Market brief 10/06/2022

VIETNAM STOCK MARKET

1,284.08

1D -1.81%

YTD -14.30%

1,325.69

1D -1.28%

YTD -13.68%

306.44

1D -2.01%

YTD -35.35%

93.72

1D -1.23%

YTD -16.83%

90.85

1D 0.00%

YTD 0.00%

21,275.69

1D 32.80%

YTD -31.53%

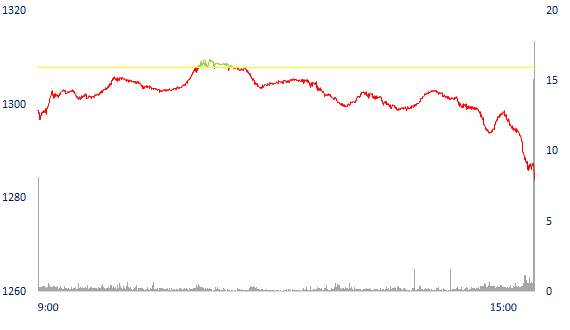

Selling pressure was strong, VN-Index dropped nearly 24 points. Market liquidity increased sharply compared to the previous session, the total matched value reached 19,100 billion dong, up 36%, of which, matched value on HoSE alone increased 30.7% to 15,525 billion dong. Foreign investors net bought about 90 billion dong.

ETF & DERIVATIVES

22,400

1D -0.22%

YTD -13.28%

15,670

1D -0.82%

YTD -13.38%

16,290

1D -8.53%

YTD -14.26%

19,020

1D -0.94%

YTD -16.94%

17,480

1D 0.75%

YTD -22.24%

28,800

1D -2.04%

YTD 2.67%

17,000

1D 3.03%

YTD -20.86%

1,313

1D -1.61%

YTD 0.00%

1,311

1D -1.72%

YTD 0.00%

1,310

1D -1.95%

YTD 0.00%

1,311

1D -1.81%

YTD 0.00%

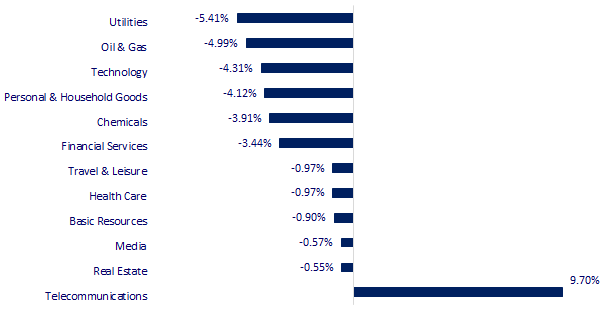

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

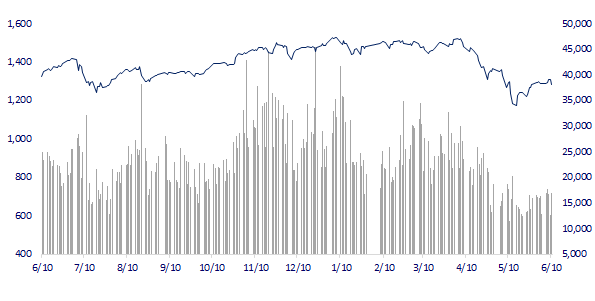

VNINDEX (12M)

GLOBAL MARKET

27,824.29

1D -0.17%

YTD -3.36%

3,284.83

1D 1.42%

YTD -9.75%

2,595.87

1D -1.13%

YTD -12.82%

21,806.18

1D 0.96%

YTD -6.80%

3,181.73

1D -0.87%

YTD 1.86%

1,632.62

1D -0.53%

YTD -1.51%

122.53

1D 1.66%

YTD 60.17%

1,845.65

1D -0.14%

YTD 1.36%

Asian stocks were mixed in the session 10/6 after China's inflation data was released. Investors are also waiting for the rate of increase in consumer prices in the US, which is expected to be announced today. In China, the Shanghai Composite Index rose 1.42% to 3,284.83 points. Hong Kong's Hang Seng Index rose 0.96%. In Japan, the Nikkei 225 index fell 0.17%. The Kospi (South Korea) index fell 1.13%.

VIETNAM ECONOMY

0.38%

1D (bps) -4

YTD (bps) -43

5.60%

2.60%

1D (bps) 4

YTD (bps) 159

3.11%

1D (bps) -1

YTD (bps) 111

23,400

1D (%) 0.41%

YTD (%) 2.01%

25,008

1D (%) -1.28%

YTD (%) -5.52%

3,533

1D (%) 0.03%

YTD (%) -3.42%

Ho Chi Minh City Department of Industry and Trade estimated retail sales of goods in May reached VND 57,757 billion, up 3.08% from the previous month, up 13.8% over the same period and the highest since January 2021. In which, retail sales of goods in May was estimated at VND 57,757 billion, up 3.08% over the previous month and up 13.8% compared to May 2021.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- SBV Governor: Credit limit tool has prevented interest rate races

- Retail sales in Ho Chi Minh City highest in 4 years

- Vietnam can become a global supply chain

- EU bans sale of petrol and diesel cars from 2035

- US Treasury Secretary: There is no sign of the economy falling into recession

- China's producer price index decelerates in May

VN30

BANK

77,700

1D -0.13%

5D 0.26%

Buy Vol. 864,000

Sell Vol. 1,034,400

33,800

1D -2.03%

5D -1.60%

Buy Vol. 1,517,000

Sell Vol. 1,602,900

27,100

1D -2.17%

5D -1.09%

Buy Vol. 5,125,200

Sell Vol. 5,701,700

37,950

1D 1.47%

5D 4.12%

Buy Vol. 13,744,200

Sell Vol. 15,355,700

30,900

1D -1.90%

5D 0.49%

Buy Vol. 17,980,500

Sell Vol. 19,807,700

27,500

1D -1.08%

5D 0.36%

Buy Vol. 10,015,000

Sell Vol. 11,811,400

25,900

1D 0.39%

5D 1.97%

Buy Vol. 6,207,100

Sell Vol. 5,887,300

29,700

1D -1.16%

5D -6.75%

Buy Vol. 2,784,100

Sell Vol. 3,370,700

21,900

1D -1.79%

5D 3.55%

Buy Vol. 28,443,400

Sell Vol. 37,182,000

25,200

1D -2.14%

5D -0.40%

Buy Vol. 4,545,400

Sell Vol. 5,815,400

A series of banks have started implementing capital raising plans recently. SeABank announced that on June 17, it will close the list of shareholders to pay dividends in shares and issue shares to increase capital from equity. Previously, VIB and ACB were the two banks that implemented the plan to increase charter capital at the earliest this year. Specifically, on June 3, ACB closed the list of shareholders to issue 675.4 million shares paying 25% dividend. ACB's charter capital was raised from more than 27,019 billion VND to 33,774 billion VND.

REAL ESTATE

77,000

1D 0.65%

5D -0.65%

Buy Vol. 2,914,800

Sell Vol. 3,141,400

40,950

1D -0.24%

5D 0.37%

Buy Vol. 1,149,700

Sell Vol. 976,000

52,700

1D -0.94%

5D -1.86%

Buy Vol. 2,126,900

Sell Vol. 2,297,100

NVL: By 2025, it is expected that Nova Consumer's revenue structure will shift to 40% from the consumer goods industry and about 60% from the agricultural segment.

OIL & GAS

118,700

1D -6.97%

5D -4.43%

Buy Vol. 3,427,700

Sell Vol. 4,229,900

15,000

1D -5.66%

5D 11.11%

Buy Vol. 61,730,100

Sell Vol. 60,981,500

45,000

1D -4.05%

5D 3.45%

Buy Vol. 2,479,300

Sell Vol. 3,222,800

POW: POW is conducting divestment of Viet Lao Power JSC, expected to record an extraordinary profit of 308b VND and complete the procedure in the second quarter of this year.

VINGROUP

78,000

1D -0.13%

5D -1.02%

Buy Vol. 2,059,200

Sell Vol. 2,197,900

68,300

1D 0.00%

5D -1.59%

Buy Vol. 3,521,700

Sell Vol. 3,953,800

30,500

1D -1.29%

5D 1.84%

Buy Vol. 2,748,800

Sell Vol. 3,848,700

VIC: VinFast VF 9 continues to be exported to China via land through Huu Nghi - Lang Son border gate, possibly for research and testing purposes.

FOOD & BEVERAGE

69,500

1D -1.00%

5D -1.14%

Buy Vol. 2,353,600

Sell Vol. 2,449,900

117,000

1D -1.27%

5D 3.72%

Buy Vol. 1,055,500

Sell Vol. 1,088,500

157,700

1D 0.45%

5D 1.61%

Buy Vol. 120,500

Sell Vol. 149,500

VNM: Vinamilk invests in developing nutritional solutions to support immunity and enhance health for young children and the elderly.

OTHERS

127,700

1D -0.08%

5D 0.55%

Buy Vol. 874,700

Sell Vol. 909,800

127,700

1D -0.08%

5D 0.55%

Buy Vol. 874,700

Sell Vol. 909,800

110,000

1D -4.60%

5D -3.51%

Buy Vol. 4,427,300

Sell Vol. 5,887,300

150,000

1D -1.83%

5D -1.45%

Buy Vol. 3,621,500

Sell Vol. 4,784,100

120,700

1D -6.07%

5D -2.03%

Buy Vol. 1,810,900

Sell Vol. 2,099,500

26,100

1D -4.92%

5D 4.40%

Buy Vol. 4,086,100

Sell Vol. 5,374,500

27,850

1D -3.97%

5D -4.79%

Buy Vol. 22,905,700

Sell Vol. 30,675,300

33,600

1D -0.59%

5D 0.60%

Buy Vol. 23,599,300

Sell Vol. 32,590,000

SSI: on June 23, the last registration was made to make a list of shareholders paying cash dividends (10%) and exercise the right to buy shares offered to existing shareholders. With 992.7 million shares outstanding, the company will spend nearly VND993b to pay dividends. With the capital increase plan, the company will issue 497.4m shares, the distribution rate is 50% at the price of 15,000 VND/share. After completing the issuance, the charter capital is expected to increase to VND 14,900 billion.

Market by numbers

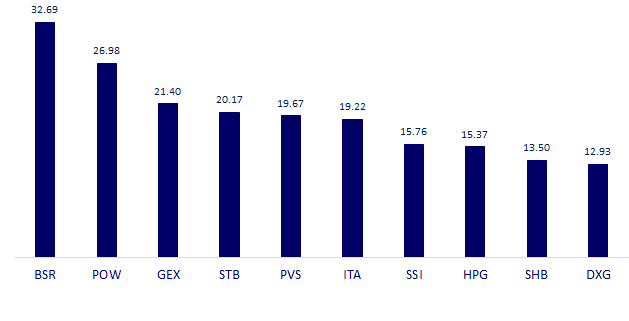

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

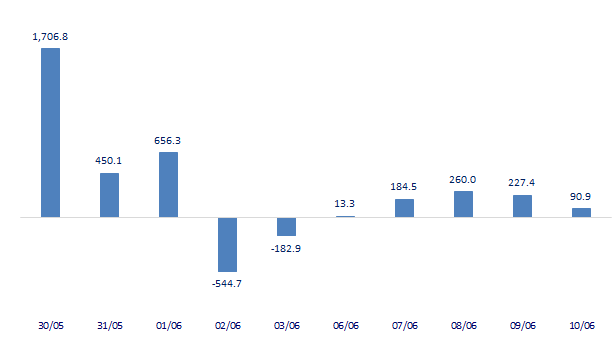

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

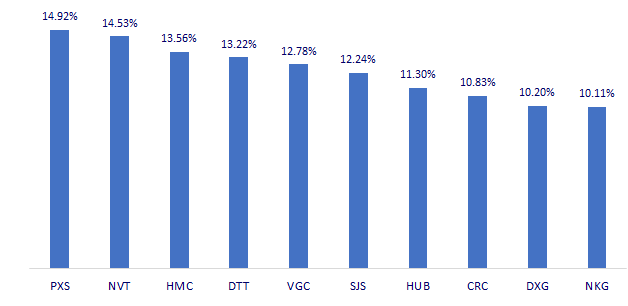

TOP INCREASES 3 CONSECUTIVE SESSIONS

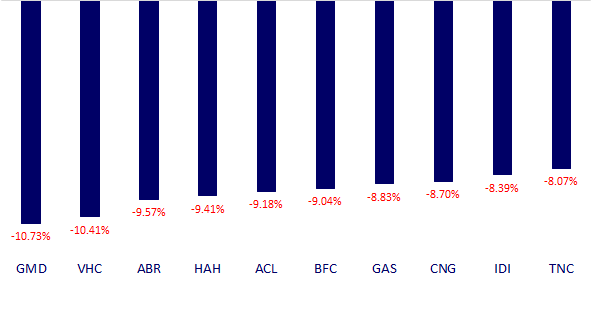

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.