Market brief 20/05/2022

VIETNAM STOCK MARKET

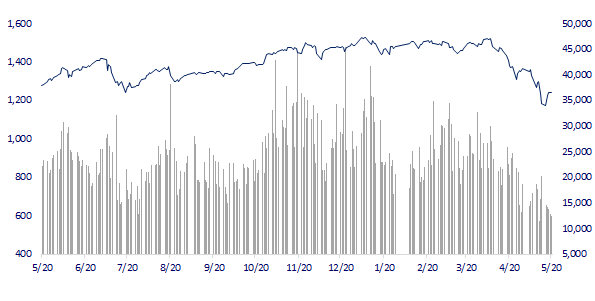

1,240.71

1D -0.07%

YTD -17.19%

1,282.51

1D -0.08%

YTD -16.49%

307.02

1D -0.32%

YTD -35.23%

94.11

1D -0.50%

YTD -16.48%

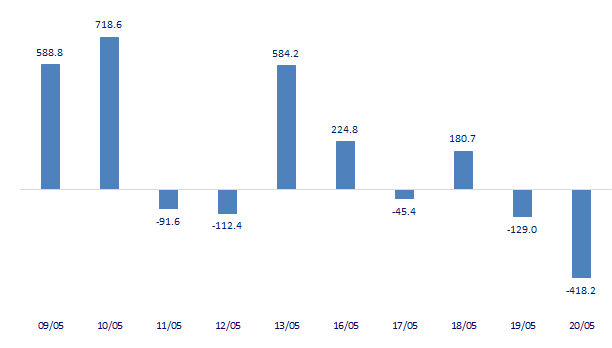

-418.24

1D 0.00%

YTD 0.00%

14,926.45

1D -2.93%

YTD -51.96%

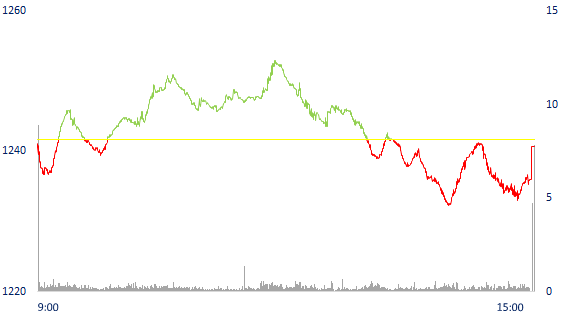

Large stocks diverged strongly, VN-Index struggled. Market liquidity decreased compared to the previous session. The total matched volume reached 13,640 billion dong, down 1%, of which, the matched value on HoSE alone decreased 0.88% to 11,526 billion dong. Foreign investors boosted their net selling of more than 418 billion dong on HoSE.

ETF & DERIVATIVES

21,680

1D 0.00%

YTD -16.07%

15,010

1D -0.79%

YTD -17.03%

16,000

1D -10.16%

YTD -15.79%

18,950

1D 4.12%

YTD -17.25%

17,470

1D -5.57%

YTD -22.29%

26,130

1D -4.98%

YTD -6.84%

16,890

1D -0.12%

YTD -21.37%

1,263

1D -0.65%

YTD 0.00%

1,274

1D -0.01%

YTD 0.00%

1,277

1D 0.18%

YTD 0.00%

1,283

1D 0.00%

YTD 0.00%

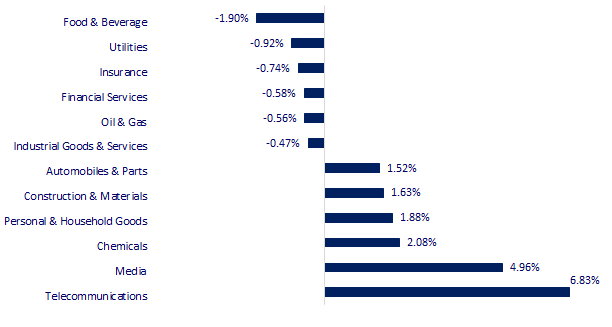

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

26,739.03

1D 0.25%

YTD -7.13%

3,146.57

1D 1.60%

YTD -13.55%

2,639.29

1D 1.81%

YTD -11.36%

20,717.24

1D 0.85%

YTD -11.46%

3,240.58

1D 1.56%

YTD 3.74%

1,622.95

1D 1.06%

YTD -2.09%

109.81

1D 0.14%

YTD 43.54%

1,845.10

1D 0.40%

YTD 1.33%

China lowers key interest rate, Asian stocks rise. In mainland China, the Shanghai Composite Index rose 1.6 percent. The People's Bank of China (PBoC) decided to keep the one-year loan prime rate unchanged at 3.7% while reducing the five-year loan rate from 4.6% to 4.45%. . Hong Kong's Hang Seng Index rose 0.85%. In Japan, the Nikkei 225 index rose 0.25%. South Korea's Kospi index rose 1.81%.

VIETNAM ECONOMY

1.75%

YTD (bps) 94

5.60%

2.53%

1D (bps) 3

YTD (bps) 152

3.07%

1D (bps) 5

YTD (bps) 107

23,311

1D (%) 0.00%

YTD (%) 1.62%

25,272

1D (%) 0.19%

YTD (%) -4.52%

3,543

1D (%) 0.60%

YTD (%) -3.14%

According to preliminary statistics of the GDC, in April, Vietnam exported 555,769 tons of rice, equivalent to USD276m, up 5% in both volume and turnover. However, compared to the same period last year, exports decreased in both volume and turnover with a corresponding decrease of 28.9%, 35% and 8.5%. In April, rice exports to the main market Philippines increased strongly by 79% in both volume and value compared to March, with 243,398 tons, equivalent to USD111.1m.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Banks continue to sharply increase deposit interest rates, reaching new highs

- China and the Philippines increase their purchases of Vietnamese rice

- The package of 4,500 billion VND of labor training is about to expire, only 17 billion VND has been disbursed

- China's central bank suddenly lowers 5-year lending rates

- G7 countries form alliance for global food security

- China negotiates to buy Russian oil to increase strategic reserves

VN30

BANK

75,300

1D -0.92%

5D 3.15%

Buy Vol. 1,238,900

Sell Vol. 1,458,200

34,500

1D -0.43%

5D 8.49%

Buy Vol. 2,175,900

Sell Vol. 1,679,900

25,900

1D -0.77%

5D 8.37%

Buy Vol. 9,467,600

Sell Vol. 8,378,900

35,700

1D -0.28%

5D 5.62%

Buy Vol. 9,125,800

Sell Vol. 9,675,000

30,600

1D 0.49%

5D 5.52%

Buy Vol. 13,479,000

Sell Vol. 12,974,500

27,000

1D 0.93%

5D 12.03%

Buy Vol. 10,725,500

Sell Vol. 10,437,800

24,350

1D 0.21%

5D 9.68%

Buy Vol. 4,263,900

Sell Vol. 4,537,200

31,400

1D 0.80%

5D 4.67%

Buy Vol. 3,130,300

Sell Vol. 3,892,600

21,600

1D -0.69%

5D 5.62%

Buy Vol. 29,204,100

Sell Vol. 27,913,800

29,050

1D 1.57%

5D 5.64%

Buy Vol. 3,414,000

Sell Vol. 4,275,400

According to aggregated data from 27 banks, in Q1/2022 the total net profit from buying and selling investment securities has decreased by nearly 38% QoQ to 1,923 billion dong. Accordingly, Military Bank (MB) rose to become the bank with the most profit from this segment with VND 1,024 billion, an increase of 52.4% compared to the first quarter of 2021, creating a big gap compared to other banks. VPBank, the leading bank in net profit from investment securities in 2021, recorded a decrease of 31% in net profit from this segment and is currently in fourth place in the rankings.

REAL ESTATE

77,800

1D -0.26%

5D 3.73%

Buy Vol. 3,646,900

Sell Vol. 3,492,900

41,400

1D -0.24%

5D 5.34%

Buy Vol. 1,454,300

Sell Vol. 1,586,900

53,800

1D -0.37%

5D 0.37%

Buy Vol. 2,879,000

Sell Vol. 2,897,700

PDR: having big problem when cash flow from operating activities is negative to 994b dong. To compensate, the enterprise increased its financial debt by VND1,400b at the end of Q1/2022.

OIL & GAS

104,500

1D -1.23%

5D 4.50%

Buy Vol. 1,191,900

Sell Vol. 890,300

12,800

1D 0.00%

5D 11.79%

Buy Vol. 42,220,000

Sell Vol. 25,775,400

40,500

1D 0.00%

5D 8.43%

Buy Vol. 1,836,200

Sell Vol. 2,095,100

POW: GE announced that it will use two GE9HA02 gas turbines at Nhon Trach 3 & 4 Power Plants, with a production capacity of 1.6 GW of PetroVietnam Power Corporation.

VINGROUP

77,800

1D -0.13%

5D -0.26%

Buy Vol. 4,074,300

Sell Vol. 4,241,500

66,800

1D -0.30%

5D -1.76%

Buy Vol. 3,981,600

Sell Vol. 4,943,100

27,350

1D -0.18%

5D 8.10%

Buy Vol. 3,802,400

Sell Vol. 4,349,500

VHM: announced on June 1, the final registration to make a list of shareholders paying dividends in 2021 in cash, the rate of 20%.

FOOD & BEVERAGE

68,100

1D -1.30%

5D 3.03%

Buy Vol. 2,296,600

Sell Vol. 2,943,400

107,800

1D -2.36%

5D 11.25%

Buy Vol. 1,387,900

Sell Vol. 1,527,000

156,500

1D -3.93%

5D -3.81%

Buy Vol. 310,600

Sell Vol. 353,500

MSN: TCB grants a credit of VND 1,000 billion to One Mount Group. This is a 12-month credit, backed by OMD shares owned by One Mount Group.

OTHERS

125,300

1D 0.00%

5D -0.48%

Buy Vol. 700,500

Sell Vol. 658,900

125,300

1D 0.00%

5D -0.48%

Buy Vol. 700,500

Sell Vol. 658,900

97,500

1D 0.52%

5D 4.17%

Buy Vol. 2,386,600

Sell Vol. 2,790,000

134,000

1D 0.75%

5D 7.11%

Buy Vol. 1,462,400

Sell Vol. 1,458,800

106,000

1D 3.82%

5D 8.72%

Buy Vol. 792,800

Sell Vol. 956,000

23,700

1D 3.27%

5D 11.27%

Buy Vol. 5,020,900

Sell Vol. 4,342,500

28,450

1D -0.18%

5D 10.27%

Buy Vol. 29,474,500

Sell Vol. 31,340,300

37,650

1D -0.66%

5D 4.87%

Buy Vol. 22,716,300

Sell Vol. 20,927,900

MWG: announced April revenue of 11,400 billion dong, up 19% over the same period last year. Accumulated 4 months, revenue reached 47,900 billion dong, up 18%. Mobile World Chain and Dien May Xanh contributed more than VND9,000 billion in April, up 22%. By the end of April, the business had 901 Dien May Xanh Supermini stores, an increase of 27 stores in the month and 35 Topzone stores, an increase of 6.

Market by numbers

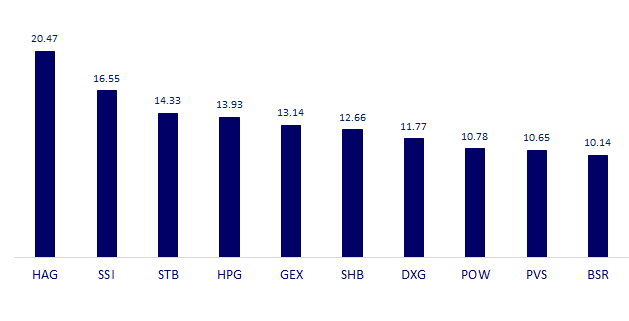

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

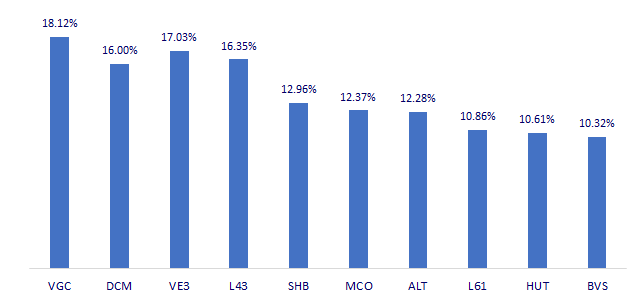

TOP INCREASES 3 CONSECUTIVE SESSIONS

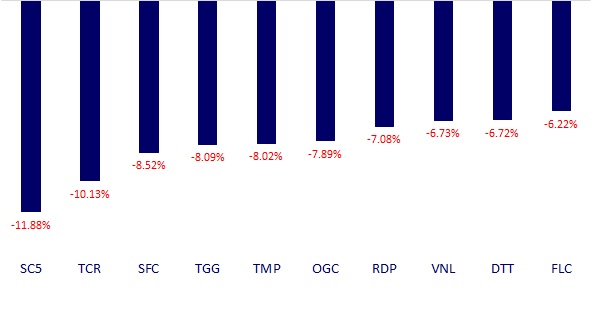

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.