Market brief 12/05/2022

VIETNAM STOCK MARKET

1,238.84

1D -4.82%

YTD -17.32%

1,279.76

1D -5.19%

YTD -16.67%

315.52

1D -5.26%

YTD -33.43%

96.44

1D -2.38%

YTD -14.41%

-112.38

1D 0.00%

YTD 0.00%

17,991.21

1D 38.03%

YTD -42.10%

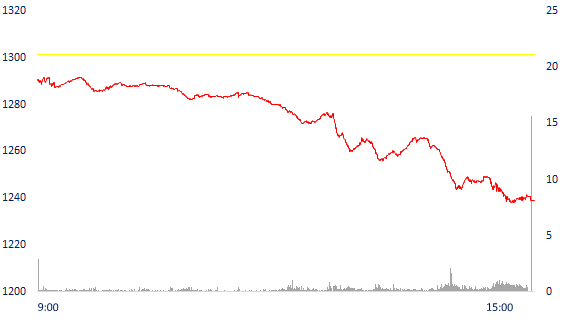

A series of stocks hit the floor, VN-Index lost nearly 63 points. Market liquidity increased sharply compared to the previous session. The total matched value reached 15,717 billion dong, up 37% of which, the matched value on HoSE increased 36% to 14,003 billion dong. Foreign investors net sold 112 billion dong.

ETF & DERIVATIVES

21,470

1D -5.83%

YTD -16.88%

15,000

1D -5.84%

YTD -17.08%

15,780

1D -11.40%

YTD -16.95%

18,300

1D -5.18%

YTD -20.09%

19,000

1D 0.00%

YTD -15.48%

26,100

1D -5.61%

YTD -6.95%

17,850

1D -2.62%

YTD -16.90%

1,270

1D -5.05%

YTD 0.00%

1,265

1D -5.36%

YTD 0.00%

1,275

1D -4.77%

YTD 0.00%

1,270

1D -5.01%

YTD 0.00%

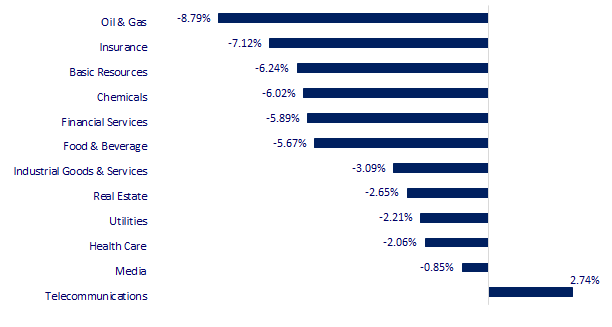

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

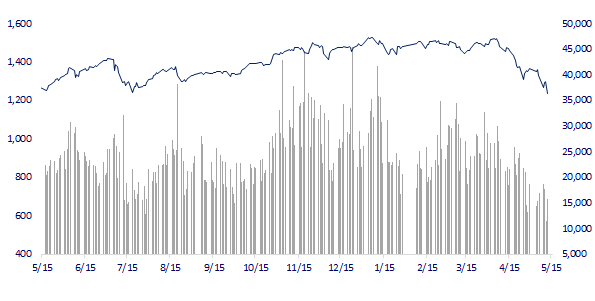

VNINDEX (12M)

GLOBAL MARKET

25,748.72

1D -0.99%

YTD -10.57%

3,054.99

1D -0.12%

YTD -16.07%

2,550.08

1D -1.63%

YTD -14.36%

19,380.34

1D -1.14%

YTD -17.17%

3,165.18

1D -1.89%

YTD 1.33%

1,584.52

1D -1.79%

YTD -4.41%

104.09

1D -1.06%

YTD 36.07%

1,848.19

1D -0.48%

YTD 1.50%

Asian stocks all fell. The Nikkei 225 index fell 0.99%. The Hang Seng Index (Hong Kong) fell 1.14%. In South Korea, the Kospi index fell 1.63%. The Shanghai Composite Index fell 0.12%. China yesterday announced April inflation at 2.1%, higher than experts' forecast.

VIETNAM ECONOMY

2.00%

1D (bps) 9

YTD (bps) 119

5.60%

2.51%

1D (bps) 5

YTD (bps) 150

3.13%

1D (bps) 9

YTD (bps) 113

23,315

1D (%) 0.54%

YTD (%) 1.63%

24,542

1D (%) -1.75%

YTD (%) -7.28%

3,475

1D (%) -0.71%

YTD (%) -5.00%

According to statistics, in the first quarter of 2022, the picture of deposit growth at banks was divergent with 7 banks recording a decline and 21 banks having positive growth. The banks with the highest deposit growth are VPBank (13.4%), HDBank (9.9%), TPBank (9.3%), SCB (9.1%), Sacombank (7.1%). , VIB (5.9%),…

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Two more banks increase deposit interest rates in May

- LEGO plans to start construction of a factory of more than 1 billion USD in Binh Duong in November

- IMF points out risks affecting Vietnam's economic outlook this year

- Russia sanctions 31 US, EU, Singapore energy companies

- Economic stagnation and inflation continue to soar in France

- China calls for enhanced cooperation with the new South Korean administration

VN30

BANK

77,000

1D -3.75%

5D -4.94%

Buy Vol. 1,417,500

Sell Vol. 1,688,400

33,600

1D -6.93%

5D -12.04%

Buy Vol. 1,956,000

Sell Vol. 2,811,300

25,000

1D -6.37%

5D -10.39%

Buy Vol. 8,480,000

Sell Vol. 10,301,600

36,300

1D -6.92%

5D -14.79%

Buy Vol. 9,084,200

Sell Vol. 11,409,300

31,100

1D -6.89%

5D -12.52%

Buy Vol. 23,468,200

Sell Vol. 26,823,500

25,650

1D -6.73%

5D -11.55%

Buy Vol. 15,311,600

Sell Vol. 15,093,700

22,950

1D -5.36%

5D -8.75%

Buy Vol. 4,065,800

Sell Vol. 4,861,900

31,600

1D -5.53%

5D -7.60%

Buy Vol. 3,246,000

Sell Vol. 3,676,300

21,950

1D -6.79%

5D -18.40%

Buy Vol. 32,566,500

Sell Vol. 37,785,300

29,500

1D -6.65%

5D -6.94%

Buy Vol. 4,551,600

Sell Vol. 5,126,000

Preliminary statistics show that the highest growth rate is MB with 14.8% since the beginning of the year. Notably, credit growth in both segments is customer loans 14.3% and corporate bonds 19.5%. MB has almost reached the provisional credit limit in the first quarter and is waiting for approval of a new credit limit. Similarly, at Techcombank, the bank's credit increased by 7.9%, up 2.81 percentage points over the same period last year.

REAL ESTATE

75,300

1D -4.32%

5D -7.27%

Buy Vol. 4,052,700

Sell Vol. 6,432,200

42,250

1D -3.10%

5D -8.35%

Buy Vol. 1,270,800

Sell Vol. 1,566,900

57,000

1D -6.10%

5D -7.32%

Buy Vol. 2,110,700

Sell Vol. 2,536,600

NLG: Dragon Capital, through its member fund, CTBC Vietnam Equity Fund, purchased an additional 1m NLG shares to raise its ownership from 22.36m shares (5.84%) to 23.37m shares (6,04%).

OIL & GAS

105,600

1D -3.03%

5D -3.47%

Buy Vol. 1,228,700

Sell Vol. 1,551,200

12,300

1D -6.82%

5D -13.07%

Buy Vol. 15,714,400

Sell Vol. 21,668,000

38,600

1D -6.99%

5D -18.91%

Buy Vol. 3,051,700

Sell Vol. 2,855,700

POW: Total revenue of the Corporation in April is estimated at 2,824b VND, equal to 154% of the monthly plan. Total accumulated revenue in 4 months is estimated at 9,948b VND.

VINGROUP

79,000

1D -1.86%

5D -1.25%

Buy Vol. 3,615,900

Sell Vol. 4,245,300

68,900

1D -2.27%

5D 0.15%

Buy Vol. 5,884,300

Sell Vol. 7,280,100

26,900

1D -6.92%

5D -11.22%

Buy Vol. 4,467,400

Sell Vol. 6,867,800

VHM: Within the next 5 years, Vinhomes strives to complete 500,000 social housing houses across the country with a total area of 50 to 60 hectares per project.

FOOD & BEVERAGE

66,500

1D -4.32%

5D -7.77%

Buy Vol. 4,680,500

Sell Vol. 4,761,700

104,100

1D -6.97%

5D -12.52%

Buy Vol. 1,466,800

Sell Vol. 1,659,300

164,900

1D 0.86%

5D -2.66%

Buy Vol. 418,100

Sell Vol. 376,700

VNM and SAB were both among the top stocks that were net bought by foreign investors in today's session with a value of VND 34 billion and VND 9.4 billion, respectively.

OTHERS

124,800

1D -1.34%

5D -4.59%

Buy Vol. 874,100

Sell Vol. 877,300

124,800

1D -1.34%

5D -4.59%

Buy Vol. 874,100

Sell Vol. 877,300

95,600

1D -6.18%

5D -8.69%

Buy Vol. 3,808,300

Sell Vol. 4,351,600

134,400

1D -4.68%

5D -10.04%

Buy Vol. 2,397,300

Sell Vol. 2,497,200

101,100

1D -5.51%

5D -8.09%

Buy Vol. 1,168,100

Sell Vol. 1,622,700

22,900

1D -6.91%

5D -18.79%

Buy Vol. 2,420,000

Sell Vol. 4,041,600

25,800

1D -6.86%

5D -16.77%

Buy Vol. 22,057,700

Sell Vol. 25,383,000

38,250

1D -5.90%

5D -9.04%

Buy Vol. 34,222,500

Sell Vol. 35,296,700

FPT: announced the Resolution of the Board of Directors to pay the remaining cash dividend in 2021 and issue shares to pay dividends from retained earnings. Specifically, the company will pay the remaining cash dividend of 2021 at the rate of 10%. With 914 million shares outstanding, the company plans to spend 914 billion dong to pay cash dividends. Along with that, FPT plans to issue 182.8 million shares, paying 20% dividend. Charter capital increased from 9,142 billion VND to 10,970 billion VND.

Market by numbers

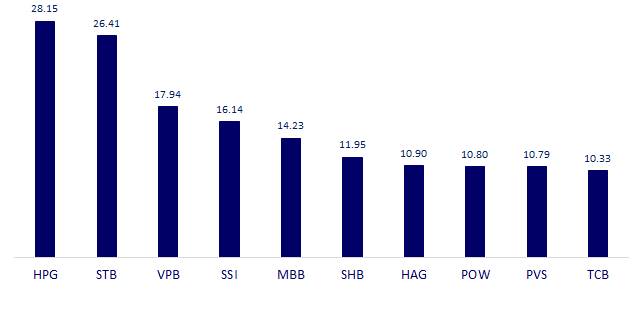

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

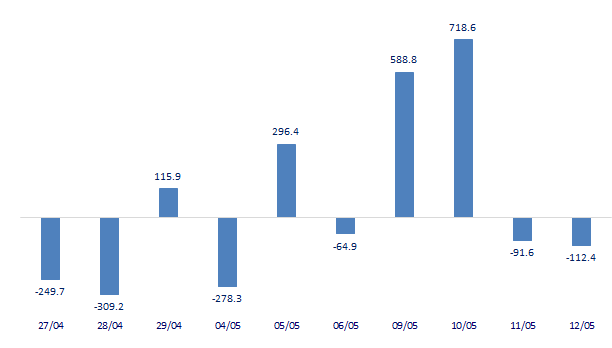

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

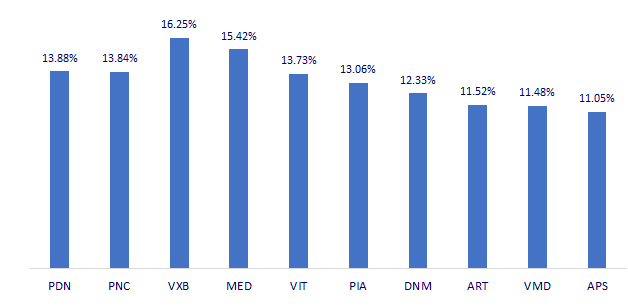

TOP INCREASES 3 CONSECUTIVE SESSIONS

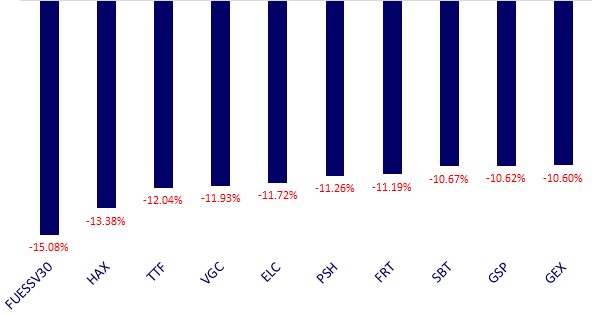

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.