Morning brief 12/09/2022

GLOBAL MARKET

32,151.71

1D 1.19%

YTD -11.67%

4,067.36

1D 1.53%

YTD -14.89%

12,112.31

1D 2.11%

YTD -23.06%

22.79

1D -3.47%

7,351.07

1D -0.40%

YTD -0.70%

13,088.21

1D 0.02%

YTD -17.61%

6,212.33

1D -0.28%

YTD -13.40%

85.34

1D 4.97%

YTD 11.56%

1,727.40

1D -0.18%

YTD -5.13%

US stocks rallied on Friday (September 9) as Wall Street closed a strong week, recovering from a decline caused by the US Federal Reserve (Fed). Ending Friday's session, the Dow Jones index advanced 377.19 points (or 1.19%) to 32,151.71 points. The S&P 500 rose 1.53% to 4,067.36 and the Nasdaq Composite added 2.11% to 12,112.31 points.

VIETNAM ECONOMY

5.90%

1D (bps) 19

YTD (bps) 509

5.60%

3.35%

1D (bps) -2

YTD (bps) 234

3.71%

1D (bps) -2

YTD (bps) 171

23,665

1D (%) 0.02%

YTD (%) 3.16%

24,464

1D (%) 0.02%

YTD (%) -7.57%

3,466

1D (%) -0.06%

YTD (%) -5.25%

The Ministry of Finance completes the draft circular stipulating the collection rates of a number of fees and charges in the field of transportation, of which, some amounts are proposed to be reduced by 50%. Specifically, the expected fee is the tonnage fee of ships and boats for domestic maritime activities, which is expected to be 80% of the toll rate specified in Clause 1, Article 12, Chapter III of the Schedule of maritime fees and charges. for inland navigation.

VIETNAM STOCK MARKET

1,248.78

1D 1.15%

YTD -16.65%

1,275.64

1D 0.80%

YTD -16.93%

284.63

1D 0.88%

YTD -39.95%

90.64

1D 0.37%

YTD -19.56%

175.81

16,150.75

1D -3.38%

YTD -48.02%

Domestic individual investors had the 3rd consecutive week of net buying with the value down 18% from the previous week and reaching 614b dong, of which 470b dong came from order matching transactions. They were the strongest net buyers of NVL with a value of VND 263b. After that, STB was also net bought 184b dong. Both SSI and KDH had a net buying value of over 100b dong

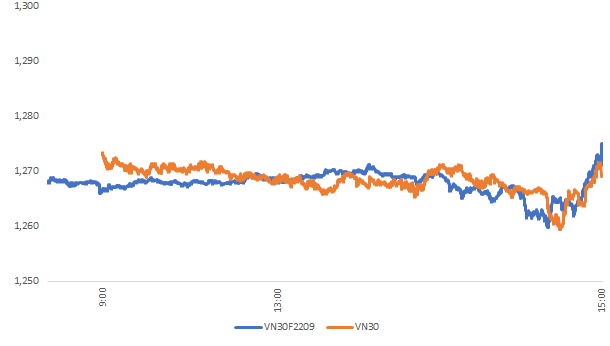

INTRADAY

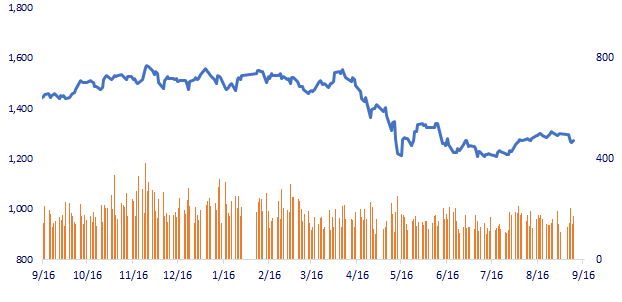

VN30 (12M)

SELECTED NEWS

- Proposal to reduce 50% of some fees in the transportation sector

- Hanoi requires commitment to disbursement progress of public investment capital

- More than 16,700 billion VND to build Ho Chi Minh City - Moc Bai highway

- Finance Minister Yellen: The US economy faces the risk of recession

- G7 will seek more allies before deciding to impose a ceiling on Russian oil prices

- The US publishes guidance on imposing price ceilings on oil and gas from Russia

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.