -5.79%

20,900

1D -2.34%

YTD -8.73%

20,350

1D -0.73%

YTD -9.48%

30,000

1D 0.67%

YTD 6.95%

18,980

1D -0.11%

YTD -11.64%

1,440

1D -1.02%

YTD 0.00%

1,441

1D -1.29%

YTD 0.00%

1,439

1D -1.29%

YTD 0.00%

1,440

1D -0.97%

YTD 0.00%

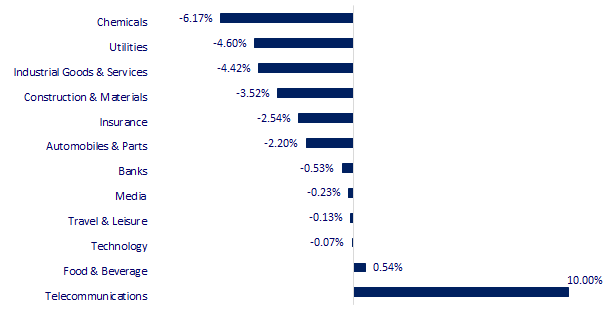

CHANGE IN PRICE BY SECTOR

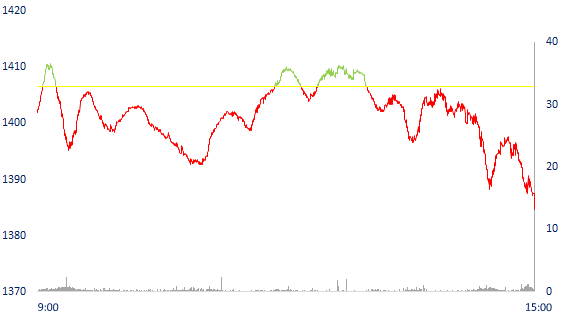

INTRADAY VNINDEX

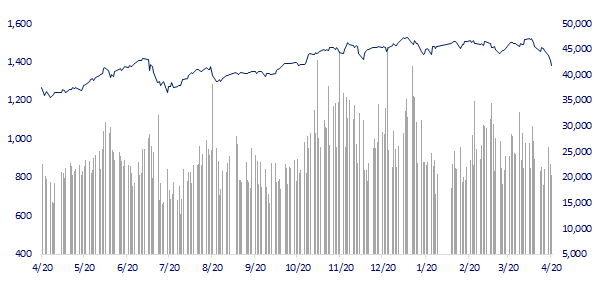

VNINDEX (12M)

GLOBAL MARKET

27,217.85

1D 0.44%

YTD -5.47%

3,151.05

1D -1.35%

YTD -13.43%

2,718.69

1D -0.01%

YTD -8.70%

20,944.67

1D -0.18%

YTD -10.48%

3,335.32

1D 0.85%

YTD 6.78%

1,680.35

1D 0.28%

YTD 1.37%

103.03

1D 0.65%

YTD 34.68%

1,955.45

1D 0.49%

YTD 7.40%

Asian stocks mixed as China kept key interest rates unchanged. The Nikkei 225 index rose 0.44%. China's stock market all fell. The Shanghai composite index fell 1.35% to 3,151.05 points. The Shenzhen component index fell 2,072% to 11,392.23 points. South Korea's Kospi fell 0.01%.

VIETNAM ECONOMY

2.11%

YTD (bps) 130

5.60%

2.36%

1D (bps) -8

YTD (bps) 135

2.97%

1D (bps) -1

YTD (bps) 97

23,185

1D (%) 0.39%

YTD (%) 1.07%

25,378

1D (%) -0.44%

YTD (%) -4.12%

3,652

1D (%) -0.05%

YTD (%) -0.16%

The State Bank of Vietnam recently announced data on the total means of payment and customer deposits at the credit institution system by the end of February 2022. Specifically, the total means of payment at the end of February reached more than 13.6 million billion dong, up 1.81% compared to the end of 2021. Customer deposits reached more than 1.1 million billion dong, up 1.38% compared to the beginning of the year. This growth mainly comes from residential customers.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- People's idle money massively returned to the banking system, deposit growth in 2M2022 was even greater than that of 2021.

- Vietnam has a great opportunity to develop the digital economy

- Pangasius exports sublimated in Q1, China and US markets grew by triple digits

- Countries simultaneously tightened monetary policy

- IMF, WB raise debt alarm in countries

- China announced 23 measures to save the economy struggling due to Covid-19

VN30

BANK

78,400

1D 0.90%

5D -4.85%

Buy Vol. 1,641,200

Sell Vol. 1,503,900

37,950

1D 0.00%

5D -7.21%

Buy Vol. 2,448,000

Sell Vol. 2,800,600

28,700

1D -0.17%

5D -8.89%

Buy Vol. 7,271,900

Sell Vol. 6,842,000

43,050

1D -1.49%

5D -10.31%

Buy Vol. 11,986,100

Sell Vol. 12,833,500

35,200

1D -1.68%

5D -9.74%

Buy Vol. 31,956,500

Sell Vol. 33,265,100

29,500

1D 0.68%

5D -9.51%

Buy Vol. 22,751,800

Sell Vol. 19,337,400

25,750

1D -0.58%

5D -8.04%

Buy Vol. 4,653,200

Sell Vol. 5,485,500

35,500

1D -1.93%

5D -11.25%

Buy Vol. 5,119,700

Sell Vol. 6,563,400

27,550

1D 0.18%

5D -12.12%

Buy Vol. 21,126,700

Sell Vol. 18,020,100

31,900

1D 0.79%

5D -5.20%

Buy Vol. 6,729,700

Sell Vol. 7,309,900

VPB: VPBank recently announced the deposit interest rate schedule for individual customers, applicable from April 15, 2022. In this adjustment, VPBank sharply increased interest rates in a series of terms. Accordingly, the highest interest rate at this bank is currently 6.9%/year, applicable to online savings customers of 50 billion VND or more with a term of 36 months, an increase of 0.2 percentage points compared to before.

REAL ESTATE

81,400

1D -0.73%

5D -5.90%

Buy Vol. 4,153,500

Sell Vol. 5,052,600

49,900

1D -0.40%

5D -1.38%

Buy Vol. 1,703,700

Sell Vol. 2,146,000

63,500

1D 0.87%

5D -4.89%

Buy Vol. 3,351,900

Sell Vol. 3,525,000

PDR: In 2022, PDR targets revenue of VND 10,700 billion and EAT of VND 2,908 billion. At the end of the first quarter, PDR only completed 5.8% of the revenue target and 9.6% of the profit target.

OIL & GAS

106,600

1D -6.41%

5D -3.18%

Buy Vol. 1,884,200

Sell Vol. 2,342,300

13,050

1D -3.33%

5D -16.88%

Buy Vol. 34,598,600

Sell Vol. 34,993,900

51,300

1D 0.59%

5D -6.22%

Buy Vol. 3,457,100

Sell Vol. 3,077,700

POW: Vung Ang 1 factory only has enough coal to store for 5 days, the price of imported coal is 3-4 times higher than the price of TKV

VINGROUP

79,300

1D 0.63%

5D -3.53%

Buy Vol. 2,386,000

Sell Vol. 3,477,600

66,800

1D -3.05%

5D -8.62%

Buy Vol. 7,556,400

Sell Vol. 9,000,100

30,650

1D -0.65%

5D -3.77%

Buy Vol. 5,050,100

Sell Vol. 6,021,100

VRE: In 2022, Vincom Retail plans to open Vicom Mega Mall Smart City (Hanoi) and 2 Vincom Plazas.

FOOD & BEVERAGE

75,600

1D -0.53%

5D -2.07%

Buy Vol. 3,036,100

Sell Vol. 3,586,800

124,300

1D 3.15%

5D -2.05%

Buy Vol. 1,510,000

Sell Vol. 2,186,500

172,000

1D 1.84%

5D 5.20%

Buy Vol. 512,900

Sell Vol. 557,900

MSN: Winmart/Winmart+ completed the rebranding in April 2022, along with that, hundreds of supermarkets and new stores were also opened.

OTHERS

142,000

1D -0.77%

5D 2.82%

Buy Vol. 1,005,400

Sell Vol. 1,229,500

142,000

1D -0.77%

5D 2.82%

Buy Vol. 1,005,400

Sell Vol. 1,229,500

112,000

1D 0.00%

5D -2.69%

Buy Vol. 5,556,400

Sell Vol. 5,288,100

156,000

1D 0.00%

5D -0.13%

Buy Vol. 4,071,900

Sell Vol. 3,203,500

118,900

1D 0.00%

5D 2.50%

Buy Vol. 1,756,500

Sell Vol. 1,934,000

32,550

1D -7.00%

5D -5.65%

Buy Vol. 3,845,800

Sell Vol. 6,062,100

35,200

1D 0.57%

5D -17.27%

Buy Vol. 18,201,100

Sell Vol. 18,246,100

43,200

1D -0.23%

5D -4.42%

Buy Vol. 22,023,900

Sell Vol. 23,050,100

SSI: announced the first quarter financial statements with consolidated revenue of VND 2,068.4 billion and profit before tax of VND 883.4 billion, up 36.2% and 66.6% respectively over the same period in 2021. All businesses grew and contributed to the overall revenue, in which securities services, capital trading and investment activities continued to be the fields that accounted for the largest proportion in the revenue structure.

Market by numbers

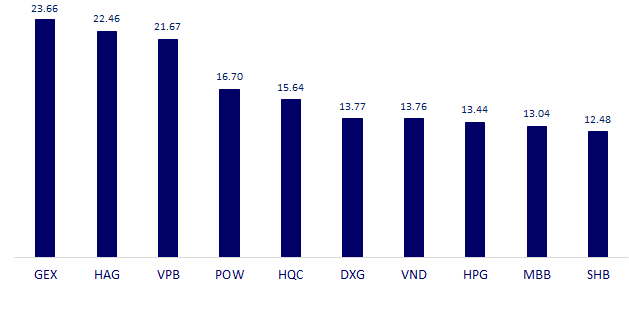

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

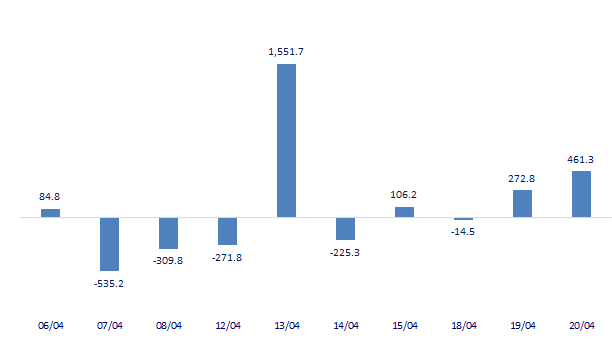

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

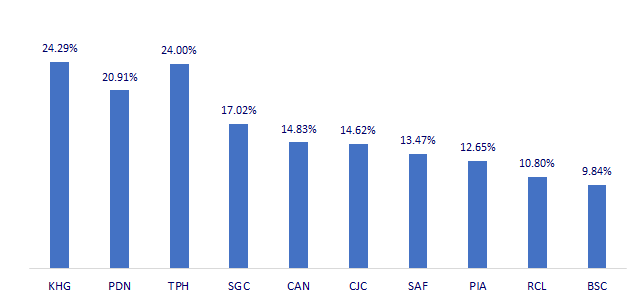

TOP INCREASES 3 CONSECUTIVE SESSIONS

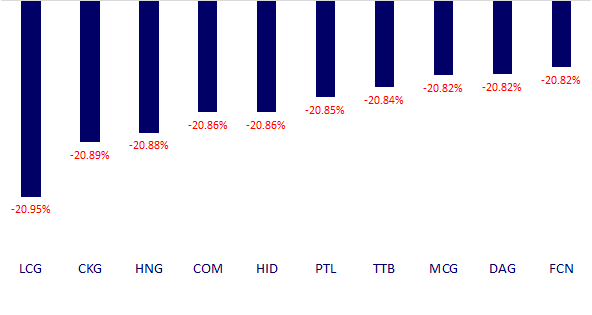

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.