Market brief 25/04/2022

VIETNAM STOCK MARKET

1,310.92

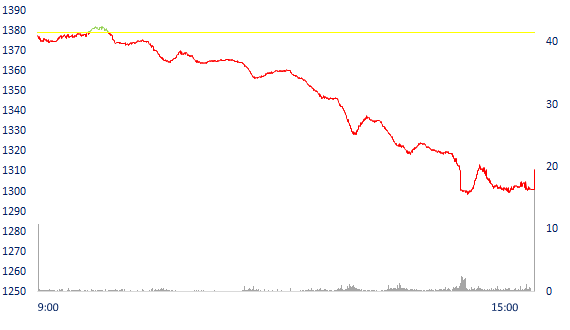

1D -4.95%

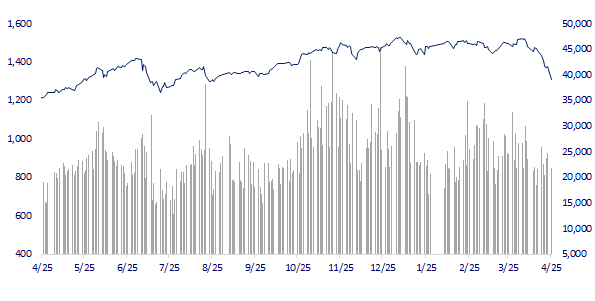

YTD -12.51%

1,366.39

1D -5.40%

YTD -11.03%

337.51

1D -6.02%

YTD -28.79%

99.54

1D -4.43%

YTD -11.66%

239.53

1D 0.00%

YTD 0.00%

25,522.33

1D -11.59%

YTD -17.86%

Vietnam's stock market fluctuated negatively in the trading session on April 25. Contrary to the general market's movements, foreign capital flow traded in a positive direction when net buying for the 7th session in a row with a value of 239 billion dong. SBT was bought the most by foreign investors on HoSE with 118 billion dong.

ETF & DERIVATIVES

23,080

1D -6.94%

YTD -10.65%

16,090

1D -5.19%

YTD -11.06%

17,450

1D -2.02%

YTD -8.16%

19,620

1D -5.45%

YTD -14.32%

19,550

1D -6.90%

YTD -13.03%

27,500

1D -5.82%

YTD -1.96%

18,040

1D -3.27%

YTD -16.01%

1,358

1D -5.82%

YTD 0.00%

1,350

1D -6.75%

YTD 0.00%

1,352

1D -6.41%

YTD 0.00%

1,353

1D -6.36%

YTD 0.00%

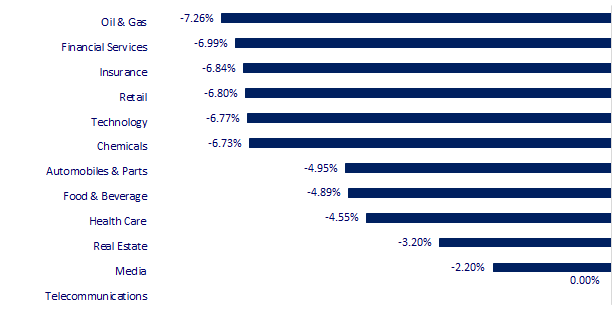

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

26,590.78

1D 0.15%

YTD -7.64%

2,928.51

1D -5.13%

YTD -19.54%

2,657.13

1D -1.76%

YTD -10.76%

19,869.34

1D -1.00%

YTD -15.08%

3,339.59

1D -0.64%

YTD 6.91%

1,675.33

1D -0.90%

YTD 1.07%

97.70

1D -1.47%

YTD 27.71%

1,909.55

1D -0.89%

YTD 4.87%

Following in the footsteps of the US, Asian stock markets mostly dropped at the beginning of the week. China's stock market fell the most. The Shanghai composite index fell 5.13% to 2,928.51 points. The Hang Seng Index (Hong Kong) dropped 1% points. The Nikkei 225 index alone rose 0.15% to 26,590.78 points.

VIETNAM ECONOMY

1.33%

1D (bps) -72

YTD (bps) 52

5.60%

2.38%

1D (bps) 4

YTD (bps) 137

2.94%

1D (bps) -4

YTD (bps) 94

23,200

1D (%) 0.39%

YTD (%) 1.13%

25,101

1D (%) -1.63%

YTD (%) -5.16%

3,567

1D (%) -0.70%

YTD (%) -2.49%

A positive signal for many related costs, VND interest rates on the interbank market have continuously fallen deeply last week. Featured in overnight VND interest rates. After stabilizing at a "new ground" of over 2%/year for a long time, in the middle of last week, the market recorded overnight interest rates leaving the 2% mark. This movement continued to show stronger until the end of the week.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Interbank interest rates fell continuously

- Develop a roadmap to adjust tax increases for tobacco, beer and alcohol

- Proposal to extend tax payment, insurance, solve the shortage of taxi drivers

- Germany sinks deep into debt due to sanctions against Russia

- Europe has a headache thinking about banning Russian oil

- ADB has spent 22.8 billion USD to help Asia - Pacific in 2021

VN30

BANK

81,800

1D -0.49%

5D 5.28%

Buy Vol. 3,103,200

Sell Vol. 3,864,900

35,850

1D -6.88%

5D -5.53%

Buy Vol. 3,689,500

Sell Vol. 5,107,900

27,350

1D -6.97%

5D -6.34%

Buy Vol. 8,079,200

Sell Vol. 9,698,800

41,050

1D -6.92%

5D -8.47%

Buy Vol. 16,879,500

Sell Vol. 16,574,800

34,250

1D -6.93%

5D -6.55%

Buy Vol. 37,633,600

Sell Vol. 50,466,900

28,100

1D -6.33%

5D -7.26%

Buy Vol. 27,152,800

Sell Vol. 26,699,500

23,550

1D -6.36%

5D -9.42%

Buy Vol. 6,460,100

Sell Vol. 7,517,400

34,500

1D -1.99%

5D -8.97%

Buy Vol. 4,615,100

Sell Vol. 6,143,100

26,800

1D -6.94%

5D -7.59%

Buy Vol. 18,417,000

Sell Vol. 24,497,600

30,500

1D -5.57%

5D -7.01%

Buy Vol. 10,000,600

Sell Vol. 11,416,500

MBB: The bank offers two scenarios of profit growth of 23% or 15% in 2022. MB will take over a credit institution with the expectation of 1.5-2 times growth in assets and credit. The bank plans to increase its charter capital to nearly VND 47,000 billion. Business real estate loans accounted for 10% of total outstanding loans, structural debt due to the impact of Covid-19 accounted for nearly 1.7%.

REAL ESTATE

80,100

1D -1.11%

5D -2.55%

Buy Vol. 4,577,900

Sell Vol. 5,055,700

46,000

1D -6.12%

5D -6.69%

Buy Vol. 1,688,100

Sell Vol. 2,082,400

62,000

1D -4.47%

5D -3.75%

Buy Vol. 2,062,500

Sell Vol. 2,544,800

KDH: in 2022, KDH is expected to complete the construction and business implementation of projects in Ho Chi Minh City such as The Classia with a scale of 4.3ha, The Privia project with 1.8ha.

OIL & GAS

104,500

1D -6.95%

5D -9.37%

Buy Vol. 809,900

Sell Vol. 1,610,200

12,450

1D -6.74%

5D -14.14%

Buy Vol. 21,549,800

Sell Vol. 31,326,000

46,600

1D -6.99%

5D -11.91%

Buy Vol. 3,184,200

Sell Vol. 3,670,300

Ending the trading session on April 22, the price of Brent oil on the London floor decreased by 2.13 USD, or 1.97%, to 106.2 USD/barrel. Closing the week, Brent oil prices fell 4.5%

VINGROUP

76,200

1D -1.93%

5D -4.15%

Buy Vol. 3,860,800

Sell Vol. 5,355,600

63,000

1D -2.63%

5D -9.74%

Buy Vol. 9,829,100

Sell Vol. 10,565,600

29,050

1D -5.99%

5D -7.34%

Buy Vol. 8,272,300

Sell Vol. 9,143,500

VIC: In 2022, Vingroup's revenue will come from the delivery of electric cars to global customers and sales will grow well thanks to the launch of 3 mega-urban projects.

FOOD & BEVERAGE

73,500

1D -3.16%

5D -4.55%

Buy Vol. 3,958,000

Sell Vol. 4,319,200

116,000

1D -5.92%

5D -6.45%

Buy Vol. 1,469,600

Sell Vol. 1,933,800

158,400

1D -6.99%

5D -6.82%

Buy Vol. 341,200

Sell Vol. 549,700

MSN: The BoDs has approved to increase the company's charter capital by more than 2,361b VND, according to which the charter capital after the increase will be more than 14,166b VND.

OTHERS

131,000

1D -5.21%

5D -5.28%

Buy Vol. 729,400

Sell Vol. 1,367,100

131,000

1D -5.21%

5D -5.28%

Buy Vol. 729,400

Sell Vol. 1,367,100

103,400

1D -6.93%

5D -10.48%

Buy Vol. 5,677,300

Sell Vol. 11,599,400

144,900

1D -7.00%

5D -9.55%

Buy Vol. 4,634,900

Sell Vol. 5,430,700

107,000

1D -6.96%

5D -13.36%

Buy Vol. 2,393,200

Sell Vol. 3,401,400

27,450

1D -6.95%

5D -25.41%

Buy Vol. 4,666,800

Sell Vol. 5,441,100

33,550

1D -6.93%

5D -10.53%

Buy Vol. 14,895,700

Sell Vol. 23,127,500

40,750

1D -6.96%

5D -4.45%

Buy Vol. 37,853,300

Sell Vol. 44,478,700

MWG: MWG will increase the number of An Khang stores from 178 to 400 by the end of June. After the trials, the business will promote the AVA Kids chain, expanding from 20 to 50 stores in June. MWG investment will dividend 10% cash and 100% stock for 2021.

Market by numbers

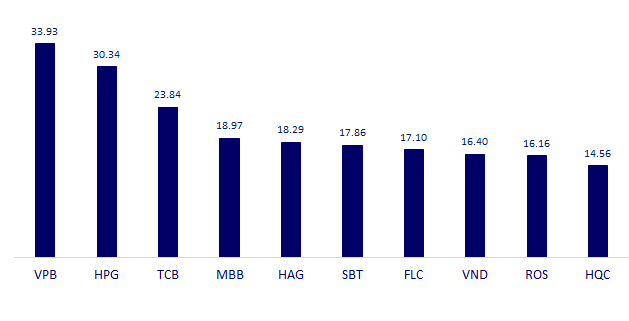

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

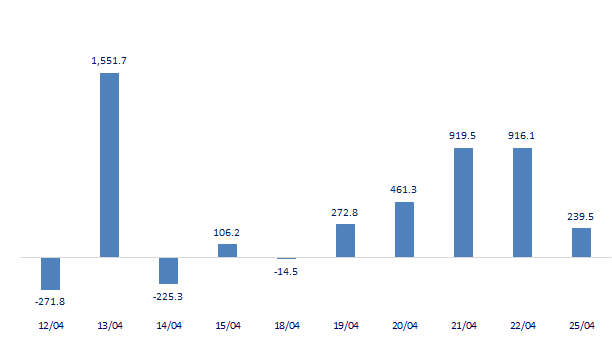

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

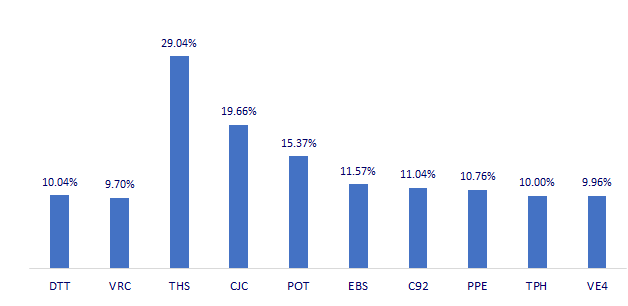

TOP INCREASES 3 CONSECUTIVE SESSIONS

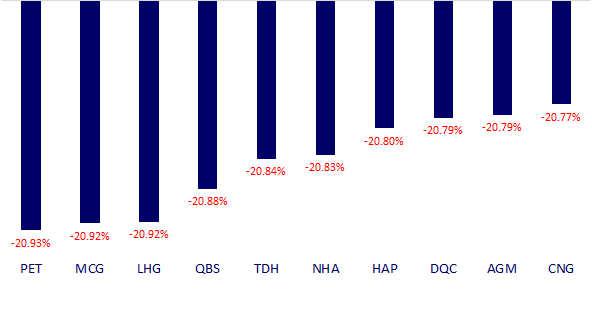

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.