Market brief 26/08/2022

VIETNAM STOCK MARKET

1,282.57

1D -0.49%

YTD -14.40%

1,306.81

1D -0.36%

YTD -14.91%

299.50

1D -0.78%

YTD -36.81%

92.88

1D -0.76%

YTD -17.57%

-59.98

1D 0.00%

YTD 0.00%

19,199.81

1D 6.47%

YTD -38.21%

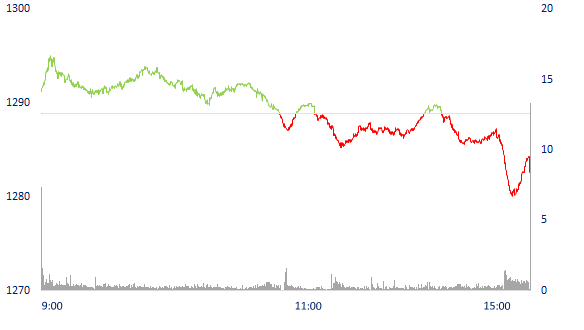

At the end of the session, VN-Index dropped 6.31 points (-0.49%) to 1,282.57 points. The whole floor had 131 gainers, 321 losers and 69 unchanged stocks. The total matched value reached VND17,371 bil, up 7% compared to the previous session, of which, the matched value on HoSE increased 7.4% to VND14,681 bil. Foreign investors net sold VND60 bil.

ETF & DERIVATIVES

22,120

1D -0.36%

YTD -14.36%

15,450

1D 0.32%

YTD -14.59%

16,260

1D -8.70%

YTD -14.42%

20,590

1D 2.95%

YTD -10.09%

18,300

1D -1.08%

YTD -18.59%

27,660

1D 0.40%

YTD -1.39%

17,200

1D 1.18%

YTD -19.93%

1,276

1D -0.58%

YTD 0.00%

1,283

1D -0.72%

YTD 0.00%

1,287

1D -0.92%

YTD 0.00%

1,293

1D -0.77%

YTD 0.00%

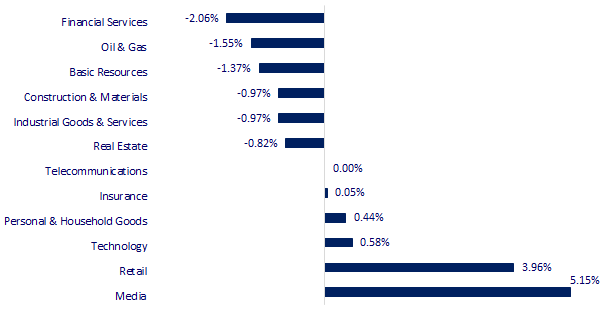

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

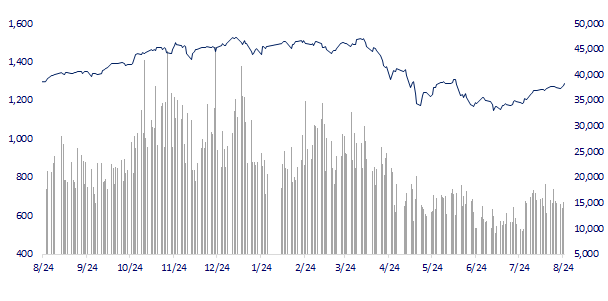

VNINDEX (12M)

GLOBAL MARKET

28,641.38

1D -0.47%

YTD -0.52%

3,236.22

1D -0.31%

YTD -11.09%

2,481.03

1D 0.15%

YTD -16.68%

20,148.00

1D 0.90%

YTD -13.89%

3,256.33

1D 0.26%

YTD 4.25%

1,645.94

1D 0.09%

YTD -0.70%

93.31

1D 0.27%

YTD 21.97%

1,764.70

1D -0.27%

YTD -3.08%

Asian markets mixed in the last session of the week. Nikkei 225 (Japan) fell 0.47%, Shanghai Composite (China) dropped 0.31%. In contrast, Kospi (Korea) increased 0.15%, Hang Seng (Hong Kong) increased 0.9%, SET (Thailand) increased 0.09%.

VIETNAM ECONOMY

3.82%

1D (bps) 5

YTD (bps) 301

5.60%

3.22%

1D (bps) 4

YTD (bps) 221

3.60%

1D (bps) 4

YTD (bps) 160

23,553

1D (%) -0.05%

YTD (%) 2.67%

24,087

1D (%) 0.06%

YTD (%) -9.00%

3,482

1D (%) -0.23%

YTD (%) -4.81%

The semiconductor market in Vietnam is expected to grow by USD1.65 bil between 2021 and 2025, according to a report by technology research and consulting company Technavio. Vietnam continues to become the focus of the semiconductor industry when Samsung announced its plan to produce semiconductor components from July next year with an additional investment of USD920 mil.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam: The new "stop" of the semiconductor industry

- Lacking a special mechanism, Cai Mep-Thi Vai port cluster has not developed commensurately

- Carefully study the plan to build an oil refinery

- Warren Buffett made $4 bil in less than half a year by investing in Occidental Petroleum stock

- Europe: Steel consumption in 2022 may decrease by 1.7%

- Russia and Saudi Arabia are vying for oil market share in Asia

VN30

BANK

82,500

1D 0.61%

5D 1.98%

Buy Vol. 2,402,300

Sell Vol. 2,967,300

39,400

1D 0.25%

5D 0.13%

Buy Vol. 3,172,000

Sell Vol. 5,118,100

28,450

1D -0.87%

5D 0.71%

Buy Vol. 7,863,500

Sell Vol. 8,162,600

39,500

1D -0.13%

5D 1.28%

Buy Vol. 7,551,300

Sell Vol. 8,588,600

31,600

1D -1.10%

5D 1.12%

Buy Vol. 22,554,400

Sell Vol. 29,329,100

23,600

1D -0.21%

5D 2.61%

Buy Vol. 15,925,400

Sell Vol. 19,299,700

26,300

1D -0.57%

5D 0.19%

Buy Vol. 2,615,500

Sell Vol. 4,944,700

28,400

1D -1.39%

5D 0.00%

Buy Vol. 2,111,300

Sell Vol. 4,250,600

25,100

1D -2.14%

5D 0.00%

Buy Vol. 17,771,600

Sell Vol. 26,628,100

25,400

1D -1.17%

5D -1.17%

Buy Vol. 3,093,600

Sell Vol. 3,949,500

24,800

1D -0.80%

5D -0.20%

Buy Vol. 6,158,400

Sell Vol. 9,594,000

BID: BIDV announced the selection of a unit to appraise the assets to secure the debt of two enterprises, Duc Nhan Dak Psi Hydropower Joint Stock Company and Hoang Nhi Co., Ltd. As of August 17, the total outstanding balance of Duc Nhan Dak Psi Hydropower Joint Stock Company at BIDV Gia Lai branch is 572.4 bil VND. BIDV said that the collateral for the debt is the Dak Psi hydropower plant with an address in Dak Pxi commune, Dak Ha district, Kon Tum province. The second debt is from Hoang Nhi Company as of August 17, the outstanding debt of this business at BIDV Gia Lai branch is more than 430.5 billion VND. The collateral for the loan balance is a building material factory in Tra Da industrial zone.

REAL ESTATE

83,300

1D -0.36%

5D 1.22%

Buy Vol. 3,603,400

Sell Vol. 5,609,600

38,350

1D 0.39%

5D -0.90%

Buy Vol. 1,164,100

Sell Vol. 1,419,300

56,300

1D -0.71%

5D -2.26%

Buy Vol. 3,236,500

Sell Vol. 3,354,800

NVL: Novaland is expected to issue more than 482.58 mil NVL shares with par value of 10,000 VND/share, equivalent to total issuance value at par value of 4,825.8 bil VND.

OIL & GAS

115,200

1D -1.12%

5D -0.35%

Buy Vol. 921,700

Sell Vol. 1,168,700

14,250

1D 1.06%

5D 4.78%

Buy Vol. 48,097,900

Sell Vol. 58,885,200

43,500

1D -0.91%

5D 1.87%

Buy Vol. 3,606,700

Sell Vol. 3,686,300

In July, the amount of coal purchased by China from Russia increased 14% year-on-year to 7.4 mil tons, marking a record level.

VINGROUP

65,000

1D -1.37%

5D -4.27%

Buy Vol. 1,571,000

Sell Vol. 1,572,800

60,300

1D -1.15%

5D 0.33%

Buy Vol. 1,542,900

Sell Vol. 2,915,600

28,850

1D -1.20%

5D -1.54%

Buy Vol. 1,673,800

Sell Vol. 2,554,400

VIC: Vingroup announced two driver-assistance technology products, including: driver monitoring system (DMS) and enhanced 360-degree panoramic view (ASVM) feature.

FOOD & BEVERAGE

76,900

1D -1.28%

5D 3.78%

Buy Vol. 3,700,900

Sell Vol. 4,989,100

112,200

1D -0.53%

5D 0.18%

Buy Vol. 671,000

Sell Vol. 816,800

188,000

1D 0.27%

5D -3.59%

Buy Vol. 288,700

Sell Vol. 161,600

VNM: Attractive valuation while profit is forecasted to grow when demand for milk increases again are the factors driving cash flow back on leading dairy stocks.

OTHERS

123,000

1D -0.32%

5D -0.81%

Buy Vol. 812,500

Sell Vol. 945,200

123,000

1D -0.32%

5D -0.81%

Buy Vol. 812,500

Sell Vol. 945,200

87,200

1D 1.04%

5D 1.51%

Buy Vol. 2,930,400

Sell Vol. 4,210,500

72,200

1D 5.56%

5D 12.64%

Buy Vol. 19,818,600

Sell Vol. 17,425,300

25,400

1D -0.20%

5D 4.96%

Buy Vol. 2,943,800

Sell Vol. 4,221,900

24,800

1D -2.75%

5D -1.39%

Buy Vol. 37,268,900

Sell Vol. 46,185,400

23,500

1D -1.47%

5D -1.05%

Buy Vol. 24,806,500

Sell Vol. 42,226,800

MWG: Mobile World recently updated its business situation until July 2022. Specifically, the company's revenue reached VND11 tril, up 16% over the same period. In which, the main contribution was the phone and electronics segment with VND 8,400 bil, up 63% over the same period.

Market by numbers

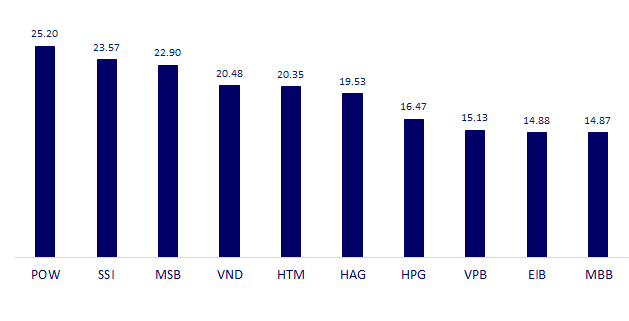

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

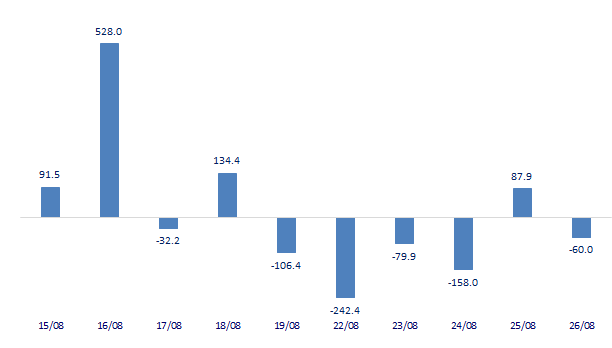

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

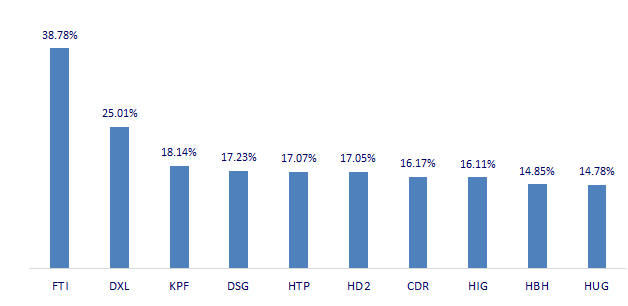

TOP INCREASES 3 CONSECUTIVE SESSIONS

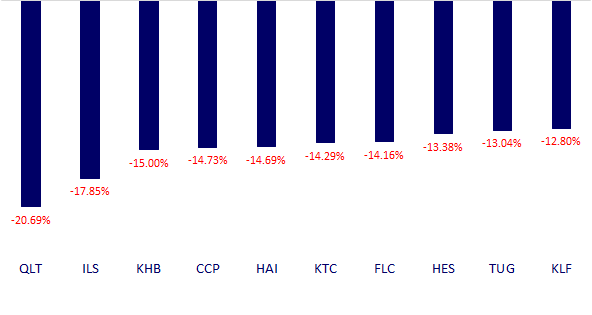

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.