Market brief 19/05/2022

VIETNAM STOCK MARKET

1,241.64

1D 0.07%

YTD -17.13%

1,283.55

1D -0.22%

YTD -16.42%

308.02

1D -0.59%

YTD -35.02%

94.58

1D -0.16%

YTD -16.06%

-128.95

1D 0.00%

YTD 0.00%

15,377.42

1D -5.69%

YTD -50.51%

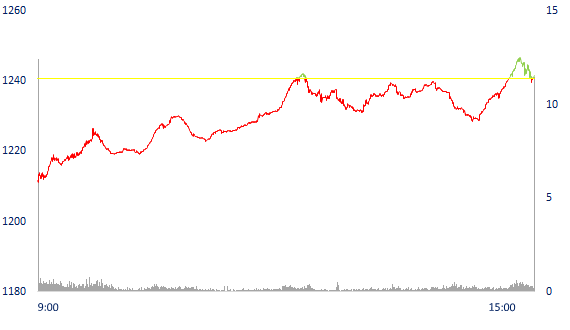

Buyers and sellers struggled strongly in the expiration of Derivative futures contracts. The total matched value on the whole market reached 13,782 billion dong, down 9% compared to the previous session, of which, matched value on HoSE floor reached 11,628 billion dong, down 10.3%. Foreign investors net sold nearly 129 billion dong on HoSE.

ETF & DERIVATIVES

21,680

1D -0.55%

YTD -16.07%

15,130

1D 0.27%

YTD -16.36%

15,880

1D -10.84%

YTD -16.42%

18,200

1D 0.05%

YTD -20.52%

18,500

1D 6.81%

YTD -17.70%

27,500

1D 5.16%

YTD -1.96%

16,910

1D -0.18%

YTD -21.28%

1,272

1D -0.78%

YTD 0.00%

1,274

1D -0.99%

YTD 0.00%

1,275

1D -0.55%

YTD 0.00%

1,283

1D 0.16%

YTD 0.00%

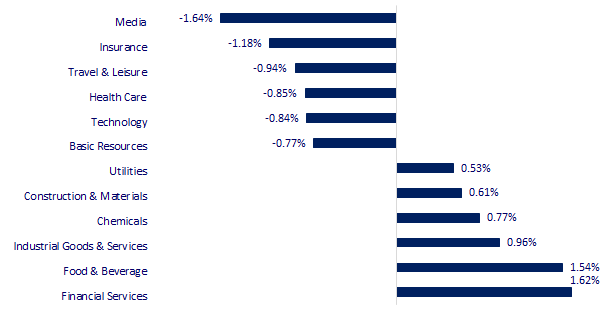

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

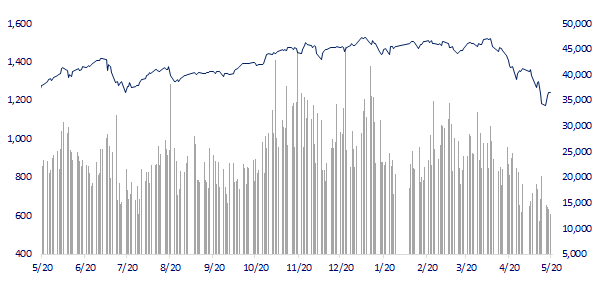

VNINDEX (12M)

GLOBAL MARKET

26,402.84

1D 0.62%

YTD -8.30%

3,096.96

1D 0.36%

YTD -14.91%

2,592.34

1D -1.28%

YTD -12.94%

20,120.68

1D 0.06%

YTD -14.01%

3,190.71

1D -1.07%

YTD 2.15%

1,605.98

1D -0.89%

YTD -3.12%

105.34

1D -2.29%

YTD 37.70%

1,826.26

1D 0.64%

YTD 0.30%

Sentiment splits, Asian stocks mixed. The Hang Seng Index in Hong Kong rose 0.06% to 20,120.60 points. In mainland China, the Shanghai Composite Index rose 0.36% to 3,096.96 points. In Japan, the Nikkei 225 gained 0.62%. South Korea's Kospi index fell 1.28% to 2,592.34 points.

VIETNAM ECONOMY

1.75%

1D (bps) -16

YTD (bps) 94

5.60%

2.50%

1D (bps) -1

YTD (bps) 149

3.02%

1D (bps) -7

YTD (bps) 102

23,390

1D (%) 0.49%

YTD (%) 1.96%

24,775

1D (%) -0.88%

YTD (%) -6.40%

3,496

1D (%) 0.03%

YTD (%) -4.43%

According to the latest updated data from the General Department of Customs, in April, textile and garment exports reached 3.15 billion USD, bringing the total export turnover of this commodity group to 11.83 billion USD, up 22.2% over the same period last year, equivalent to an increase of 2.15 billion USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The US and EU sharply increased imports of clothes and shoes from Vietnam

- Fed raises interest rates and 5 big impacts on Vietnam's economy

- US FDI into Vietnam: Realizing the billion-dollar plan

- Turkey blocks talks on admission of Finland and Sweden to NATO

- Goldman Sachs lowers China's 2022 growth forecast

- India is not the only country to ban food exports

VN30

BANK

76,000

1D 0.80%

5D -1.30%

Buy Vol. 1,269,000

Sell Vol. 1,182,200

34,650

1D -0.72%

5D 3.13%

Buy Vol. 1,872,100

Sell Vol. 1,686,400

26,100

1D -1.88%

5D 4.40%

Buy Vol. 8,752,900

Sell Vol. 7,097,300

35,800

1D -0.69%

5D -1.38%

Buy Vol. 10,067,600

Sell Vol. 9,960,800

30,450

1D -1.62%

5D -2.09%

Buy Vol. 16,990,500

Sell Vol. 15,309,700

26,750

1D 0.38%

5D 4.29%

Buy Vol. 12,351,800

Sell Vol. 12,761,600

24,300

1D 1.25%

5D 5.88%

Buy Vol. 5,165,300

Sell Vol. 5,096,100

31,150

1D -3.26%

5D -1.42%

Buy Vol. 3,627,000

Sell Vol. 3,698,700

21,750

1D 0.00%

5D -0.91%

Buy Vol. 39,222,400

Sell Vol. 42,568,400

28,600

1D -1.21%

5D -3.05%

Buy Vol. 4,460,000

Sell Vol. 3,604,700

By the end of the first quarter, BIDV led the banking industry in terms of net interest income with more than 12,800 billion dong, up 18%. Along with BIDV, Vietcombank and VietinBank are also two banks with a net interest income of over 10,000 billion. In which, Vietcombank increased by 19% to nearly 11,976 billion dong, VietinBank decreased by 5% to 10,146 billion dong. The three big state-owned enterprises in turn hold the largest net interest income in the system in the context that these are also the banks that own the most valuable portfolio of loans and investments.

REAL ESTATE

78,000

1D -0.38%

5D 3.59%

Buy Vol. 4,335,700

Sell Vol. 3,404,300

41,500

1D 0.00%

5D -1.78%

Buy Vol. 1,427,600

Sell Vol. 1,314,500

54,000

1D -3.23%

5D -5.26%

Buy Vol. 2,934,500

Sell Vol. 3,350,900

Both the two most important capital channels of real estate, credit and bonds, have appeared congested after the move to tighten credit to this sector.

OIL & GAS

105,800

1D 0.76%

5D 0.19%

Buy Vol. 2,330,800

Sell Vol. 1,946,600

12,800

1D 1.19%

5D 4.07%

Buy Vol. 29,967,000

Sell Vol. 34,327,700

40,500

1D -2.17%

5D 4.92%

Buy Vol. 2,588,300

Sell Vol. 2,564,700

PLX: PLX's profit recorded in the first quarter of 2022 decreased 40% year-on-year, although revenue increased 75%, reaching the highest level in the industry.

VINGROUP

77,900

1D -0.13%

5D -1.39%

Buy Vol. 4,018,800

Sell Vol. 4,803,200

67,000

1D 0.15%

5D -2.76%

Buy Vol. 5,926,900

Sell Vol. 6,279,600

27,400

1D 0.00%

5D 1.86%

Buy Vol. 5,231,500

Sell Vol. 4,323,200

VIC: Vingroup poured tens of thousands of billion dong for industrial park real estate company. Vinhomes IZ increased capital rapidly from 70b VND to 18,500b VND in 2 years.

FOOD & BEVERAGE

69,000

1D -1.85%

5D 3.76%

Buy Vol. 2,254,600

Sell Vol. 3,075,500

110,400

1D 6.98%

5D 6.05%

Buy Vol. 3,040,500

Sell Vol. 2,300,500

162,900

1D 0.87%

5D -1.21%

Buy Vol. 271,500

Sell Vol. 298,500

MSN: Masan plans to issue a maximum of more than 7 million ESOP shares. Implementation time is the second quarter of this year. These shares will be restricted to transfer within 1 year

OTHERS

125,300

1D -0.32%

5D 0.40%

Buy Vol. 1,790,300

Sell Vol. 945,600

125,300

1D -0.32%

5D 0.40%

Buy Vol. 1,790,300

Sell Vol. 945,600

97,000

1D -0.72%

5D 1.46%

Buy Vol. 2,874,900

Sell Vol. 2,572,400

133,000

1D -0.37%

5D -1.04%

Buy Vol. 1,663,100

Sell Vol. 1,461,700

102,100

1D 0.00%

5D 0.99%

Buy Vol. 840,100

Sell Vol. 823,400

22,950

1D -1.71%

5D 0.22%

Buy Vol. 3,683,400

Sell Vol. 3,157,700

28,500

1D -0.52%

5D 10.47%

Buy Vol. 39,152,000

Sell Vol. 32,546,500

37,900

1D -0.79%

5D -0.92%

Buy Vol. 27,767,200

Sell Vol. 25,334,000

HPG: Topping the list of listed companies' profits in the first quarter of 2022 is Hoa Phat Group with a net profit of more than 8,200 billion dong, an increase of 18% over the same period, corresponding to an average of more than VND 8,200 billion. 90 billion dong profit for shareholders every day.

Market by numbers

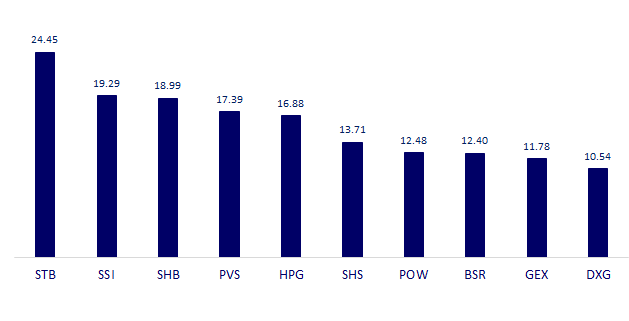

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

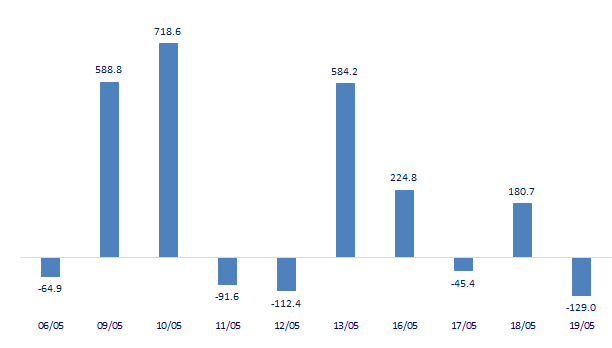

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

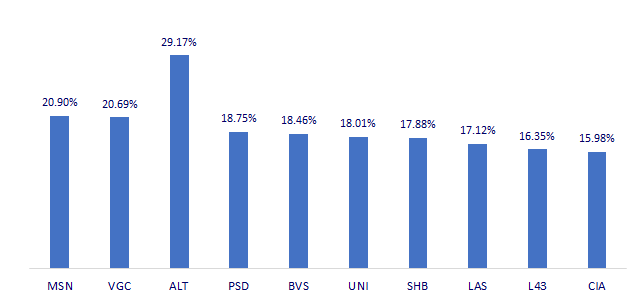

TOP INCREASES 3 CONSECUTIVE SESSIONS

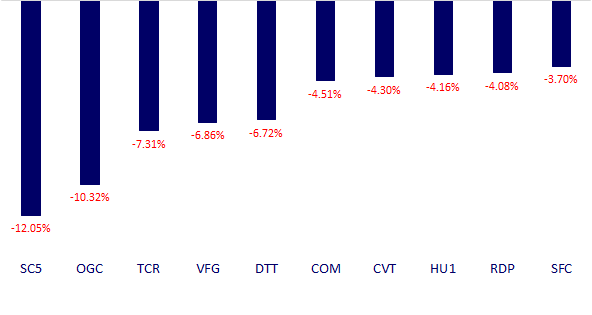

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.