Market brief 24/08/2022

VIETNAM STOCK MARKET

1,277.16

1D 0.50%

YTD -14.76%

1,296.41

1D 0.34%

YTD -15.58%

301.30

1D 0.72%

YTD -36.43%

93.30

1D 0.56%

YTD -17.20%

-156.75

1D 0.00%

YTD 0.00%

17,895.01

1D 5.46%

YTD -42.41%

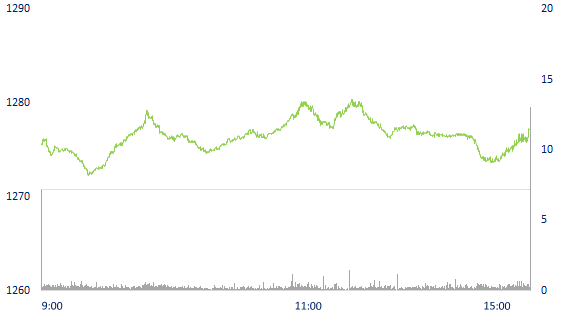

At the end of the trading session on August 24, 2022, VN-Index continued to increase positively. Liquidity on HOSE improved, increased by 8% compared to the previous session with a total trading value of VND15,196 bil. As observed at leading stocks, banking group was the main gainer of the market when contributing 3.1 points to VN-Index. Followed by the Food and Chemical Manufacturing group.

ETF & DERIVATIVES

21,910

1D 0.55%

YTD -15.18%

15,250

1D 0.00%

YTD -15.70%

16,050

1D -9.88%

YTD -15.53%

19,760

1D -2.61%

YTD -13.71%

18,290

1D 1.33%

YTD -18.64%

27,220

1D 0.26%

YTD -2.96%

16,700

1D -0.18%

YTD -22.25%

1,272

1D 0.45%

YTD 0.00%

1,274

1D 0.11%

YTD 0.00%

1,282

1D 0.18%

YTD 0.00%

1,285

1D 0.16%

YTD 0.00%

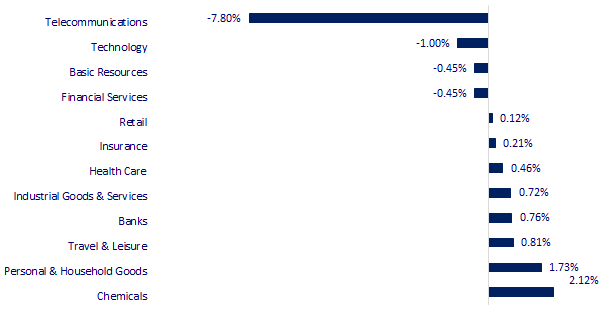

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

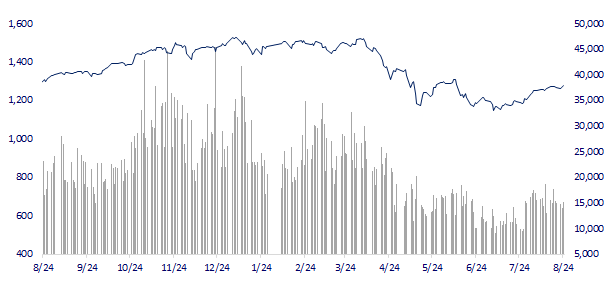

VNINDEX (12M)

GLOBAL MARKET

28,313.47

1D -0.44%

YTD -1.66%

3,215.20

1D -1.86%

YTD -11.66%

2,447.45

1D 0.50%

YTD -17.81%

19,268.74

1D -1.20%

YTD -17.65%

3,237.68

1D -0.26%

YTD 3.65%

1,633.48

1D -0.04%

YTD -1.46%

94.72

1D 1.13%

YTD 23.82%

1,764.95

1D 0.33%

YTD -3.07%

Asian stocks mixed in the session of 24/8. In Japan, the Nikkei 225 index fell 0.49% to 28,313.47 points. Chinese stocks fell. The Shanghai Composite Index fell 1.86% to 3,215.2 points. The Hang Seng Index (Hong Kong) fell 1.2% to 19,268.74 points. In South Korea, the Kospi rose 0.5% to 2,447.45.

VIETNAM ECONOMY

2.73%

1D (bps) 24

YTD (bps) 192

5.60%

3.17%

1D (bps) -2

YTD (bps) 216

3.58%

1D (bps) 1

YTD (bps) 158

23,615

1D (%) 0.15%

YTD (%) 2.94%

24,079

1D (%) 0.03%

YTD (%) -9.03%

3,490

1D (%) -0.26%

YTD (%) -4.59%

Statistics of businesses that have published semi-annual financial statements for review in 2022 show that the profits of many businesses have changed after the review. Most of them changed in the direction of decreasing profits, some businesses even changed from being profitable to losing, and many businesses continued to be questioned by the audit about their ability to continue operating.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam has the opportunity to welcome the "wave" of large-scale FDI

- New or unfinished wind and solar power all have to negotiate with EVN to sell electricity

- Explanation of public investment: 8 months, Ho Chi Minh City disbursed 29% of capital

- Europe's thirst for gas is creating a new race on a global scale

- Poland calls for complete dismantling of Nord Stream 2 pipeline

- Euro hits 2-decade low, yuan 2-year low, USD fluctuates like a roller coaster

VN30

BANK

82,000

1D 2.24%

5D 0.61%

Buy Vol. 1,979,600

Sell Vol. 2,053,700

39,300

1D -0.51%

5D -1.75%

Buy Vol. 1,511,700

Sell Vol. 2,298,600

28,200

1D 0.71%

5D -3.09%

Buy Vol. 6,584,200

Sell Vol. 5,849,500

39,250

1D 1.16%

5D -0.13%

Buy Vol. 7,828,400

Sell Vol. 7,321,300

31,400

1D 0.64%

5D 4.15%

Buy Vol. 21,732,200

Sell Vol. 23,099,100

23,300

1D 0.43%

5D 0.76%

Buy Vol. 15,549,200

Sell Vol. 13,103,300

25,900

1D 0.78%

5D -3.18%

Buy Vol. 2,898,500

Sell Vol. 3,091,500

28,100

1D 0.36%

5D -2.09%

Buy Vol. 2,195,500

Sell Vol. 2,649,000

25,400

1D 1.60%

5D 0.00%

Buy Vol. 24,651,000

Sell Vol. 24,051,300

25,100

1D -0.40%

5D -4.02%

Buy Vol. 2,179,900

Sell Vol. 3,848,500

24,850

1D 0.20%

5D -0.40%

Buy Vol. 5,037,300

Sell Vol. 6,149,900

BID: Joint Stock Commercial Bank for Investment and Development of Vietnam has just announced the auction of debts of two companies with outstanding loans of up to VND 940 bil. Specifically, on September 8, BIDV will conduct an auction of assets that are debts of Vertical Synergy Vietnam Joint Stock Company, including all principal balances, interest balances, and fees incurred up to the time of the purchase and sale transaction. Total outstanding debt as of August 14, 2022 is VND477.5 bil, of which principal balance is VND347 bil, interest balance is 130 billion dong. The starting price for this debt is VND 381.57 bil.

REAL ESTATE

82,900

1D 1.10%

5D -1.78%

Buy Vol. 3,386,700

Sell Vol. 3,724,700

37,750

1D 0.13%

5D -3.94%

Buy Vol. 1,768,200

Sell Vol. 1,618,400

56,400

1D -0.35%

5D -3.09%

Buy Vol. 3,128,200

Sell Vol. 3,223,600

The supply of housing scarced in recent years, causing increase of apartment prices, not only in the primary segment, but also in old apartments, including apartments without red books.

OIL & GAS

117,300

1D 0.26%

5D 4.36%

Buy Vol. 653,600

Sell Vol. 1,110,200

14,050

1D 1.08%

5D 0.72%

Buy Vol. 33,951,200

Sell Vol. 43,546,800

43,800

1D -0.45%

5D 2.70%

Buy Vol. 3,840,000

Sell Vol. 3,330,400

Despite many advantages and in line with the commitment to cut CO2 emissions, the development of imported LNG power projects in Vietnam is still facing many great challenges.

VINGROUP

64,900

1D -0.15%

5D -3.57%

Buy Vol. 1,767,300

Sell Vol. 1,630,600

59,700

1D 0.34%

5D -2.61%

Buy Vol. 2,843,400

Sell Vol. 2,223,600

28,600

1D -0.87%

5D -3.05%

Buy Vol. 3,096,300

Sell Vol. 2,709,900

VHM: Masterise Homes and Vinhomes have just announced a partnership to distribute 2 Masteri Waterfront projects in Vinhomes Ocean Park and Masteri West Heights.

FOOD & BEVERAGE

77,700

1D 2.51%

5D 7.02%

Buy Vol. 12,361,600

Sell Vol. 9,410,900

111,900

1D -0.62%

5D 0.54%

Buy Vol. 1,018,000

Sell Vol. 1,126,100

187,000

1D -1.58%

5D -0.80%

Buy Vol. 246,700

Sell Vol. 213,900

Domestic individual investors net bought more than VND170 bil, gathering strongly VNM session 24/8

OTHERS

123,500

1D 0.00%

5D 0.00%

Buy Vol. 712,700

Sell Vol. 775,700

123,500

1D 0.00%

5D 0.00%

Buy Vol. 712,700

Sell Vol. 775,700

86,200

1D 0.23%

5D -1.24%

Buy Vol. 1,852,400

Sell Vol. 2,331,300

66,800

1D -0.15%

5D 2.77%

Buy Vol. 5,104,800

Sell Vol. 4,648,500

24,150

1D 0.84%

5D -1.63%

Buy Vol. 2,593,100

Sell Vol. 2,167,900

25,250

1D -0.59%

5D 2.85%

Buy Vol. 27,138,200

Sell Vol. 31,690,400

23,500

1D -0.63%

5D -3.29%

Buy Vol. 24,057,500

Sell Vol. 24,600,300

FPT: FPT Smart Cloud is the only Asian company to receive the Stevie Awards in the category of Most Innovative Technology Enterprise, on August 17. The company passed 3,700 nominations in 63 countries around the world to receive the award. The jury is made up of 300 experts from around the world. According to the council's assessment, FPT has achieved many marks in product innovation and development after two years of establishment.

Market by numbers

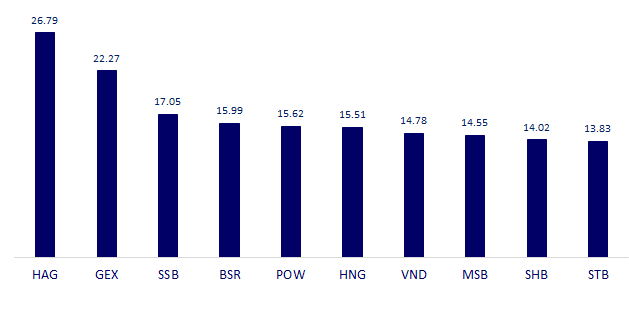

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

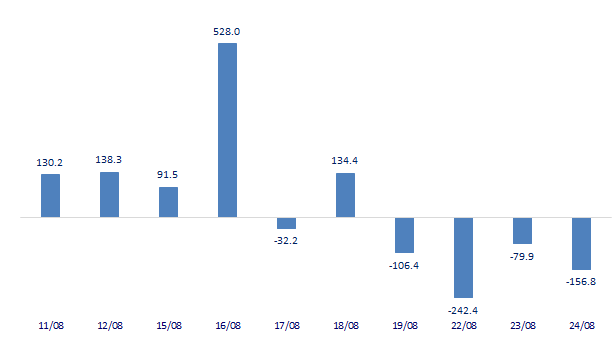

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

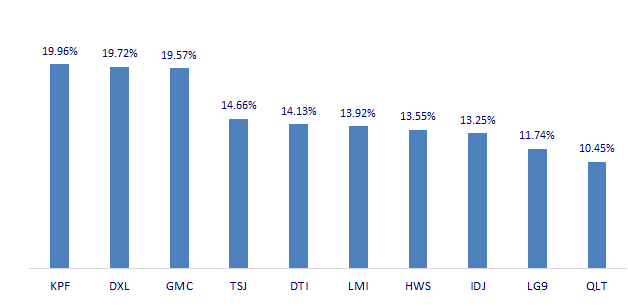

TOP INCREASES 3 CONSECUTIVE SESSIONS

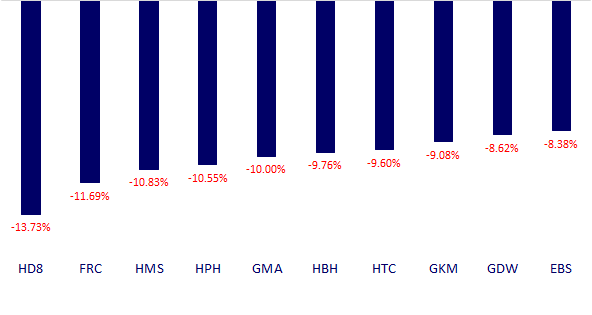

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.