Market brief 07/06/2022

VIETNAM STOCK MARKET

1,291.35

1D 0.10%

YTD -13.81%

1,324.37

1D -0.20%

YTD -13.76%

304.15

1D -0.87%

YTD -35.83%

93.69

1D -0.22%

YTD -16.85%

184.50

1D 0.00%

YTD 0.00%

22,870.10

1D 10.66%

YTD -26.40%

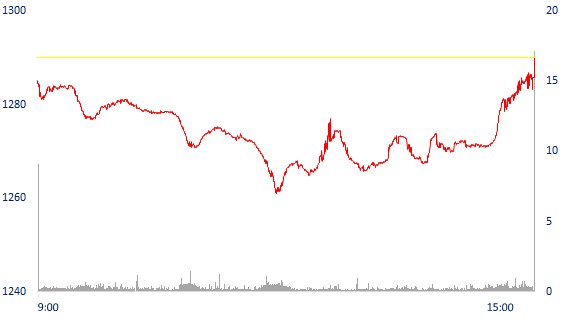

A series of stocks recovered strongly, VN-Index closed in green. Market liquidity continued to increase compared to the previous session, the total matched value reached 20,017 billion dong, up 7.8%, of which, the matched value on HoSE alone increased by 7.6% to 16,460 billion dong. Foreign investors net bought about 150 billion dong on HoSE.

ETF & DERIVATIVES

22,350

1D 0.00%

YTD -13.47%

15,550

1D -0.32%

YTD -14.04%

16,390

1D -7.97%

YTD -13.74%

19,010

1D 0.05%

YTD -16.99%

17,000

1D -0.53%

YTD -24.38%

28,800

1D 0.00%

YTD 2.67%

16,820

1D 0.12%

YTD -21.69%

1,306

1D -0.56%

YTD 0.00%

1,309

1D -0.40%

YTD 0.00%

1,311

1D -0.33%

YTD 0.00%

1,315

1D 0.00%

YTD 0.00%

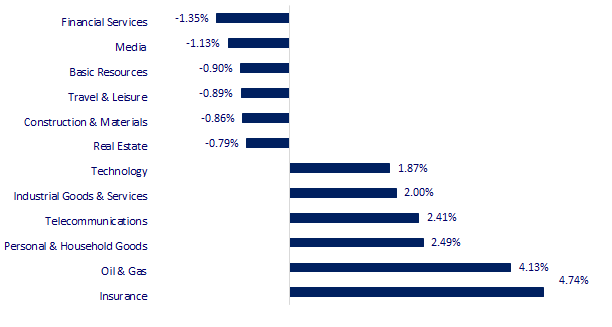

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

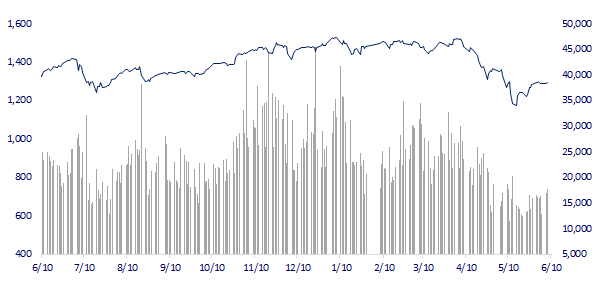

VNINDEX (12M)

GLOBAL MARKET

27,943.95

1D -0.14%

YTD -2.94%

3,241.76

1D 0.17%

YTD -10.94%

2,626.34

1D -1.66%

YTD -11.80%

21,531.67

1D -0.22%

YTD -7.98%

3,231.54

1D 0.15%

YTD 3.45%

1,631.92

1D -0.86%

YTD -1.55%

118.28

1D -0.89%

YTD 54.61%

1,852.45

1D 0.55%

YTD 1.74%

Asian stocks were mixed in the session on June 7 as investors waited for the interest rate decision of the Australian central bank. In China, the Shanghai Composite Index rose 0.17%. The Hang Seng Index (Hong Kong) fell 0.22%. South Korea's Kospi index fell 1.66%.

VIETNAM ECONOMY

0.39%

1D (bps) -1

YTD (bps) -42

5.60%

2.59%

1D (bps) 7

YTD (bps) 158

3.14%

1D (bps) 6

YTD (bps) 114

23,410

1D (%) 0.36%

YTD (%) 2.05%

25,190

1D (%) -1.19%

YTD (%) -4.83%

3,548

1D (%) -0.17%

YTD (%) -3.01%

According to the Import-Export Department (Ministry of Industry and Trade), Vietnam's rubber exports in the first five months of 2022 are very positive, growing in both volume and value. In particular, in May, rubber exports increased by more than 40% in volume and nearly 28% in value compared to April 2022.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Export of rubber increased sharply in May 2022

- Governor of the State Bank: In the first 4 months of the year, nearly 55 trillion dong of bad debt has been handled

- Thailand wants to buy Vietnamese rice

- The US declares an energy emergency, increasing imports of solar panels from Southeast Asia

- Russia increases gas supplies to China

- Russia finds a way to avoid default when the US waiver period expires

VN30

BANK

81,000

1D 1.63%

5D 2.66%

Buy Vol. 1,443,500

Sell Vol. 1,888,100

33,600

1D -1.75%

5D -4.82%

Buy Vol. 1,842,800

Sell Vol. 2,158,200

27,400

1D 0.74%

5D -1.79%

Buy Vol. 5,223,600

Sell Vol. 5,007,300

36,200

1D 0.42%

5D -2.56%

Buy Vol. 8,034,500

Sell Vol. 6,966,900

30,450

1D -0.49%

5D -1.77%

Buy Vol. 12,525,300

Sell Vol. 12,667,700

26,950

1D -1.10%

5D -2.88%

Buy Vol. 9,647,400

Sell Vol. 10,001,200

25,300

1D 0.00%

5D -3.07%

Buy Vol. 2,405,200

Sell Vol. 3,199,700

29,600

1D -3.58%

5D -8.50%

Buy Vol. 3,786,100

Sell Vol. 3,280,800

20,200

1D -1.46%

5D -9.62%

Buy Vol. 30,574,600

Sell Vol. 23,991,700

24,950

1D -1.38%

5D -1.15%

Buy Vol. 3,683,300

Sell Vol. 4,591,000

TCB: From June 4, 2022, Techcombank raised interest rates from 0.15-0.35 percentage points for all deposit terms. As is the case with ordinary customers, who are under 50 years of age and apply for a deposit of less than 1 billion VND, Techcombank will apply an interest rate of 3 months at 3.35%/year, 6-month term is 4.65%/year and 12 months is 5.55%/year. The average personal savings deposit interest rate as of the beginning of June 2022 is popular at 2.85-4%/year with a term of less than 6 months; from 4-6.35%/year with a term from 6 to under 12 months; and 5.1-7.3%/year with term of 12-13 months.

REAL ESTATE

76,000

1D -0.39%

5D -2.56%

Buy Vol. 4,222,900

Sell Vol. 3,997,100

40,400

1D -0.62%

5D -3.92%

Buy Vol. 874,700

Sell Vol. 1,091,400

52,900

1D -1.49%

5D -3.47%

Buy Vol. 2,149,200

Sell Vol. 2,582,500

KDH: In the second or third quarter, Khang Dien will issue 64.2 million shares to pay a 10% dividend and offer 9.6 million ESOP shares to the company's leaders and employees.

OIL & GAS

130,000

1D 0.08%

5D 10.45%

Buy Vol. 3,214,600

Sell Vol. 3,242,300

14,750

1D 6.88%

5D 8.86%

Buy Vol. 109,378,400

Sell Vol. 58,942,600

46,700

1D 4.01%

5D 6.14%

Buy Vol. 2,839,900

Sell Vol. 2,642,600

GAS: Mo Rong gas compressor has reached the milestone of total production of 5 billion m3 of gas on May 19, 2022. Mo Rong gas compressor is a joint operation between GAS and Vietsovpetro.

VINGROUP

78,000

1D -0.64%

5D -1.02%

Buy Vol. 2,375,300

Sell Vol. 2,841,100

68,500

1D -1.15%

5D -1.58%

Buy Vol. 4,645,700

Sell Vol. 7,058,400

29,900

1D -0.17%

5D -0.83%

Buy Vol. 2,502,500

Sell Vol. 3,429,600

VIC: VinFast has completed issuing 4 bonds with a term of 36 months, maturing in May 2025. With the issuance value of each lot is 500 billion dong, the total par value is 2,000 billion dong.

FOOD & BEVERAGE

70,600

1D -0.28%

5D -1.53%

Buy Vol. 2,550,600

Sell Vol. 2,325,500

117,900

1D 0.77%

5D 4.89%

Buy Vol. 1,935,200

Sell Vol. 2,366,800

159,900

1D 0.88%

5D 4.17%

Buy Vol. 245,500

Sell Vol. 242,000

MSN: The Board of Directors approved the transfer of one or more transactions of the entire number of shares of The CrownX JSC and Masan Vision JSC

OTHERS

126,800

1D -0.63%

5D -3.13%

Buy Vol. 774,100

Sell Vol. 701,600

126,800

1D -0.63%

5D -3.13%

Buy Vol. 774,100

Sell Vol. 701,600

115,600

1D 2.30%

5D 5.19%

Buy Vol. 6,334,400

Sell Vol. 6,157,400

153,000

1D -0.45%

5D 6.28%

Buy Vol. 3,260,500

Sell Vol. 3,096,000

128,000

1D 2.40%

5D 11.40%

Buy Vol. 2,768,900

Sell Vol. 3,267,500

25,300

1D 0.60%

5D 0.40%

Buy Vol. 3,524,800

Sell Vol. 3,310,800

28,200

1D -2.76%

5D -4.89%

Buy Vol. 33,292,700

Sell Vol. 34,432,600

33,200

1D -0.30%

5D -4.32%

Buy Vol. 29,755,000

Sell Vol. 32,823,600

HPG: In May this year, Hoa Phat Group announced that it had produced 780,000 tons of crude steel, up 16% over the same period last year. Total sales of billet, construction steel and hot-rolled coil (HRC) was 660,000 tons, up 10% compared to May 2021 and also 10% month-on-month.

Market by numbers

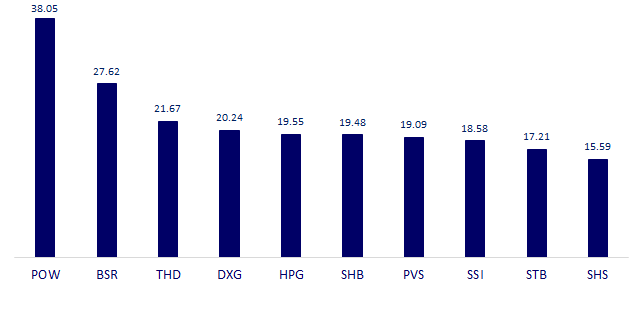

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

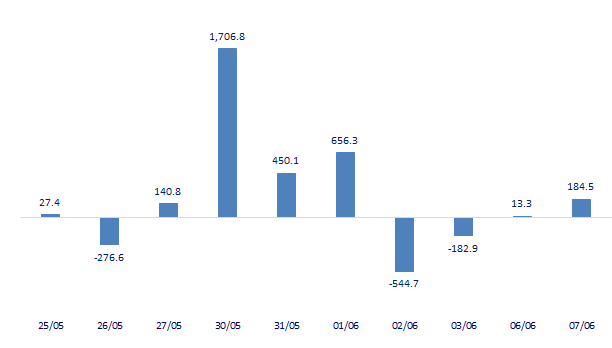

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

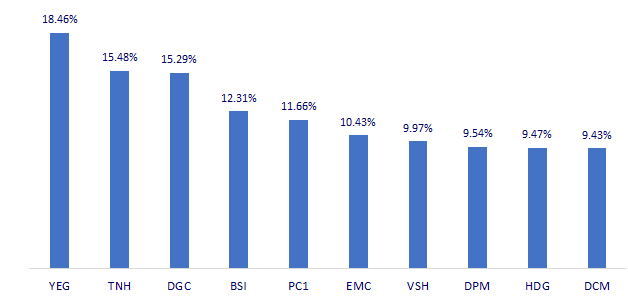

TOP INCREASES 3 CONSECUTIVE SESSIONS

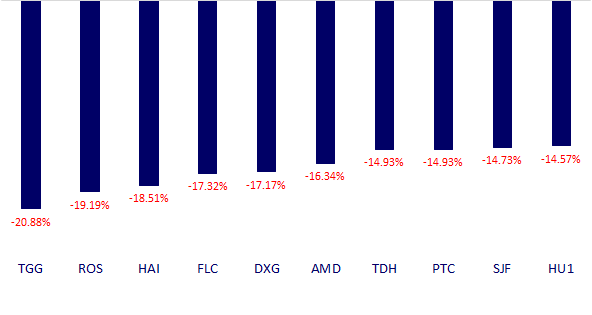

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.