Market brief 01/06/2022

VIETNAM STOCK MARKET

1,299.52

1D 0.53%

YTD -13.27%

1,335.49

1D 0.22%

YTD -13.04%

315.37

1D -0.12%

YTD -33.46%

95.10

1D -0.37%

YTD -15.60%

656.31

1D 0.00%

YTD 0.00%

18,874.79

1D -3.07%

YTD -39.25%

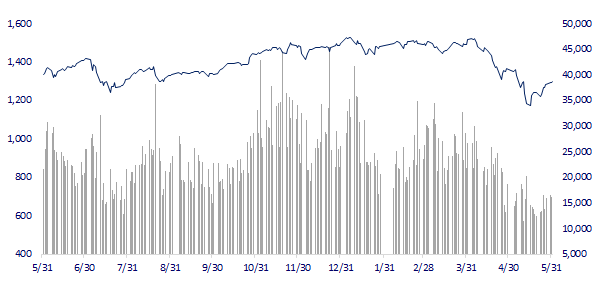

The stock market continued to go down in May, domestic investors sold a net 3,200 billion dong. Market liquidity decreased sharply compared to April. Total average trading value reached 17,773 billion dong, down 32.4%, of which, average matched value reached 16,174 billion dong/session, down 33%.

ETF & DERIVATIVES

22,650

1D 1.57%

YTD -12.31%

15,740

1D 0.32%

YTD -12.99%

16,720

1D -6.12%

YTD -12.00%

20,000

1D 0.00%

YTD -12.66%

17,820

1D -1.00%

YTD -20.73%

28,350

1D 1.25%

YTD 1.07%

17,010

1D -1.10%

YTD -20.81%

1,320

1D 0.03%

YTD 0.00%

1,324

1D 0.69%

YTD 0.00%

1,326

1D 0.61%

YTD 0.00%

1,326

1D 0.42%

YTD 0.00%

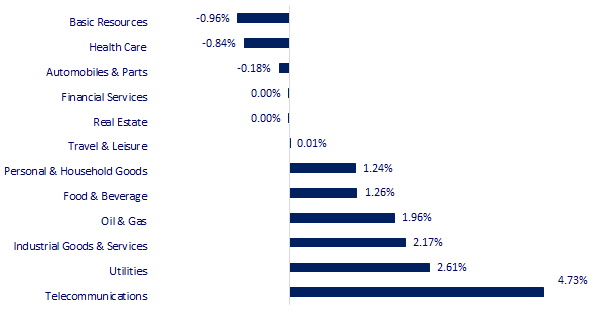

CHANGE IN PRICE BY SECTOR

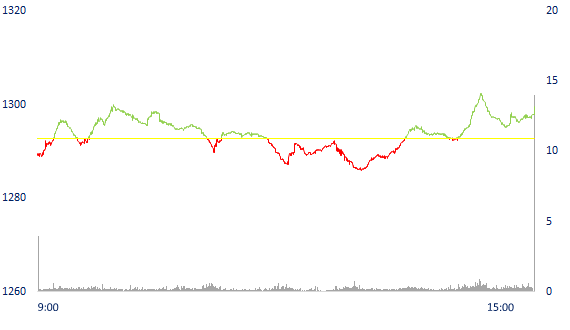

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,457.89

1D -0.01%

YTD -4.63%

3,182.16

1D -0.13%

YTD -12.57%

2,685.90

1D 0.00%

YTD -9.80%

21,294.94

1D -0.49%

YTD -8.99%

3,244.00

1D 0.36%

YTD 3.85%

1,660.01

1D -0.20%

YTD 0.14%

116.19

1D 0.68%

YTD 51.88%

1,832.00

1D -0.28%

YTD 0.62%

Asian stocks mostly in the session 1/6. China's manufacturing sector continues to show signs of improvement. In China, the Shanghai Composite Index fell 0.13% to 3,182.16 points. The Hang Seng Index (Hong Kong) fell 0.49%. In Japan, the Nikkei 225 index fell 0.01% to 27,457.89 points. The Korean stock market is closed for a holiday.

VIETNAM ECONOMY

0.33%

1D (bps) -5

YTD (bps) -48

5.60%

2.54%

1D (bps) 1

YTD (bps) 153

3.06%

1D (bps) -3

YTD (bps) 106

23,420

1D (%) 0.39%

YTD (%) 2.09%

25,308

1D (%) -1.01%

YTD (%) -4.38%

3,540

1D (%) -0.06%

YTD (%) -3.23%

After reaching a record of over $1.1 billion in April 2022 with a growth rate of over 50%, entering May 2022, seafood exports could not maintain the hot growth rate, but still hit the $1 billion mark, which is high. 27% more than the same period in 2021.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Seafood exports in May cooled down, still touching the USD 1 billion mark

- Banks have not been granted more room yet, credit growth has started to cool down

- There is a target to expect Vietnam's GDP to increase by 8% this year

- Euro zone inflation hits record high in May

- China lost nearly 900 billion USD in budget revenue due to the pandemic

- Russia's oil exports still amazingly recover despite the sanctions

VN30

BANK

80,500

1D 2.03%

5D 4.55%

Buy Vol. 1,156,600

Sell Vol. 2,012,700

35,150

1D -0.42%

5D 0.72%

Buy Vol. 1,894,300

Sell Vol. 2,356,000

27,750

1D -0.54%

5D 3.16%

Buy Vol. 9,441,700

Sell Vol. 8,070,300

36,850

1D -0.81%

5D 0.96%

Buy Vol. 6,345,100

Sell Vol. 7,043,000

30,850

1D -0.48%

5D -2.06%

Buy Vol. 17,560,200

Sell Vol. 17,152,400

27,600

1D -0.54%

5D -1.60%

Buy Vol. 9,081,200

Sell Vol. 9,307,000

26,150

1D 0.19%

5D 1.95%

Buy Vol. 3,359,500

Sell Vol. 5,663,800

32,000

1D -1.08%

5D 0.31%

Buy Vol. 2,831,900

Sell Vol. 3,953,100

22,250

1D -0.45%

5D -2.20%

Buy Vol. 30,655,300

Sell Vol. 26,095,100

31,100

1D -1.43%

5D 3.67%

Buy Vol. 4,905,400

Sell Vol. 8,167,000

At Vietcombank, credit growth as of April 29 was 8.8%, almost full 10% of the room allocated by the State Bank since the beginning of the year. MB's credit growth reached more than 14.3% after the first three months of the year, much higher than the 8.6% growth in the same period last year. HDBank's loan growth more than doubled. Eximbank, Sacombank, TPBank, VPBank or SHB are also in the same situation.

REAL ESTATE

78,000

1D 0.00%

5D -1.14%

Buy Vol. 3,089,400

Sell Vol. 3,541,200

42,000

1D -0.12%

5D 2.69%

Buy Vol. 1,251,200

Sell Vol. 1,725,100

54,500

1D -0.55%

5D 3.22%

Buy Vol. 2,636,800

Sell Vol. 2,983,000

PDR: From 2019-2021, PDR's pre-tax profit continuously increased from VND 1,105b (2019) and reached VND 2,344b (2021). In 2022, PDR asserts that pre-tax profit will increase to VND3,635b.

OIL & GAS

121,000

1D 2.80%

5D 11.62%

Buy Vol. 2,507,900

Sell Vol. 3,090,000

13,950

1D 2.95%

5D 4.10%

Buy Vol. 48,121,900

Sell Vol. 43,467,100

44,500

1D 1.14%

5D 7.49%

Buy Vol. 1,993,900

Sell Vol. 2,604,700

PLX: Visa-Petrolimex officially implemented Visa contactless card payment at petrol stations owned by Petrolimex nationwide.

VINGROUP

79,300

1D 0.63%

5D 2.06%

Buy Vol. 2,381,500

Sell Vol. 3,034,700

70,300

1D 1.01%

5D 6.56%

Buy Vol. 5,868,300

Sell Vol. 7,096,600

30,050

1D -0.33%

5D 2.04%

Buy Vol. 3,369,100

Sell Vol. 5,702,400

VIC: Recently, Vingroup has adjusted its orientation and identified three main areas of activity, namely Industrial Technology, Trade and Service and Social Volunteering.

FOOD & BEVERAGE

71,900

1D 0.28%

5D 0.00%

Buy Vol. 2,121,000

Sell Vol. 2,890,500

115,000

1D 2.31%

5D 4.07%

Buy Vol. 1,631,700

Sell Vol. 1,795,300

153,100

1D -0.26%

5D -0.58%

Buy Vol. 552,700

Sell Vol. 582,700

VNM: Vinamilk and Moc Chau Milk have spent more than 2 years researching and forming a project called "Moc Chau Milk Paradise Complex" with a total investment of up to 3,150 billion VND.

OTHERS

131,300

1D 0.31%

5D 4.46%

Buy Vol. 850,000

Sell Vol. 811,400

131,300

1D 0.31%

5D 4.46%

Buy Vol. 850,000

Sell Vol. 811,400

111,800

1D 1.73%

5D 6.48%

Buy Vol. 4,082,300

Sell Vol. 4,782,800

145,500

1D 0.41%

5D 4.68%

Buy Vol. 2,212,500

Sell Vol. 1,926,500

117,300

1D 2.09%

5D 1.65%

Buy Vol. 2,275,900

Sell Vol. 1,643,800

25,150

1D -0.20%

5D -0.79%

Buy Vol. 2,527,800

Sell Vol. 2,253,400

29,550

1D -0.34%

5D 2.60%

Buy Vol. 29,342,100

Sell Vol. 25,771,700

34,350

1D -1.01%

5D -0.29%

Buy Vol. 37,352,600

Sell Vol. 37,034,500

MWG: Announced that June 8 is the last registration date to close the list of shareholders paying cash dividend at the rate of 10%. Accordingly, the expected payment date is June 17. With more than 732 million shares outstanding, the company is expected to spend 732 billion dong to pay the above dividend. In addition to cash, the 2021 dividend will include 100% in shares. MWG will issue an additional 732 million shares to pay dividends, raising the company's charter capital to VND14,640 billion.

Market by numbers

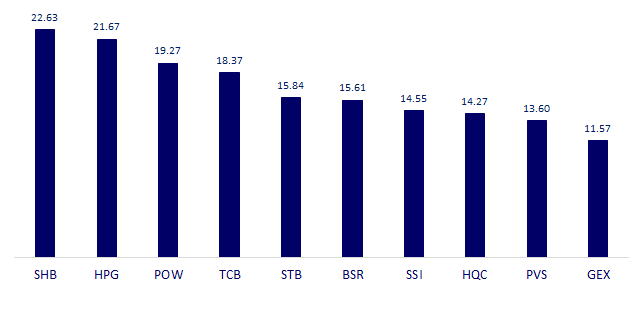

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

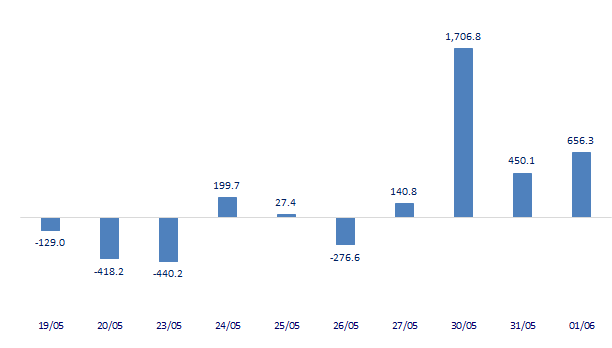

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

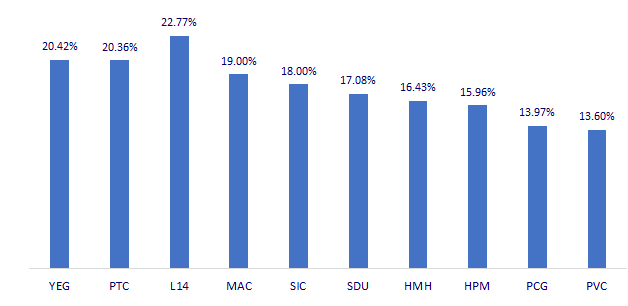

TOP INCREASES 3 CONSECUTIVE SESSIONS

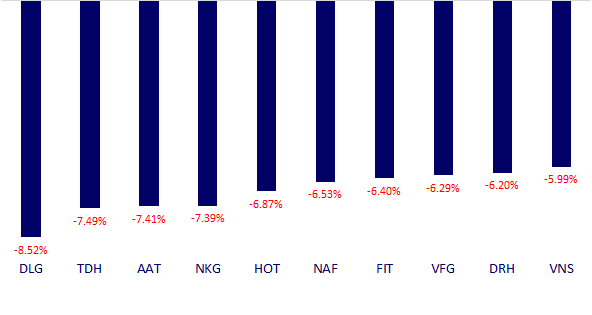

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.