Market brief 25/07/2022

VIETNAM STOCK MARKET

1,188.50

1D -0.52%

YTD -20.68%

1,222.60

1D -0.51%

YTD -20.39%

285.38

1D -1.19%

YTD -39.79%

88.35

1D -0.55%

YTD -21.59%

308.96

1D 0.00%

YTD 0.00%

11,882.08

1D -8.16%

YTD -61.76%

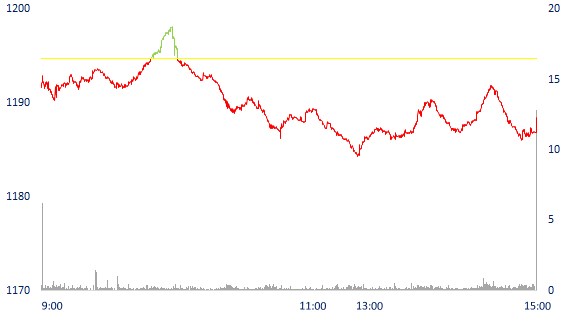

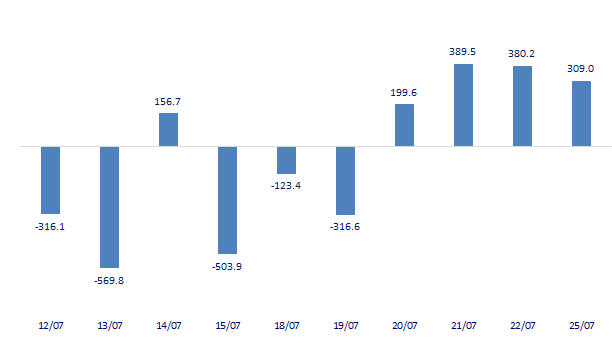

Trading moderately, VN-Index dropped more than 6 points. Market liquidity dropped sharply compared to the previous session. The total matched value reached 10,550 billion dong, down 10.4%, of which, the matched value on HoSE alone decreased by 10.5% and stood at 8,760 billion dong. Foreign investors net bought 309 billion dong.

ETF & DERIVATIVES

20,720

1D -0.81%

YTD -19.78%

14,400

1D -1.17%

YTD -20.40%

15,190

1D -14.71%

YTD -20.05%

17,450

1D -1.91%

YTD -23.80%

16,610

1D -0.24%

YTD -26.11%

26,100

1D -1.14%

YTD -6.95%

15,900

1D 0.38%

YTD -25.98%

1,219

1D -0.30%

YTD 0.00%

1,220

1D -0.34%

YTD 0.00%

1,222

1D -0.31%

YTD 0.00%

1,222

1D -0.30%

YTD 0.00%

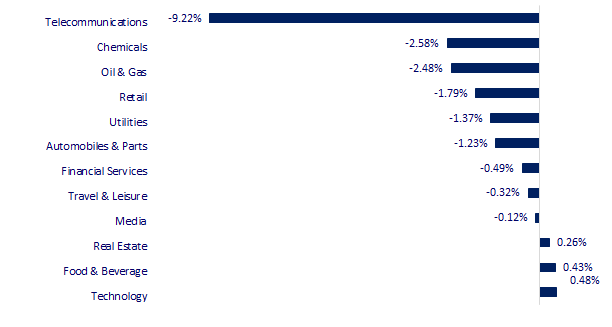

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

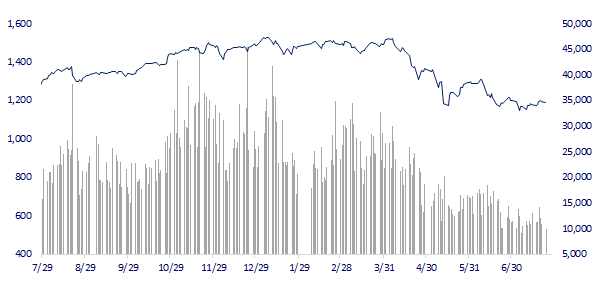

VNINDEX (12M)

GLOBAL MARKET

27,699.25

1D -0.02%

YTD -3.79%

3,250.39

1D -0.60%

YTD -10.70%

2,403.69

1D 0.44%

YTD -19.28%

20,562.94

1D 0.13%

YTD -12.12%

3,180.47

1D -0.03%

YTD 1.82%

1,560.31

1D 0.49%

YTD -5.87%

95.58

1D 1.44%

YTD 24.94%

1,728.70

1D 0.39%

YTD -5.06%

Asian stocks mixed in the first session of the week. Japan's Nikkei 225 index fell 0.02%. In South Korea, the Kospi index rose 0.44%. Hong Kong's Hang Seng Index rose 0.13%. The Shanghai Composite Index fell 0.6%.

VIETNAM ECONOMY

2.80%

1D (bps) 64

YTD (bps) 199

5.60%

2.85%

1D (bps) 2

YTD (bps) 184

3.36%

1D (bps) 1

YTD (bps) 136

23,610

1D (%) 0.30%

YTD (%) 2.92%

24,347

1D (%) -0.90%

YTD (%) -8.01%

3,537

1D (%) 0.03%

YTD (%) -3.31%

This year, the entire textile and garment industry aims to achieve an export value of 43.5 billion USD. However, the risk of a resurgence of the COVID-19 epidemic is causing important trading partners of Vietnam such as China and Japan to still apply strict measures against the epidemic. This significantly affects the supply chain of raw materials, accessories and consumption of textile products of Vietnam.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Adding Phuoc Dong - Long An port to the Southeast seaport planning

- Textile and garment export turnover reached 23 billion USD

- Prime Minister: Unifying investment plan for key transport infrastructure projects in Nghe An province

- The Fed will be more aggressive in the fight with inflation

- Financial markets enter one of the most important weeks of summer

- Russia cuts interest rates to 8% after 4 months of skyrocketing to 20%

VN30

BANK

72,900

1D 0.55%

5D 1.25%

Buy Vol. 1,348,800

Sell Vol. 2,213,300

35,400

1D -0.28%

5D -0.28%

Buy Vol. 2,465,500

Sell Vol. 2,955,100

26,600

1D -1.12%

5D -1.12%

Buy Vol. 5,315,400

Sell Vol. 4,759,900

36,800

1D -0.81%

5D 1.38%

Buy Vol. 3,785,700

Sell Vol. 4,820,900

27,650

1D -1.78%

5D -1.78%

Buy Vol. 11,773,500

Sell Vol. 13,160,500

25,250

1D -1.17%

5D -0.59%

Buy Vol. 8,115,000

Sell Vol. 6,791,200

23,600

1D -0.84%

5D 0.43%

Buy Vol. 1,877,200

Sell Vol. 1,802,500

27,400

1D -2.32%

5D 0.55%

Buy Vol. 2,493,800

Sell Vol. 2,473,900

22,850

1D -0.65%

5D 1.33%

Buy Vol. 16,619,000

Sell Vol. 16,829,400

24,050

1D -1.23%

5D 0.63%

Buy Vol. 3,236,300

Sell Vol. 3,238,700

VPB: VPbank has just announced its business results for the first 6 months of the year with a pre-tax profit of VND 15.3 trillion, which increase of nearly 70% compared to the same period in 2021. Total operating income in the first 6 months of 2022 up 37% y/y to VND31.5 trillion, thanks to strong growth in both interest income and service income.

REAL ESTATE

73,700

1D -0.27%

5D 0.14%

Buy Vol. 1,526,400

Sell Vol. 2,019,500

36,300

1D -0.55%

5D 0.28%

Buy Vol. 688,800

Sell Vol. 1,099,700

52,400

1D 0.38%

5D -1.32%

Buy Vol. 1,750,700

Sell Vol. 1,989,300

Da Nang: Many projects are located in prime locations, but are abandoned for a long time, creating many consequences.

OIL & GAS

104,700

1D -2.88%

5D 7.38%

Buy Vol. 1,008,100

Sell Vol. 1,224,000

13,150

1D 0.00%

5D 0.38%

Buy Vol. 25,580,700

Sell Vol. 17,659,000

41,100

1D -1.67%

5D 2.11%

Buy Vol. 826,400

Sell Vol. 891,200

GAS: played the role of a "hero" pulling VN-Index to nearly 1,200 when bringing back more than 5.1 points for the index in today's session.

VINGROUP

67,300

1D 1.20%

5D -1.03%

Buy Vol. 1,265,300

Sell Vol. 1,910,800

58,900

1D 0.34%

5D -0.17%

Buy Vol. 1,925,700

Sell Vol. 3,117,700

26,300

1D 1.15%

5D 0.96%

Buy Vol. 2,312,100

Sell Vol. 2,315,700

VIC: Deputy Prime Minister issued a document on highway investment of 23,000 billion proposed by Vingroup - Techcombank consortium

FOOD & BEVERAGE

72,900

1D 1.25%

5D 1.67%

Buy Vol. 2,559,500

Sell Vol. 2,650,200

108,600

1D 0.09%

5D 5.85%

Buy Vol. 704,000

Sell Vol. 1,255,600

165,000

1D -0.60%

5D 7.00%

Buy Vol. 163,200

Sell Vol. 255,600

MSN: Masan is about to build another large brewery in Hau Giang with a capacity of up to 100 million liters/year, with a total investment of VND 3,500 billion.

OTHERS

125,800

1D 0.16%

5D 1.29%

Buy Vol. 655,100

Sell Vol. 692,900

125,800

1D 0.16%

5D 1.29%

Buy Vol. 655,100

Sell Vol. 692,900

85,400

1D 0.35%

5D 2.89%

Buy Vol. 3,526,700

Sell Vol. 5,398,000

63,300

1D -1.86%

5D 3.77%

Buy Vol. 7,076,100

Sell Vol. 9,609,700

113,200

1D -1.14%

5D -0.26%

Buy Vol. 484,200

Sell Vol. 709,300

22,800

1D -2.98%

5D -1.72%

Buy Vol. 2,121,700

Sell Vol. 2,911,200

20,450

1D -2.15%

5D -2.15%

Buy Vol. 31,329,700

Sell Vol. 35,817,800

21,900

1D -1.35%

5D -3.10%

Buy Vol. 30,916,000

Sell Vol. 32,062,600

FPT: In the first half of 2022, FPT recorded a net revenue of nearly 20 trillion dong, up 22% over the same period. In which, revenue from technology segment reached more than VND 11 trillion, up 24%, while revenue from telecommunications accounted for more than VND 7 billion, up 16%. Not only increased revenue, but FPT's gross profit margin also increased slightly from 39% to over 40%. As a result, gross profit increased by 26% to nearly VND8 trillion.

Market by numbers

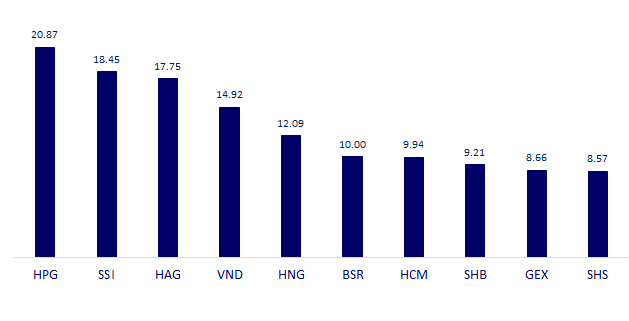

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

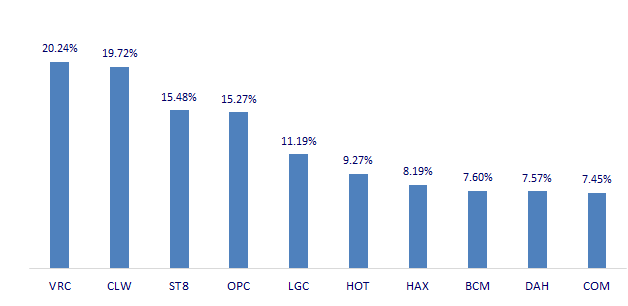

TOP INCREASES 3 CONSECUTIVE SESSIONS

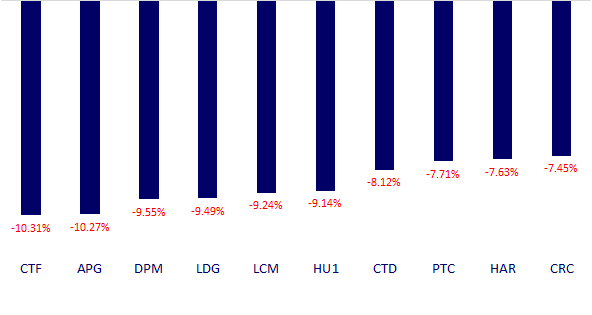

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.