Market brief 07/09/2022

VIETNAM STOCK MARKET

1,243.17

1D -2.68%

YTD -17.03%

1,268.95

1D -2.32%

YTD -17.37%

284.05

1D -3.14%

YTD -40.07%

90.38

1D -1.37%

YTD -19.79%

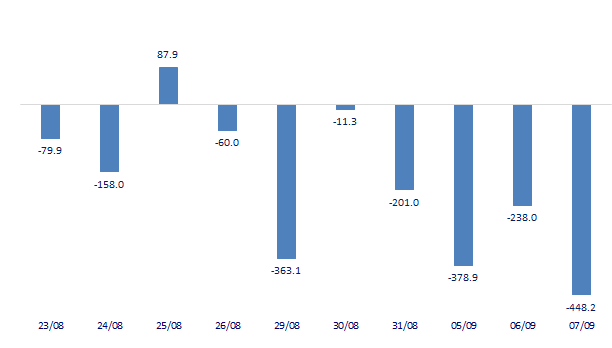

-448.19

1D 0.00%

YTD 0.00%

23,965.31

1D 45.16%

YTD -22.87%

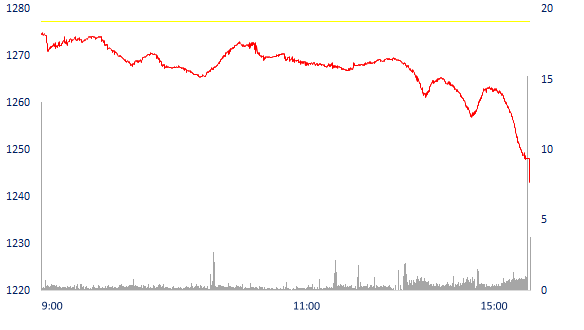

A series of stocks fell deeply, VN-Index lost more than 34 points. At the end of the session, VN-Index dropped to 1,243.17 points. The whole floor had 71 gainers, 423 losers and 41 standstill stocks. HNX-Index dropped 9.22 points (-3.14%) to 284.05 points. The whole floor had 41 gainers, 171 losers and 32 standstill stocks.

ETF & DERIVATIVES

21,800

1D -0.68%

YTD -15.60%

15,050

1D -2.08%

YTD -16.80%

16,240

1D -8.82%

YTD -14.53%

20,960

1D 1.60%

YTD -8.47%

17,800

1D -1.87%

YTD -20.82%

26,900

1D -2.50%

YTD -4.10%

16,420

1D -2.26%

YTD -23.56%

1,250

1D -1.87%

YTD 0.00%

1,260

1D -1.52%

YTD 0.00%

1,263

1D -1.93%

YTD 0.00%

1,265

1D -1.94%

YTD 0.00%

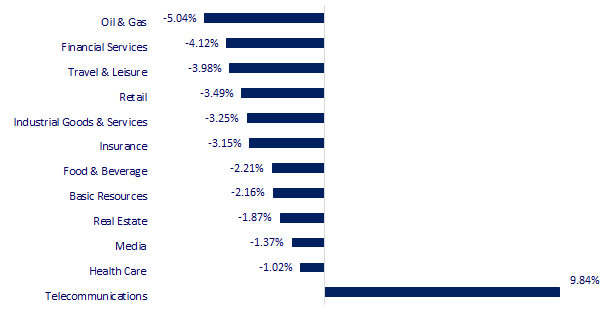

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

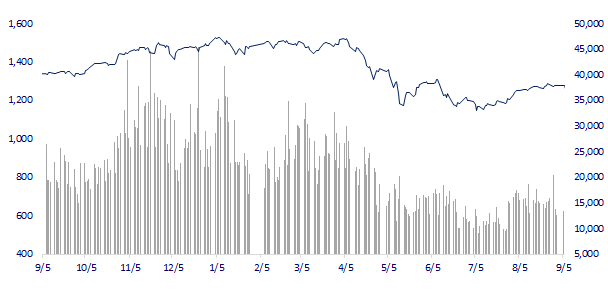

VNINDEX (12M)

GLOBAL MARKET

27,430.30

1D 0.41%

YTD -4.73%

3,246.29

1D 0.09%

YTD -10.81%

2,376.46

1D -1.39%

YTD -20.19%

19,044.30

1D -0.83%

YTD -18.61%

3,210.83

1D -0.41%

YTD 2.79%

1,638.93

1D 0.20%

YTD -1.13%

87.59

1D 1.49%

YTD 14.50%

1,716.75

1D 0.62%

YTD -5.71%

Asia - Pacific stocks were mixed after a lackluster session of US stocks due to interest rate worries. In Japan, the Nikkei 225 index rose 0.41% to 27,430.3 points. The Kospi (South Korea) index fell 1.39% to 2,376.46 points. Hong Kong's Hang Seng Index fell 0.83% to 19,044.3. The Shanghai Composite Index rose 0.09% to 3,246.29.

VIETNAM ECONOMY

5.21%

1D (bps) 79

YTD (bps) 440

5.60%

3.33%

YTD (bps) 232

3.76%

1D (bps) 14

YTD (bps) 176

23,723

1D (%) 0.25%

YTD (%) 3.41%

24,075

1D (%) 0.35%

YTD (%) -9.04%

3,449

1D (%) -0.12%

YTD (%) -5.71%

Deputy Prime Minister Le Minh Khai has just signed a decision to supplement, adjust and assign the medium-term public investment plan with central budget capital for the 2021-2025 period to ministries, central agencies and localities. Accordingly, the total investment of the Ring 4 project in Hanoi capital will reach over VND 85,000 billion, the total investment capital of the Ring 3 project in Ho Chi Minh City will also reach over VND 75,000 billion.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The total investment of the Belt 4 project in Hanoi capital is over VND 85,000 billion

- Need more than VND 1.2 million billion to build the airport system in the period of 2021-2050

- Increase decentralization and decentralization for localities, improve the efficiency of disbursement of public investment capital

- Europe's largest economy is hard to avoid recession

- Strong interest rate hikes won't support the euro as the energy shock deepens

- JPY/USD exchange rate broke the 143 point

VN30

BANK

80,000

1D -3.26%

5D -4.76%

Buy Vol. 3,502,300

Sell Vol. 3,431,800

37,800

1D -5.62%

5D -5.50%

Buy Vol. 4,180,900

Sell Vol. 5,233,500

27,350

1D -3.19%

5D -3.19%

Buy Vol. 6,193,800

Sell Vol. 8,179,100

37,550

1D -2.85%

5D -3.59%

Buy Vol. 5,830,000

Sell Vol. 6,269,700

30,300

1D -3.50%

5D -4.72%

Buy Vol. 28,485,200

Sell Vol. 28,656,000

23,000

1D -2.75%

5D -3.16%

Buy Vol. 24,852,200

Sell Vol. 29,260,900

26,100

1D -2.25%

5D -2.25%

Buy Vol. 6,209,600

Sell Vol. 9,159,600

27,300

1D -2.50%

5D -2.50%

Buy Vol. 2,445,600

Sell Vol. 3,019,700

24,350

1D -1.42%

5D -1.81%

Buy Vol. 36,048,200

Sell Vol. 39,419,800

24,500

1D -0.41%

5D -2.00%

Buy Vol. 4,940,100

Sell Vol. 5,807,100

24,300

1D -1.42%

5D -1.42%

Buy Vol. 4,196,700

Sell Vol. 5,899,800

The State Bank of Vietnam (SBV) has just informed the media about the results of credit management and orientation in the last months of 2022. Accordingly, by August 26, 2022, credit increased by 9.91% compared to that of the end of 2022. at the end of 2021, is a high increase compared to the same period in recent years, in line with economic growth, business support and positive economic recovery in recent months. Credit structure focuses on production and business sectors, priority areas, while credit for potential risk areas is strictly controlled, in line with the direction of Directive 01.

REAL ESTATE

83,800

1D 2.07%

5D 2.32%

Buy Vol. 5,208,600

Sell Vol. 5,272,800

35,300

1D -2.49%

5D -4.59%

Buy Vol. 1,738,400

Sell Vol. 2,043,800

53,800

1D -2.18%

5D -2.54%

Buy Vol. 2,559,200

Sell Vol. 3,064,800

KDH: Negative cash flow, Khang Dien's KDH stock was excluded from the FTSE Vietnam Index.

OIL & GAS

112,000

1D -3.86%

5D -4.36%

Buy Vol. 1,222,400

Sell Vol. 1,437,000

14,000

1D -2.10%

5D 0.00%

Buy Vol. 30,591,700

Sell Vol. 40,936,500

40,000

1D -3.61%

5D -5.21%

Buy Vol. 3,462,100

Sell Vol. 3,811,400

The prices of two oil products, diesel and kerosene, are still higher than gasoline prices, which will negatively affect production and exploitation costs as well as the prices of consumer goods.

VINGROUP

62,500

1D -1.26%

5D -1.88%

Buy Vol. 1,958,400

Sell Vol. 2,341,000

59,500

1D -2.62%

5D -2.46%

Buy Vol. 2,510,400

Sell Vol. 3,546,200

27,650

1D -1.43%

5D -0.18%

Buy Vol. 2,926,400

Sell Vol. 3,217,500

VHM: Vinhomes Ocean Park 3 - The Crown (Vinhomes Dai An), an area of 294 hectares under construction, is likely to be opened for sale in the second half of this year.

FOOD & BEVERAGE

75,700

1D -2.70%

5D 0.26%

Buy Vol. 3,627,700

Sell Vol. 4,913,700

112,000

1D -2.61%

5D -2.18%

Buy Vol. 1,030,700

Sell Vol. 1,292,600

188,000

1D -0.32%

5D 0.05%

Buy Vol. 361,600

Sell Vol. 207,500

SAB: Sabeco officially launched the first coffee-flavored beer product line in Vietnam.

OTHERS

113,900

1D -4.85%

5D -6.33%

Buy Vol. 1,104,300

Sell Vol. 1,356,500

113,900

1D -4.85%

5D -6.33%

Buy Vol. 1,104,300

Sell Vol. 1,356,500

84,000

1D -2.10%

5D -3.00%

Buy Vol. 3,084,700

Sell Vol. 3,392,900

70,700

1D -3.02%

5D -4.46%

Buy Vol. 10,040,500

Sell Vol. 9,733,300

25,800

1D -0.39%

5D -2.09%

Buy Vol. 9,200,600

Sell Vol. 9,802,400

22,550

1D -5.05%

5D -6.04%

Buy Vol. 35,035,400

Sell Vol. 38,401,600

23,000

1D -2.34%

5D 0.00%

Buy Vol. 36,612,100

Sell Vol. 46,856,700

HPG: According to the consolidated financial statements after review, the Board of Directors of Hoa Phat Group did not receive remuneration in the first half of the year, while in the same period last year received VND 17.7 billion. Meanwhile, for the whole year of 2021, the remuneration for members of the Board of Directors is up to VND117.7 billion and in 2020 is VND24.2 billion.

Market by numbers

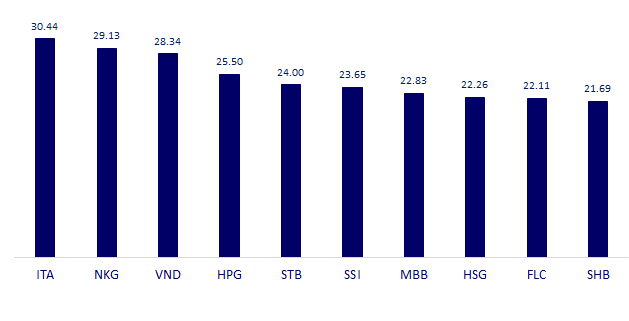

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

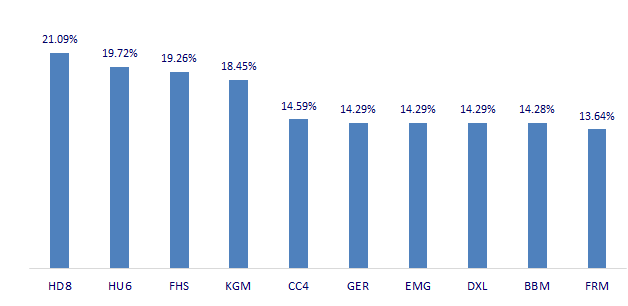

TOP INCREASES 3 CONSECUTIVE SESSIONS

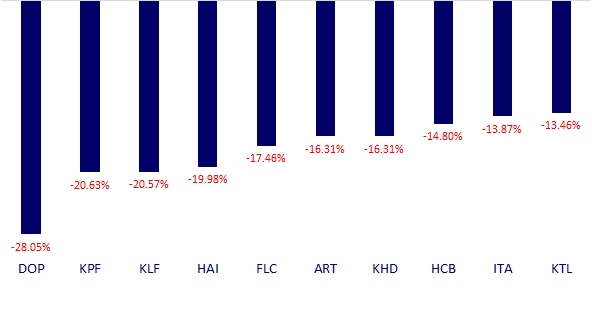

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.