Market brief 04/05/2022

VIETNAM STOCK MARKET

1,348.68

1D -1.33%

YTD -9.98%

1,389.59

1D -1.96%

YTD -9.51%

360.97

1D -1.33%

YTD -23.84%

104.02

1D -0.28%

YTD -7.69%

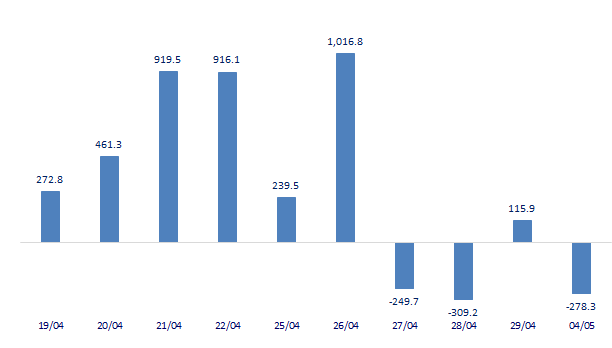

-278.32

1D 0.00%

YTD 0.00%

16,839.57

1D -21.60%

YTD -45.80%

Foreign investors net sold again 278 billion dong in session 4/5. Foreign investors net sold the most on KDH with 47 billion dong. After that, DGC and VHC were net sold at VND 30 billion and VND 22 billion, respectively. Meanwhile, NLG was bought the most with 46 billion dong. HPG and BCG were net bought 32 billion dong and 21 billion dong respectively.

ETF & DERIVATIVES

23,500

1D -1.92%

YTD -9.02%

16,330

1D -1.92%

YTD -9.73%

17,770

1D -0.22%

YTD -6.47%

20,500

1D -4.21%

YTD -10.48%

20,500

1D 3.54%

YTD -8.81%

28,600

1D -0.87%

YTD 1.96%

19,210

1D 3.06%

YTD -10.57%

1,391

1D -1.80%

YTD 0.00%

1,384

1D -1.45%

YTD 0.00%

1,385

1D -1.72%

YTD 0.00%

1,383

1D -1.85%

YTD 0.00%

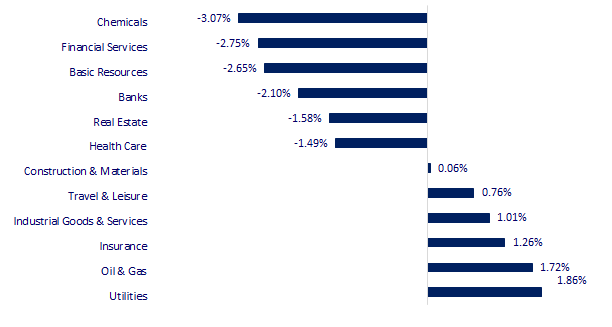

CHANGE IN PRICE BY SECTOR

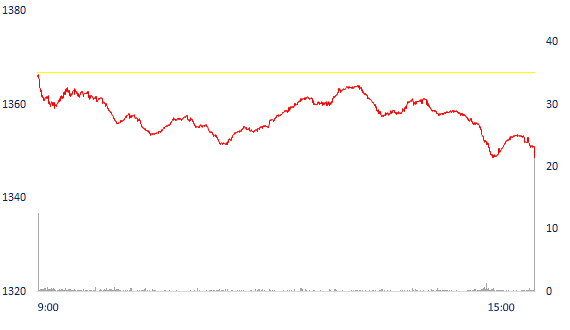

INTRADAY VNINDEX

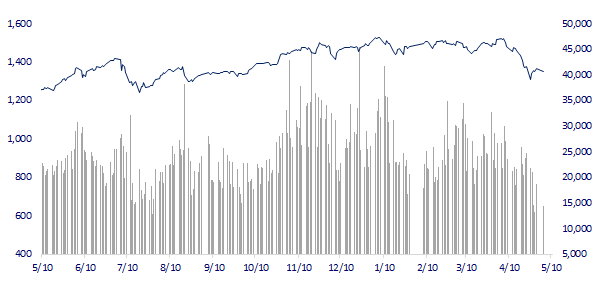

VNINDEX (12M)

GLOBAL MARKET

26,818.53

1D 0.00%

YTD -6.85%

3,047.06

1D 0.00%

YTD -16.28%

2,677.57

1D -0.65%

YTD -10.08%

20,869.52

1D -0.26%

YTD -10.81%

3,349.27

1D -0.23%

YTD 7.22%

1,652.29

1D -0.91%

YTD -0.32%

106.13

1D 2.73%

YTD 38.73%

1,866.92

1D 0.18%

YTD 2.53%

Asian stock markets fell, investors waited for the Fed's interest rate decision. Markets in Japan and mainland China were closed for a holiday. South Korea's Kospi index fell 0.65%. The Hang Seng Index fell 0.26%

VIETNAM ECONOMY

1.37%

YTD (bps) 56

5.60%

2.37%

1D (bps) 3

YTD (bps) 136

2.98%

1D (bps) 1

YTD (bps) 98

23,185

1D (%) 0.35%

YTD (%) 1.07%

24,626

1D (%) -1.15%

YTD (%) -6.96%

3,545

1D (%) 0.00%

YTD (%) -3.09%

In the first 4 months of the year, there were 5 groups of products with export value reaching over 1 billion USD, including coffee about 1.7 billion USD, rice about 1 billion USD, vegetables and fruits reaching 1.2 billion USD, shrimp 1, 3 billion USD, wood products reached nearly 5.5 billion USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- PMI in April reached nearly 52 points, production costs continued to increase rapidly

- Many banks continue to increase deposit interest rates from May

- Export of agricultural products skyrocketed, revealing a product group exceeding the USD 1 billion mark

- European Commission proposes to exclude 3 Russian banks from SWIFT

- EU plans to find alternative sources from Africa to replace Russian gas imports

- Yields on 10-year US Treasuries stay above 3%

VN30

BANK

79,900

1D -1.24%

5D -1.96%

Buy Vol. 1,364,100

Sell Vol. 1,811,000

37,250

1D 0.00%

5D 0.13%

Buy Vol. 2,474,300

Sell Vol. 2,822,900

27,000

1D -2.70%

5D -4.59%

Buy Vol. 6,883,900

Sell Vol. 8,029,100

42,000

1D -4.55%

5D 0.96%

Buy Vol. 8,662,200

Sell Vol. 10,746,900

35,800

1D -2.45%

5D -0.42%

Buy Vol. 16,792,600

Sell Vol. 23,862,300

28,900

1D -3.02%

5D -2.69%

Buy Vol. 11,806,700

Sell Vol. 14,160,600

24,800

1D -1.98%

5D -0.80%

Buy Vol. 3,750,100

Sell Vol. 4,214,200

32,000

1D -4.76%

5D -8.05%

Buy Vol. 2,369,900

Sell Vol. 2,747,000

26,750

1D -3.43%

5D -5.14%

Buy Vol. 14,077,100

Sell Vol. 14,860,400

31,750

1D -2.91%

5D 2.75%

Buy Vol. 3,569,600

Sell Vol. 4,044,100

BID: Q1.2022 business results with net interest income increasing by 18.4% QoQ, reaching nearly VND12,826b. Profit from the foreign exchange business increased by more than 54%, with 584b dong, the investment securities business gained 1.6b dong, the same period last year lost nearly 331b dong. Net profit from the service segment decreased by more than 11%, bringing in 1,275b dong QoQ, the securities trading segment lost nearly 2b dong while in the same period last year, the bank reported a profit of more than 450b dong, the net profit from the trading segment Other business activities also decreased by more than 19%, earning 1,458b VND.

REAL ESTATE

80,500

1D -1.83%

5D -0.98%

Buy Vol. 3,876,700

Sell Vol. 4,579,000

46,500

1D -2.92%

5D -1.06%

Buy Vol. 691,500

Sell Vol. 778,600

61,500

1D -0.97%

5D -0.81%

Buy Vol. 3,012,200

Sell Vol. 3,227,500

NVL: consolidated financial results of the first quarter with more than 1,965 billion dong of total revenue and nearly 1,046 billion dong of profit after tax, up 49% over the same period.

OIL & GAS

108,000

1D 1.89%

5D -2.70%

Buy Vol. 1,008,800

Sell Vol. 1,098,100

14,050

1D 6.84%

5D 8.49%

Buy Vol. 40,506,600

Sell Vol. 26,876,200

48,650

1D 1.35%

5D 0.72%

Buy Vol. 1,487,300

Sell Vol. 1,644,200

The Inter-Ministry of Industry said that the highest price of gasoline E5 RON 92 on May 4 was 27,460 VND per liter (an increase of 330 VND); RON 95 is 28,430 VND per liter (up 440 VND).

VINGROUP

79,700

1D -0.38%

5D 2.18%

Buy Vol. 2,338,300

Sell Vol. 3,664,300

64,500

1D -0.77%

5D -0.77%

Buy Vol. 3,985,900

Sell Vol. 4,611,600

29,950

1D -3.07%

5D -1.80%

Buy Vol. 3,779,300

Sell Vol. 4,722,300

VIC: plans to offer to the international market USD1.5b worth of bonds with the option to receive VinFast shares. The Group will issue the first phase with a scale of USD525m right in May.

FOOD & BEVERAGE

72,500

1D -2.29%

5D -3.33%

Buy Vol. 2,521,300

Sell Vol. 2,887,300

113,100

1D -2.50%

5D -4.96%

Buy Vol. 969,800

Sell Vol. 1,025,300

163,500

1D 0.86%

5D -3.25%

Buy Vol. 336,600

Sell Vol. 175,000

VNM: Q1.2022, consolidated net revenue maintained its upward momentum at 5.2% QoQ, reaching VND 13,878 billion and completing 21.3% of the year plan (VND 64,070 billion).

OTHERS

130,300

1D 0.31%

5D 1.01%

Buy Vol. 656,100

Sell Vol. 601,400

130,300

1D 0.31%

5D 1.01%

Buy Vol. 656,100

Sell Vol. 601,400

104,500

1D -0.48%

5D 1.46%

Buy Vol. 3,033,300

Sell Vol. 2,816,300

149,500

1D 0.20%

5D 1.56%

Buy Vol. 2,072,600

Sell Vol. 1,979,800

108,300

1D 0.28%

5D 1.21%

Buy Vol. 761,200

Sell Vol. 1,079,600

28,050

1D -2.77%

5D -3.61%

Buy Vol. 2,385,200

Sell Vol. 2,556,000

32,000

1D -4.62%

5D -6.98%

Buy Vol. 11,323,700

Sell Vol. 11,993,700

42,000

1D -3.00%

5D -1.18%

Buy Vol. 21,098,000

Sell Vol. 25,127,600

HPG: consolidated financial statements of the first quarter with revenue increasing 41.3% to 44,058 billion dong. COGS increased more strongly so gross profit also increased by 23.5% to 10,108 billion dong. Gross profit margin decreased from 26.25% to 22.94%. Financial revenue decreased 14% to VND 769 billion, financial expenses increased 45% to VND 1,111 billion. Selling expenses increased by 39% and administrative expenses increased by 28%.

Market by numbers

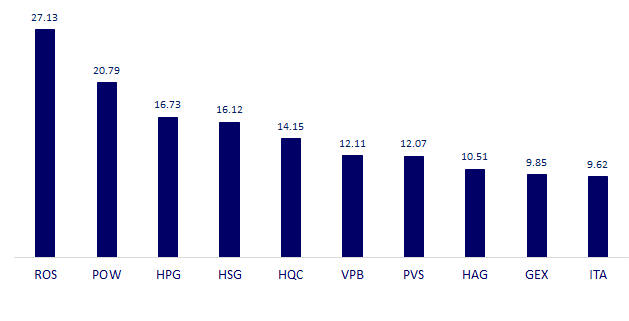

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

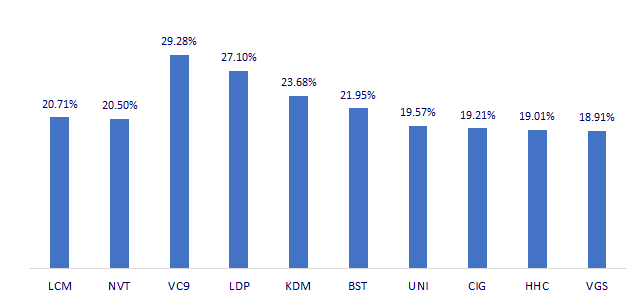

TOP INCREASES 3 CONSECUTIVE SESSIONS

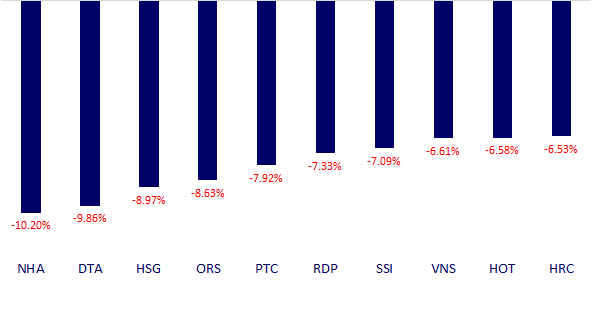

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.