Morning brief 16/05/2022

GLOBAL MARKET

32,196.66

1D 1.47%

YTD -11.54%

4,023.89

1D 2.39%

YTD -15.80%

11,805.00

1D 3.82%

YTD -25.01%

32.56

1D 0.00%

7,418.15

1D 2.55%

YTD 0.20%

14,027.93

1D 2.10%

YTD -11.69%

6,362.68

1D 2.52%

YTD -11.30%

108.03

1D 0.46%

YTD 41.22%

1,814.12

1D -0.48%

YTD -0.37%

Investors are poring over an index for clues as to how much further U.S. stocks can slide. There are some signs that the decline is not over yet. On May 12, the S&P 500 index continued its decline of nearly 20% from its peak in January, before recovering later this week, near the top of a bear market, amid many concerns that prolonged inflation will cause the US Federal Reserve (Fed) to continue raising interest rates. The tech-league Nasdaq Composite is even lower, with 24.5% so far.

VIETNAM ECONOMY

2.00%

YTD (bps) 119

5.60%

2.56%

1D (bps) 5

YTD (bps) 155

3.12%

1D (bps) -1

YTD (bps) 112

23,235

1D (%) 0.00%

YTD (%) 1.29%

24,779

1D (%) 0.26%

YTD (%) -6.38%

3,472

1D (%) -0.03%

YTD (%) -5.08%

According to three credit rating agencies, Moody's, S&P and Fitch rate Vietnam at BB (according to Fitch and S&P) and Moody's at Ba3. All three organizations rate Vietnam at a Positive outlook.

VIETNAM STOCK MARKET

1,182.77

1D -4.53%

YTD -21.06%

1,223.76

1D -4.38%

YTD -20.31%

302.39

1D -4.16%

YTD -36.20%

93.61

1D -2.93%

YTD -16.92%

584.21

23,319.40

1D 29.62%

YTD -24.95%

In the past week, domestic individual investors traded somewhat negatively and was the main factor causing the market's decline, while both foreign investors and domestic institutions were good net buyers. Domestic individual investors net sold again 3,486b dong in HoSE after the previous 2 consecutive weeks of net buying.

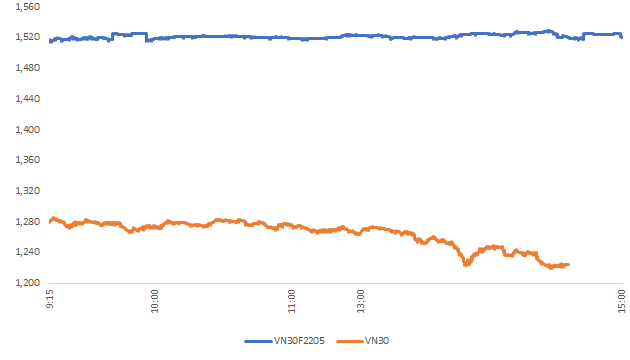

INTRADAY

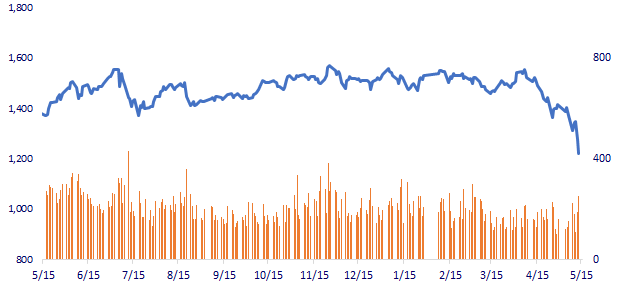

VN30 (12M)

SELECTED NEWS

- Vietnam is rated at Positive outlook

- Prime Minister promotes cooperation with oil and gas projects with large US corporations

- Existing inflationary pressure

- The renminbi increases its proportion in the basket of IMF reserves

- Recession scenarios the US has to face

- China's slow growth affects the world

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.