Market brief 08/07/2022

VIETNAM STOCK MARKET

1,171.31

1D 0.41%

YTD -21.82%

1,231.54

1D 0.19%

YTD -19.81%

277.80

1D 2.18%

YTD -41.39%

86.96

1D 0.67%

YTD -22.83%

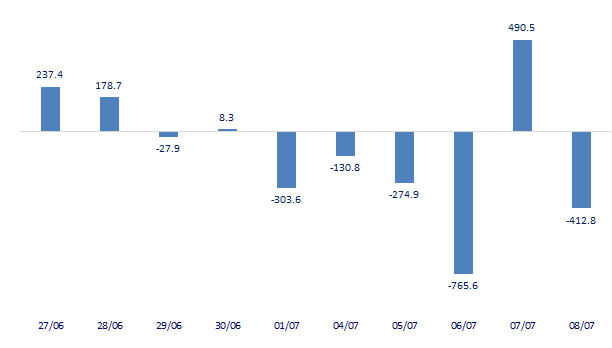

-412.80

1D 0.00%

YTD 0.00%

12,036.90

1D 15.48%

YTD -61.26%

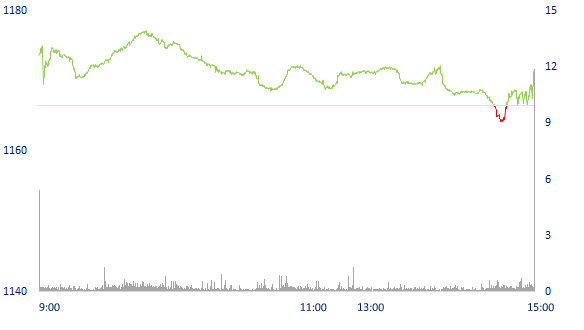

SSI hit the ceiling, VN-Index gained nearly 5 points. Market liquidity improved more than yesterday with a total matched value of 10,886 billion dong, up 20.4%, of which, matched value on HoSE alone increased by 20.5% to 9,350 billion dong. Foreign investors net sold about 413 billion dong.

ETF & DERIVATIVES

20,890

1D 0.92%

YTD -19.13%

14,550

1D 0.55%

YTD -19.57%

15,220

1D -14.54%

YTD -19.89%

17,850

1D -3.72%

YTD -22.05%

16,400

1D 0.37%

YTD -27.05%

26,100

1D -1.51%

YTD -6.95%

15,740

1D 0.32%

YTD -26.72%

1,222

1D -0.02%

YTD 0.00%

1,225

1D 0.07%

YTD 0.00%

1,223

1D -0.03%

YTD 0.00%

1,225

1D 0.00%

YTD 0.00%

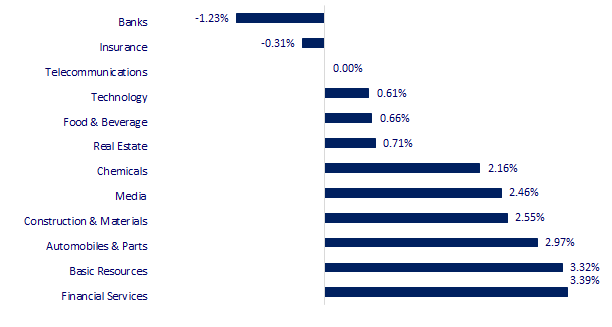

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

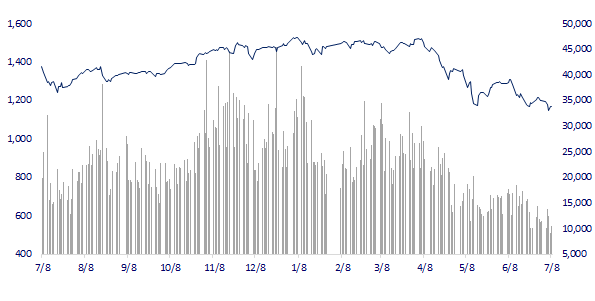

VNINDEX (12M)

GLOBAL MARKET

26,517.19

1D -1.27%

YTD -7.90%

3,356.08

1D -0.25%

YTD -7.79%

2,350.61

1D 0.70%

YTD -21.06%

21,725.78

1D -0.44%

YTD -7.15%

3,131.26

1D 0.06%

YTD 0.24%

1,557.87

1D -0.29%

YTD -6.02%

102.50

1D 0.61%

YTD 33.99%

1,739.35

1D -0.10%

YTD -4.47%

Asian stocks mixed after a rally in the US. Investors in the region await the June jobs report from the world's number one economy. In Japan, the Nikkei 225 index fell 1.27%. South Korea's Kospi index rose 0.07%. In Hong Kong, the Hang Seng index fell 0.44%. The Shanghai Composite Index fell 0.25%.

VIETNAM ECONOMY

0.82%

YTD (bps) 1

5.60%

2.67%

1D (bps) 2

YTD (bps) 166

3.32%

1D (bps) -1

YTD (bps) 132

23,580

1D (%) 0.36%

YTD (%) 2.79%

24,122

1D (%) -1.35%

YTD (%) -8.86%

3,555

1D (%) 0.00%

YTD (%) -2.82%

According to a report of the Ministry of Finance, in the first 6 months of 2022, the Finance sector's state budget revenue reached 941,300 billion VND, equaling 66.7% of the estimate (central budget revenue reached 66.4% of the estimate, local budget revenue is estimated at approximately 67% of the estimate), an increase of 19.9% over the same period in 2021.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- State budget bumper to 228,300 billion

- Accelerating disbursement of public investment capital in the last 6 months of 2022

- From August 1, port infrastructure fees in Ho Chi Minh City will be reduced by 50%.

- Korea - US to conduct economic security dialogue

- ADB and UK to build USD134 million fund for ASEAN

- Mr. Biden consults with advisers on the plan to remove tariffs on China

VN30

BANK

74,000

1D -1.99%

5D 0.00%

Buy Vol. 1,282,600

Sell Vol. 1,985,400

35,000

1D -3.58%

5D -0.14%

Buy Vol. 3,445,500

Sell Vol. 4,602,000

25,900

1D -1.52%

5D -3.90%

Buy Vol. 4,670,200

Sell Vol. 6,332,300

37,550

1D -0.66%

5D 4.31%

Buy Vol. 6,522,700

Sell Vol. 8,442,400

28,600

1D -1.04%

5D -1.72%

Buy Vol. 13,255,500

Sell Vol. 12,110,500

25,050

1D -0.20%

5D 3.51%

Buy Vol. 12,615,300

Sell Vol. 11,222,600

23,700

1D -1.25%

5D -3.27%

Buy Vol. 1,732,700

Sell Vol. 2,028,600

27,100

1D -1.28%

5D -0.73%

Buy Vol. 1,925,500

Sell Vol. 2,572,900

22,500

1D -0.44%

5D 2.27%

Buy Vol. 35,274,400

Sell Vol. 33,526,700

24,000

1D -0.62%

5D -0.21%

Buy Vol. 3,135,600

Sell Vol. 3,409,300

MBB: From the beginning of July until now, MB Debt Management and Asset Exploitation Company Limited (MBAMC), a subsidiary of MBB has announced 3 selections of asset auction organization. personal customer property for debt recovery. According to the announcements, the collateral is 11 properties in Dak Nong province and Can Tho city with a starting price of more than 9 billion VND.

REAL ESTATE

73,800

1D -0.27%

5D -0.81%

Buy Vol. 1,344,900

Sell Vol. 2,028,700

36,050

1D 1.26%

5D 2.07%

Buy Vol. 1,969,800

Sell Vol. 1,763,400

52,800

1D 0.96%

5D 0.76%

Buy Vol. 1,545,600

Sell Vol. 1,251,800

NVL: Disclosure of information about the appellate judgment on the "Construction contract dispute", whereby, NVL does not have any obligations and interests related to the judgment.

OIL & GAS

95,600

1D 1.59%

5D -13.10%

Buy Vol. 1,518,900

Sell Vol. 1,308,300

13,000

1D 1.56%

5D -4.41%

Buy Vol. 20,117,400

Sell Vol. 16,872,000

39,350

1D 0.90%

5D -3.08%

Buy Vol. 606,200

Sell Vol. 585,900

Concerned about supply, oil prices rebounded. Brent oil futures rose $3.96, or 3.9%, to $104.65 a barrel. WTI oil price increased by 4.2 USD, or 4.3%, to 102.7 USD/barrel.

VINGROUP

70,000

1D 0.29%

5D -3.58%

Buy Vol. 2,275,900

Sell Vol. 3,125,200

61,000

1D 0.00%

5D -0.65%

Buy Vol. 2,900,800

Sell Vol. 3,243,200

27,000

1D 0.00%

5D -5.76%

Buy Vol. 1,877,800

Sell Vol. 2,312,600

VHM: In the next 5 years, Vinhomes is expected to complete and put on the market 500,000 social housing houses with a total area of 50-60 hectares/project.

FOOD & BEVERAGE

73,000

1D 0.00%

5D 2.48%

Buy Vol. 2,701,400

Sell Vol. 3,989,200

104,900

1D 1.84%

5D -3.50%

Buy Vol. 838,800

Sell Vol. 850,600

155,100

1D -0.70%

5D 0.78%

Buy Vol. 186,100

Sell Vol. 310,700

VNM: In the coming time, Vinamilk does not plan to buy treasury shares but focuses on sustainable development, growth with profit and revenue.

OTHERS

127,800

1D -1.16%

5D -1.77%

Buy Vol. 527,700

Sell Vol. 679,900

127,800

1D -1.16%

5D -1.77%

Buy Vol. 527,700

Sell Vol. 679,900

83,600

1D 0.60%

5D -5.00%

Buy Vol. 1,898,900

Sell Vol. 1,565,500

65,000

1D 1.56%

5D -7.54%

Buy Vol. 4,171,400

Sell Vol. 4,035,100

116,000

1D 0.00%

5D -9.52%

Buy Vol. 2,165,700

Sell Vol. 1,185,300

21,200

1D 2.17%

5D -6.19%

Buy Vol. 2,098,100

Sell Vol. 1,722,500

20,400

1D 6.81%

5D 3.55%

Buy Vol. 60,255,700

Sell Vol. 40,469,200

22,450

1D 3.22%

5D 0.22%

Buy Vol. 32,581,300

Sell Vol. 32,507,300

HPG: Last month's construction steel consumption grew well thanks to the strong growth in the southern market and exports, by 200% and 60% respectively over the same period in 2021. The Government's promotion of the progress of projects Public investment projects, especially key infrastructure projects, including the North-South expressway, have helped improve the demand in the building materials market compared to the previous year.

Market by numbers

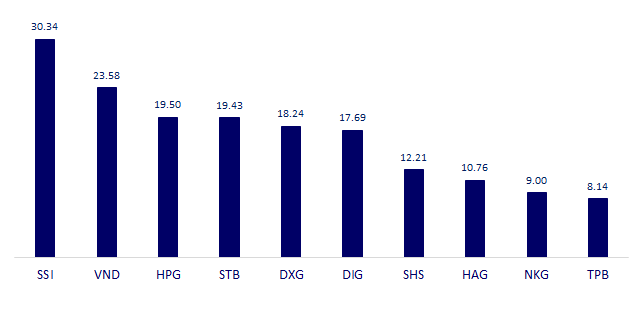

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

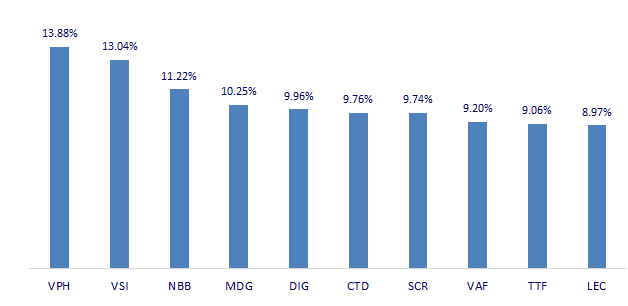

TOP INCREASES 3 CONSECUTIVE SESSIONS

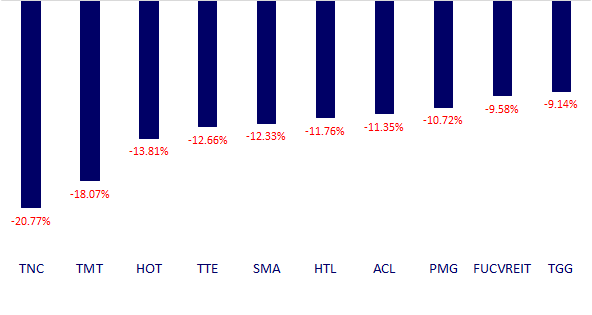

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.