Market brief 13/09/2022

VIETNAM STOCK MARKET

1,248.40

1D -0.10%

YTD -16.68%

1,272.48

1D -0.24%

YTD -17.14%

281.59

1D -0.53%

YTD -40.59%

90.40

1D 0.17%

YTD -19.77%

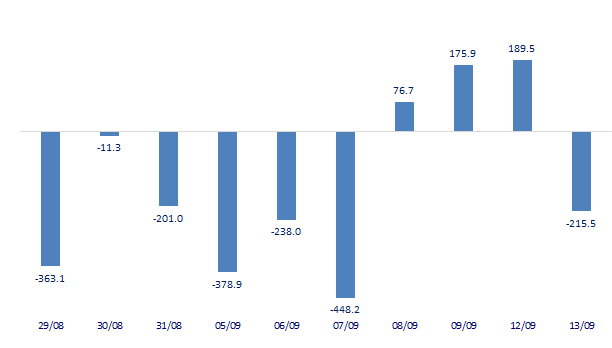

-215.51

1D 0.00%

YTD 0.00%

14,733.85

1D 15.12%

YTD -52.58%

Foreign investors net sold again 215.51 billion dong on September 13. Foreign investors on HoSE were the strongest net buyers of DGC with 76 billion dong. PVD and HPG were net bought 72 billion dong and 34 billion dong respectively. On the other side, SSI was sold the most on this floor with 106 billion dong. ETF certificates FUEVFVND were also net sold 59 billion dong.

ETF & DERIVATIVES

21,630

1D -0.32%

YTD -16.26%

15,010

1D -0.27%

YTD -17.03%

15,810

1D -11.23%

YTD -16.79%

20,700

1D -4.56%

YTD -9.61%

17,400

1D 1.75%

YTD -22.60%

27,200

1D 0.82%

YTD -3.03%

16,390

1D -0.18%

YTD -23.70%

1,260

1D -0.01%

YTD 0.00%

1,263

1D -0.15%

YTD 0.00%

1,267

1D -0.12%

YTD 0.00%

1,272

1D -0.51%

YTD 0.00%

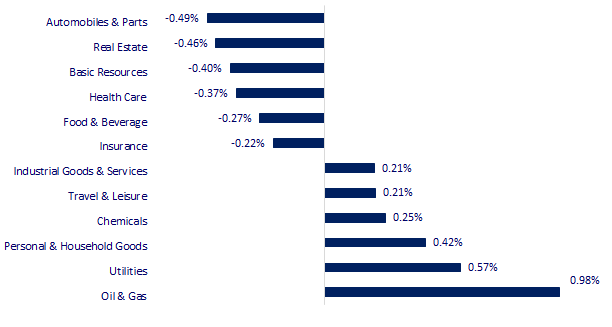

CHANGE IN PRICE BY SECTOR

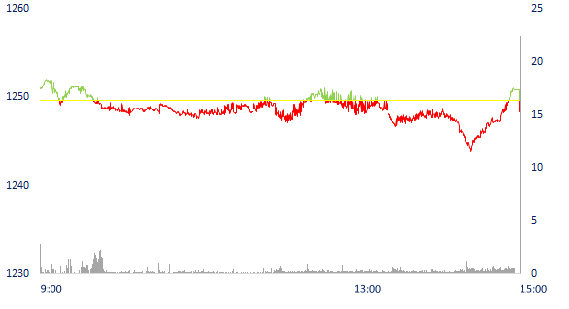

INTRADAY VNINDEX

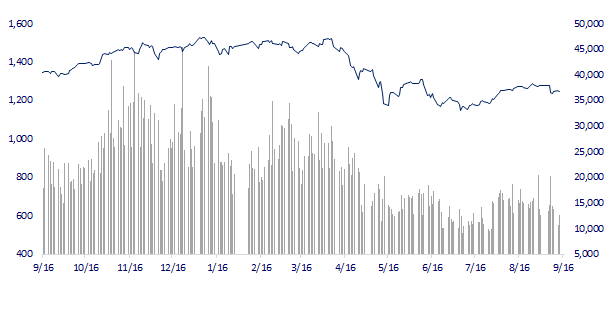

VNINDEX (12M)

GLOBAL MARKET

28,614.63

1D 0.01%

YTD -0.62%

3,263.80

1D 0.05%

YTD -10.33%

2,449.54

1D 2.74%

YTD -17.74%

19,326.86

1D -0.01%

YTD -17.40%

3,290.08

1D 0.47%

YTD 5.33%

1,661.09

1D -0.28%

YTD 0.21%

88.93

1D 2.44%

YTD 16.25%

1,739.05

1D 0.43%

YTD -4.49%

Asian stocks mostly rallied in the September 13 session ahead of the US August inflation report. In South Korea, the Kospi rose 2.74% to 2,449.54 in the first trading session after the holiday. Japan's Nikkei 225 index rose 0.01% to 28,614.63 points.

VIETNAM ECONOMY

4.29%

1D (bps) -33

YTD (bps) 348

5.60%

3.34%

1D (bps) -1

YTD (bps) 233

3.68%

1D (bps) -3

YTD (bps) 168

23,775

1D (%) 0.46%

YTD (%) 3.64%

24,377

1D (%) -0.79%

YTD (%) -7.90%

3,469

1D (%) 0.09%

YTD (%) -5.17%

The Ministry of Finance said that in 8M2022, the balance between the central budget and local budgets was guaranteed. State budget is surplus VND251,800 billion, the highest in recent months. According to a report of the Ministry of Finance, the total state budget revenue in 8 months reached VND1.28 million billion, up 19.4%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In 8 months, Vietnam has a trade deficit of 2.2 million tons of iron and steel

- Total state budget revenue in 8 months increased by 19.4%

- Rice exports confidently 'finish' USD3.3 billion

- EU builds USD13 billion pipeline to replace Russian gas

- China has a pork crisis

- The decline in foreign exchange reserves creates challenges for Asian central banks

VN30

BANK

78,600

1D -0.63%

5D -4.96%

Buy Vol. 1,689,900

Sell Vol. 1,800,600

36,800

1D -0.27%

5D -8.11%

Buy Vol. 1,508,900

Sell Vol. 1,807,600

27,500

1D 1.66%

5D -2.65%

Buy Vol. 4,246,200

Sell Vol. 4,643,600

37,300

1D -0.53%

5D -3.49%

Buy Vol. 2,762,600

Sell Vol. 3,131,800

30,500

1D 0.16%

5D -2.87%

Buy Vol. 11,343,200

Sell Vol. 13,406,800

22,550

1D -0.22%

5D -4.65%

Buy Vol. 9,103,800

Sell Vol. 9,273,100

25,900

1D 0.97%

5D -3.00%

Buy Vol. 1,535,900

Sell Vol. 2,114,300

26,850

1D -0.37%

5D -4.11%

Buy Vol. 1,692,100

Sell Vol. 2,140,500

23,050

1D -0.22%

5D -6.68%

Buy Vol. 14,491,600

Sell Vol. 11,839,600

23,350

1D 0.00%

5D -5.08%

Buy Vol. 2,167,800

Sell Vol. 2,251,000

23,800

1D 0.21%

5D -3.45%

Buy Vol. 2,897,700

Sell Vol. 4,345,900

12 Vietnamese banks have just been upgraded their credit rating by Moody's after this organization raised Vietnam's national rating from Ba3 to Ba2. The banks updated this time are ABB, VCB, BID, LPB, OCB, SHB, SSB, TPB, Agribank, VIB, CTG and MSB

REAL ESTATE

83,500

1D -0.48%

5D 1.71%

Buy Vol. 4,395,800

Sell Vol. 4,232,300

35,800

1D 0.00%

5D -1.10%

Buy Vol. 1,569,800

Sell Vol. 2,798,200

51,800

1D -3.36%

5D -5.82%

Buy Vol. 2,151,700

Sell Vol. 2,317,800

KDH: through Saphire Real Estate Business Investment Co., Ltd (KDH owns 99.9% of shares) agrees to dissolve Nam Thong (a subsidiary of Saphire with 99.9% ownership).

OIL & GAS

114,200

1D 0.44%

5D -1.97%

Buy Vol. 478,000

Sell Vol. 762,500

14,150

1D 0.35%

5D -1.05%

Buy Vol. 30,678,500

Sell Vol. 33,673,000

40,100

1D -0.37%

5D -3.37%

Buy Vol. 1,214,100

Sell Vol. 1,803,600

PLX has dropped nearly 37% from the highest level since the beginning of the year after the domestic gasoline price has continuously plummeted to the lowest level

VINGROUP

64,100

1D 0.16%

5D 1.26%

Buy Vol. 1,397,700

Sell Vol. 2,189,600

60,700

1D -1.14%

5D -0.65%

Buy Vol. 2,944,000

Sell Vol. 4,465,300

28,350

1D -1.39%

5D 1.07%

Buy Vol. 2,686,000

Sell Vol. 4,388,300

VRE: This year, on average, the occupancy rate of shopping malls remained stable at 82.5% in Q2, is expected to increase to 82.6% in Q3 and continue to increase to 85.5% in Q4

FOOD & BEVERAGE

75,700

1D 0.53%

5D -2.70%

Buy Vol. 2,479,800

Sell Vol. 2,848,900

114,000

1D -0.87%

5D -0.87%

Buy Vol. 881,400

Sell Vol. 1,038,600

191,000

1D -2.05%

5D 1.27%

Buy Vol. 221,100

Sell Vol. 289,100

MSN: Currently, MSN is operating a high-tech pig farm in Nghe An with a scale of 223ha, with a capacity of 250,000 live pigs/year; and 2 meat processing complexes in Ha Nam and Long An

OTHERS

117,400

1D -0.09%

5D -1.92%

Buy Vol. 670,500

Sell Vol. 951,500

117,400

1D -0.09%

5D -1.92%

Buy Vol. 670,500

Sell Vol. 951,500

84,600

1D 0.00%

5D -1.40%

Buy Vol. 1,799,400

Sell Vol. 2,347,500

74,100

1D 0.14%

5D 1.65%

Buy Vol. 4,552,200

Sell Vol. 5,731,800

25,050

1D 0.20%

5D -3.28%

Buy Vol. 3,723,700

Sell Vol. 3,423,000

21,650

1D -0.92%

5D -8.84%

Buy Vol. 36,935,700

Sell Vol. 34,149,000

23,700

1D -0.42%

5D 0.64%

Buy Vol. 26,549,600

Sell Vol. 35,466,800

VJC: has just approved the private placement of 34.8 million shares to 100 professional securities investors. The above shares equal 6.43% of the outstanding shares, will be restricted from transferring within 1 year, will be issued this year or next year.

Market by numbers

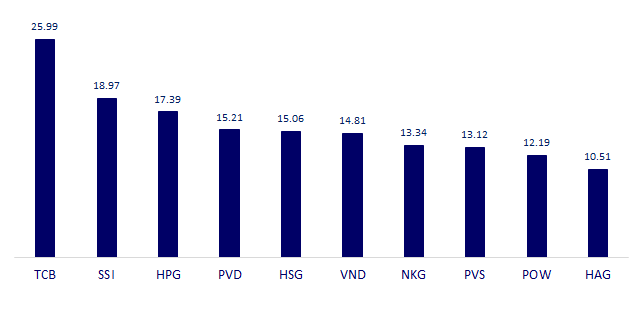

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

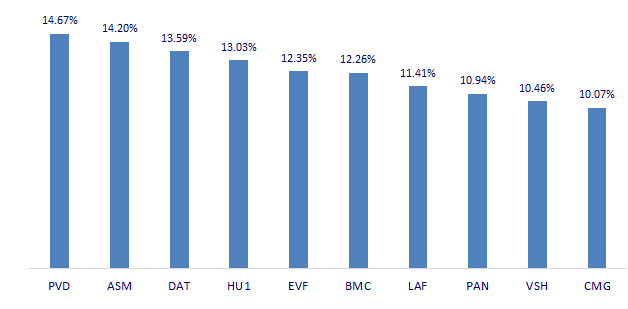

TOP INCREASES 3 CONSECUTIVE SESSIONS

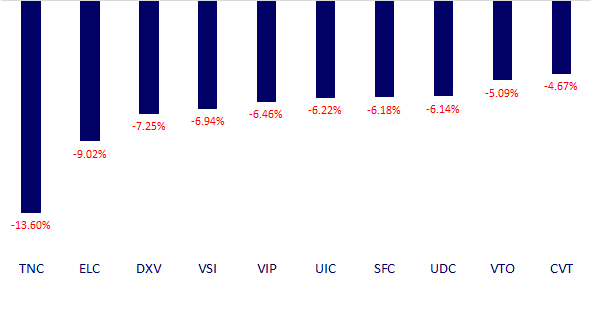

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.