Market brief 09/09/2022

VIETNAM STOCK MARKET

1,248.78

1D 1.15%

YTD -16.65%

1,275.64

1D 0.80%

YTD -16.93%

284.63

1D 0.88%

YTD -39.95%

90.64

1D 0.37%

YTD -19.56%

175.81

1D 0.00%

YTD 0.00%

16,150.75

1D -3.38%

YTD -48.02%

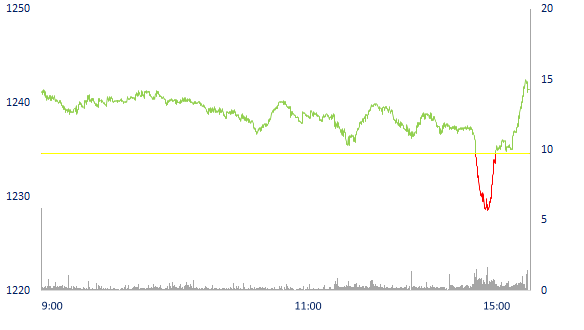

Strong demand at the end of the session pulled VN-Index up 14 points, foreign investors continued to net buy nearly VND200 billion. VN-30 group rebounded to more than 10 points, green color covered almost all stocks. Market leading stocks focused on industry groups such as steel and energy.

ETF & DERIVATIVES

21,540

1D 0.23%

YTD -16.61%

15,030

1D 0.20%

YTD -16.92%

16,020

1D -10.05%

YTD -15.68%

20,910

1D -0.24%

YTD -8.69%

17,600

1D 2.62%

YTD -21.71%

27,000

1D 0.90%

YTD -3.74%

16,290

1D 0.31%

YTD -24.16%

1,257

1D 0.56%

YTD 0.00%

1,260

1D 0.32%

YTD 0.00%

1,263

1D 0.22%

YTD 0.00%

1,275

1D 0.86%

YTD 0.00%

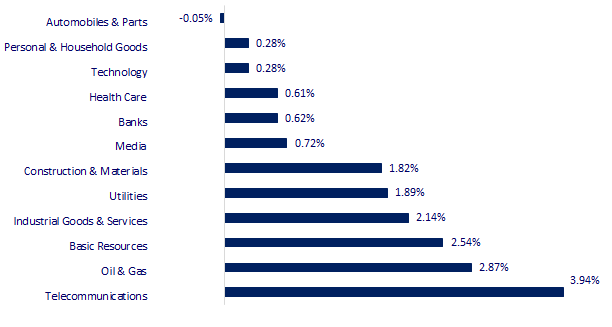

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

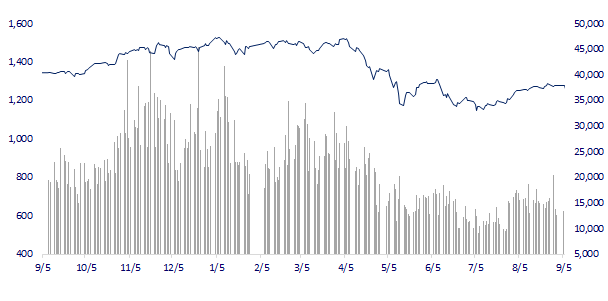

VNINDEX (12M)

GLOBAL MARKET

28,214.75

1D 0.53%

YTD -2.00%

3,262.05

1D 0.82%

YTD -10.38%

2,384.28

1D 0.00%

YTD -19.93%

19,362.25

1D 2.69%

YTD -17.25%

3,262.95

1D 0.80%

YTD 4.46%

1,655.69

1D 0.85%

YTD -0.12%

84.88

1D 4.40%

YTD 10.95%

1,738.85

1D 0.49%

YTD -4.50%

Asian stocks rallied in the last session of the week after US stocks rallied for a second straight session yesterday. The Nikkei 225 (Japan) gained 0.53%, the Shanghai Composite (China) gained 0.82%, the Hang Seng (Hong Kong) gained 2.69%.

VIETNAM ECONOMY

5.90%

1D (bps) 19

YTD (bps) 509

5.60%

3.35%

1D (bps) -2

YTD (bps) 234

3.71%

1D (bps) -2

YTD (bps) 171

23,661

1D (%) 0.00%

YTD (%) 3.14%

24,460

1D (%) 0.00%

YTD (%) -7.59%

3,468

1D (%) 0.00%

YTD (%) -5.19%

According to the Ministry of Planning and Investment (MPI), by the end of August 2022, the total foreign direct investment (FDI) registered for new, adjusted and contributed capital to buy shares of foreign investors Vietnam is estimated at nearly USD16.8 billion. In that general result, localities such as Hai Phong, Bac Ninh, Bac Giang, Vinh Phuc, Thai Nguyen... continue to emerge as bright spots in attracting this capital flow.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Overcoming Bangkok, Seoul, and Hanoi for the first time to be honored as Asia's leading tourist destination

- Bright spot to attract FDI

- Domestic individuals opening new securities accounts lowest since November 2021

- Europe meets to find a way out of the energy shock

- Fed: US economic outlook is weak but inflation is falling

- Russia will restrict individual investors from buying foreign stocks from "unfriendly" countries

VN30

BANK

78,800

1D 1.03%

5D -6.19%

Buy Vol. 1,647,200

Sell Vol. 1,466,000

37,000

1D 0.82%

5D -7.50%

Buy Vol. 2,350,900

Sell Vol. 2,286,800

26,850

1D 0.00%

5D -4.96%

Buy Vol. 4,002,500

Sell Vol. 4,600,500

37,650

1D 0.67%

5D -3.34%

Buy Vol. 4,616,000

Sell Vol. 4,497,300

30,500

1D 2.01%

5D -4.09%

Buy Vol. 25,266,100

Sell Vol. 25,007,800

22,700

1D -0.44%

5D -4.42%

Buy Vol. 13,154,800

Sell Vol. 15,155,400

25,800

1D 1.18%

5D -3.37%

Buy Vol. 3,259,600

Sell Vol. 4,916,600

27,000

1D 0.37%

5D -3.57%

Buy Vol. 1,717,100

Sell Vol. 2,573,600

23,750

1D -0.63%

5D -4.23%

Buy Vol. 33,426,800

Sell Vol. 42,556,800

23,600

1D 0.00%

5D -5.60%

Buy Vol. 7,089,900

Sell Vol. 6,858,600

24,000

1D 0.00%

5D -2.64%

Buy Vol. 3,236,000

Sell Vol. 4,538,100

VCB: After being allowed by the State Bank to increase the maximum credit balance by 2.7%, Vietcombank will continue to control credit growth in essential sectors and industries of the economy, which is priority areas of the Government, control liquidity and credit risk well, ensure that the bad debt ratio is controlled at a low level, maintain the level of interest rates on capital mobilization, lending rates, ensure reasonable level, supporting the process of economic recovery and development as well as the recovery and development of enterprises.

REAL ESTATE

84,700

1D -0.35%

5D 3.42%

Buy Vol. 2,545,400

Sell Vol. 4,496,500

35,500

1D 0.00%

5D -4.05%

Buy Vol. 1,219,200

Sell Vol. 1,275,000

53,500

1D -0.93%

5D -3.08%

Buy Vol. 2,007,600

Sell Vol. 2,191,800

According to expert Savills, Hanoi's housing market recorded a decrease in supply and transaction volume, while house prices continued to increase from previous years.

OIL & GAS

114,000

1D 1.97%

5D -2.65%

Buy Vol. 774,700

Sell Vol. 690,900

14,050

1D 2.55%

5D 0.36%

Buy Vol. 36,168,600

Sell Vol. 37,832,600

40,200

1D 1.01%

5D -4.74%

Buy Vol. 1,284,600

Sell Vol. 1,210,000

European gas prices have dropped 42.4% from August's record

VINGROUP

64,400

1D 2.38%

5D 1.10%

Buy Vol. 1,961,200

Sell Vol. 2,607,200

59,900

1D 0.50%

5D -1.80%

Buy Vol. 2,260,000

Sell Vol. 2,996,200

27,500

1D 0.36%

5D -0.72%

Buy Vol. 2,050,900

Sell Vol. 2,046,200

VHM: Vinhomes has launched a commitment to sub-lease The Beverly apartment with a fixed rate of 7% per year on the selling price of the apartment.

FOOD & BEVERAGE

75,900

1D 0.26%

5D 0.53%

Buy Vol. 1,971,700

Sell Vol. 2,430,200

116,100

1D 0.96%

5D 1.40%

Buy Vol. 747,300

Sell Vol. 1,043,200

193,800

1D 1.10%

5D 3.14%

Buy Vol. 429,600

Sell Vol. 372,700

MSN: Masan Group launched the WINLife ecosystem with the first chain of 27 multi-convenience stores to fully meet the essential needs of consumers with a convenient experience.

OTHERS

118,000

1D 2.61%

5D -2.96%

Buy Vol. 585,400

Sell Vol. 767,300

118,000

1D 2.61%

5D -2.96%

Buy Vol. 585,400

Sell Vol. 767,300

84,300

1D 0.00%

5D -2.66%

Buy Vol. 1,933,100

Sell Vol. 2,298,800

72,000

1D 0.70%

5D -2.70%

Buy Vol. 6,065,100

Sell Vol. 4,936,600

25,350

1D 1.40%

5D -3.80%

Buy Vol. 6,559,100

Sell Vol. 5,754,600

22,200

1D 0.68%

5D -7.50%

Buy Vol. 71,249,500

Sell Vol. 51,967,800

23,800

1D 3.03%

5D 3.48%

Buy Vol. 52,529,700

Sell Vol. 48,438,200

FPT: The new office of FPT Software is located at Kongens Lyngby - the regional commercial center north of Copenhagen, the capital of Denmark. This is also the area where many big shopping stores of the city are located, chosen by many large businesses and organizations to set up their offices such as COWI A/S, Bang & Olufsen, ICEpower.

Market by numbers

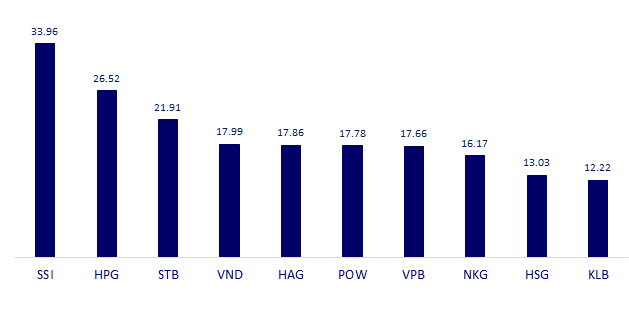

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

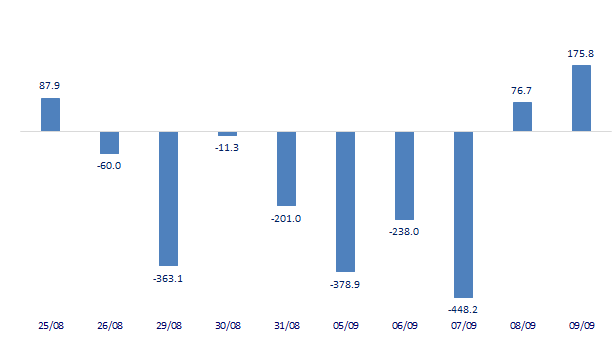

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

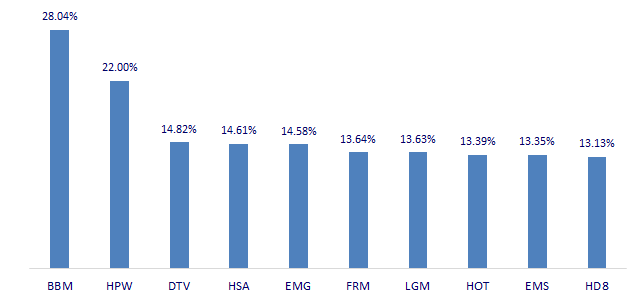

TOP INCREASES 3 CONSECUTIVE SESSIONS

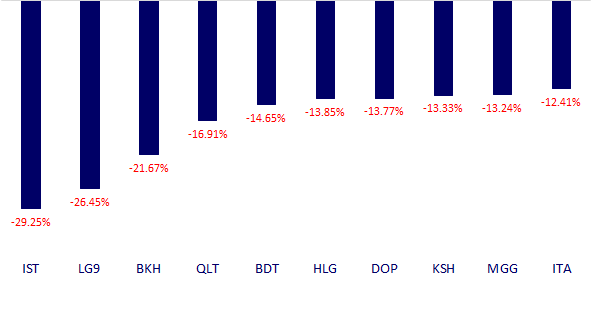

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.