Market brief 31/08/2022

VIETNAM STOCK MARKET

1,280.51

1D 0.09%

YTD -14.53%

1,301.44

1D 0.25%

YTD -15.25%

291.92

1D -0.66%

YTD -38.41%

92.44

1D 0.05%

YTD -17.96%

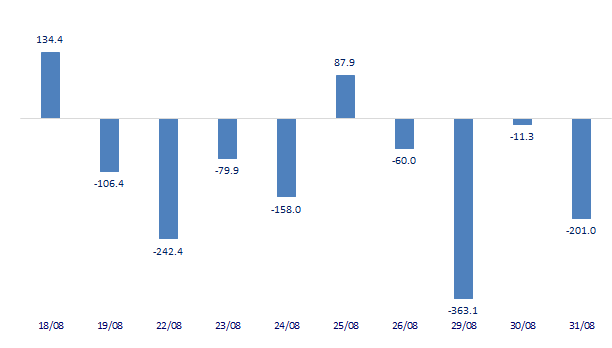

-201.02

1D 0.00%

YTD 0.00%

15,035.00

1D -7.28%

YTD -51.61%

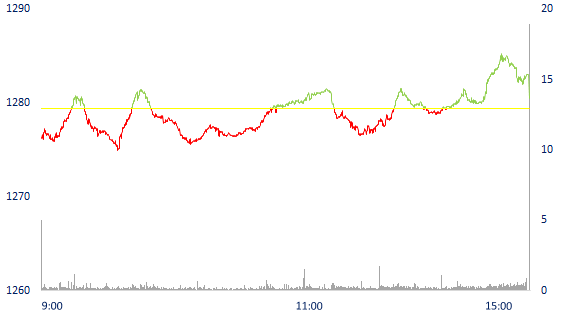

Seafood stocks raced to break out, VN-Index gained slightly. The total matched value reached 13,967 billion dong, down 4% compared to the previous session, of which, the matched value on HoSE alone decreased by 4.34% to 11,683 billion dong. Foreign investors net sold more than 201 billion dong on HoSE.

ETF & DERIVATIVES

22,060

1D 0.27%

YTD -14.60%

15,430

1D 0.26%

YTD -14.70%

16,290

1D -8.53%

YTD -14.26%

21,000

1D -2.28%

YTD -8.30%

18,010

1D -1.04%

YTD -19.88%

27,800

1D 0.29%

YTD -0.89%

17,080

1D 1.91%

YTD -20.48%

1,277

1D 0.54%

YTD 0.00%

1,281

1D 0.13%

YTD 0.00%

1,291

1D 0.49%

YTD 0.00%

1,294

1D 0.54%

YTD 0.00%

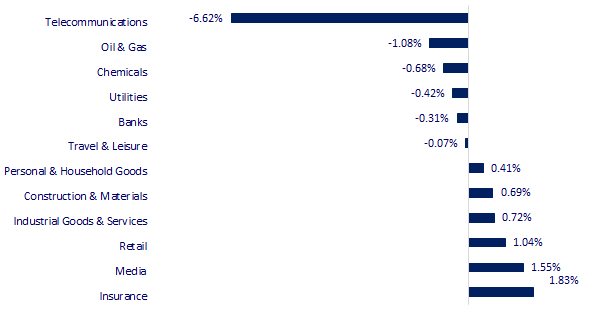

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

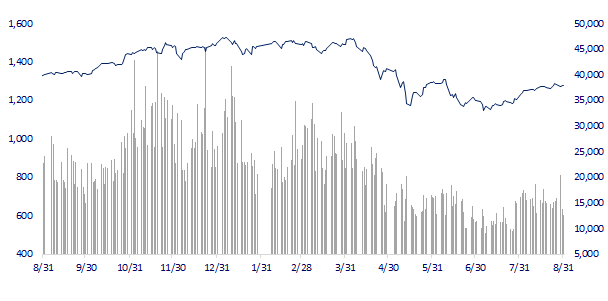

VNINDEX (12M)

GLOBAL MARKET

28,091.53

1D 0.08%

YTD -2.43%

3,202.14

1D -0.78%

YTD -12.02%

2,472.05

1D 0.86%

YTD -16.98%

19,954.39

1D 1.65%

YTD -14.72%

3,221.67

1D -0.55%

YTD 3.14%

1,638.93

1D -0.03%

YTD -1.13%

88.69

1D -3.69%

YTD 15.93%

1,724.65

1D -0.45%

YTD -5.28%

Asian stocks mixed, China's manufacturing activity continued to decline. In Japan, the Nikkei 225 index rose 0.08%. South Korea's Kospi index rose 0.86%. The Hang Seng Index (Hong Kong) increased 1.65% to 19,954.39 points. The Shanghai Composite Index fell 0.78%.

VIETNAM ECONOMY

4.42%

1D (bps) 54

YTD (bps) 361

5.60%

3.16%

1D (bps) -7

YTD (bps) 215

3.50%

1D (bps) -10

YTD (bps) 150

23,605

1D (%) 0.19%

YTD (%) 2.90%

24,149

1D (%) -0.22%

YTD (%) -8.76%

3,472

1D (%) 0.43%

YTD (%) -5.08%

The Ministry of Industry and Trade expects this year's export turnover to reach 368 billion USD, up more than 9% over the same period in 2021 and about 8% higher than the target assigned by the Government. The trade balance is expected to have a surplus of 1 billion USD, reaching the target set at the beginning of the year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- FDI decreased for the 7th month in a row

- Vietnam is expected to have a trade surplus of 1 billion USD this year

- Exporters have a headache because of high inflation, customers cancel orders

- Russia temporarily closes the Nord Stream 1 gas pipeline to Germany for 3 days for maintenance

- Manufacturing activity in China is still in a downtrend due to lack of electricity

- Europe soon achieves gas reserve target despite supply cuts from Russia

VN30

BANK

84,000

1D -2.33%

5D 2.44%

Buy Vol. 1,500,400

Sell Vol. 2,466,000

40,000

1D 0.50%

5D 1.78%

Buy Vol. 2,529,400

Sell Vol. 3,656,100

28,250

1D -0.53%

5D 0.18%

Buy Vol. 4,876,700

Sell Vol. 4,964,400

38,950

1D 0.52%

5D -0.76%

Buy Vol. 4,253,600

Sell Vol. 4,677,000

31,800

1D 1.44%

5D 1.27%

Buy Vol. 15,744,700

Sell Vol. 16,038,400

23,750

1D 0.42%

5D 1.93%

Buy Vol. 15,414,300

Sell Vol. 14,806,500

26,700

1D 1.52%

5D 3.09%

Buy Vol. 4,385,600

Sell Vol. 3,805,600

28,000

1D 0.36%

5D -0.36%

Buy Vol. 1,519,500

Sell Vol. 1,556,500

24,800

1D 0.61%

5D -2.36%

Buy Vol. 16,518,600

Sell Vol. 17,524,700

25,000

1D 0.00%

5D -0.40%

Buy Vol. 2,334,300

Sell Vol. 2,410,900

24,650

1D 0.41%

5D -0.80%

Buy Vol. 4,355,200

Sell Vol. 4,531,000

In the context of slow credit growth, many banks had to actively reduce the size of corporate bonds to have more room to lend. Techcombank, said the bank has reallocated credit by reducing the portion of large corporate bonds to switch to personal home loans. Accordingly, bond outstanding decreased from VND 77 trillion to VND 49 trillion in Q2, equivalent to a decrease of 36%. Another bank, TPBank, also actively reduced its corporate bond balance by VND 4.3 trillion in the second quarter to reserve room for credit growth in the first quarter of the third quarter.

REAL ESTATE

81,900

1D -0.36%

5D -1.21%

Buy Vol. 2,350,200

Sell Vol. 2,833,800

37,000

1D -1.86%

5D -1.99%

Buy Vol. 1,477,200

Sell Vol. 1,703,400

55,200

1D 0.18%

5D -2.13%

Buy Vol. 2,695,400

Sell Vol. 2,860,200

NVL: NVL's payables increased by more than VND 14,000 billion in Q2, most of which was invested by Novaland to develop projects with third parties.

OIL & GAS

117,100

1D -1.51%

5D -0.17%

Buy Vol. 855,600

Sell Vol. 1,179,200

14,000

1D 1.08%

5D -0.36%

Buy Vol. 37,137,100

Sell Vol. 37,298,400

42,200

1D -0.12%

5D -3.65%

Buy Vol. 2,375,100

Sell Vol. 1,868,000

On August 29, European gas prices fell the most since March after Germany announced that its gas reserves were filling up faster than planned.

VINGROUP

63,700

1D 0.16%

5D -1.85%

Buy Vol. 2,327,700

Sell Vol. 2,455,200

61,000

1D 1.84%

5D 2.18%

Buy Vol. 4,647,800

Sell Vol. 4,475,500

27,700

1D -2.46%

5D -3.15%

Buy Vol. 4,336,200

Sell Vol. 3,093,000

VIC: Total liabilities as of June 30, 2022 reached VND 396,914 billion. In which, prepaid money from customers and partners to buy the Group's products reached VND 134,106 billion.

FOOD & BEVERAGE

75,500

1D -0.66%

5D -2.83%

Buy Vol. 2,653,400

Sell Vol. 2,860,400

114,500

1D 0.70%

5D 2.32%

Buy Vol. 1,175,000

Sell Vol. 1,546,300

187,900

1D 0.00%

5D 0.48%

Buy Vol. 227,200

Sell Vol. 311,800

MSN: has 84 subsidiaries and affiliates, spanning everything from mining to banking. MSN has attracted investment capital from China's Alibaba and South Korea's SK.

OTHERS

121,600

1D -0.65%

5D -1.54%

Buy Vol. 762,100

Sell Vol. 896,400

121,600

1D -0.65%

5D -1.54%

Buy Vol. 762,100

Sell Vol. 896,400

86,600

1D 0.23%

5D 0.46%

Buy Vol. 2,321,500

Sell Vol. 2,618,200

74,000

1D 0.95%

5D 10.78%

Buy Vol. 8,746,900

Sell Vol. 7,374,600

26,350

1D -1.13%

5D 9.11%

Buy Vol. 4,600,800

Sell Vol. 4,769,300

24,000

1D 0.21%

5D -4.95%

Buy Vol. 22,475,800

Sell Vol. 21,450,300

23,000

1D -0.22%

5D -2.13%

Buy Vol. 29,265,900

Sell Vol. 25,346,200

MWG: MWG's retail chain of food and essential consumer goods has closed more than 400 stores (since April 2022). Specifically, by the end of July, Bach Hoa Xanh operated 1,735 stores. The average revenue of each store is about 1.3 billion VND per month. In the first 7 months of the year, Bach Hoa Xanh recorded a revenue of VND 15,200 billion, down 14% compared to the same period last year, contributing more than 18.6% to the total revenue of MWG.

Market by numbers

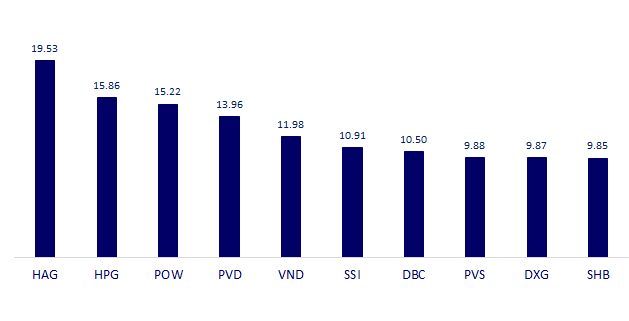

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

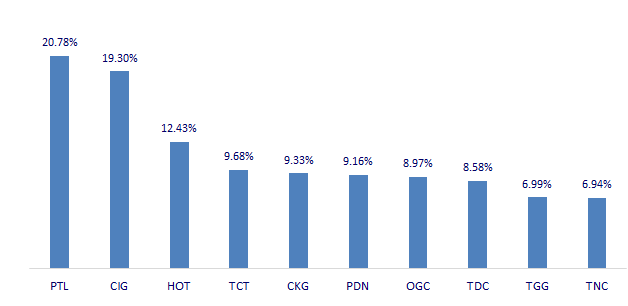

TOP INCREASES 3 CONSECUTIVE SESSIONS

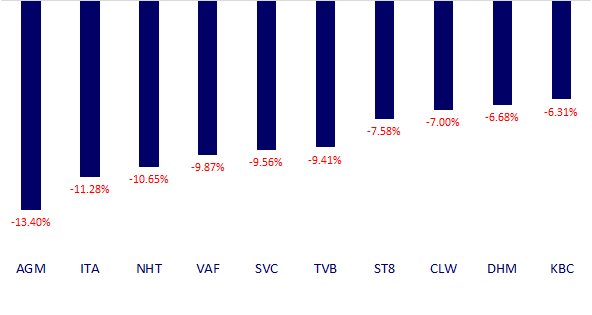

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.