Market brief 15/07/2022

VIETNAM STOCK MARKET

1,179.25

1D -0.25%

YTD -21.29%

1,220.14

1D -0.15%

YTD -20.55%

284.40

1D -0.12%

YTD -40.00%

87.32

1D 0.15%

YTD -22.51%

-503.93

1D 0.00%

YTD 0.00%

15,229.14

1D 16.88%

YTD -50.99%

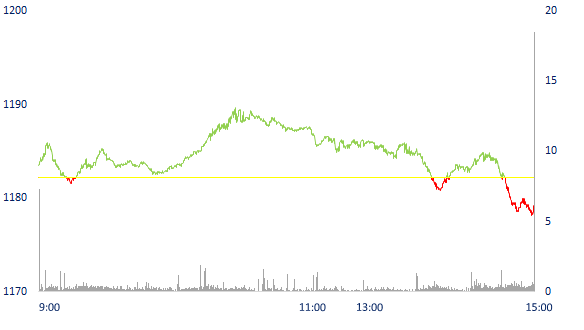

HPG attracted cash flow, VN-Index dropped at the end of the session. Market liquidity improved compared to the previous session. Total matched value reached 13,371 billion dong, up 13.4%, of which, matched value on HoSE alone increased 14.7% to 11,378 billion dong. Foreign investors net sold nearly 504 billion dong.

ETF & DERIVATIVES

20,630

1D -0.29%

YTD -20.13%

14,400

1D -0.14%

YTD -20.40%

15,100

1D -15.22%

YTD -20.53%

17,920

1D 1.24%

YTD -21.75%

16,450

1D 0.24%

YTD -26.82%

25,530

1D -1.69%

YTD -8.98%

15,680

1D 0.38%

YTD -27.00%

1,210

1D -0.13%

YTD 0.00%

1,212

1D -0.02%

YTD 0.00%

1,211

1D -0.22%

YTD 0.00%

1,210

1D -0.46%

YTD 0.00%

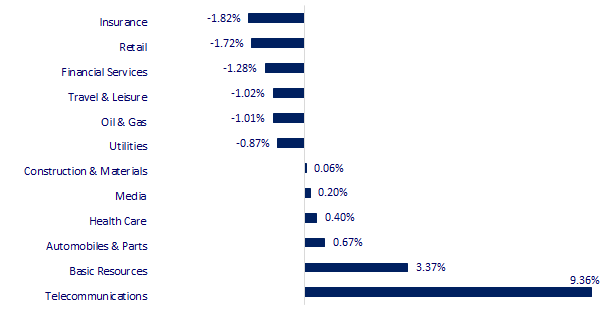

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

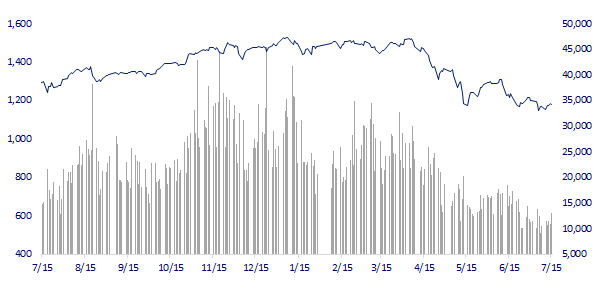

VNINDEX (12M)

GLOBAL MARKET

26,788.47

1D 0.36%

YTD -6.96%

3,228.06

1D -1.64%

YTD -11.31%

2,330.98

1D 0.37%

YTD -21.72%

20,297.72

1D -1.01%

YTD -13.25%

3,099.15

1D 0.28%

YTD -0.79%

1,533.37

1D -0.22%

YTD -7.50%

96.03

1D 0.18%

YTD 25.53%

1,699.75

1D -0.60%

YTD -6.65%

Asian stocks mixed, China recorded slow growth in the second quarter due to Covid-19. Chinese stocks with the Shanghai Composite Index fell 1.64%. In South Korea, the Kospi index rose 0.37%. The Hang Seng Index (Hong Kong) fell 1.01%. Japan's Nikkei 225 index rose 0.36%.

VIETNAM ECONOMY

0.76%

1D (bps) 3

YTD (bps) -5

5.60%

2.69%

1D (bps) 1

YTD (bps) 168

3.30%

1D (bps) 3

YTD (bps) 130

23,588

1D (%) 0.12%

YTD (%) 2.82%

24,281

1D (%) 0.30%

YTD (%) -8.26%

3,540

1D (%) 0.11%

YTD (%) -3.23%

Governor Nguyen Thi Hong said that in 2022, the State Bank's credit orientation will increase by about 14%, higher than the growth rate of 13.61% in 2021 and 12.17% in 2020. Up to now, inflation is still low. Under increasing pressure in the coming time, the State Bank of Vietnam still maintains the oriented credit target for 2022 at 14%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Governor: 'Still keeping the credit growth target in 2022 at 14%'

- The Ministry of Finance: Continue to inspect and examine bond issuers

- Deputy Prime Minister asked to resolutely withdraw projects that are behind schedule

- Germany warns gas prices to triple next year

- China and Singapore renew currency swap agreement

- Euro plunges due to instability in Italy, USD jumps to new 20-year high, gold "evaporates" nearly 2%

VN30

BANK

72,300

1D -0.14%

5D -2.30%

Buy Vol. 1,263,000

Sell Vol. 1,743,800

35,800

1D -0.97%

5D 2.29%

Buy Vol. 2,698,800

Sell Vol. 3,662,000

27,000

1D 0.00%

5D 4.25%

Buy Vol. 13,220,000

Sell Vol. 13,644,700

36,100

1D 0.42%

5D -3.86%

Buy Vol. 6,750,500

Sell Vol. 6,678,600

28,250

1D 0.71%

5D -1.22%

Buy Vol. 15,808,500

Sell Vol. 12,870,300

25,450

1D -0.20%

5D 1.60%

Buy Vol. 13,865,700

Sell Vol. 15,482,900

23,600

1D -0.42%

5D -0.42%

Buy Vol. 2,845,200

Sell Vol. 2,852,400

27,100

1D 0.74%

5D 0.00%

Buy Vol. 2,551,600

Sell Vol. 3,054,800

23,000

1D -1.29%

5D 2.22%

Buy Vol. 28,220,000

Sell Vol. 32,918,500

24,000

1D -0.21%

5D 0.00%

Buy Vol. 4,129,900

Sell Vol. 4,700,000

VPB: The international credit rating agency Moody's Investors Service (Moody's) has just announced to maintain the credit rating of Ba3, a positive outlook for VPBank - equivalent to the ceiling of Vietnam's national credit rating. Notably, out of 21 Vietnamese banks rated by Moody's, VPBank is one of the two banks whose baseline credit rating (BCA) is limited by Vietnam's national rating ceiling (Ba3).

REAL ESTATE

73,600

1D -0.14%

5D -0.27%

Buy Vol. 2,146,900

Sell Vol. 2,358,400

36,350

1D -1.22%

5D 0.83%

Buy Vol. 1,079,700

Sell Vol. 1,168,100

52,800

1D 0.00%

5D 0.00%

Buy Vol. 1,813,100

Sell Vol. 1,752,600

NVL: The Board of Directors approved a loan of 55 million USD secured by NVL shares and other assets under the joint ownership of Novaland.

OIL & GAS

97,500

1D -1.32%

5D 1.99%

Buy Vol. 993,000

Sell Vol. 1,085,900

13,000

1D -0.76%

5D 0.00%

Buy Vol. 23,437,400

Sell Vol. 28,161,700

39,800

1D -0.75%

5D 1.14%

Buy Vol. 620,800

Sell Vol. 922,100

POW: NT2's Q2/2022 NPAT is expected to be about VND160 billion compared to VND24.5 billion in Q2/2021, an increase of more than 6.5 times over the same period.

VINGROUP

69,600

1D 0.14%

5D -0.57%

Buy Vol. 2,445,800

Sell Vol. 2,965,900

60,000

1D -0.17%

5D -1.64%

Buy Vol. 3,795,100

Sell Vol. 4,230,800

26,200

1D 0.58%

5D -2.96%

Buy Vol. 2,297,900

Sell Vol. 2,823,300

VIC: VinFast announced that it received a $1.2b incentive from the state of North Carolina for the project to build an electric vehicle factory, to become the first electric car production in this state.

FOOD & BEVERAGE

71,600

1D -1.10%

5D -1.92%

Buy Vol. 2,234,700

Sell Vol. 3,486,000

101,200

1D -1.27%

5D -3.53%

Buy Vol. 639,000

Sell Vol. 924,100

154,000

1D -0.58%

5D -0.71%

Buy Vol. 101,400

Sell Vol. 113,900

MSN: A subsidiary of Masan High-Tech Materials has poured 52 million euros into Nyobolt, the only company in the field of manufacturing Tungsten-application batteries.

OTHERS

124,700

1D -1.58%

5D -2.43%

Buy Vol. 487,700

Sell Vol. 547,700

124,700

1D -1.58%

5D -2.43%

Buy Vol. 487,700

Sell Vol. 547,700

82,200

1D -0.72%

5D -1.67%

Buy Vol. 2,618,100

Sell Vol. 2,777,200

61,500

1D -1.76%

5D -5.38%

Buy Vol. 4,918,200

Sell Vol. 5,033,900

113,500

1D -1.73%

5D -2.16%

Buy Vol. 2,035,600

Sell Vol. 1,342,100

23,150

1D -0.22%

5D 9.20%

Buy Vol. 3,610,800

Sell Vol. 3,684,500

21,100

1D -1.86%

5D 3.43%

Buy Vol. 26,437,100

Sell Vol. 32,775,000

23,200

1D 4.50%

5D 3.34%

Buy Vol. 82,780,400

Sell Vol. 69,551,500

HPG: In the first 6 months of 2022, Hoa Phat Group has paid nearly 7,400 billion VND to the State budget, up 42% compared to the same period in 2021 and even larger than the tax paid in the whole 2020. HPG's tax payment has also skyrocketed to nearly 12,700 billion dong, up 73.4% compared to 2020. Among Hoa Phat's taxes, VAT accounts for the highest proportion.

Market by numbers

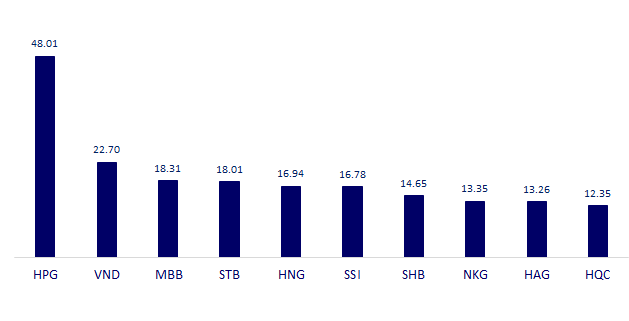

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

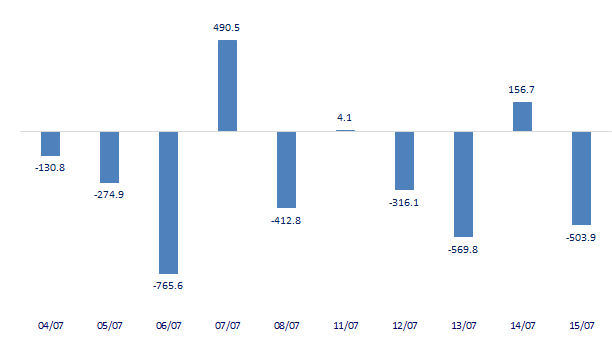

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

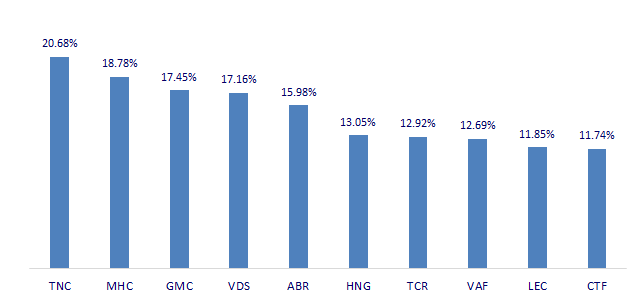

TOP INCREASES 3 CONSECUTIVE SESSIONS

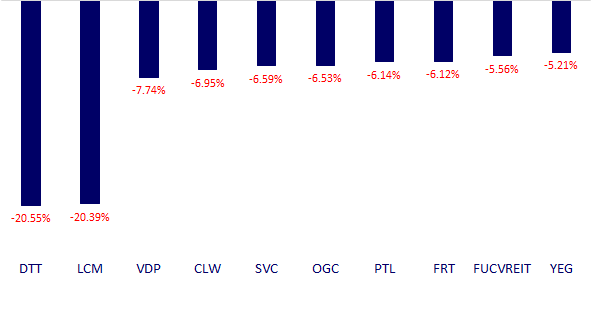

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.