Market brief 24/05/2022

VIETNAM STOCK MARKET

1,233.38

1D 1.20%

YTD -17.68%

1,272.71

1D 1.38%

YTD -17.13%

305.96

1D 1.76%

YTD -35.45%

93.12

1D -0.54%

YTD -17.36%

199.67

1D 0.00%

YTD 0.00%

16,145.84

1D 1.61%

YTD -48.04%

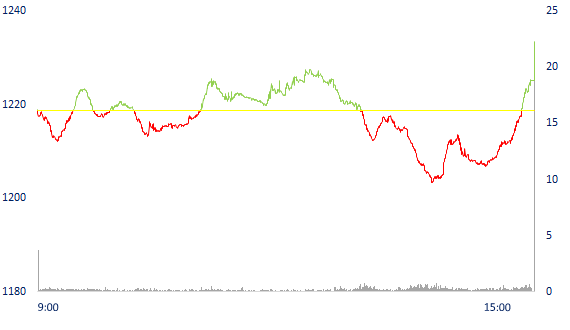

VN-Index increased spectacularly at the end of the session, VN30-Index gained more than 17 points. Market liquidity was similar to yesterday with a total matched value of 14,228 billion dong, up 1.66%, of which, matched value on HoSE alone increased by 0.18% and reached 12,057 billion dong. Foreign investors net bought nearly 200 billion dong.

ETF & DERIVATIVES

21,320

1D -0.37%

YTD -17.46%

14,860

1D 1.16%

YTD -17.86%

15,930

1D -10.56%

YTD -16.16%

18,940

1D 6.11%

YTD -17.29%

16,800

1D 0.00%

YTD -25.27%

25,890

1D 1.93%

YTD -7.70%

16,160

1D 0.56%

YTD -24.77%

1,260

1D 1.21%

YTD 0.00%

1,243

1D 0.24%

YTD 0.00%

1,267

1D 1.11%

YTD 0.00%

1,283

1D 0.00%

YTD 0.00%

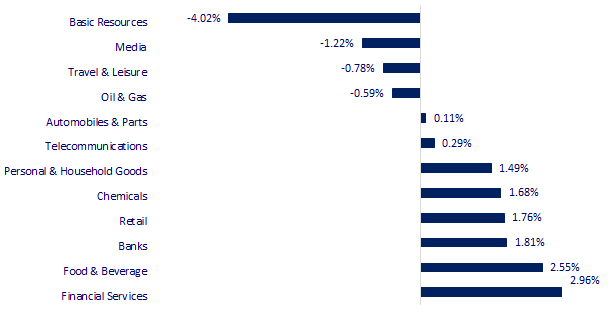

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

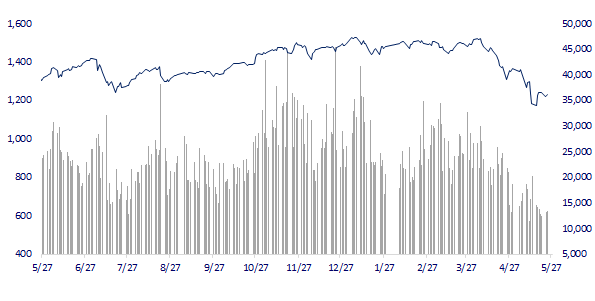

VNINDEX (12M)

GLOBAL MARKET

26,748.14

1D -0.62%

YTD -7.10%

3,070.93

1D -2.41%

YTD -15.63%

2,605.87

1D -1.57%

YTD -12.49%

20,112.10

1D -1.57%

YTD -14.04%

3,195.04

1D -0.58%

YTD 2.28%

1,626.23

1D -0.55%

YTD -1.89%

110.55

1D 0.92%

YTD 44.51%

1,855.12

1D 0.35%

YTD 1.88%

Asian stocks fell, Japanese industrial activity slowed. In Japan, the Nikkei 225 index fell 0.62%. South Korea's Kospi index fell 1.57%. In China, the Shanghai Composite Index fell 2.41%. Hong Kong's Hang Seng Index drops 1.57%

VIETNAM ECONOMY

1.14%

1D (bps) -61

YTD (bps) 33

5.60%

2.59%

1D (bps) 9

YTD (bps) 158

3.09%

YTD (bps) 109

23,435

1D (%) 0.51%

YTD (%) 2.16%

25,316

1D (%) -0.59%

YTD (%) -4.35%

3,550

1D (%) 0.00%

YTD (%) -2.95%

The Vietnam Maritime Administration has just announced the volume of cargo through the seaport in 4 months of 2022. Accordingly, the output reached nearly 241m tons excluding transit goods that are not handled at the port, an increase of 2% compared to the same period last year. period in 2021. In which, exports reached 61.95m tons, up 2%; imported goods reached 67.49m tons, down 9%; domestic goods reached 110.99m tons, up 10% over the same period in 2021.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Cargo throughput through seaports still has low growth

- Leather and footwear industry aims to be self-sufficient in 70-80% of raw materials

- Vietnam raised three priority proposals for regional cooperation

- The European Union has not resumed the regulation against budget deficit

- ECB President: ECB is likely to get rid of negative interest rates by the end of September

- International banks are pessimistic about RMB exchange rate outlook

VN30

BANK

75,600

1D 1.61%

5D -0.53%

Buy Vol. 1,374,900

Sell Vol. 1,623,400

33,750

1D 1.20%

5D -2.03%

Buy Vol. 1,395,700

Sell Vol. 1,419,000

26,000

1D 4.00%

5D -0.95%

Buy Vol. 8,783,800

Sell Vol. 7,002,700

35,250

1D 1.15%

5D 1.15%

Buy Vol. 6,904,300

Sell Vol. 7,478,000

30,000

1D 2.39%

5D -3.23%

Buy Vol. 17,657,100

Sell Vol. 16,118,300

26,850

1D 2.09%

5D 2.09%

Buy Vol. 11,851,000

Sell Vol. 11,376,800

24,600

1D 1.65%

5D 2.50%

Buy Vol. 3,684,700

Sell Vol. 3,599,000

30,900

1D 3.00%

5D -6.36%

Buy Vol. 2,385,000

Sell Vol. 3,283,500

21,750

1D 6.88%

5D 6.88%

Buy Vol. 35,543,100

Sell Vol. 25,826,200

28,800

1D 1.23%

5D -1.54%

Buy Vol. 3,211,400

Sell Vol. 3,259,800

TCB: Techcombank is still the "champion" in terms of demand deposits. According to the financial statements, demand deposits and margin deposits at Techcombank on March 31, 2022 were VND 165,745 billion, up 4.3% compared to the beginning of the year. Accordingly, the demand deposit ratio (CASA) reached 50.4%, almost unchanged compared to the end of 2021. It is known that the driving force for CASA growth in the first quarter of Techcombank came from individual customers, contributed VND 107,800 billion, up 24.8%.

REAL ESTATE

77,200

1D 1.05%

5D -1.40%

Buy Vol. 3,523,800

Sell Vol. 3,111,500

40,100

1D -1.96%

5D -3.84%

Buy Vol. 955,400

Sell Vol. 1,255,800

53,200

1D 0.38%

5D -6.67%

Buy Vol. 2,425,300

Sell Vol. 2,643,400

NVL: The Board of Directors approved the plan to issue shares to convert the company's bonds at the rate of 54,145 shares/bond, the conversion price is VND 85,000/share.

OIL & GAS

105,800

1D 2.22%

5D 4.86%

Buy Vol. 1,386,900

Sell Vol. 1,590,900

12,850

1D 0.78%

5D 3.63%

Buy Vol. 20,647,900

Sell Vol. 18,550,600

40,000

1D -0.62%

5D -4.31%

Buy Vol. 1,487,200

Sell Vol. 1,782,700

PLX: in 2022, PLX sets a target of total revenue of VND 186,000 billion and pre-tax profit of VND 3,060 billion, up 10% and down 19.2% respectively compared to 2021.

VINGROUP

77,600

1D 0.26%

5D -0.51%

Buy Vol. 2,860,600

Sell Vol. 3,262,000

66,900

1D 0.30%

5D 0.00%

Buy Vol. 4,164,000

Sell Vol. 4,122,900

28,100

1D 2.74%

5D 2.55%

Buy Vol. 4,366,000

Sell Vol. 4,129,500

VIC: BoDs decide to transfer a part of capital in GeneStory JSC. According to the consolidated financial statements of the first quarter, Vingroup owns 99.02% of the capital of this subsidiary.

FOOD & BEVERAGE

68,900

1D 3.92%

5D -1.57%

Buy Vol. 4,670,700

Sell Vol. 3,268,500

109,000

1D 4.31%

5D 12.95%

Buy Vol. 1,627,500

Sell Vol. 1,491,400

154,000

1D -0.06%

5D -6.95%

Buy Vol. 297,900

Sell Vol. 309,000

MSN: The mini-mall's goal by 2025 will be to serve 30-50m people. Towards 30,000 points of sale nationwide and a revenue of 7-8bUSD/year, accounting for 50% of the retail market share.

OTHERS

125,300

1D 0.24%

5D -2.11%

Buy Vol. 836,100

Sell Vol. 729,400

125,300

1D 0.24%

5D -2.11%

Buy Vol. 836,100

Sell Vol. 729,400

98,200

1D 1.76%

5D -1.50%

Buy Vol. 2,404,500

Sell Vol. 2,677,100

133,000

1D 1.68%

5D 1.06%

Buy Vol. 1,023,900

Sell Vol. 1,204,300

107,900

1D 3.25%

5D 4.66%

Buy Vol. 1,073,600

Sell Vol. 1,184,100

24,150

1D 1.90%

5D 3.43%

Buy Vol. 3,069,600

Sell Vol. 2,611,400

28,100

1D 6.04%

5D -3.60%

Buy Vol. 43,394,400

Sell Vol. 33,318,400

34,900

1D -5.03%

5D -8.64%

Buy Vol. 60,534,600

Sell Vol. 64,327,200

HPG: Hoa Phat follows the general trend of buying land, buying projects to do. However, recently, the issuance of bonds was easy, so real estate businesses with a lot of money went to buy many projects, leading to an increase in land prices. Therefore, the company has not purchased any real estate projects, will go to localities to participate in bidding and project development.

Market by numbers

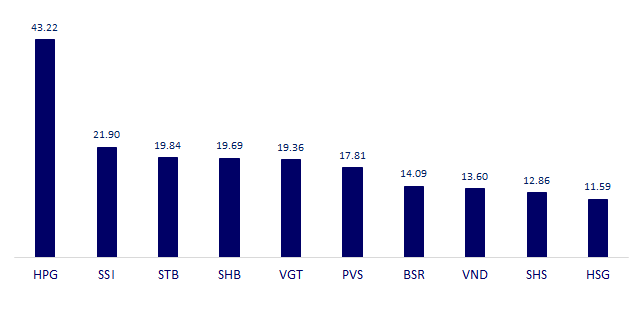

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

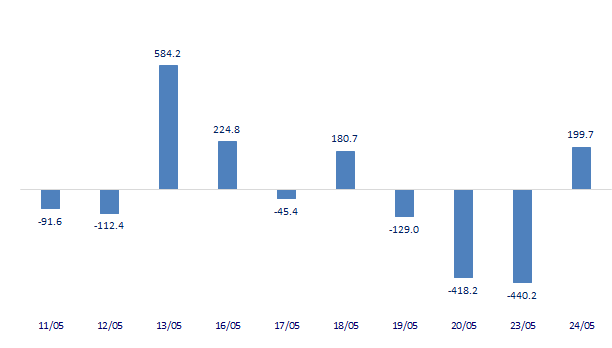

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

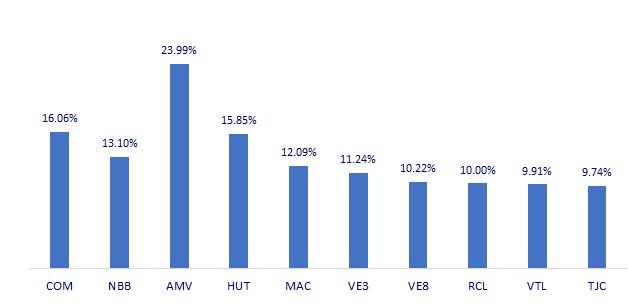

TOP INCREASES 3 CONSECUTIVE SESSIONS

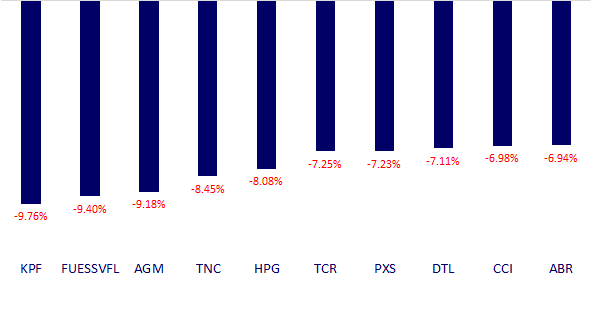

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.