Market brief 28/06/2022

VIETNAM STOCK MARKET

1,218.10

1D 1.27%

YTD -18.70%

1,273.41

1D 1.33%

YTD -17.08%

283.87

1D 1.23%

YTD -40.11%

89.01

1D 0.99%

YTD -21.01%

178.68

1D 0.00%

YTD 0.00%

16,914.29

1D 19.45%

YTD -45.56%

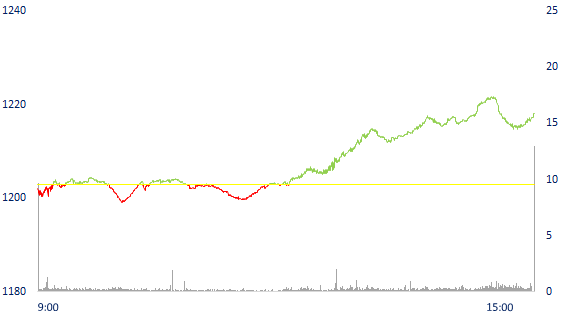

Banking stocks broke out, VN-Index gained more than 15 points. Market liquidity increased compared to the previous session, the total matched value reached 13,923 billion dong, up 25.5%, of which, the matched value on HoSE increased 28% to 12,520 billion dong. Foreign investors net bought 178 billion dong.

ETF & DERIVATIVES

21,450

1D 1.61%

YTD -16.96%

15,040

1D 1.42%

YTD -16.86%

15,690

1D -11.90%

YTD -17.42%

18,400

1D 1.10%

YTD -19.65%

16,600

1D 4.34%

YTD -26.16%

27,650

1D 1.95%

YTD -1.43%

16,000

1D 0.95%

YTD -25.51%

1,261

1D 1.03%

YTD 0.00%

1,259

1D 1.02%

YTD 0.00%

1,256

1D 0.79%

YTD 0.00%

1,261

1D 1.05%

YTD 0.00%

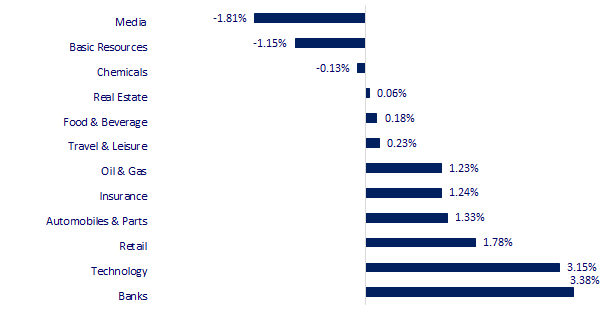

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

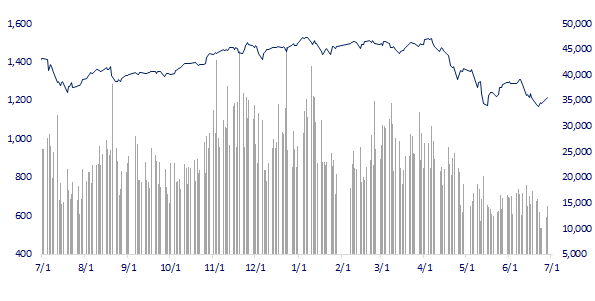

VNINDEX (12M)

GLOBAL MARKET

27,049.47

1D 0.58%

YTD -6.05%

3,409.21

1D 0.89%

YTD -6.33%

2,422.09

1D 0.84%

YTD -18.66%

22,418.97

1D 0.85%

YTD -4.18%

3,140.21

1D 0.09%

YTD 0.53%

1,594.47

1D 0.90%

YTD -3.81%

111.38

1D 0.65%

YTD 45.59%

1,823.55

1D -0.10%

YTD 0.15%

Asian stocks all rallied on June 28, although most of the market went down in the morning. The Shanghai Composite Index rose 0.89% to 3,409.21 points. In Japan, the Nikkei 225 index rose 0.58%. South Korea's Kospi index rose 0.84%.

VIETNAM ECONOMY

0.37%

YTD (bps) -44

5.60%

2.57%

YTD (bps) 156

3.17%

YTD (bps) 117

23,475

1D (%) 0.36%

YTD (%) 2.33%

25,064

1D (%) -1.07%

YTD (%) -5.30%

3,547

1D (%) 0.08%

YTD (%) -3.03%

Deputy Prime Minister Le Van Thanh informed that Vietnam is one of the six countries with the highest vaccine coverage rate in the world. Socio-economic activities have returned to normal. In the first six months of 2022, GDP growth rate is estimated at 6.38%, GDP growth is expected to be 6.5-7% in 2022.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Deputy Prime Minister: GDP is expected to increase by 6.38% in the second quarter

- Vietnam - A promising destination for big companies

- Controlling inflation cannot increase interest rates, tighten credit

- US Secretary of State: Russian gold ban will cost Moscow $19 billion a year

- Central banks in Asia spend billions of dollars to keep local currencies stable

- Oil rises waiting for news from G7 meeting

VN30

BANK

76,300

1D 1.87%

5D -1.80%

Buy Vol. 1,952,300

Sell Vol. 1,901,800

33,650

1D 5.98%

5D 11.06%

Buy Vol. 4,076,500

Sell Vol. 3,350,700

26,700

1D 4.30%

5D 15.84%

Buy Vol. 17,771,600

Sell Vol. 13,027,700

36,700

1D 3.23%

5D 11.21%

Buy Vol. 8,842,300

Sell Vol. 8,583,000

30,000

1D 3.81%

5D 10.29%

Buy Vol. 27,243,200

Sell Vol. 19,265,500

24,700

1D 2.49%

5D 10.02%

Buy Vol. 25,499,500

Sell Vol. 18,708,900

24,250

1D 3.85%

5D 2.75%

Buy Vol. 4,753,000

Sell Vol. 2,984,100

27,600

1D 3.37%

5D 7.60%

Buy Vol. 3,687,500

Sell Vol. 3,674,700

22,550

1D 4.88%

5D 17.45%

Buy Vol. 56,211,100

Sell Vol. 48,711,600

24,500

1D 2.30%

5D 6.52%

Buy Vol. 5,016,600

Sell Vol. 5,712,700

BID: has just announced the selection of an auction organization for customers' debts at BIDV, the total outstanding balance as of April 30 is nearly VND 4,838 billion. The collateral for the aforementioned debt includes: Land use rights and assets attached to land formed in the future under the project Phuoc Kien commune, Nha Be district, Ho Chi Minh City and property rights on mining stone in Hoa Thach and Phu Man communes, Quoc Oai district, Hanoi city.

REAL ESTATE

75,100

1D -4.70%

5D -0.53%

Buy Vol. 5,197,300

Sell Vol. 6,982,300

39,250

1D 0.51%

5D 1.55%

Buy Vol. 1,219,000

Sell Vol. 1,339,300

53,000

1D 0.76%

5D 4.95%

Buy Vol. 2,612,800

Sell Vol. 2,366,800

NVL: Novaland consulted on changing the structure of the BoD and adjusting the plan to pay a 10% stock dividend, equivalent to a value of 1,930 billion VND

OIL & GAS

116,000

1D 1.40%

5D -2.93%

Buy Vol. 1,466,600

Sell Vol. 1,531,500

13,900

1D 0.36%

5D -0.36%

Buy Vol. 38,918,600

Sell Vol. 38,102,100

41,800

1D 0.72%

5D 7.18%

Buy Vol. 1,060,900

Sell Vol. 1,134,200

Oil rose waiting for news from the G7 meeting. Ending Monday's session, the Brent oil contract advanced 1.74% to $115.09 a barrel. The WTI oil contract added $1.95 (1.8%) to $109.57 a barrel.

VINGROUP

73,600

1D -0.27%

5D -1.87%

Buy Vol. 3,129,800

Sell Vol. 4,309,700

63,800

1D 0.47%

5D -1.85%

Buy Vol. 2,939,300

Sell Vol. 3,323,500

28,850

1D 0.35%

5D 3.04%

Buy Vol. 2,225,200

Sell Vol. 3,017,000

VIC: VEIL net bought more than 3,900 billion dong in one month. TCB and DGC appear in the top 10 of the portfolio replacing VIC and MBB.

FOOD & BEVERAGE

70,800

1D -0.42%

5D -3.93%

Buy Vol. 4,894,200

Sell Vol. 5,376,100

114,000

1D 0.88%

5D 2.70%

Buy Vol. 1,754,500

Sell Vol. 1,820,300

157,100

1D 0.19%

5D 1.35%

Buy Vol. 176,600

Sell Vol. 134,200

While MSN was net bought by foreign investors with a value of 64bdong in today's session, VNM was sold strongly with 93b dong.

OTHERS

133,000

1D 0.00%

5D 4.07%

Buy Vol. 789,700

Sell Vol. 865,200

133,000

1D 0.00%

5D 4.07%

Buy Vol. 789,700

Sell Vol. 865,200

89,700

1D 3.70%

5D 0.67%

Buy Vol. 5,078,200

Sell Vol. 4,923,700

72,800

1D 1.82%

5D -0.95%

Buy Vol. 7,421,700

Sell Vol. 6,355,500

129,500

1D 0.00%

5D 8.66%

Buy Vol. 1,146,400

Sell Vol. 1,152,200

23,500

1D 0.64%

5D 8.29%

Buy Vol. 2,006,300

Sell Vol. 1,957,600

19,600

1D -1.26%

5D 18.56%

Buy Vol. 23,064,300

Sell Vol. 26,619,300

22,500

1D -1.75%

5D 8.17%

Buy Vol. 31,502,200

Sell Vol. 31,504,900

BVH: At the end of last year, the Ministry of Finance sent an official letter to SCIC requesting to focus on divesting capital in 3 enterprises, namely Bao Viet Group (BVH), Bao Minh Joint Stock Corporation (BMI) and Thieu Plastics Joint Stock Company. Tien Phong (NTP). This raises the expectation that SCIC will soon implement divestment in these 3 businesses, but the list of divestments this year is completely unnamed.

Market by numbers

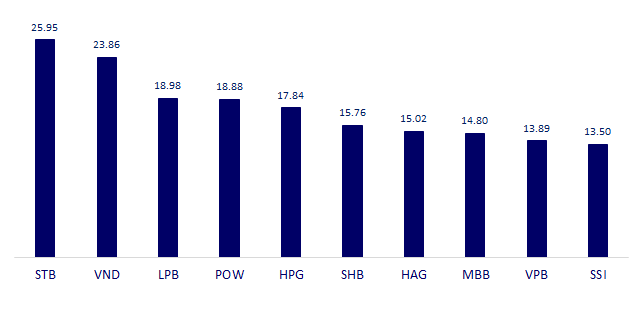

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

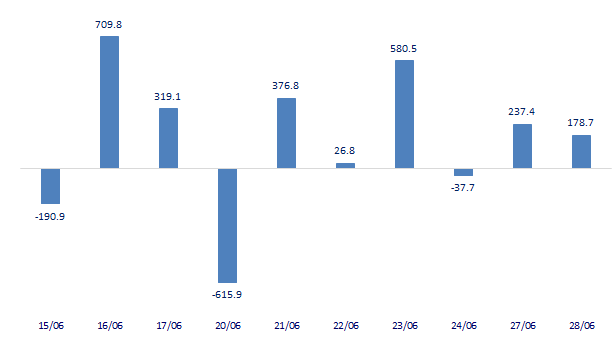

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

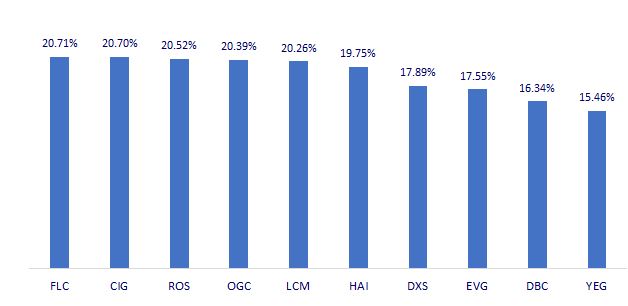

TOP INCREASES 3 CONSECUTIVE SESSIONS

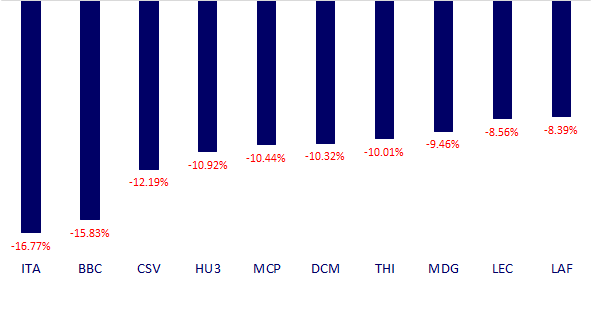

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.