Market brief 08/06/2022

VIETNAM STOCK MARKET

1,307.91

1D 1.28%

YTD -12.71%

1,342.03

1D 1.33%

YTD -12.61%

310.93

1D 2.23%

YTD -34.40%

95.00

1D 1.40%

YTD -15.69%

259.96

1D 0.00%

YTD 0.00%

20,086.75

1D -12.17%

YTD -35.35%

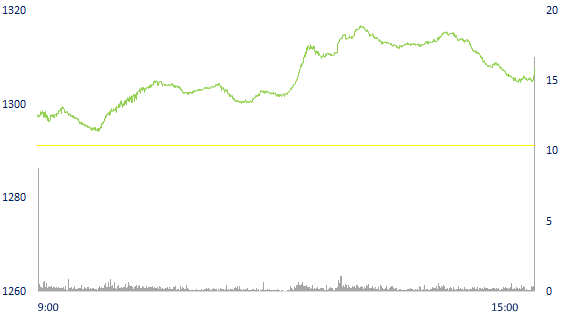

Banking and real estate stocks raced to break out, VN-Index increased by nearly 17 points. Market liquidity decreased compared to the previous session. The total matched value reached 18,565 billion dong, down 7.3%, of which, the matched value on HoSE alone decreased by 4.75% to 15,678 billion dong. Foreign investors net bought about 270 billion dong on HoSE.

ETF & DERIVATIVES

22,400

1D 0.22%

YTD -13.28%

15,720

1D 1.09%

YTD -13.10%

16,620

1D -6.68%

YTD -12.53%

19,400

1D 2.05%

YTD -15.28%

17,800

1D 4.71%

YTD -20.82%

29,480

1D 2.36%

YTD 5.10%

17,180

1D 2.14%

YTD -20.02%

1,332

1D 1.95%

YTD 0.00%

1,330

1D 1.61%

YTD 0.00%

1,331

1D 1.56%

YTD 0.00%

1,333

1D 1.37%

YTD 0.00%

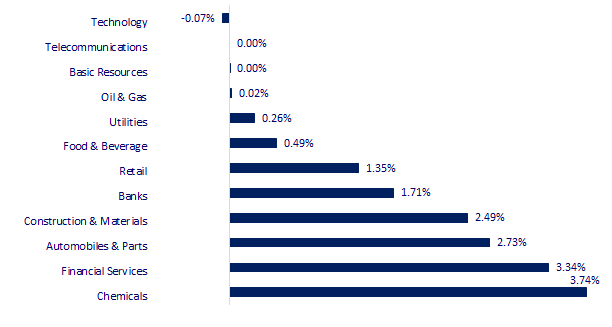

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

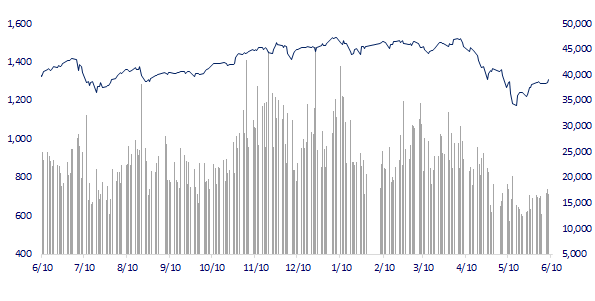

VNINDEX (12M)

GLOBAL MARKET

28,234.29

1D 0.10%

YTD -1.94%

3,263.79

1D 0.68%

YTD -10.33%

2,626.15

1D -0.01%

YTD -11.80%

22,014.59

1D 0.96%

YTD -5.91%

3,225.80

1D -0.18%

YTD 3.27%

1,636.89

1D 0.30%

YTD -1.25%

120.70

1D 0.87%

YTD 57.78%

1,849.80

1D -0.13%

YTD 1.59%

Asian stocks mostly traded on June 8. Investors await the rate decision of the Reserve Bank of India, which is expected to be announced later today. Japan's Nikkei 225 index rose 0.1%. Japan's gross domestic product (GDP) fell by 0.5% in the first quarter of 2022 from the same period a year earlier, according to revised data released on June 8, a positive sign compared to the decrease in GDP. 1% previously announced.

VIETNAM ECONOMY

0.42%

1D (bps) 3

YTD (bps) -39

5.60%

2.54%

1D (bps) -5

YTD (bps) 153

3.21%

1D (bps) 7

YTD (bps) 121

23,410

1D (%) 0.34%

YTD (%) 2.05%

25,276

1D (%) -0.94%

YTD (%) -4.50%

3,536

1D (%) -0.31%

YTD (%) -3.34%

Regarding credit in the real estate sector, Governor of the State Bank of Vietnam Nguyen Thi Hong said that by the end of April 2022, the total outstanding loans for the real estate sector of credit institutions reached 2,288. VND 278 billion, an increase of 10.19% compared to the end of 2021, accounting for 20.44% of the total outstanding loans to the economy; bad debt ratio is 1.62%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Governor of the State Bank: 94% of real estate loans are currently medium and long-term loans

- The Government sets out 5 tasks and solutions for sustainable development of the agricultural sector

- Deposit interest rates go up

- World Bank forecasts Russia's GDP in 2022 will fall by nearly 9%

- Fed's GDP tracker shows US economy may be on the brink of recession

- Australia raises interest rates to curb soaring inflation

VN30

BANK

79,200

1D -2.22%

5D -1.61%

Buy Vol. 1,722,600

Sell Vol. 2,297,100

34,300

1D 2.08%

5D -2.42%

Buy Vol. 1,840,600

Sell Vol. 1,912,800

27,700

1D 1.09%

5D -0.18%

Buy Vol. 11,453,700

Sell Vol. 10,076,900

37,250

1D 2.90%

5D 1.09%

Buy Vol. 10,419,100

Sell Vol. 10,420,200

31,800

1D 4.43%

5D 3.08%

Buy Vol. 36,372,800

Sell Vol. 27,261,700

27,950

1D 3.71%

5D 1.27%

Buy Vol. 28,554,500

Sell Vol. 19,062,400

25,950

1D 2.57%

5D -0.76%

Buy Vol. 4,293,700

Sell Vol. 4,546,300

30,250

1D 2.20%

5D -5.47%

Buy Vol. 6,338,000

Sell Vol. 7,300,600

21,600

1D 6.93%

5D -2.92%

Buy Vol. 34,232,900

Sell Vol. 14,447,800

25,700

1D 3.01%

5D 3.30%

Buy Vol. 6,441,300

Sell Vol. 6,702,000

VPB: VPBank increased the interest rate by 0.3%/year for deposits with terms of 13, 24 and 36 months, bringing the interest rate to 6.4%/year. In case the deposit value is over 300 million VND with a term of 6 months or more, the interest rate is 0.3 - 0.5%/year higher than depositing at the counter. Currently, some banks apply a deposit interest rate of over 7%/year such as VPBank at 6.9%/year, SCB at 7.5%/year..., but with conditions of bulk deposit.

REAL ESTATE

76,400

1D 0.53%

5D -2.05%

Buy Vol. 3,638,900

Sell Vol. 4,249,900

41,300

1D 2.23%

5D -1.67%

Buy Vol. 1,347,100

Sell Vol. 1,280,200

52,700

1D -0.38%

5D -3.30%

Buy Vol. 2,809,700

Sell Vol. 2,803,900

KDH: Khang Dien has completed the acquisition of two new land funds, Doan Nguyen (6 hectares in Cat Lai, Thu Duc City) and Nguyen Thu (have not disclosed project details).

OIL & GAS

128,900

1D -0.85%

5D 6.53%

Buy Vol. 3,056,300

Sell Vol. 3,282,000

15,400

1D 4.41%

5D 10.39%

Buy Vol. 72,642,200

Sell Vol. 48,555,800

46,850

1D 0.32%

5D 5.28%

Buy Vol. 4,918,500

Sell Vol. 3,579,400

PLX: Expected 5-month accumulated pre-tax profit is about VND 1,340 billion, fulfilling 44% of the year plan. The Group will divest PGBank in the first half of the fourth quarter.

VINGROUP

78,100

1D 0.13%

5D -1.51%

Buy Vol. 2,391,700

Sell Vol. 3,156,100

68,500

1D 0.00%

5D -2.56%

Buy Vol. 2,917,800

Sell Vol. 5,578,300

30,400

1D 1.67%

5D 1.16%

Buy Vol. 3,537,300

Sell Vol. 4,768,800

VHM: On June 1, the Government Of Singapore fund became a major shareholder of VHM after buying 612,000 VHM shares, bringing its holding ratio to 5.01%, equivalent to 218.23m shares.

FOOD & BEVERAGE

71,000

1D 0.57%

5D -1.25%

Buy Vol. 3,275,700

Sell Vol. 3,210,900

119,300

1D 1.19%

5D 3.74%

Buy Vol. 1,809,700

Sell Vol. 2,186,000

159,700

1D -0.13%

5D 4.31%

Buy Vol. 420,400

Sell Vol. 364,600

MSN was in the top of the stocks that were bought the most by foreign investors in today's session with a value of 84 billion dong, while VNM was net sold more than 24 billion dong.

OTHERS

127,000

1D 0.16%

5D -3.27%

Buy Vol. 881,100

Sell Vol. 848,100

127,000

1D 0.16%

5D -3.27%

Buy Vol. 881,100

Sell Vol. 848,100

115,000

1D -0.52%

5D 2.86%

Buy Vol. 4,135,300

Sell Vol. 5,387,000

153,400

1D 0.26%

5D 6.12%

Buy Vol. 3,381,400

Sell Vol. 3,831,000

128,000

1D 0.00%

5D 9.12%

Buy Vol. 2,083,000

Sell Vol. 2,861,000

27,050

1D 6.92%

5D 7.55%

Buy Vol. 8,357,500

Sell Vol. 3,247,800

29,300

1D 3.90%

5D -0.85%

Buy Vol. 26,130,300

Sell Vol. 30,482,500

32,900

1D -0.90%

5D -4.22%

Buy Vol. 37,993,000

Sell Vol. 40,057,300

SSI: SSI was approved to offer 497.4 million shares to existing shareholders. The asking price is 15,000 VND/share, corresponding to the expected mobilized value of nearly 7,500 billion VND. If the offering is successful, the charter capital of SSI will increase from VND 9,947 billion to VND 14,921 billion - thereby continuing to be the securities company with the largest capital scale in the market.

Market by numbers

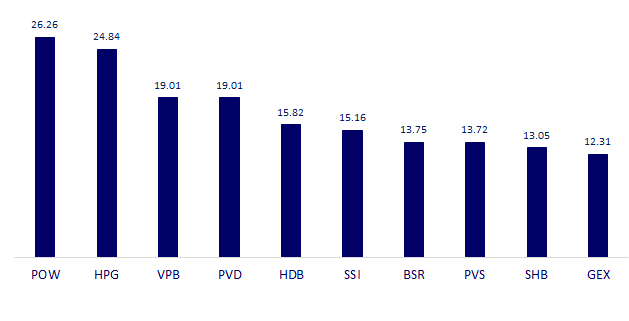

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

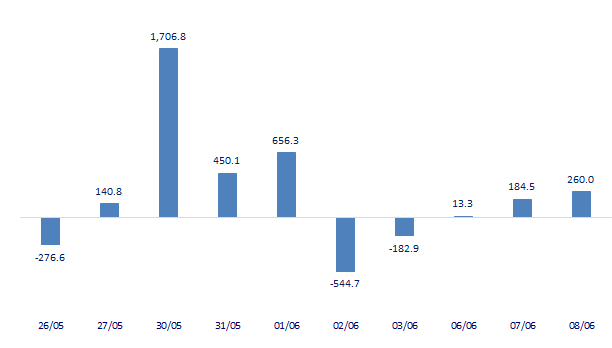

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

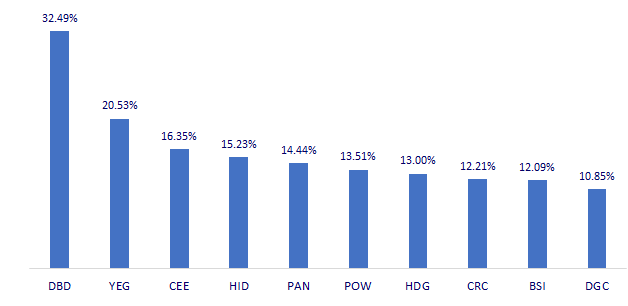

TOP INCREASES 3 CONSECUTIVE SESSIONS

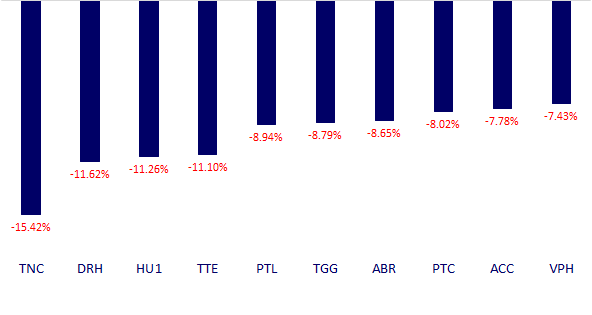

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.