Market brief 25/05/2022

VIETNAM STOCK MARKET

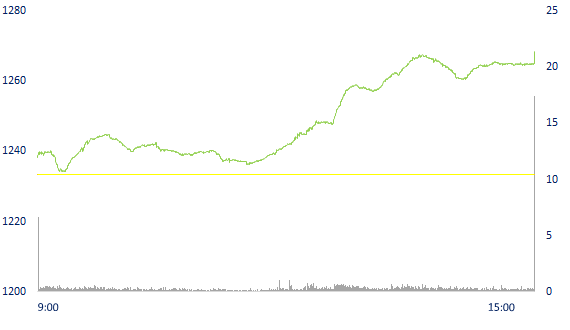

1,268.43

1D 2.84%

YTD -15.34%

1,310.70

1D 2.98%

YTD -14.65%

314.91

1D 2.93%

YTD -33.56%

94.78

1D 1.78%

YTD -15.89%

27.39

1D 0.00%

YTD 0.00%

19,715.46

1D 22.11%

YTD -36.55%

Foreign investors saw a slight net buying of 27 billion dong on May 25. Two fertilizer tickers DCM and DPM still shared the two leading positions in net buying value of foreign investors on HoSE with 60 billion dong and 58 billion dong, respectively. VNM is behind with a net buying value of 44 billion dong.

ETF & DERIVATIVES

22,000

1D 3.19%

YTD -14.83%

15,400

1D 3.63%

YTD -14.87%

16,460

1D -7.58%

YTD -13.37%

19,090

1D 0.79%

YTD -16.64%

17,440

1D 3.81%

YTD -22.42%

27,090

1D 4.63%

YTD -3.42%

16,700

1D 3.34%

YTD -22.25%

1,296

1D 2.85%

YTD 0.00%

1,298

1D 4.46%

YTD 0.00%

1,299

1D 2.55%

YTD 0.00%

1,283

1D 0.00%

YTD 0.00%

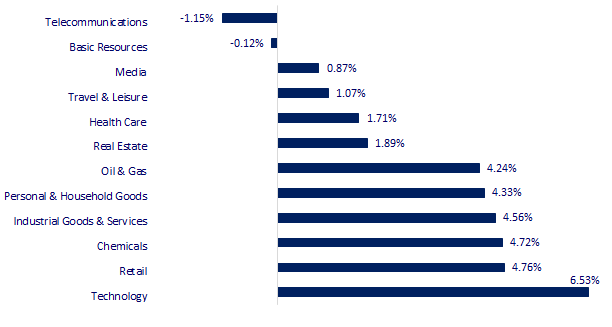

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

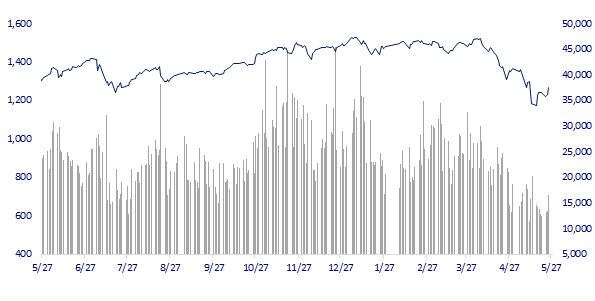

VNINDEX (12M)

GLOBAL MARKET

26,677.80

1D -0.06%

YTD -7.34%

3,107.46

1D 1.19%

YTD -14.63%

2,617.22

1D 0.44%

YTD -12.10%

20,171.27

1D 0.08%

YTD -13.79%

3,179.58

1D -0.48%

YTD 1.79%

1,625.18

1D -0.06%

YTD -1.96%

111.19

1D 0.31%

YTD 45.35%

1,852.74

1D -0.50%

YTD 1.75%

Asian stocks mixed, New Zealand raised interest rates. The Nikkei 225 index fell 0.06%. In mainland China, the Shanghai Composite Index rose 1.19%. The Kospi in South Korea rose 0.44%.

VIETNAM ECONOMY

1.04%

1D (bps) -10

YTD (bps) 23

5.60%

2.52%

1D (bps) -7

YTD (bps) 151

3.07%

1D (bps) -2

YTD (bps) 107

23,420

1D (%) 0.28%

YTD (%) 2.09%

25,197

1D (%) -1.74%

YTD (%) -4.80%

3,546

1D (%) -0.37%

YTD (%) -3.06%

Commodity exports were relatively favorable in the first months of the year. Many large industries such as textiles, footwear, etc. have had orders until the end of the year. However, the situation of supply chain disruption and import (import) of raw materials from China are posing many challenges. Footwear is an industry that is under a lot of pressure on the supply of raw materials when this industry imports up to 70% of raw materials and accessories from China.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Export faces the challenge of lack of raw materials

- Minimize administrative procedures, industrial zone planning procedures

- National Assembly Chairman: Slow disbursement of public investment has affected economic recovery

- USD hits 1-month low, euro and gold rise sharply

- Germany plans to bring back coal power plants if Russia cuts gas

- China urges banks to increase lending

VN30

BANK

77,000

1D 1.85%

5D 2.12%

Buy Vol. 1,224,000

Sell Vol. 1,463,500

34,900

1D 3.41%

5D 0.00%

Buy Vol. 2,435,700

Sell Vol. 2,365,000

26,900

1D 3.46%

5D 1.13%

Buy Vol. 9,468,100

Sell Vol. 8,725,800

36,500

1D 3.55%

5D 1.25%

Buy Vol. 11,018,600

Sell Vol. 11,810,500

31,500

1D 5.00%

5D 1.78%

Buy Vol. 27,470,000

Sell Vol. 19,826,600

28,050

1D 4.47%

5D 5.25%

Buy Vol. 19,320,900

Sell Vol. 17,746,800

25,650

1D 4.27%

5D 6.88%

Buy Vol. 6,234,600

Sell Vol. 5,209,200

31,900

1D 3.24%

5D -0.93%

Buy Vol. 5,811,200

Sell Vol. 7,299,500

22,750

1D 4.60%

5D 4.60%

Buy Vol. 33,269,300

Sell Vol. 33,780,400

30,000

1D 4.17%

5D 3.63%

Buy Vol. 6,389,400

Sell Vol. 5,525,200

VCB: The Chairman of Vietcombank said that credit growth by the end of the first quarter reached 7% and by April 29 was 8.8% - a relatively good increase compared to the general level of the banking industry. Thus, compared to the officially granted credit limit of 10%, Vietcombank has used up most of the allocated credit room and is waiting for the State Bank to increase the room.

REAL ESTATE

78,900

1D 2.20%

5D 0.77%

Buy Vol. 3,598,300

Sell Vol. 4,149,700

40,900

1D 2.00%

5D -1.45%

Buy Vol. 2,194,800

Sell Vol. 2,131,600

52,800

1D -0.75%

5D -5.38%

Buy Vol. 2,839,400

Sell Vol. 3,251,300

PDR: PDR's share price plummeted, causing the company to add 1.7 million shares as collateral for a bond batch of VND500 billion mobilized at the end of last year.

OIL & GAS

108,400

1D 2.46%

5D 3.24%

Buy Vol. 1,256,700

Sell Vol. 1,359,900

13,400

1D 4.28%

5D 5.93%

Buy Vol. 35,302,000

Sell Vol. 33,047,400

41,400

1D 3.50%

5D 0.00%

Buy Vol. 2,162,600

Sell Vol. 2,128,800

PLX: with the largest inventory of 24,254 billion dong, up 84.2% compared to the beginning of the year; in which, goods increased sharply from 9,481 billion dong to 19,392 billion dong.

VINGROUP

77,700

1D 0.13%

5D -0.38%

Buy Vol. 2,612,900

Sell Vol. 3,802,700

67,900

1D 1.49%

5D 1.49%

Buy Vol. 4,992,600

Sell Vol. 5,904,000

29,450

1D 4.80%

5D 7.48%

Buy Vol. 6,356,600

Sell Vol. 7,780,400

VIC: The Ministry of Transport has approved Vingroup - Techcombank to study and invest in the North - South expressway west of the Gia Nghia - Chon Thanh section.

FOOD & BEVERAGE

71,900

1D 4.35%

5D 2.28%

Buy Vol. 4,773,800

Sell Vol. 4,250,500

110,500

1D 1.38%

5D 7.07%

Buy Vol. 1,287,500

Sell Vol. 1,444,300

154,000

1D 0.00%

5D -4.64%

Buy Vol. 311,500

Sell Vol. 331,600

VNM: Platinum Victory Pte. Ltd. continue to register to buy nearly 21 million VNM shares. Estimated time of transaction is from May 26, 2022 to June 24, 2022

OTHERS

125,700

1D 0.32%

5D 0.00%

Buy Vol. 1,049,300

Sell Vol. 1,025,200

125,700

1D 0.32%

5D 0.00%

Buy Vol. 1,049,300

Sell Vol. 1,025,200

105,000

1D 6.92%

5D 7.47%

Buy Vol. 6,237,700

Sell Vol. 4,770,700

139,000

1D 4.51%

5D 4.12%

Buy Vol. 2,498,100

Sell Vol. 3,080,900

115,400

1D 6.95%

5D 13.03%

Buy Vol. 2,635,100

Sell Vol. 2,119,500

25,350

1D 4.97%

5D 8.57%

Buy Vol. 4,839,100

Sell Vol. 4,156,600

28,800

1D 2.49%

5D 0.52%

Buy Vol. 27,837,500

Sell Vol. 32,867,600

34,450

1D -1.29%

5D -9.82%

Buy Vol. 72,522,000

Sell Vol. 60,893,700

MWG: announced the Resolution of the Board of Directors approving the plan to increase the charter capital of Bach Hoa Xanh Investment and Technology Joint Stock Company by VND 13,890 billion. Implementation time in May. The purpose of raising capital is to buy back all shares of Bach Hoa Xanh Trading Joint Stock Company and serve the business plan.

Market by numbers

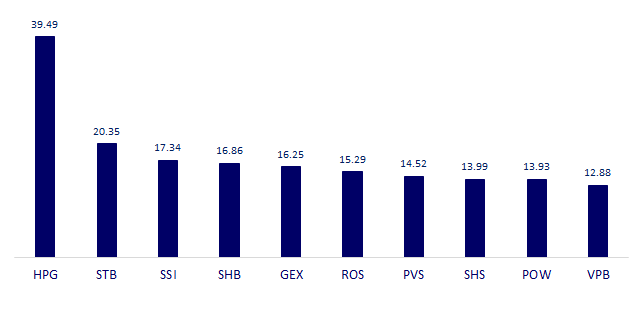

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

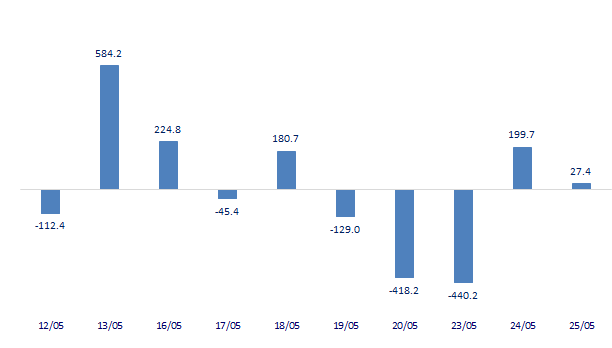

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

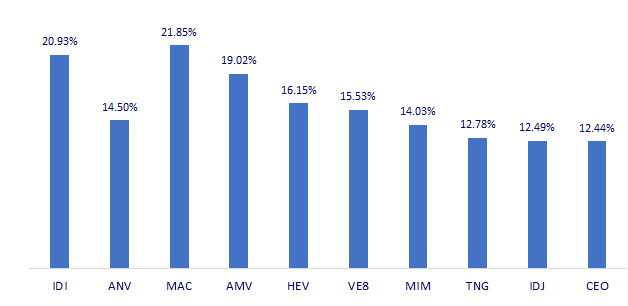

TOP INCREASES 3 CONSECUTIVE SESSIONS

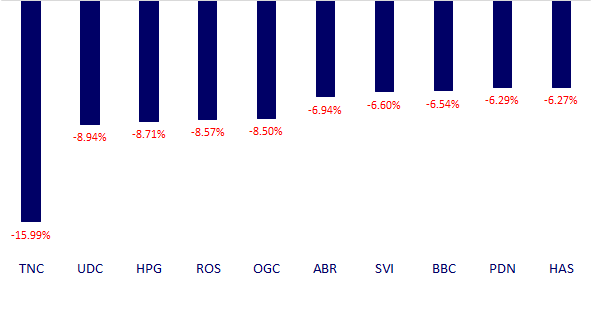

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.