Market Brief 22/09/2022

VIETNAM STOCK MARKET

1,214.70

1D 0.34%

YTD -18.93%

1,228.94

1D 0.06%

YTD -19.98%

265.64

1D 0.21%

YTD -43.96%

88.55

1D 0.36%

YTD -21.41%

-486.75

1D 0.00%

YTD 0.00%

13,522.01

1D 20.19%

YTD -56.48%

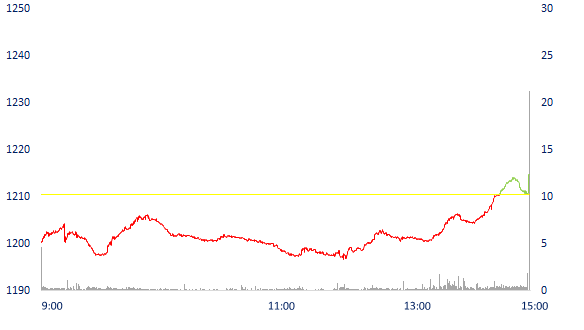

Vietnam's stock market in the morning session of September 22 did not react positively to the move to raise interest rates by 0.75%. However, the afternoon session of the market gradually became more positive, VN-Index increased by more than 4 points. VN30 stocks recorded an overwhelming gain with 17 gainers. Typically, SSI, VIB, GAS, GVR, POW, BID increased well with a margin of over 1%.

ETF & DERIVATIVES

20,820

1D 0.48%

YTD -19.40%

14,480

1D -0.14%

YTD -19.96%

15,150

1D -14.94%

YTD -20.26%

20,000

1D -1.23%

YTD -12.66%

16,260

1D -1.33%

YTD -27.67%

26,110

1D -0.08%

YTD -6.92%

15,990

1D 1.27%

YTD -25.56%

1,218

1D 0.19%

YTD 0.00%

1,220

1D 0.25%

YTD 0.00%

1,219

1D 0.16%

YTD 0.00%

1,225

1D 0.44%

YTD 0.00%

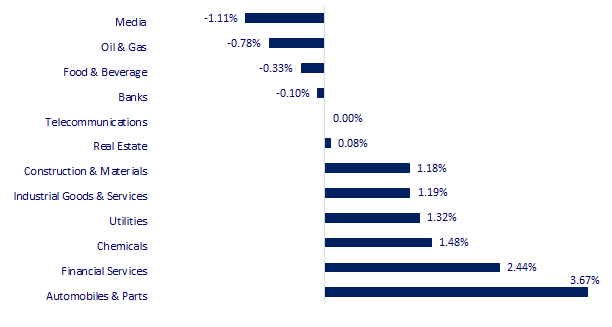

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

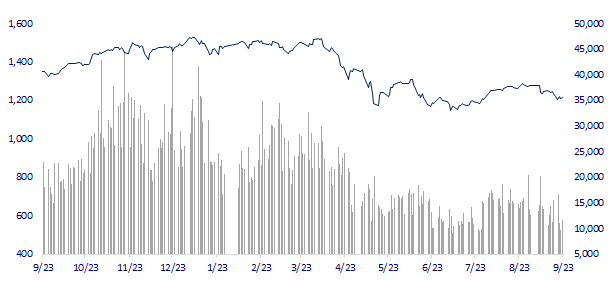

VNINDEX (12M)

GLOBAL MARKET

27,153.83

1D 0.31%

YTD -5.69%

3,108.91

1D -0.27%

YTD -14.59%

2,332.31

1D -0.63%

YTD -21.67%

18,147.95

1D -1.61%

YTD -22.44%

3,263.07

1D 0.04%

YTD 4.46%

1,646.49

1D 0.80%

YTD -0.67%

83.50

1D 1.21%

YTD 9.15%

1,678.25

1D 0.72%

YTD -7.83%

Asian stocks fell after the US Federal Reserve (Fed) announced the third largest interest rate hike in a row and signaled similar adjustments in the future. The Kospi index lost 0.63% (14.9 points) and closed at 2,332.31 points. The Hang Seng Index dropped 1.61% (296.67 points) to 18,147.95 points

VIETNAM ECONOMY

4.68%

1D (bps) 7

YTD (bps) 387

5.60%

3.73%

1D (bps) 19

YTD (bps) 272

4.14%

1D (bps) 24

YTD (bps) 214

23,845

1D (%) 0.04%

YTD (%) 3.95%

24,139

1D (%) 0.60%

YTD (%) -8.80%

3,419

1D (%) -0.35%

YTD (%) -6.53%

At the Government meeting on September 22, the Prime Minister gave instructions after the Fed raised interest rates, asking the State Bank to study and increase the operating and mobilizing interest rates but keeping the lending interest rates stable. The Prime Minister emphasized that the goal is to prioritize stabilizing the macro-economy, controlling inflation, promoting growth, and ensuring major balances.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Many Japanese enterprises have plans to expand investment in Vietnam

- Operating beyond capacity, Dung Quat oil refinery contributes to ensuring gasoline supply for the domestic market

- Many thermal power plants are in short supply of coal fuel

- BoJ decides to maintain super-loose monetary policy, Japanese Yen plunges again

- Iron ore prices in China close to 9-month low

- Fed raises interest rates, US may have a deficit of $2.1 trillion

VN30

BANK

78,000

1D -1.14%

5D -1.52%

Buy Vol. 1,804,500

Sell Vol. 1,783,000

35,150

1D 1.15%

5D -1.68%

Buy Vol. 2,754,900

Sell Vol. 1,905,300

25,400

1D -0.59%

5D -5.58%

Buy Vol. 6,239,800

Sell Vol. 4,575,200

34,550

1D 0.14%

5D -5.60%

Buy Vol. 5,753,300

Sell Vol. 4,115,100

29,300

1D -0.68%

5D -3.30%

Buy Vol. 16,285,700

Sell Vol. 16,911,400

21,250

1D 0.24%

5D -4.06%

Buy Vol. 10,898,900

Sell Vol. 8,860,800

24,700

1D 0.00%

5D -1.79%

Buy Vol. 1,684,600

Sell Vol. 1,392,400

25,350

1D 0.40%

5D -4.52%

Buy Vol. 1,276,400

Sell Vol. 1,056,700

21,950

1D 0.92%

5D -4.77%

Buy Vol. 13,657,600

Sell Vol. 8,564,000

22,500

1D 2.27%

5D -2.17%

Buy Vol. 3,031,800

Sell Vol. 1,991,500

22,800

1D 0.88%

5D -3.18%

Buy Vol. 3,763,100

Sell Vol. 3,090,400

TCB: International credit rating agency Moody's Investor Service (Moody's) upgraded Techcombank's credit rating to Ba1, stable outlook. Moody's said the upgrade reflects the bank's reputation level. Previously, Techcombank's credit rating was limited by Vietnam's national credit rating ceiling of "Ba3". According to Moody's, capital and profitability are outstanding strengths of TCB. The ratio of tangible capital to risky assets adjusted by Moody's reached 13.6% at the end of 2021, among the highest among Vietnamese banks rated by Moody's

REAL ESTATE

84,600

1D 0.00%

5D -0.82%

Buy Vol. 5,263,100

Sell Vol. 4,378,200

31,450

1D 0.00%

5D -11.41%

Buy Vol. 6,480,000

Sell Vol. 5,631,500

51,600

1D 0.00%

5D 0.58%

Buy Vol. 1,859,800

Sell Vol. 1,865,400

Savills report: real estate in the South Industrial Park has an occupancy rate of 84%. Industrial zones in the North, the occupancy rate reached 83% and there was only about 2,000 hectares left.

OIL & GAS

111,000

1D 1.83%

5D -0.72%

Buy Vol. 485,000

Sell Vol. 701,900

13,650

1D 1.49%

5D -5.54%

Buy Vol. 28,325,600

Sell Vol. 23,097,700

37,550

1D -0.92%

5D -4.45%

Buy Vol. 2,515,600

Sell Vol. 2,518,400

On September 21, the price of gasoline E5 RON 92 decreased by 450 VND/liter, to the price of 21,780 VND/liter; RON 95 gasoline price decreased by 630 VND/liter, to 22,580 VND/liter

VINGROUP

63,300

1D 0.32%

5D -0.94%

Buy Vol. 3,264,500

Sell Vol. 3,412,300

57,700

1D -1.03%

5D -4.63%

Buy Vol. 3,888,100

Sell Vol. 3,571,600

28,650

1D 0.17%

5D -0.69%

Buy Vol. 1,552,900

Sell Vol. 2,039,200

VHM: Vinhomes Ocean Park 3 - The Crown is the next piece in the 1,200-hectare super complex of real estate developer Vinhomes, which will launch at the end of Q3/2022 - the beginning of Q4/2022

FOOD & BEVERAGE

76,900

1D 0.00%

5D 3.22%

Buy Vol. 1,860,100

Sell Vol. 2,508,900

110,000

1D -1.79%

5D -1.79%

Buy Vol. 794,500

Sell Vol. 938,300

187,000

1D -0.53%

5D 0.92%

Buy Vol. 137,900

Sell Vol. 221,200

VNM: Brand Finance announced the top 50 most valuable brands in Vietnam, an increase of 36% compared to 2021. VNM - the industry leader, and ranked 3rd in the rankings with a value growth of 18%

OTHERS

115,000

1D 0.00%

5D -0.86%

Buy Vol. 692,700

Sell Vol. 734,100

115,000

1D 0.00%

5D -0.86%

Buy Vol. 692,700

Sell Vol. 734,100

82,900

1D 0.73%

5D -0.96%

Buy Vol. 2,536,700

Sell Vol. 2,089,700

70,100

1D 0.14%

5D -5.14%

Buy Vol. 8,026,800

Sell Vol. 7,287,600

23,600

1D 1.51%

5D -7.45%

Buy Vol. 3,206,000

Sell Vol. 2,204,000

21,100

1D 2.68%

5D -2.54%

Buy Vol. 42,086,800

Sell Vol. 29,091,800

23,000

1D 0.44%

5D -2.54%

Buy Vol. 23,551,000

Sell Vol. 19,268,400

SSI: On September 22, 28 new covered warrants issued by SSI at the end of August were officially listed on HOSE. Specifically, the warrants issued and listed by SSI this time are based on 12 bluechips, representatives of the banking industry (ACB, MBB, STB, TCB, TPB, VPB), real estate and building materials (VHM) , KDH and HPG) and retail group (FPT, MWG, VRE). This is SSI's largest warrant issuance ever

Market by numbers

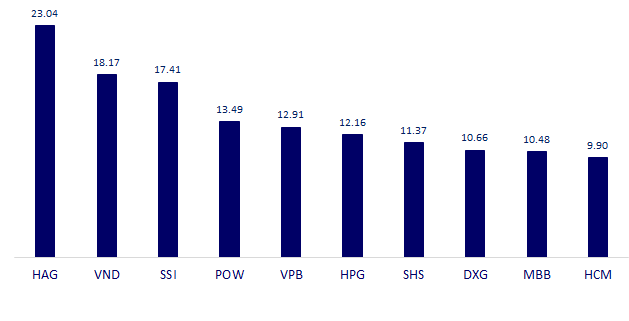

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

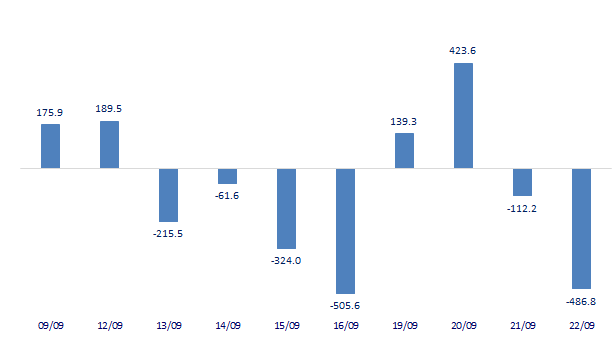

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

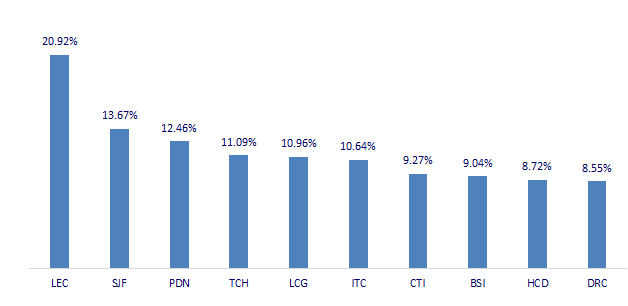

TOP INCREASES 3 CONSECUTIVE SESSIONS

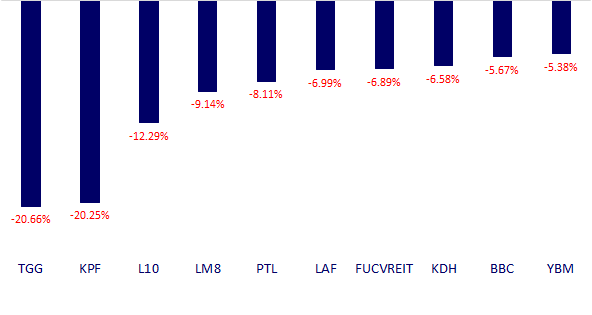

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.