Market brief 22/04/2022

VIETNAM STOCK MARKET

1,370.21

1D -1.05%

YTD -8.55%

1,426.87

1D -0.60%

YTD -7.09%

366.61

1D -3.53%

YTD -22.65%

104.89

1D -1.42%

YTD -6.91%

919.52

1D 0.00%

YTD 0.00%

28,104.95

1D 16.05%

YTD -9.55%

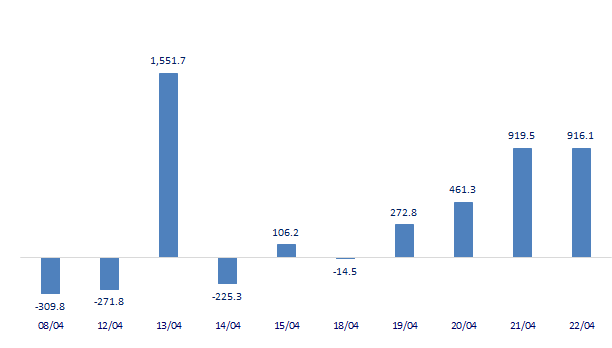

Foreign investors boosted their net buying of nearly 920 billion dong in the session on April 21. VRE topped the list of foreign investors' net buying with 71 billion dong. VNM and NLG were net bought 57 billion dong and 48.9 billion dong respectively. Meanwhile, VHM was sold the most with 63 billion dong. DPM and CII were net sold 61 billion dong and 51 billion dong respectively.

ETF & DERIVATIVES

24,990

1D 0.77%

YTD -3.25%

16,900

1D -0.06%

YTD -6.58%

18,400

1D 3.31%

YTD -3.16%

20,700

1D -0.96%

YTD -9.61%

20,500

1D 0.74%

YTD -8.81%

29,800

1D -0.67%

YTD 6.24%

18,760

1D -1.16%

YTD -12.66%

1,450

1D 0.69%

YTD 0.00%

1,450

1D 0.62%

YTD 0.00%

1,450

1D 0.76%

YTD 0.00%

1,435

1D -0.33%

YTD 0.00%

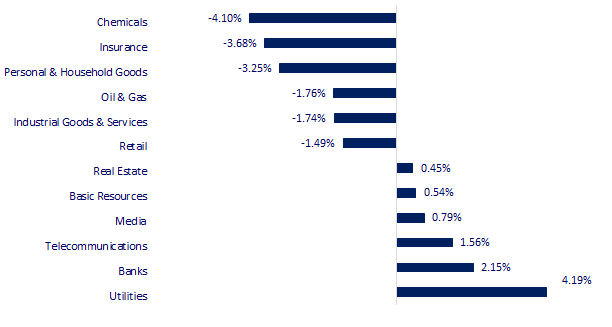

CHANGE IN PRICE BY SECTOR

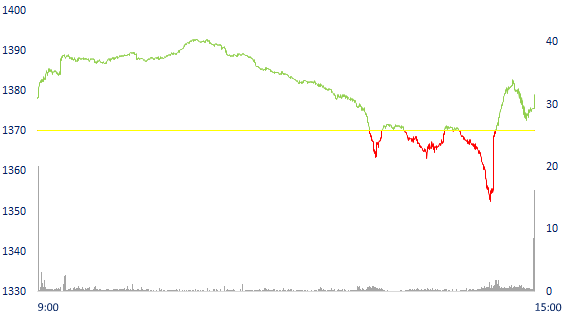

INTRADAY VNINDEX

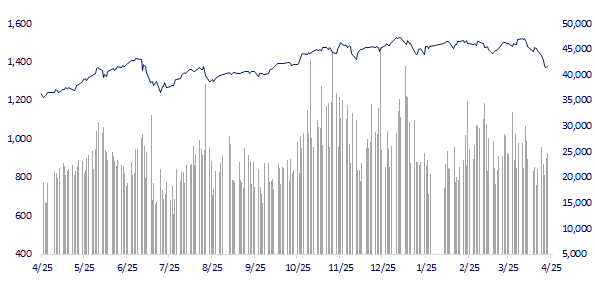

VNINDEX (12M)

GLOBAL MARKET

27,553.06

1D 0.31%

YTD -4.30%

3,079.81

1D -2.26%

YTD -15.38%

2,728.21

1D 0.35%

YTD -8.38%

20,682.22

1D -0.48%

YTD -11.61%

3,348.46

1D 0.39%

YTD 7.20%

1,690.55

1D 0.61%

YTD 1.99%

103.08

1D 0.25%

YTD 34.75%

1,946.10

1D -0.58%

YTD 6.88%

Many Asian markets fell on worries about China's economy slowing down. The stock markets of China and Hong Kong fell to the lowest levels of the month after the news that the Shanghai city government continued to maintain blockade measures to control the epidemic. Accordingly, the Shanghai composite index fell 2.26%. The Shenzhen component index fell 2.7%. The Hang Seng Index fell 0.48%

VIETNAM ECONOMY

2.05%

1D (bps) -6

YTD (bps) 124

5.60%

2.34%

1D (bps) -2

YTD (bps) 133

2.98%

1D (bps) 1

YTD (bps) 98

23,185

1D (%) 0.35%

YTD (%) 1.07%

25,506

1D (%) -0.46%

YTD (%) -3.63%

3,632

1D (%) -0.44%

YTD (%) -0.71%

Textile and garment export turnover in the first quarter increased by more than 20% and is the highest increase over the same period since 2012 until now. According to the General Department of Customs, the US market accounted for 50.3% of the country's total textile and garment export value in the first quarter of 2022.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Textile and garment exports have grown the most in the past 10 years and the US market accounts for more than 50% of turnover

- Vietnam has a large trade deficit in the first half of April due to special characteristics

- The Government requested to review the list of projects in the economic recovery program

- Global economy: Recession risks are always waiting

- Inflation in Russia reaches its highest level in 20 years

- Hong Kong lost its status as the world's aviation center because of zero Covid

VN30

BANK

78,400

1D 0.00%

5D -3.21%

Buy Vol. 2,977,100

Sell Vol. 3,175,000

38,500

1D 1.45%

5D -4.94%

Buy Vol. 3,910,700

Sell Vol. 3,700,000

29,000

1D 1.05%

5D -7.05%

Buy Vol. 8,621,800

Sell Vol. 8,569,400

43,600

1D 1.28%

5D -7.82%

Buy Vol. 16,024,400

Sell Vol. 14,891,200

35,500

1D 0.85%

5D -10.13%

Buy Vol. 31,674,700

Sell Vol. 28,189,800

30,000

1D 1.69%

5D -7.12%

Buy Vol. 22,154,300

Sell Vol. 18,856,500

24,900

1D -3.30%

5D -8.79%

Buy Vol. 8,035,400

Sell Vol. 7,459,300

34,800

1D -1.97%

5D -10.88%

Buy Vol. 5,269,900

Sell Vol. 5,653,400

27,650

1D 0.36%

5D -10.23%

Buy Vol. 19,205,800

Sell Vol. 15,195,100

31,500

1D -1.25%

5D -6.80%

Buy Vol. 7,511,500

Sell Vol. 8,574,800

VPB: announced business results for the first quarter of 2022 with consolidated pre-tax profit of over 11,146 billion VND, nearly three times higher than the same period last year. This is the record profit in a quarter that VPBank has recorded so far, contributing to bringing the bank's equity above 95 trillion VND and capital adequacy ratio (CAR) according to Circular 41. over 15%. Notably, the growth rate of profit from the core business of the individual bank reached more than 56%, along with an impressive recovery in business activities of FE Credit, promising to create momentum for VPBank to make a strong breakthrough in 2022.

REAL ESTATE

80,100

1D -1.60%

5D -5.76%

Buy Vol. 5,947,800

Sell Vol. 6,399,400

48,000

1D -3.81%

5D -4.19%

Buy Vol. 2,360,000

Sell Vol. 2,702,400

63,400

1D -0.16%

5D -3.45%

Buy Vol. 3,265,800

Sell Vol. 3,787,600

NVL: plans to research and implement new projects such as the Grand Sentosa project in Saigon South, NovaWorld Ho Tram will continue to launch a new phase of Long Island about 30 hectares.

OIL & GAS

105,000

1D -1.50%

5D -5.91%

Buy Vol. 1,745,900

Sell Vol. 1,737,600

13,300

1D 1.92%

5D -14.47%

Buy Vol. 37,261,600

Sell Vol. 29,144,900

50,300

1D -1.95%

5D -8.04%

Buy Vol. 3,923,500

Sell Vol. 2,977,200

POW: NT2 saw a 40% increase in profit after tax in Q1.2022 thanks to increased electricity sales. Revenue from electricity production increased by 21.6% QoQ, reaching VND 2,006.5b.

VINGROUP

77,500

1D -2.27%

5D -5.14%

Buy Vol. 3,242,300

Sell Vol. 5,019,700

64,000

1D -4.19%

5D -11.48%

Buy Vol. 8,950,700

Sell Vol. 8,775,900

30,500

1D -0.49%

5D -4.24%

Buy Vol. 10,116,400

Sell Vol. 9,073,100

VIC: To prepare the charging station infrastructure for the electric vehicle ecosystem, last year, VinFast built and installed more than 40,000 thousand charging ports across the country.

FOOD & BEVERAGE

75,000

1D -0.79%

5D -1.70%

Buy Vol. 6,168,600

Sell Vol. 7,523,600

123,000

1D -1.05%

5D -2.15%

Buy Vol. 2,138,000

Sell Vol. 2,662,600

169,700

1D -1.34%

5D 1.68%

Buy Vol. 640,800

Sell Vol. 900,700

VNM: Platinum Victory PTE.LTD, continued to register to buy nearly 20.9m VNM shares, bringing the holding volume to 242.75m shares (11.62%). The transaction was made from April 21 to May 20.

OTHERS

136,500

1D -3.87%

5D -0.29%

Buy Vol. 1,100,500

Sell Vol. 1,490,900

136,500

1D -3.87%

5D -0.29%

Buy Vol. 1,100,500

Sell Vol. 1,490,900

112,000

1D 0.00%

5D -3.95%

Buy Vol. 6,908,300

Sell Vol. 6,560,300

155,500

1D -0.32%

5D -2.51%

Buy Vol. 4,319,200

Sell Vol. 3,301,300

119,000

1D 0.08%

5D 1.71%

Buy Vol. 2,254,600

Sell Vol. 3,307,700

30,500

1D -6.30%

5D -11.72%

Buy Vol. 6,312,900

Sell Vol. 6,480,900

36,050

1D 2.41%

5D -14.17%

Buy Vol. 22,475,200

Sell Vol. 19,296,300

43,350

1D 0.35%

5D -3.45%

Buy Vol. 32,512,200

Sell Vol. 27,381,400

PNJ: announced first quarter revenue of 10,143 billion dong, up 41.2% over the same period last year; profit after tax is 721 billion dong, up 40.7%. With this result, the enterprise has achieved 39.3% of the revenue target and 54.6% of the year's profit target. Most of the main business segments grew, such as retail up 43.2%, gold bars up 61.1% and wholesale up 12.3%.

Market by numbers

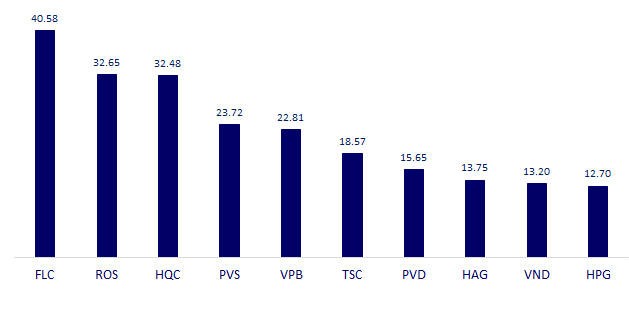

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

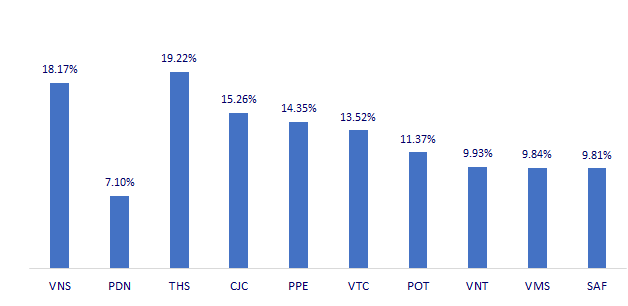

TOP INCREASES 3 CONSECUTIVE SESSIONS

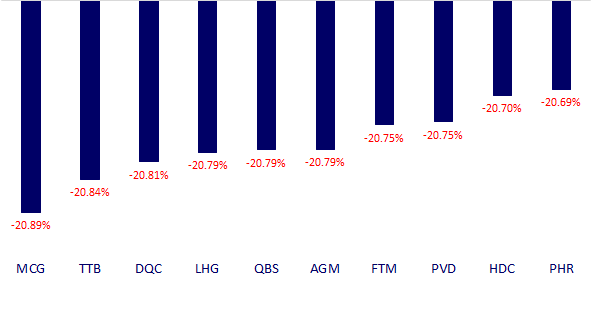

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.