Market brief 22/07/2022

VIETNAM STOCK MARKET

1,194.76

1D -0.31%

YTD -20.26%

1,228.84

1D -0.52%

YTD -19.98%

288.83

1D 0.26%

YTD -39.06%

88.84

1D -0.31%

YTD -21.16%

380.21

1D 0.00%

YTD 0.00%

12,892.86

1D -8.87%

YTD -58.51%

Foreign investors net bought 380 billion dong in the session 22/7. Foreign investors on HoSE concentrated on net buying of MWG with 106 billion dong. GAS and MSN were behind with a net buying value of VND73 billion and VND52 billion, respectively. On the other side, KBC was sold the most on this floor with 7 billion dong. Next is VHM with 12.8 billion dong.

ETF & DERIVATIVES

20,890

1D 0.48%

YTD -19.13%

14,570

1D 0.34%

YTD -19.46%

15,110

1D -15.16%

YTD -20.47%

17,790

1D 2.83%

YTD -22.31%

16,650

1D -0.18%

YTD -25.93%

26,400

1D 0.61%

YTD -5.88%

15,840

1D -0.56%

YTD -26.26%

1,222

1D -0.11%

YTD 0.00%

1,224

1D -0.01%

YTD 0.00%

1,225

1D 0.10%

YTD 0.00%

1,226

1D -0.07%

YTD 0.00%

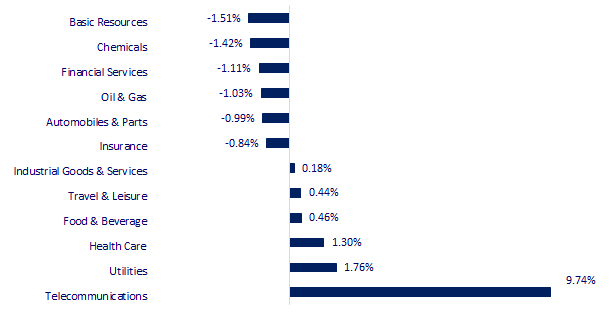

CHANGE IN PRICE BY SECTOR

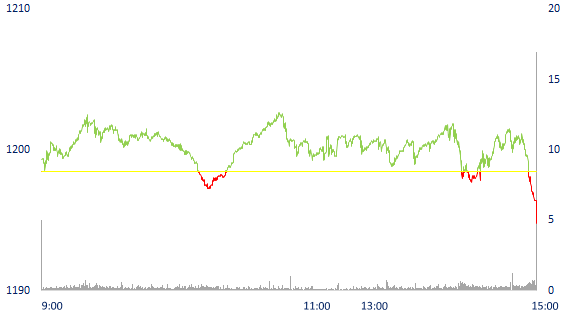

INTRADAY VNINDEX

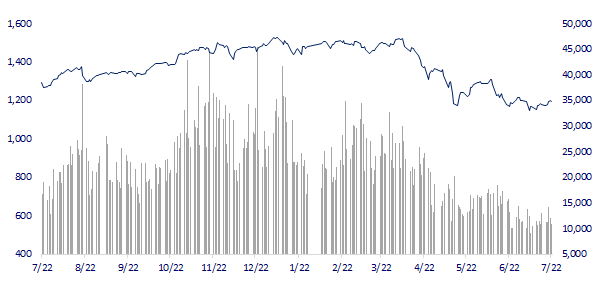

VNINDEX (12M)

GLOBAL MARKET

27,914.66

1D 0.18%

YTD -3.05%

3,269.97

1D -0.06%

YTD -10.16%

2,393.14

1D -0.66%

YTD -19.63%

20,609.14

1D -0.47%

YTD -11.92%

3,181.34

1D 0.92%

YTD 1.85%

1,552.73

1D 0.42%

YTD -6.33%

95.25

1D -1.80%

YTD 24.51%

1,721.90

1D 0.37%

YTD -5.43%

Asian stocks mixed, Japanese inflation reached 2.2%. In Japan, the Nikkei 225 index recovered, up 0.18%. Hong Kong's Hang Seng Index fell 0.47%. In China, the Shanghai Composite Index fell 0.06%. In South Korea, the Kospi index fell 0.66%.

VIETNAM ECONOMY

2.16%

1D (bps) 76

YTD (bps) 135

5.60%

2.83%

1D (bps) 6

YTD (bps) 182

3.35%

1D (bps) 8

YTD (bps) 135

23,620

1D (%) -0.04%

YTD (%) 2.96%

24,205

1D (%) -0.42%

YTD (%) -8.55%

3,529

1D (%) -0.03%

YTD (%) -3.53%

After continuously expanding the scale up to 20,000 - 40,000 billion VND/session, the SBV has sharply reduced the volume of bills issued in recent days. Accordingly, on July 21, there were 150 billion winning 56-day bills while there were 20,000 billion 14-day bills maturing. Previously, the State Bank also issued only 7,000 billion more bills on July 19 and July 20, while the maturity amount was 19,700 billion and 18 trillion respectively.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank regularly pumps money

- Homebuyers manage with rising interest rates

- Facing many difficulties, textile and garment exports still "target" 43 billion USD

- Russia continues to supply gas through Nord Stream 1

- Euro and gold soar as ECB raises interest rates for the first time in 11 years, USD turns to fall

- Inflation in Japan surged the most in 7 years

VN30

BANK

72,500

1D 0.00%

5D 0.28%

Buy Vol. 1,534,600

Sell Vol. 2,283,000

35,500

1D -2.74%

5D -0.84%

Buy Vol. 2,318,700

Sell Vol. 3,083,100

26,900

1D -2.18%

5D -0.37%

Buy Vol. 5,372,800

Sell Vol. 7,639,100

37,100

1D 0.68%

5D 2.77%

Buy Vol. 6,986,700

Sell Vol. 10,970,300

28,150

1D -0.18%

5D -0.35%

Buy Vol. 12,058,200

Sell Vol. 16,778,300

25,550

1D -0.20%

5D 0.39%

Buy Vol. 12,193,800

Sell Vol. 13,348,600

23,800

1D -1.04%

5D 0.85%

Buy Vol. 1,959,800

Sell Vol. 2,735,400

28,050

1D -0.88%

5D 3.51%

Buy Vol. 3,726,600

Sell Vol. 3,997,300

23,000

1D -0.43%

5D 0.00%

Buy Vol. 21,272,000

Sell Vol. 23,873,900

24,350

1D -1.22%

5D 1.46%

Buy Vol. 3,298,300

Sell Vol. 4,876,700

TCB: Techcombank has just announced its business results for the first 6 months of the year with pre-tax profit of VND 14.1 trillion, up 22.3% over the same period in 2021. Total operating income in the first 6 months of 2022 up 16.6% y/y to VND21.1 trillion, thanks to strong growth in both interest income and service income.

REAL ESTATE

73,900

1D -0.40%

5D 0.41%

Buy Vol. 2,866,900

Sell Vol. 3,257,000

36,500

1D -1.22%

5D 0.41%

Buy Vol. 807,400

Sell Vol. 1,196,000

52,200

1D -1.32%

5D -1.14%

Buy Vol. 1,846,300

Sell Vol. 1,929,000

PDR: Q2/2022 net revenue reached more than VND853b, up 59% QoQ, but COGS decreased by 28% to VND95b, pushing gross profit to more than VND758b (up 87%).

OIL & GAS

107,800

1D 3.55%

5D 10.56%

Buy Vol. 2,025,000

Sell Vol. 2,046,900

13,150

1D -1.50%

5D 1.15%

Buy Vol. 21,741,000

Sell Vol. 21,493,100

41,800

1D -1.30%

5D 5.03%

Buy Vol. 952,300

Sell Vol. 1,012,000

Oil prices fell sharply on Thursday (July 21) as higher gasoline inventories in the US and after the European Central Bank (ECB) raised interest rates led to concerns about demand.

VINGROUP

66,500

1D -2.92%

5D -4.45%

Buy Vol. 1,133,200

Sell Vol. 1,957,500

58,700

1D -0.34%

5D -2.17%

Buy Vol. 2,701,200

Sell Vol. 3,374,700

26,000

1D -1.14%

5D -0.76%

Buy Vol. 1,984,000

Sell Vol. 2,516,300

VIC: To realize the goal of expanding the factory scale in the US, VinFast signed a Framework Agreement, appointing Credit Suisse (Singapore) Ltd. is the party that arranges for the issuances.

FOOD & BEVERAGE

72,000

1D -1.64%

5D 0.56%

Buy Vol. 1,194,000

Sell Vol. 2,246,800

108,500

1D 2.84%

5D 7.21%

Buy Vol. 1,739,900

Sell Vol. 1,782,500

166,000

1D 0.61%

5D 7.79%

Buy Vol. 365,600

Sell Vol. 319,600

MSN: Masan will open a chain of pharmacies under the brand name Dr. Win, has a charter capital of VND28.57b and is in the process of recruiting pharmacists to expand in the near future.

OTHERS

125,600

1D -0.32%

5D 0.72%

Buy Vol. 607,000

Sell Vol. 627,700

125,600

1D -0.32%

5D 0.72%

Buy Vol. 607,000

Sell Vol. 627,700

85,100

1D 0.12%

5D 3.53%

Buy Vol. 2,664,400

Sell Vol. 3,515,800

64,500

1D 0.62%

5D 4.88%

Buy Vol. 15,524,300

Sell Vol. 8,862,300

114,500

1D 0.44%

5D 0.88%

Buy Vol. 855,900

Sell Vol. 1,001,100

23,500

1D -0.84%

5D 1.51%

Buy Vol. 4,116,100

Sell Vol. 4,628,500

20,900

1D -1.88%

5D -0.95%

Buy Vol. 27,987,800

Sell Vol. 39,804,900

22,200

1D -2.20%

5D -4.31%

Buy Vol. 27,254,600

Sell Vol. 33,185,800

PNJ: PNJ reported second quarter profit increased by nearly 65% compared to the low base level of 2021. PNJ recorded revenue, VND 8,067 billion, up 81.1%; profit after tax is 367 billion dong, up 64.8% over the same period last year. The 6-month cumulative gross profit margin reached 17.6%, down from 18.6% in the same period of 2021 mainly due to the growth of 24K gold revenue and the change in the merchandise structure of the retail channel.

Market by numbers

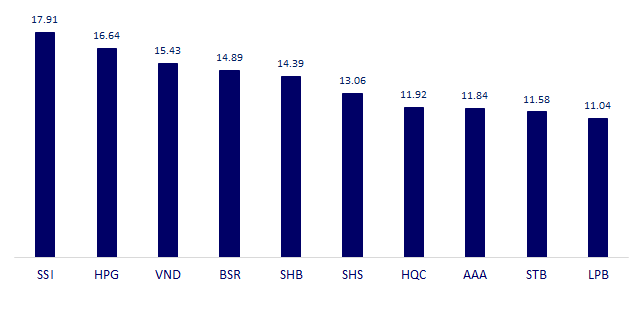

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

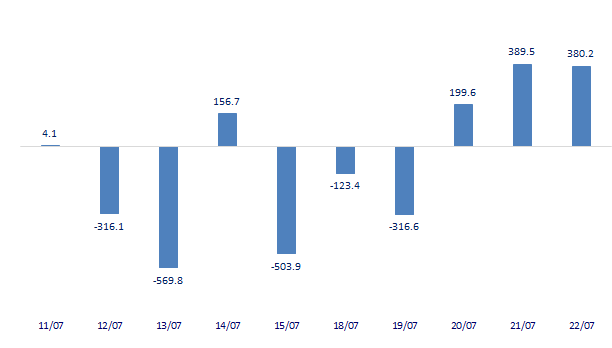

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

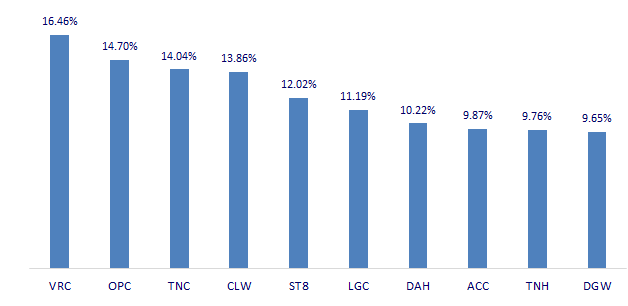

TOP INCREASES 3 CONSECUTIVE SESSIONS

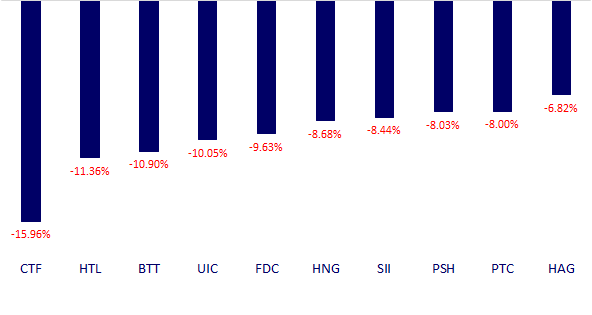

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.