Market brief 07/07/2022

VIETNAM STOCK MARKET

1,166.48

1D 1.47%

YTD -22.15%

1,229.23

1D 1.43%

YTD -19.96%

271.86

1D -0.02%

YTD -42.64%

86.38

1D 0.19%

YTD -23.34%

490.51

1D 0.00%

YTD 0.00%

10,422.97

1D -30.85%

YTD -66.46%

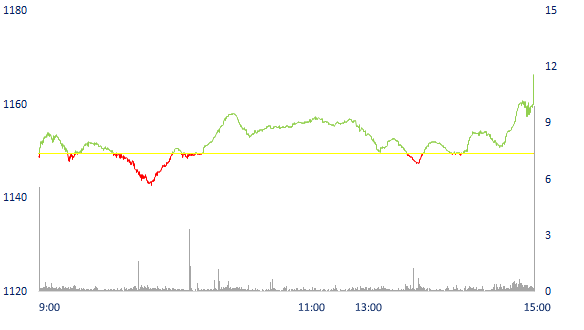

VN-Index increased by nearly 17 points, the lowest trading value since November 2020. Market liquidity was at a low level with a total matched value of VND 9,042 billion (down 32.5% compared to the previous session) the lowest since November 27, 2020 (VND 9,011 billion), in which, matched value HoSE's own order decreased by 30% to 7,759 billion dong. Foreign investors net bought nearly 490 billion dong.

ETF & DERIVATIVES

20,700

1D 0.19%

YTD -19.86%

14,470

1D 0.56%

YTD -20.01%

15,190

1D -14.71%

YTD -20.05%

18,540

1D -1.07%

YTD -19.04%

16,340

1D 0.25%

YTD -27.31%

26,500

1D 3.03%

YTD -5.53%

15,690

1D -2.55%

YTD -26.96%

1,222

1D 0.51%

YTD 0.00%

1,224

1D 0.52%

YTD 0.00%

1,223

1D 0.42%

YTD 0.00%

1,225

1D 0.57%

YTD 0.00%

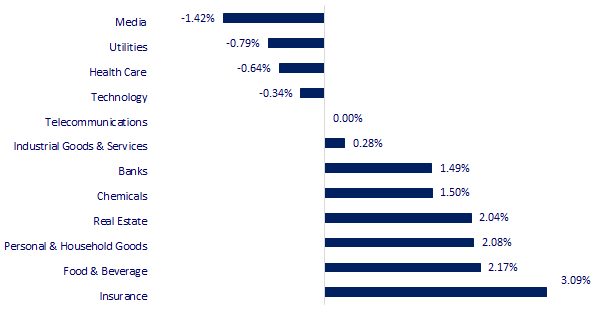

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

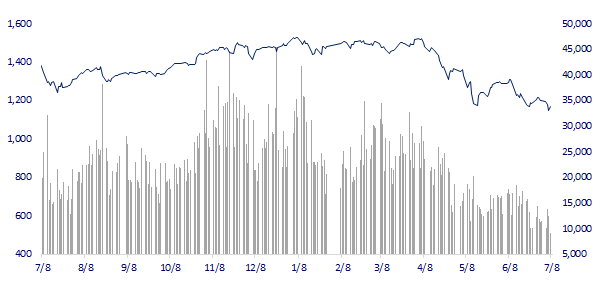

VNINDEX (12M)

GLOBAL MARKET

26,490.53

1D 1.33%

YTD -7.99%

3,364.40

1D 0.27%

YTD -7.57%

2,334.27

1D 1.84%

YTD -21.61%

21,643.58

1D 1.62%

YTD -7.50%

3,129.40

1D 0.83%

YTD 0.18%

1,562.37

1D 1.33%

YTD -5.75%

99.28

1D 2.17%

YTD 29.78%

1,740.85

1D 0.23%

YTD -4.39%

Asian stocks all went up in the session on 7/7. The Nikkei 225 index gained 1.33%. In South Korea, the Kospi rose 1.84%. In China, the Shanghai Composite Index reversed, gaining 0.27% despite falling at the beginning of the session. Hong Kong's Hang Seng Index rose 1.62%.

VIETNAM ECONOMY

0.82%

1D (bps) -6

YTD (bps) 1

5.60%

2.65%

1D (bps) -4

YTD (bps) 164

3.33%

1D (bps) 9

YTD (bps) 133

23,575

1D (%) 0.23%

YTD (%) 2.77%

24,278

1D (%) -1.09%

YTD (%) -8.27%

3,555

1D (%) 0.00%

YTD (%) -2.82%

After the GDP of the second quarter and the first six months were announced by the General Statistics Office to increase by 7.72% and 6.42% respectively over the same period last year, many institutions and experts have adjusted their Vietnam economic growth forecasts this year. In its July economic update report just released, HSBC has revised its forecast for Vietnam's economic growth to 6.9%, up 0.3 percentage points from the previous one.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam's economic growth this year is forecast to exceed the target of 6-6.5%

- The Ministry of Industry and Trade proposes to use the budget to compensate the price of petrol for fishermen

- Government Inspector asked the Ministry of Industry and Trade to report a series of hot oil-related issues

- US sanctions a series of companies that bring Iranian oil to China

- USD hits new 20-year high, euro reaches 2-decade low while gold continues to plunge to 9-month low

- China is ready to open pork reserves to control inflation

VN30

BANK

75,500

1D 3.71%

5D 0.94%

Buy Vol. 1,883,400

Sell Vol. 2,414,800

36,300

1D 1.97%

5D 8.36%

Buy Vol. 4,460,700

Sell Vol. 5,065,200

26,300

1D 1.74%

5D 0.57%

Buy Vol. 6,258,900

Sell Vol. 7,132,700

37,800

1D 0.53%

5D 6.33%

Buy Vol. 6,890,200

Sell Vol. 8,995,200

28,900

1D 0.35%

5D -0.34%

Buy Vol. 14,725,200

Sell Vol. 13,405,600

25,100

1D 0.80%

5D 3.72%

Buy Vol. 16,870,800

Sell Vol. 12,682,400

24,000

1D 0.63%

5D 0.00%

Buy Vol. 1,653,700

Sell Vol. 2,432,800

27,450

1D 1.86%

5D 1.10%

Buy Vol. 2,571,100

Sell Vol. 2,962,900

22,600

1D 0.44%

5D 5.12%

Buy Vol. 40,589,400

Sell Vol. 30,838,300

24,150

1D -0.21%

5D 0.63%

Buy Vol. 3,118,300

Sell Vol. 4,647,900

VPB: VPB announced the issuance of 30 million shares under the Employee Options Program (ESOP) with par value of 10,000 VND/share. The time to issue shares is in July. VPBank will use 30 million treasury shares to offer to employees at the rate of 0.675%. Total proceeds after issuing ESOP is 300 billion dong. These shares will be restricted to transfer up to three years from the closing date of the offering. After the first year, 30% of the shares will be released, and the second and third years will have a clearance rate of 35%, respectively.

REAL ESTATE

74,000

1D 0.82%

5D -0.67%

Buy Vol. 2,314,700

Sell Vol. 2,711,600

35,600

1D 1.57%

5D 0.67%

Buy Vol. 1,145,000

Sell Vol. 1,192,100

52,300

1D 0.58%

5D 0.97%

Buy Vol. 1,720,200

Sell Vol. 1,492,300

NVL: Nova Consumer expands its consumer goods portfolio, consolidating revenue from Q3 by completing a food company merger.

OIL & GAS

94,100

1D -1.77%

5D -16.31%

Buy Vol. 1,933,500

Sell Vol. 1,326,000

12,800

1D 0.00%

5D -5.88%

Buy Vol. 30,345,000

Sell Vol. 23,414,300

39,000

1D 2.09%

5D -3.23%

Buy Vol. 898,000

Sell Vol. 882,100

POW: PV Power plans to put Dakrinh Hydropower shares on the stock exchange this year and list Hua Na Hydropower shares.

VINGROUP

69,800

1D 3.41%

5D -5.03%

Buy Vol. 2,764,800

Sell Vol. 3,641,400

61,000

1D 3.21%

5D -1.77%

Buy Vol. 3,320,900

Sell Vol. 3,439,600

27,000

1D 3.85%

5D -5.43%

Buy Vol. 3,708,800

Sell Vol. 3,586,000

VHM: After transferring all contributed capital at Vinpearl Landmark 81, Vinhomes will have 33 subsidiaries, most of them operating in the field of construction and real estate business.

FOOD & BEVERAGE

73,000

1D 3.25%

5D 4.61%

Buy Vol. 4,564,000

Sell Vol. 4,774,200

103,000

1D 3.00%

5D -7.36%

Buy Vol. 862,900

Sell Vol. 778,700

156,200

1D 2.36%

5D 1.03%

Buy Vol. 124,900

Sell Vol. 215,900

VNM: Sales of the whole dairy market are forecasted to reach 140,000 billion to 2025, Vinamilk alone aims to increase revenue from 61,000 billion VND in 2021 to 86,000 billion VND in 2025.

OTHERS

129,300

1D 1.73%

5D -0.54%

Buy Vol. 790,800

Sell Vol. 725,800

129,300

1D 1.73%

5D -0.54%

Buy Vol. 790,800

Sell Vol. 725,800

83,100

1D -0.48%

5D -3.60%

Buy Vol. 2,270,600

Sell Vol. 2,760,900

64,000

1D 0.00%

5D -10.49%

Buy Vol. 2,313,700

Sell Vol. 2,661,800

116,000

1D 3.57%

5D -9.73%

Buy Vol. 2,271,900

Sell Vol. 1,246,900

20,750

1D -0.48%

5D -7.98%

Buy Vol. 1,903,300

Sell Vol. 1,780,100

19,100

1D 0.53%

5D 1.60%

Buy Vol. 27,370,300

Sell Vol. 18,638,600

21,750

1D 1.40%

5D -2.47%

Buy Vol. 19,903,300

Sell Vol. 17,941,200

HPG: announced sales volume of construction steel, billet and hot rolled coil (HRC) in June reached 560,000 tons, up 14% YoY and down 15% MoM. In which, construction steel output reached 348,000 tons, up 51% over the same period and down 11% over the previous month; HRC recorded 202,000 tons, down 12% YoY.

Market by numbers

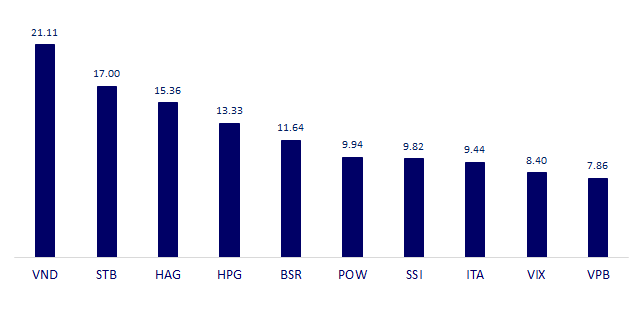

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

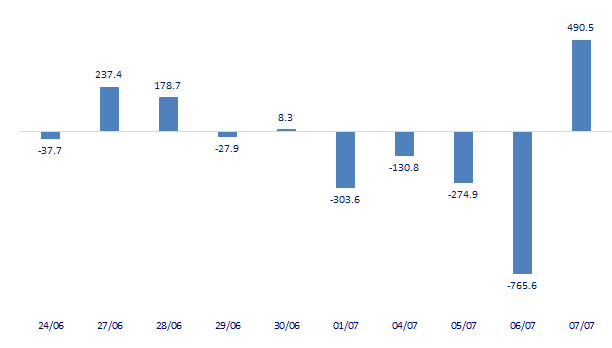

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

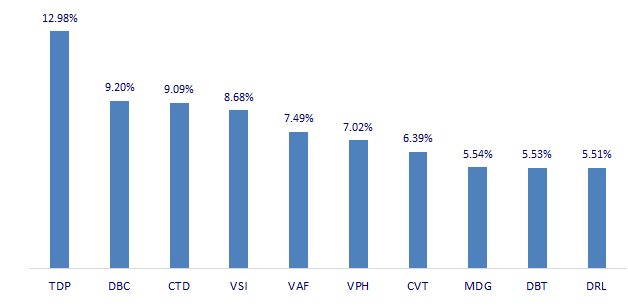

TOP INCREASES 3 CONSECUTIVE SESSIONS

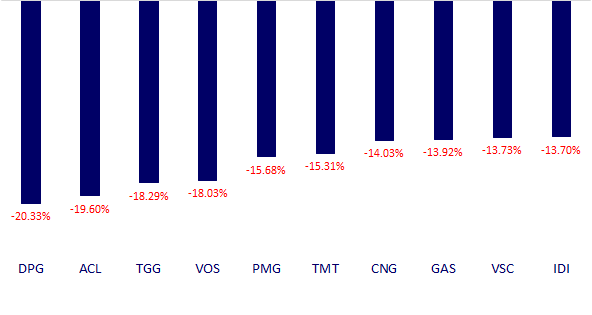

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.