Market Brief 23/05/2022

VIETNAM STOCK MARKET

1,218.81

1D -1.77%

YTD -18.65%

1,255.35

1D -2.12%

YTD -18.26%

300.66

1D -2.07%

YTD -36.57%

93.63

1D -0.51%

YTD -16.91%

-440.24

1D 0.00%

YTD 0.00%

15,890.61

1D 6.46%

YTD -48.86%

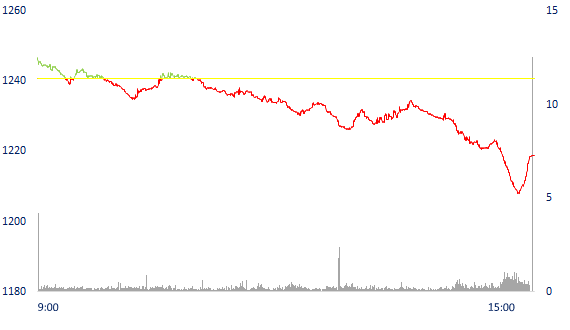

At the end of the session on May 23, VN-Index dropped 21.9 points (1.77%) to 1,218.81 points, the total trading value today reached nearly 17,200 billion dong, equivalent to a volume of 746.7 million units. Foreign investors' trade today is still a minus point when they net sold nearly 440 billion on HOSE

ETF & DERIVATIVES

21,400

1D -1.29%

YTD -17.15%

14,690

1D -2.13%

YTD -18.79%

15,700

1D -11.85%

YTD -17.37%

17,850

1D -5.80%

YTD -22.05%

16,800

1D -3.84%

YTD -25.27%

25,400

1D -2.79%

YTD -9.45%

16,070

1D -4.85%

YTD -25.19%

1,245

1D -1.45%

YTD 0.00%

1,240

1D -2.67%

YTD 0.00%

1,253

1D -1.86%

YTD 0.00%

1,283

1D 0.00%

YTD 0.00%

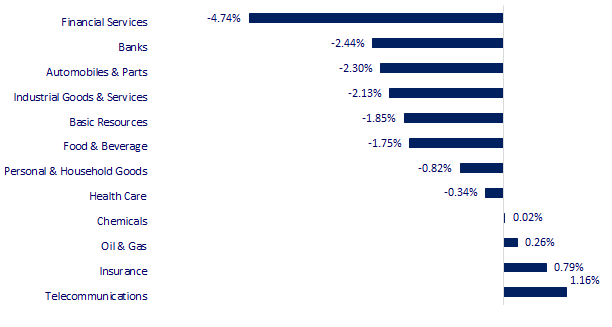

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

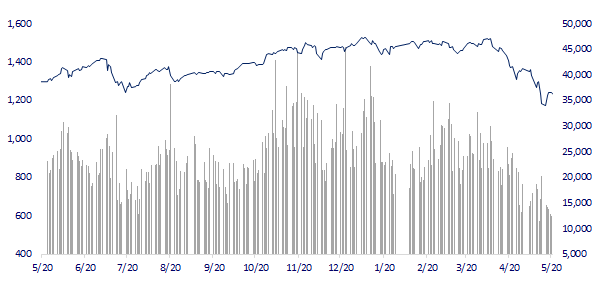

VNINDEX (12M)

GLOBAL MARKET

27,001.52

1D 0.98%

YTD -6.22%

3,146.86

1D 0.01%

YTD -13.54%

2,647.38

1D 0.31%

YTD -11.09%

20,470.06

1D -1.19%

YTD -12.51%

3,213.65

1D -0.83%

YTD 2.88%

1,635.28

1D 0.76%

YTD -1.35%

111.62

1D 1.65%

YTD 45.91%

1,863.10

1D 0.98%

YTD 2.32%

Asia-Pacific stock markets mixed in the first session of the week in the context of investors still carrying many worries. In Japan, the Nikkei 225 index gained 0.94%, while the Topix index gained 0.85%. In mainland China, the Shanghai Composite Index fell 0.33%. The Shenzhen Component fell 0.67%. The Hang Seng Index (Hong Kong) fell 1.36%. The Hang Seng Tech Hang Seng Tech Index fell 2.25%.

VIETNAM ECONOMY

1.75%

YTD (bps) 94

5.60%

2.50%

YTD (bps) 149

3.09%

1D (bps) 7

YTD (bps) 109

23,319

1D (%) 0.04%

YTD (%) 1.65%

25,487

1D (%) 1.04%

YTD (%) -3.71%

3,555

1D (%) 0.94%

YTD (%) -2.82%

According to the General Department of Customs, in the first 4 months of 2022, the whole country exported 627,932 tons of fertilizers of all kinds, worth US$412.62 million, up 32.7% in volume, up 174.8 % in value. Export fertilizer price reached 657 million USD, up 107% over the same period last year. Thanks to high fertilizer prices, the export value of 4 months is almost equal to last year's exports

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Prime Minister has started plans to accelerate disbursement of public investment capital in 2022

- Fertilizer exports in 4 months increased to a record, bringing in nearly 413 million USD

- Import of computers and electronic products increased by nearly 7 billion USD

- The EU is facing the risk of oil and gas shortages

- Japan's inflation index stopped at 2.5%.

- UN warns global wheat stocks have fallen to lowest levels since 2008

VN30

BANK

74,400

1D -1.20%

5D 0.27%

Buy Vol. 853,800

Sell Vol. 1,311,200

33,350

1D -3.33%

5D 3.57%

Buy Vol. 2,047,600

Sell Vol. 1,846,100

25,000

1D -3.47%

5D 1.83%

Buy Vol. 7,969,100

Sell Vol. 7,401,600

34,850

1D -2.38%

5D 6.90%

Buy Vol. 8,274,600

Sell Vol. 8,794,100

29,300

1D -4.25%

5D 1.03%

Buy Vol. 17,521,800

Sell Vol. 17,796,200

26,300

1D -2.59%

5D 6.91%

Buy Vol. 9,989,200

Sell Vol. 10,510,600

24,200

1D -0.62%

5D 7.56%

Buy Vol. 2,990,400

Sell Vol. 4,708,800

30,000

1D -4.46%

5D -3.23%

Buy Vol. 3,300,900

Sell Vol. 4,653,400

20,350

1D -5.79%

5D 6.82%

Buy Vol. 47,732,300

Sell Vol. 46,301,100

28,450

1D -2.07%

5D 3.08%

Buy Vol. 2,337,200

Sell Vol. 2,468,100

The move to increase interest rates in the last half year has helped deposits to banks grow positively in the first months of 2022. According to statistics, in the first quarter of 2022, only 7 banks recorded a decline while 21 banks recorded a decline. banks have positive growth. The banks with the highest deposit growth are VPBank (13.4%), HDBank (9.9%), TPBank (9.3%), SCB (9.1%), Sacombank (7.1%). , VIB (5.9%),…

REAL ESTATE

76,400

1D -1.80%

5D 1.87%

Buy Vol. 2,758,700

Sell Vol. 2,584,300

40,900

1D -1.21%

5D 4.07%

Buy Vol. 663,000

Sell Vol. 1,075,700

53,000

1D -1.49%

5D -2.93%

Buy Vol. 2,289,700

Sell Vol. 2,562,100

PDR: AGM approved business plan with revenue of 10,700 billion dong, profit after tax of 2,908 billion dong, PDR completed 5.8% of profit target and 9.6% of profit target for the whole year.

OIL & GAS

103,500

1D -0.96%

5D 8.95%

Buy Vol. 762,800

Sell Vol. 1,076,300

12,750

1D -0.39%

5D 9.91%

Buy Vol. 35,155,200

Sell Vol. 29,544,700

40,250

1D -0.62%

5D 2.94%

Buy Vol. 1,712,600

Sell Vol. 1,832,500

PLX: PLX submitted a plan to pay a cash dividend at the rate of 12%, equivalent to a payment of VND 1,524.7 billion.

VINGROUP

77,400

1D -0.51%

5D 0.52%

Buy Vol. 3,863,000

Sell Vol. 4,885,500

66,700

1D -0.15%

5D 1.37%

Buy Vol. 4,286,600

Sell Vol. 5,838,000

27,350

1D 0.00%

5D 4.19%

Buy Vol. 3,288,500

Sell Vol. 4,801,900

VIC: Vingroup guarantees payment obligations for VND 2,000 billion of bonds issued by VinFast

FOOD & BEVERAGE

66,300

1D -2.64%

5D 0.76%

Buy Vol. 3,037,500

Sell Vol. 3,664,900

104,500

1D -3.06%

5D 15.85%

Buy Vol. 1,173,800

Sell Vol. 1,175,700

154,100

1D -1.53%

5D -2.34%

Buy Vol. 206,500

Sell Vol. 263,000

MSN: A member company of Masan Group has just opened the first Joins Pro laundry shop in Ho Chi Minh City. This marks the group's ambition to enter a new field.

OTHERS

125,000

1D -0.24%

5D -0.79%

Buy Vol. 814,800

Sell Vol. 843,400

125,000

1D -0.24%

5D -0.79%

Buy Vol. 814,800

Sell Vol. 843,400

96,500

1D -1.03%

5D 3.54%

Buy Vol. 1,800,500

Sell Vol. 2,395,900

130,800

1D -2.39%

5D 6.34%

Buy Vol. 921,200

Sell Vol. 1,134,900

104,500

1D -1.42%

5D 6.63%

Buy Vol. 820,800

Sell Vol. 1,050,200

23,700

1D 0.00%

5D 8.47%

Buy Vol. 2,206,700

Sell Vol. 2,658,400

26,500

1D -6.85%

5D -2.93%

Buy Vol. 45,102,000

Sell Vol. 48,552,200

36,750

1D -2.39%

5D 1.24%

Buy Vol. 14,463,800

Sell Vol. 18,594,500

PNJ: In 4 months, PNJ recorded net revenue of 12,912 billion dong and profit after tax of 866 billion dong; increased 42.9% and 44.9% respectively compared to the first 4 months of 2021. Gross profit margin reached 17.8%, down from 18.4% in the same period of 2021 mainly due to the increased proportion of gold bar revenue. Total operating expenses during this period increased by 28.3%

Market by numbers

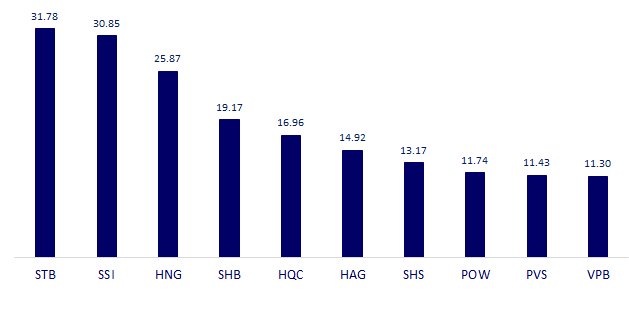

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

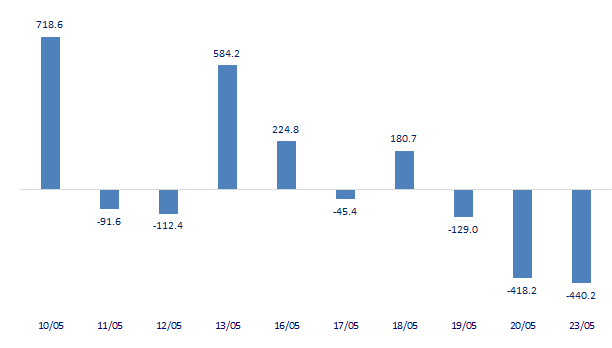

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

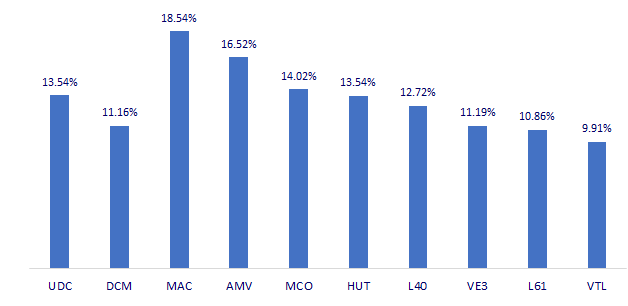

TOP INCREASES 3 CONSECUTIVE SESSIONS

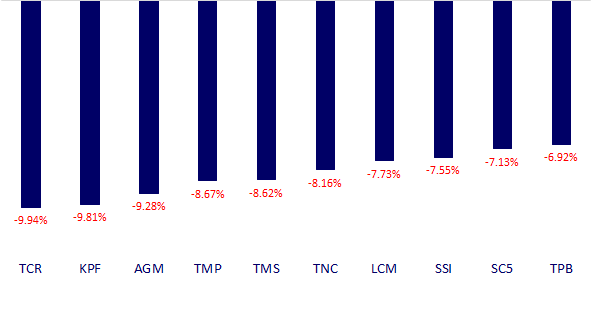

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.