Market brief 01/07/2022

VIETNAM STOCK MARKET

1,198.90

1D 0.11%

YTD -19.98%

1,252.24

1D 0.27%

YTD -18.46%

278.88

1D 0.43%

YTD -41.16%

88.18

1D -0.45%

YTD -21.74%

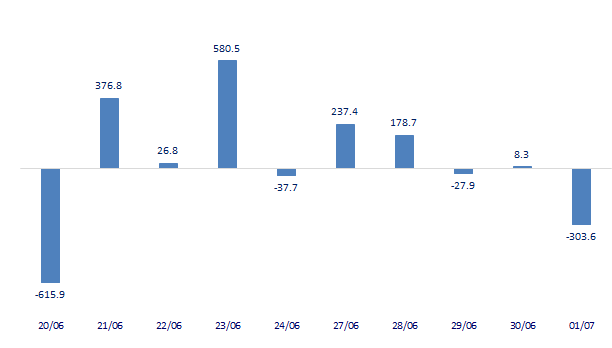

-303.59

1D 0.00%

YTD 0.00%

14,637.87

1D 11.95%

YTD -52.89%

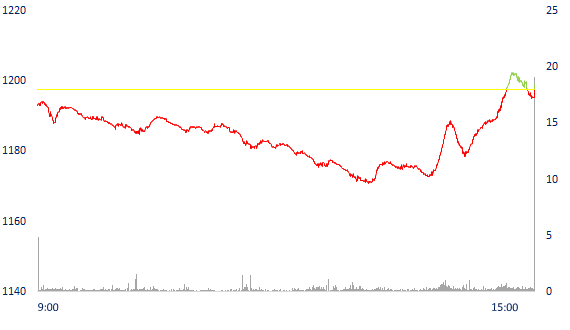

Securities stocks broke out, VN-Index closed in the green. The total matched value of the whole market was about 12,700 billion dong, up 6.5% compared to the previous session, of which, the matching value on HoSE decreased slightly by 0.3% to 10,527 billion dong. Foreign investors net sold 303 billion dong.

ETF & DERIVATIVES

21,300

1D -0.23%

YTD -17.54%

14,750

1D -0.61%

YTD -18.46%

15,340

1D -13.87%

YTD -19.26%

18,710

1D 6.91%

YTD -18.30%

16,020

1D -3.20%

YTD -28.74%

27,000

1D -2.14%

YTD -3.74%

16,100

1D -0.56%

YTD -25.05%

1,241

1D -0.23%

YTD 0.00%

1,241

1D -0.19%

YTD 0.00%

1,240

1D -0.10%

YTD 0.00%

1,242

1D 0.15%

YTD 0.00%

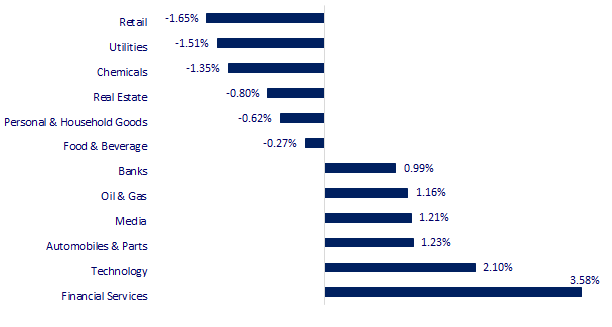

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

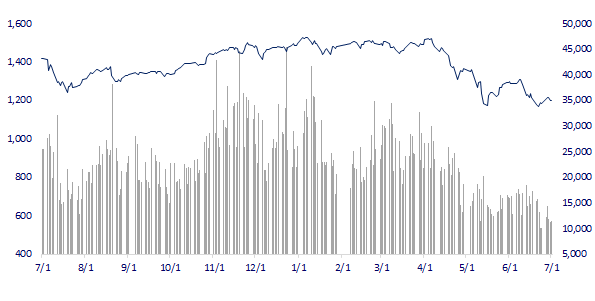

VNINDEX (12M)

GLOBAL MARKET

25,935.62

1D -0.81%

YTD -9.92%

3,387.64

1D -0.32%

YTD -6.93%

2,305.42

1D -1.17%

YTD -22.58%

21,859.79

1D 0.00%

YTD -6.57%

3,095.59

1D -0.21%

YTD -0.90%

1,572.67

1D 0.28%

YTD -5.12%

107.94

1D -0.93%

YTD 41.10%

1,791.60

1D -1.12%

YTD -1.60%

Asian stocks all fell in the last session of the week. The Nikkei 225 index fell 0.81% to 25,935.62 points. In South Korea, the Kospi index fell 1.17%. Chinese stocks closed lower despite receiving positive results from a published private survey. Accordingly, the Shanghai Composite Index fell 0.32%.

VIETNAM ECONOMY

0.71%

YTD (bps) -10

5.60%

2.66%

YTD (bps) 165

3.19%

YTD (bps) 119

23,525

1D (%) 0.49%

YTD (%) 2.55%

24,836

1D (%) -1.03%

YTD (%) -6.17%

3,549

1D (%) 0.17%

YTD (%) -2.98%

Information was announced by the Ministry of Finance at a conference with ministries, branches and localities to review the disbursement of public investment capital from foreign capital in the first 6 months of the year held on July 1. In the first 6 months of 2022, disbursement of public investment capital from foreign loans only reached 9.12% of the assigned capital plan, of which, ministries and branches reached 16.12%, localities reached 5.38%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank of Vietnam increased the attraction of money, nearly 45,000 billion bills were issued on June 30

- ODA disbursement only reached 9.12% in the first half of 2022

- UK imports of Vietnamese pangasius increased 6 times

- Inflation 'cooled down' in Germany

- UK trade activity lowest since publication

- India raises import tax on gold and oil

VN30

BANK

74,000

1D -1.07%

5D -1.33%

Buy Vol. 2,142,400

Sell Vol. 2,532,500

35,050

1D 4.63%

5D 12.34%

Buy Vol. 6,471,500

Sell Vol. 4,780,900

26,950

1D 3.06%

5D 8.89%

Buy Vol. 6,207,600

Sell Vol. 6,695,100

36,000

1D 1.27%

5D 1.41%

Buy Vol. 6,673,100

Sell Vol. 5,678,500

29,100

1D 0.34%

5D 3.37%

Buy Vol. 16,084,700

Sell Vol. 11,828,900

24,200

1D 0.00%

5D 2.11%

Buy Vol. 13,276,800

Sell Vol. 11,377,800

24,500

1D 2.08%

5D 6.52%

Buy Vol. 3,146,200

Sell Vol. 3,346,900

27,300

1D 0.55%

5D 5.00%

Buy Vol. 1,818,200

Sell Vol. 1,772,800

22,000

1D 2.33%

5D 3.77%

Buy Vol. 32,589,500

Sell Vol. 30,130,300

24,050

1D 0.21%

5D 1.05%

Buy Vol. 3,653,200

Sell Vol. 3,079,300

HDB: HDBank first set up its headquarters with 5 branches in Hau Giang, Dien Bien, Lai Chau, Hoa Binh and Phu Quoc island districts. In addition, the bank will expand its network with 13 transaction points in Kon Tum, Nam Dinh, Dak Nong, Vinh Phuc, Ninh Binh, Bac Giang, Thai Binh, Bac Lieu and Ninh Thuan provinces. Completing this plan, HDBank will increase its network to 347 banking transaction points, more than 23,000 financial transaction points, with nearly 15,500 employees.

REAL ESTATE

74,400

1D -0.13%

5D 0.54%

Buy Vol. 2,304,900

Sell Vol. 3,016,700

38,850

1D -0.13%

5D 1.04%

Buy Vol. 1,035,800

Sell Vol. 1,461,600

52,400

1D 1.16%

5D -0.19%

Buy Vol. 2,058,000

Sell Vol. 1,886,600

PDR: The project with the largest scale in Phat Dat's inventory is The EverRich 2 Project with the inventory recorded at this project alone amounting to VND3,604 billion.

OIL & GAS

113,000

1D -2.16%

5D -0.88%

Buy Vol. 1,804,800

Sell Vol. 1,810,600

13,600

1D 0.00%

5D 0.37%

Buy Vol. 32,584,200

Sell Vol. 34,755,000

40,600

1D 0.74%

5D -0.49%

Buy Vol. 1,070,200

Sell Vol. 876,200

Gasoline price decreased by more than 100 VND/liter after a series of consecutive increases. Accordingly, the price of E5 gasoline decreased by 410 VND/liter…

VINGROUP

72,600

1D -1.22%

5D -2.68%

Buy Vol. 2,682,900

Sell Vol. 3,977,500

61,400

1D -1.13%

5D -2.85%

Buy Vol. 4,582,800

Sell Vol. 4,982,000

28,650

1D 0.35%

5D 3.99%

Buy Vol. 2,763,000

Sell Vol. 3,261,100

VIC: Decided to transfer all shares in One Mount Group Joint Stock Company, after the transfer, One Mount Group Joint Stock Company is no longer an affiliated company of Vingroup.

FOOD & BEVERAGE

73,700

1D 2.08%

5D 3.08%

Buy Vol. 4,939,700

Sell Vol. 5,350,000

109,500

1D -2.23%

5D 0.00%

Buy Vol. 805,300

Sell Vol. 981,700

153,900

1D -0.45%

5D -1.09%

Buy Vol. 99,700

Sell Vol. 146,400

MSN: In the first 6 months of the year, MSN was in the top of the market with the biggest drop in market capitalization when it dropped to 1.84 billion USD.

OTHERS

130,100

1D 0.08%

5D 1.40%

Buy Vol. 636,600

Sell Vol. 798,900

130,100

1D 0.08%

5D 1.40%

Buy Vol. 636,600

Sell Vol. 798,900

88,000

1D 2.09%

5D 2.92%

Buy Vol. 3,414,800

Sell Vol. 3,612,400

70,300

1D -1.68%

5D -2.23%

Buy Vol. 5,773,500

Sell Vol. 6,151,500

128,200

1D -0.23%

5D 5.08%

Buy Vol. 2,096,100

Sell Vol. 1,989,700

22,600

1D 0.22%

5D -0.66%

Buy Vol. 2,797,400

Sell Vol. 2,112,300

19,700

1D 4.79%

5D 5.91%

Buy Vol. 30,637,400

Sell Vol. 25,625,800

22,400

1D 0.45%

5D 2.75%

Buy Vol. 24,915,100

Sell Vol. 26,149,400

BVH: In 2022, BVH's business plan for the parent company is almost flat with total revenue of VND 1,530 billion and profit after tax is expected to reach VND 1,050 billion. Regarding the profit distribution plan, the Group plans to use the entire undistributed profit after tax of 2,246 billion dong to pay dividends in 2021 at the rate of 30.261%.

Market by numbers

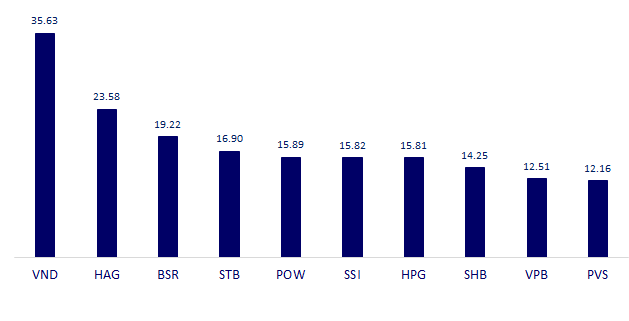

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

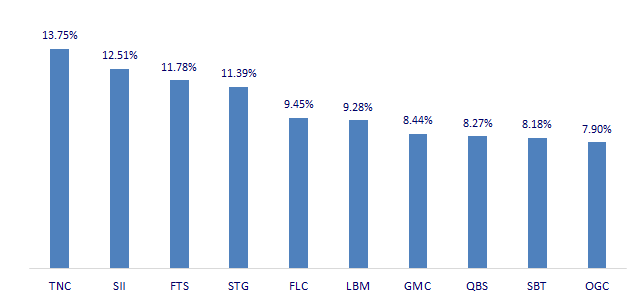

TOP INCREASES 3 CONSECUTIVE SESSIONS

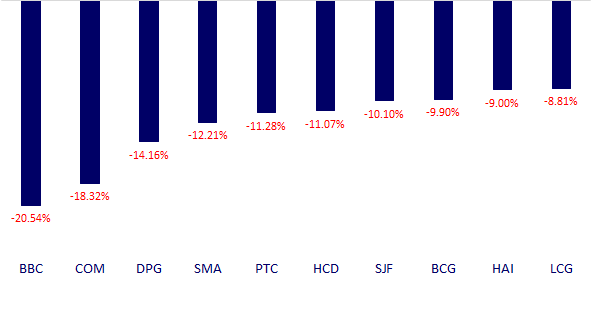

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.