Morning brief 02/08/2022

GLOBAL MARKET

32,798.40

1D -0.14%

YTD -9.89%

4,118.63

1D -0.28%

YTD -13.81%

12,368.98

1D -0.18%

YTD -21.42%

22.84

1D 7.08%

7,413.42

1D -0.13%

YTD 0.14%

13,479.63

1D -0.03%

YTD -15.14%

6,436.86

1D -0.18%

YTD -10.27%

93.69

1D -3.85%

YTD 22.47%

1,795.40

1D 0.81%

YTD -1.39%

U.S. stocks fell in the first session of August after ending the month with their biggest gains since early 2022. The Dow Jones Industrial Average fell 46.73 points, or 0.14%, to 32,798.4 points. The S&P 500 index fell 0.28% to 4,118.63 points. The Nasdaq Composite Index fell 0.18% to 12,368.98 points. The streak of three consecutive sessions of gains of US stocks was officially cut off.

VIETNAM ECONOMY

4.19%

1D (bps) -49

YTD (bps) 338

5.60%

3.13%

1D (bps) 8

YTD (bps) 212

3.62%

1D (bps) 5

YTD (bps) 162

23,500

1D (%) 0.11%

YTD (%) 2.44%

24,723

1D (%) 0.47%

YTD (%) -6.59%

3,521

1D (%) -0.25%

YTD (%) -3.75%

After a positive recovery to a growth rate of 6.42% in the first half year, Vietnam's economy started the first month of the third quarter of 2022 with a sustained recovery momentum, even increasing. The IIP index in July 2022 is estimated to increase by 1.6% over the previous month and by 11.2% over the same period last year. In general, in 7 months, it is estimated to increase by 8.8% over the same period last year, higher than the increase of 7.6% of last year and 2.6% of 2020.

VIETNAM STOCK MARKET

1,231.35

1D 2.07%

YTD -17.82%

1,256.25

1D 1.97%

YTD -18.20%

294.62

1D 2.08%

YTD -37.84%

89.91

1D 0.33%

YTD -20.21%

651.24

18,801.26

1D 10.26%

YTD -39.49%

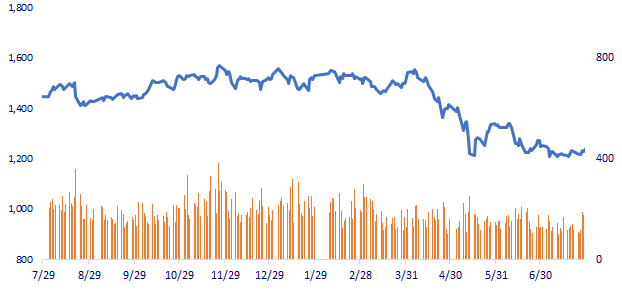

At the end of the session, VN-Index increased by 25 points (2.07%) to 1,231 points. HNX-Index increased 6 points to 294 points and UPCoM-Index increased 0.3 points to 89.91 points. Liquidity on HOSE continued to maintain a high level with matched value reaching VND 16,195 billion.

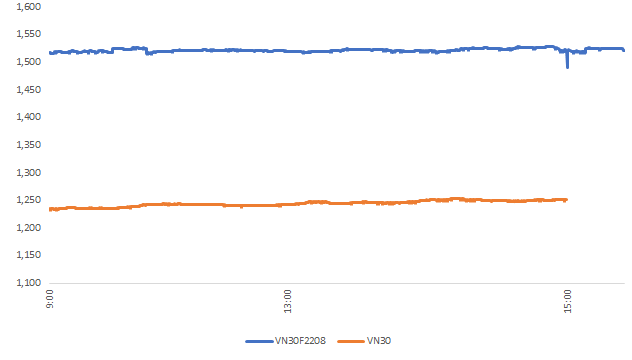

INTRADAY

VN30 (12M)

SELECTED NEWS

- Strive to disburse all public investment capital before December 31

- One large corporation proposes to invest in 2 wind power projects of more than VND 380,000 billion in Ninh Thuan

- Leverage to bring Thua Thien Hue to a city directly under the Central Government

- Manufacturing activity at Asian factories declines due to weaker supply and demand

- Europe is like sitting on fire when Russia continuously cuts gas

- Q3/2022: Apple recorded record revenue of $83 billion, over Wall Street's expectations despite the gloomy world economy

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.