Market brief 08/09/2022

VIETNAM STOCK MARKET

1,234.60

1D -0.69%

YTD -17.60%

1,265.57

1D -0.27%

YTD -17.59%

282.15

1D -0.67%

YTD -40.47%

90.31

1D -0.08%

YTD -19.85%

76.22

1D 0.00%

YTD 0.00%

16,715.36

1D -30.25%

YTD -46.20%

On HoSE, foreign investors ended a series of 7 consecutive net selling sessions with a net buying of VND74 billion, equivalent to a volume of 168,300 shares. Foreign investors on HoSE were the strongest net buyers of HPG with VND100 billion. Meanwhile, SSI was sold the most on this floor with VND35 billion.

ETF & DERIVATIVES

21,490

1D -1.42%

YTD -16.80%

15,000

1D -0.33%

YTD -17.08%

16,130

1D -9.43%

YTD -15.11%

20,960

1D 0.00%

YTD -8.47%

17,150

1D -3.65%

YTD -23.71%

26,760

1D -0.52%

YTD -4.60%

16,240

1D -1.10%

YTD -24.39%

1,250

1D -1.88%

YTD 0.00%

1,256

1D -1.84%

YTD 0.00%

1,260

1D -2.14%

YTD 0.00%

1,264

1D -2.01%

YTD 0.00%

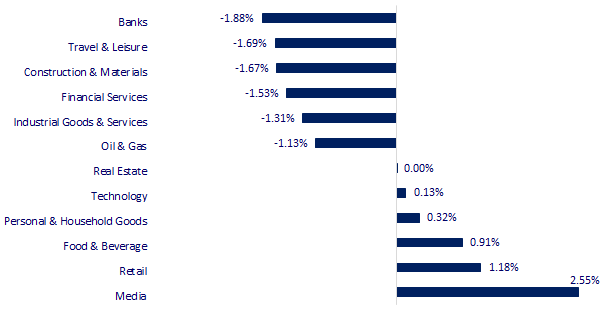

CHANGE IN PRICE BY SECTOR

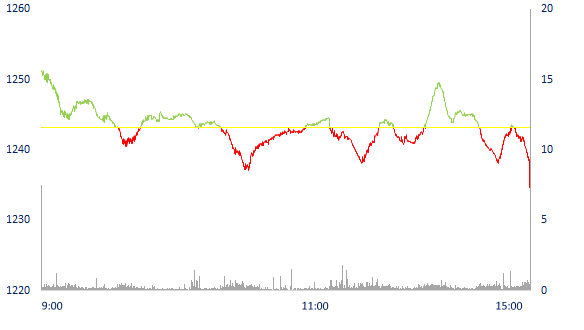

INTRADAY VNINDEX

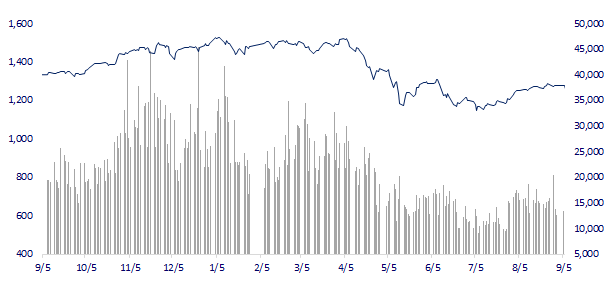

VNINDEX (12M)

GLOBAL MARKET

28,065.28

1D 0.63%

YTD -2.52%

3,235.59

1D -0.33%

YTD -11.10%

2,384.28

1D 0.33%

YTD -19.93%

18,854.62

1D -1.00%

YTD -19.42%

3,237.07

1D 0.82%

YTD 3.63%

1,641.71

1D 0.17%

YTD -0.96%

81.30

1D -1.72%

YTD 6.27%

1,730.45

1D 0.20%

YTD -4.96%

At the end of the session, the Asia - Pacific market was mixed. The Nikkei 225 (Japan) gained 0.63%, the Kospi (Korea) gained 0.33%, while the Shanghai Composite (China) fell 0.33%, the Hang Seng (Hong Kong) dropped 1%.

VIETNAM ECONOMY

5.71%

1D (bps) 50

YTD (bps) 490

5.60%

3.37%

1D (bps) 4

YTD (bps) 236

3.73%

1D (bps) -4

YTD (bps) 173

23,669

1D (%) -0.30%

YTD (%) 3.18%

24,259

1D (%) -0.21%

YTD (%) -8.35%

3,452

1D (%) -0.17%

YTD (%) -5.63%

According to the tax agency's report, the total state budget revenue in the eight months of 2022 managed by this agency is estimated at VND 1,002,874 billion, equaling 85.4% of the estimate, equaling 118.4% compared to the same period. In which, domestic revenue was estimated at VND 951,789 billion, equaling 83% of the estimate, equaling 115.9% over the same period.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- It is expected to "pour" nearly 1,400 billion into the Quang Ngai - Hoai Nhon highway in 2022

- Every year, 33,500 billion VND is needed to invest in the power grid system

- The Ministry of Transport supports the investment policy of Lai Chau Airport

- Apple's gamble when not increasing iPhone prices

- Foreign capital poured into stocks in Asian emerging economies highest in nearly 2 years

- Strong USD is spreading 'pain' globally

VN30

BANK

78,000

1D -2.50%

5D -7.14%

Buy Vol. 1,714,200

Sell Vol. 2,051,900

36,700

1D -2.91%

5D -8.25%

Buy Vol. 3,394,500

Sell Vol. 3,973,400

26,850

1D -1.83%

5D -4.96%

Buy Vol. 5,210,200

Sell Vol. 5,751,400

37,400

1D -0.40%

5D -3.98%

Buy Vol. 4,002,300

Sell Vol. 4,043,300

29,900

1D -1.32%

5D -5.97%

Buy Vol. 14,227,100

Sell Vol. 16,640,500

22,800

1D -0.87%

5D -4.00%

Buy Vol. 12,128,400

Sell Vol. 14,234,600

25,500

1D -2.30%

5D -4.49%

Buy Vol. 3,350,000

Sell Vol. 6,470,300

26,900

1D -1.47%

5D -3.93%

Buy Vol. 2,080,400

Sell Vol. 2,578,100

23,900

1D -1.85%

5D -3.63%

Buy Vol. 15,606,600

Sell Vol. 21,120,600

23,600

1D -3.67%

5D -5.60%

Buy Vol. 2,665,600

Sell Vol. 4,443,200

24,000

1D -1.23%

5D -2.64%

Buy Vol. 3,233,100

Sell Vol. 5,554,100

The State Bank of Vietnam (SBV) has issued Document No. 6221/NHNN-TD on promoting the implementation of the interest rate support program under Decree No. 31/2022/ND-CP. In particular, the State Bank of Vietnam requires commercial banks to review the list of existing customers who are eligible for interest rate support, industries, whose loans have signed loan agreements and disbursements from January 1, 2022, and a debt repayment date from May 20, 2022 to capture the need for support; notify and guide customers on dossiers and procedures for interest rate support according to regulations.

REAL ESTATE

85,000

1D 1.43%

5D 3.79%

Buy Vol. 6,326,300

Sell Vol. 8,141,600

35,500

1D 0.57%

5D -4.05%

Buy Vol. 974,900

Sell Vol. 1,148,700

54,000

1D 0.37%

5D -2.17%

Buy Vol. 2,196,300

Sell Vol. 2,181,700

The Ministry of Construction has just submitted to the Prime Minister for approval a project to build more than 1.8 million social housing houses for low-income people in the period 2021-2030.

OIL & GAS

111,800

1D -0.18%

5D -4.53%

Buy Vol. 748,700

Sell Vol. 740,800

13,700

1D -2.14%

5D -2.14%

Buy Vol. 29,057,500

Sell Vol. 42,526,000

39,800

1D -0.50%

5D -5.69%

Buy Vol. 2,111,400

Sell Vol. 2,219,300

Deputy Prime Minister: Consider reducing VAT and excise tax on gasoline.

VINGROUP

62,900

1D 0.64%

5D -1.26%

Buy Vol. 1,150,300

Sell Vol. 2,555,400

59,600

1D 0.17%

5D -2.30%

Buy Vol. 2,786,300

Sell Vol. 3,125,200

27,400

1D -0.90%

5D -1.08%

Buy Vol. 1,682,500

Sell Vol. 1,674,600

VIC: Vinpearl becomes a strategic partner of ShopeePay, promoting domestic tourism.

FOOD & BEVERAGE

75,700

1D 0.00%

5D 0.26%

Buy Vol. 2,334,900

Sell Vol. 2,526,400

115,000

1D 2.68%

5D 0.44%

Buy Vol. 731,900

Sell Vol. 925,800

191,700

1D 1.97%

5D 2.02%

Buy Vol. 323,400

Sell Vol. 279,000

Market breadth was in favor of the sellers but blue-chips MSN, VIC, SAB, NVL, MWG helped VN-Index to close the morning session in the green.

OTHERS

115,000

1D 0.97%

5D -5.43%

Buy Vol. 750,700

Sell Vol. 766,800

115,000

1D 0.97%

5D -5.43%

Buy Vol. 750,700

Sell Vol. 766,800

84,300

1D 0.36%

5D -2.66%

Buy Vol. 2,386,100

Sell Vol. 2,144,600

71,500

1D 1.13%

5D -3.38%

Buy Vol. 7,480,200

Sell Vol. 6,491,000

25,000

1D -3.10%

5D -5.12%

Buy Vol. 3,788,700

Sell Vol. 5,000,800

22,050

1D -2.22%

5D -8.13%

Buy Vol. 25,502,900

Sell Vol. 31,256,700

23,100

1D 0.43%

5D 0.43%

Buy Vol. 37,862,800

Sell Vol. 41,552,100

HPG: Hoa Phat Group has just announced that sales volume of construction steel, billet and hot rolled coil (HRC) in August reached 628,000 tons. In which, construction steel reached 386,000 tons, up 44% compared to the same period in 2021. HRC reached 233,000 tons, up 56% compared to July 2022 but slightly decreased compared to August 2021. The remaining about 9,000 tons is mixed steel, only a small part of the export volume in last year.

Market by numbers

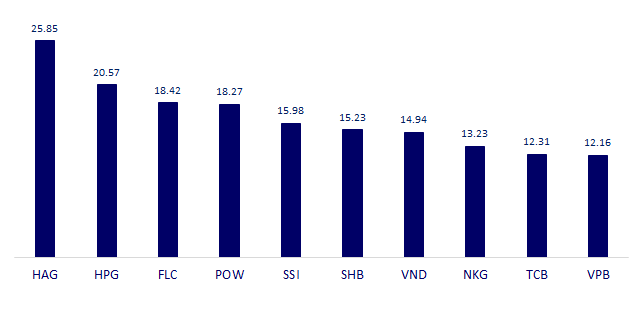

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

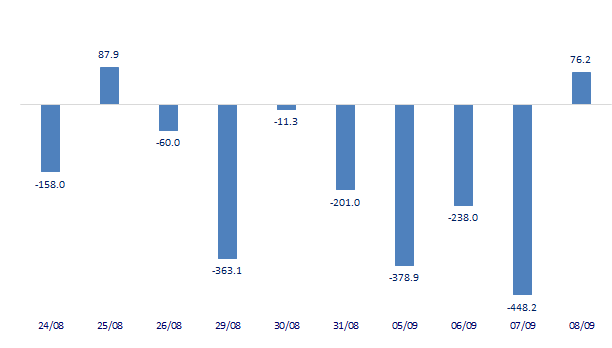

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

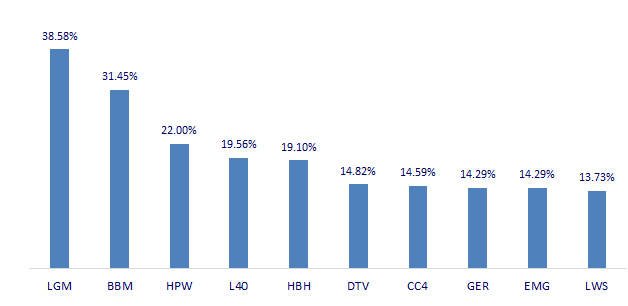

TOP INCREASES 3 CONSECUTIVE SESSIONS

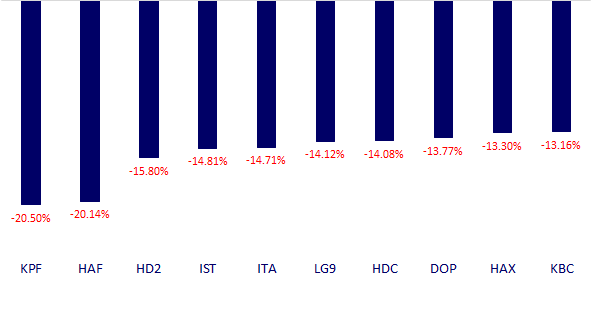

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.