Market brief 17/08/2022

VIETNAM STOCK MARKET

1,275.28

1D 0.05%

YTD -14.88%

1,300.40

1D 0.41%

YTD -15.32%

302.59

1D -0.14%

YTD -36.16%

93.07

1D 0.25%

YTD -17.40%

-32.22

1D 0.00%

YTD 0.00%

20,642.21

1D 18.14%

YTD -33.57%

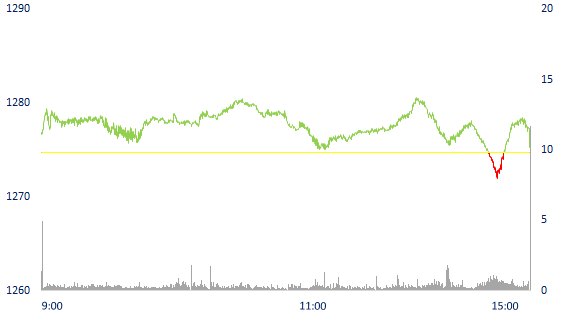

At the end of the session, VN-Index increased by 0.59 points (0.05%) to 1,275.28 points. Foreign investors turned negative again when they bought 40.6 million shares, worth VND951 billion, while selling 40.2 million shares worth VND983 billion. Total net buying volume was at 335,300 shares, but in terms of value, this capital flow was net sold at VND32 billion.

ETF & DERIVATIVES

22,040

1D 0.64%

YTD -14.67%

15,420

1D 0.98%

YTD -14.76%

15,910

1D -10.67%

YTD -16.26%

19,100

1D 0.53%

YTD -16.59%

17,990

1D -0.61%

YTD -19.97%

27,370

1D 1.00%

YTD -2.42%

16,760

1D 0.36%

YTD -21.97%

1,275

1D 0.44%

YTD 0.00%

1,285

1D 0.41%

YTD 0.00%

1,298

1D 0.43%

YTD 0.00%

1,309

1D 0.93%

YTD 0.00%

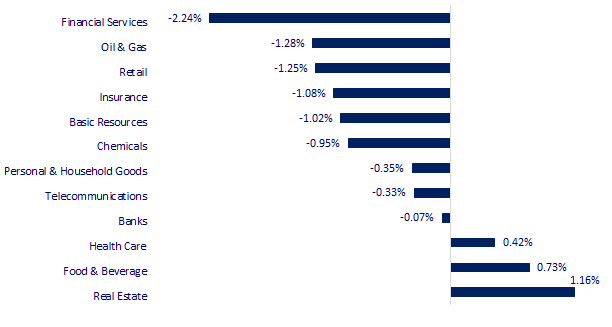

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

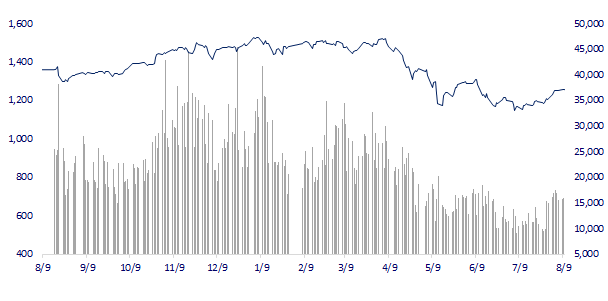

VNINDEX (12M)

GLOBAL MARKET

29,222.77

1D 0.37%

YTD 1.50%

3,292.53

1D 0.45%

YTD -9.54%

2,516.47

1D -0.67%

YTD -15.49%

19,922.45

1D 0.46%

YTD -14.85%

3,262.76

1D 0.28%

YTD 4.45%

1,639.72

1D 0.60%

YTD -1.08%

87.30

1D 0.60%

YTD 14.12%

1,788.65

1D -0.01%

YTD -1.77%

Asian stocks largely rallied ahead of a flurry of positive economic data. In Japan, the Nikkei 225 index rose 0.37%. In South Korea, the Kospi index fell 0.67%. In Hong Kong, the Hang Seng index rose 0.46%. Chinese stocks rallied. The Shanghai Composite Index rose 0.45%.

VIETNAM ECONOMY

1.99%

1D (bps) -72

YTD (bps) 118

5.60%

3.17%

1D (bps) -1

YTD (bps) 216

3.56%

1D (bps) -1

YTD (bps) 156

23,544

1D (%) 0.00%

YTD (%) 2.63%

24,558

1D (%) 0.12%

YTD (%) -7.22%

3,522

1D (%) 0.11%

YTD (%) -3.72%

The Prime Minister assigned 06 Working Groups established under Decision No. 548/QD-TTg dated May 2, 2022 of the Prime Minister to continue inspecting, urging, removing difficulties and obstacles, pushing strongly disbursing public investment capital in 2022 at 41 ministries, central agencies and 18 localities with disbursement results as of July 31, 2022 below the national average (34.47%).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Binh Duong disbursed nearly 3,000 billion VND of public investment capital

- More than 90 trillion VND to build Thu Thiem - Long Thanh and Bien Hoa - Vung Tau railways

- The Prime Minister assigned 6 working groups to urge the disbursement of public investment capital

- China's premier urges economic support

- Energy-food vicious circle in Europe

- Warren Buffett continues to pour money into oil and gas stocks and Apple

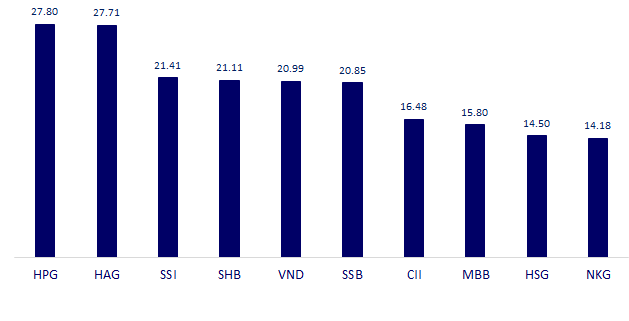

VN30

BANK

81,500

1D 0.00%

5D 1.24%

Buy Vol. 1,161,500

Sell Vol. 1,766,400

40,000

1D -1.23%

5D 4.17%

Buy Vol. 2,501,000

Sell Vol. 2,845,400

29,100

1D -0.34%

5D 2.28%

Buy Vol. 5,330,400

Sell Vol. 9,934,700

39,300

1D 0.77%

5D 1.29%

Buy Vol. 6,018,200

Sell Vol. 8,876,800

30,150

1D 0.00%

5D 0.17%

Buy Vol. 20,477,100

Sell Vol. 22,088,200

27,750

1D 1.83%

5D 2.02%

Buy Vol. 25,834,500

Sell Vol. 26,411,400

26,750

1D 1.52%

5D 6.79%

Buy Vol. 7,183,700

Sell Vol. 7,637,800

28,700

1D -0.52%

5D 1.41%

Buy Vol. 1,953,500

Sell Vol. 2,962,100

25,400

1D -0.59%

5D 2.01%

Buy Vol. 18,495,900

Sell Vol. 20,676,300

26,150

1D -0.95%

5D 0.58%

Buy Vol. 3,286,000

Sell Vol. 4,905,500

24,950

1D 0.40%

5D 0.40%

Buy Vol. 5,284,200

Sell Vol. 6,765,200

VCB: Vietcombank has just announced the selection of an auction organization for the right to recover secured debts of Beton 6 Joint Stock Company (UPCoM: BT6). As of the end of July 31, the total outstanding balance of Beton 6 at the bank was VND 103.3 billion. In which, the principal debt is 63.7 billion dong, the interest debt within the term is 27.3 billion dong, and the overdue interest debt is 12.2 billion dong. Collateral including property rights is the receivables of Beton 6, machinery and equipment owned by the enterprise under the mortgage contract of property rights signed between Vietcombank Ho Chi Minh City branch and this enterprise.

REAL ESTATE

84,400

1D 1.69%

5D 1.44%

Buy Vol. 3,911,600

Sell Vol. 6,011,000

39,300

1D 1.16%

5D 1.42%

Buy Vol. 1,835,700

Sell Vol. 1,699,300

58,200

1D 6.79%

5D 8.38%

Buy Vol. 6,689,500

Sell Vol. 5,640,700

The Department of Construction recommends the People's Committee of Khanh Hoa province to suspend the implementation of subdivision planning projects (1/2,000) of zones of Cam Ranh.

OIL & GAS

112,400

1D -0.97%

5D 1.35%

Buy Vol. 1,412,400

Sell Vol. 1,587,800

13,950

1D -1.06%

5D 0.00%

Buy Vol. 23,632,800

Sell Vol. 31,481,100

42,650

1D -1.39%

5D 1.67%

Buy Vol. 2,542,700

Sell Vol. 3,336,300

Russia's oil production has recovered positively recently, but businesses will have to work hard to find new customers when EU sanctions take effect.

VINGROUP

67,300

1D 2.12%

5D 3.86%

Buy Vol. 3,777,100

Sell Vol. 3,509,700

61,300

1D 0.00%

5D 0.00%

Buy Vol. 3,534,000

Sell Vol. 4,511,600

29,500

1D 0.68%

5D 3.87%

Buy Vol. 2,539,000

Sell Vol. 3,535,800

At the end of trading on August 17, the group of "Vingroup" stocks and other leading market capitalization codes all gained, helping the general market stay in green.

FOOD & BEVERAGE

72,600

1D 1.11%

5D 0.14%

Buy Vol. 2,986,200

Sell Vol. 2,805,000

111,300

1D 2.11%

5D 5.20%

Buy Vol. 1,821,100

Sell Vol. 1,965,000

188,500

1D 0.27%

5D 3.57%

Buy Vol. 320,300

Sell Vol. 336,700

SAB: Saigon Beer management said that the increase in average selling price, and improved production efficiency have helped the unit achieve the highest increase in quarterly net profit ever.

OTHERS

123,500

1D 0.08%

5D -1.52%

Buy Vol. 943,300

Sell Vol. 1,072,200

123,500

1D 0.08%

5D -1.52%

Buy Vol. 943,300

Sell Vol. 1,072,200

88,300

1D -0.45%

5D 2.67%

Buy Vol. 2,381,600

Sell Vol. 3,466,600

65,000

1D -1.52%

5D 2.20%

Buy Vol. 3,463,000

Sell Vol. 7,240,500

24,550

1D -1.01%

5D -2.00%

Buy Vol. 2,773,400

Sell Vol. 4,460,300

24,550

1D -0.20%

5D 0.00%

Buy Vol. 34,670,200

Sell Vol. 43,255,800

24,300

1D -1.02%

5D 2.10%

Buy Vol. 49,727,500

Sell Vol. 56,433,400

VJC: From July 13 to August 10, Deputy General Director Luong The Phuc sold and matched 100,000 VJC shares, reducing the holding to 130,400 units, accounting for 0.02% of the capital.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

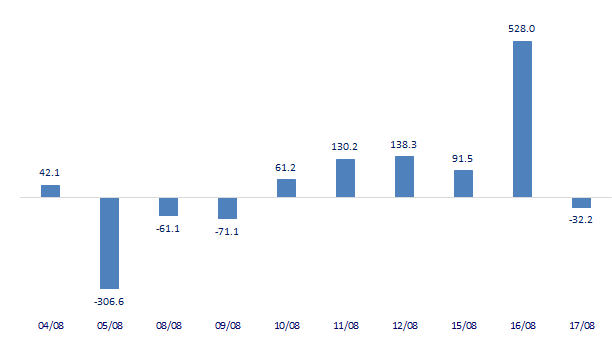

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

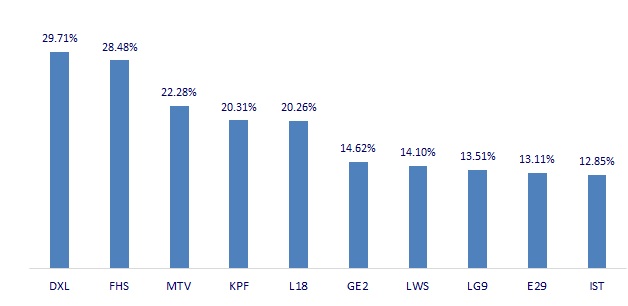

TOP INCREASES 3 CONSECUTIVE SESSIONS

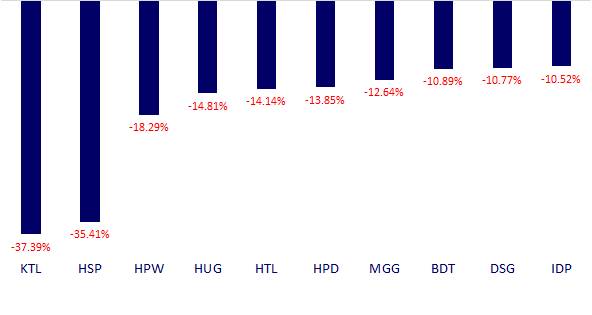

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.