Market Brief 26/09/2022

VIETNAM STOCK MARKET

1,174.35

1D -2.40%

YTD -21.62%

1,187.22

1D -2.32%

YTD -22.69%

255.68

1D -3.31%

YTD -46.06%

86.68

1D -2.16%

YTD -23.07%

-555.11

1D 0.00%

YTD 0.00%

20,089.27

1D 51.92%

YTD -35.35%

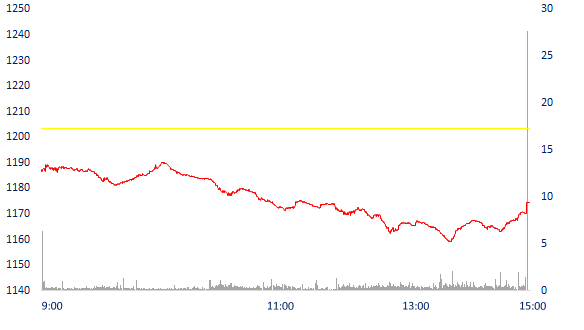

VN-Index continued the downward correction, a series of large-cap stocks were sold strongly today. Up to 27/30 stocks declined in the VN30 basket, of which 16 stocks fell below 2%. VIB and GAS recorded green color of about 1%, but the contribution to the market was not too significant. In the whole market, there were 874 stocks that decreased, of which 73 stocks fell in full range.

ETF & DERIVATIVES

20,270

1D -2.64%

YTD -21.53%

14,000

1D -2.71%

YTD -22.61%

14,640

1D -17.80%

YTD -22.95%

19,750

1D -0.75%

YTD -13.76%

15,410

1D -3.26%

YTD -31.45%

25,160

1D -2.10%

YTD -10.30%

15,480

1D -1.78%

YTD -27.93%

1,189

1D -2.03%

YTD 0.00%

1,190

1D -1.35%

YTD 0.00%

1,184

1D -1.70%

YTD 0.00%

1,192

1D -1.49%

YTD 0.00%

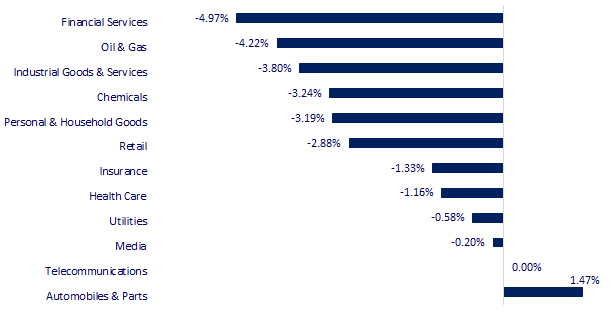

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

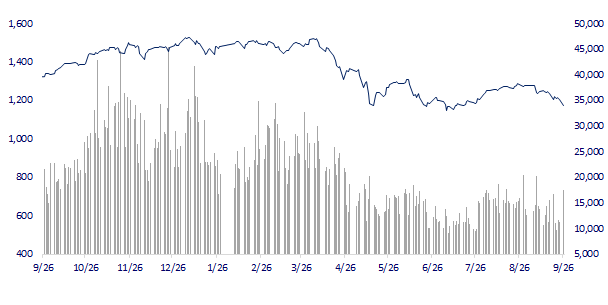

VNINDEX (12M)

GLOBAL MARKET

26,431.55

1D -0.54%

YTD -8.20%

3,051.23

1D -1.20%

YTD -16.17%

2,220.94

1D -3.02%

YTD -25.41%

17,855.14

1D -0.44%

YTD -23.69%

3,181.97

1D -1.55%

YTD 1.87%

1,621.25

1D -0.74%

YTD -2.19%

78.42

1D -0.81%

YTD 2.51%

1,649.15

1D 0.28%

YTD -9.43%

Asian stocks continued to fall sharply as the negative sentiment still weighed on the market. In Japan, the Nikkei 225 index fell 0.54% to 26,431.55 points. In South Korea, the Kospi index fell 3.02% to 2,220.94 points. Hong Kong's Hang Seng Index lost 0.44% in last trading hour

VIETNAM ECONOMY

4.89%

1D (bps) 21

YTD (bps) 408

5.60%

4.03%

1D (bps) 15

YTD (bps) 302

4.36%

1D (bps) 12

YTD (bps) 236

23,861

1D (%) 0.03%

YTD (%) 4.01%

23,609

1D (%) -0.32%

YTD (%) -10.80%

3,381

1D (%) -0.47%

YTD (%) -7.57%

The remarkable reaction in the first session of the domestic market to receive the Fed's decision to raise interest rates was that the interbank rate closed up 43 dong compared to the last session of the previous week, at 23,712 dong/USD. On the morning of September 26, the central exchange rate continued to increase by 10 VND compared to the previous session, to 23,334 VND/USD. This is the third consecutive increase of the central rate

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Disbursement of foreign investment capital continued to increase strongly, reaching 15.4 billion USD in 9 months

- 8M/2022, automobile import turnover reached 2.25 billion USD

- 9 months, disbursement of public investment is higher than the same period of more than 34,597 billion dong

- British Pound loses record value, towards parity with USD

- China establishes $4.2 billion fund to buy real estate

- The won has lost a record since the global financial crisis in 2009

VN30

BANK

75,000

1D -1.19%

5D -4.82%

Buy Vol. 1,961,200

Sell Vol. 2,257,600

33,400

1D -3.88%

5D -2.34%

Buy Vol. 3,603,200

Sell Vol. 3,693,200

23,500

1D -6.00%

5D -7.84%

Buy Vol. 9,677,800

Sell Vol. 9,772,300

33,250

1D -2.78%

5D -5.14%

Buy Vol. 7,581,500

Sell Vol. 7,243,100

27,600

1D -4.00%

5D -7.69%

Buy Vol. 25,094,600

Sell Vol. 26,290,900

20,100

1D -4.29%

5D -4.29%

Buy Vol. 17,157,400

Sell Vol. 17,010,600

23,450

1D -3.50%

5D -4.29%

Buy Vol. 3,738,400

Sell Vol. 4,241,500

24,900

1D -0.60%

5D -0.40%

Buy Vol. 2,517,400

Sell Vol. 2,797,000

20,500

1D -4.43%

5D -5.09%

Buy Vol. 26,891,700

Sell Vol. 24,240,300

22,550

1D 1.12%

5D 2.27%

Buy Vol. 4,802,500

Sell Vol. 4,235,600

22,200

1D -1.77%

5D -2.84%

Buy Vol. 7,746,900

Sell Vol. 6,873,000

Almost banking stocks have decreased compared to the beginning of the year. The market capitalization of the whole industry "evaporated" 363,744 billion dong (~15.6 billion USD) to less than 1.54 million billion dong, lower than the time when VN-Index bottomed (1,150 points) on July 6, 2022. CTG, VPB, VIB, TPB have all lost more than 1 billion USD in market capitalization since the beginning of the year, especially TCB's capitalization has decreased by nearly 2.4 billion USD. Most of the above stocks have dropped to the lowest level since the beginning of August 2022

REAL ESTATE

84,500

1D 0.00%

5D -0.59%

Buy Vol. 4,683,700

Sell Vol. 4,639,900

29,600

1D -5.43%

5D -12.04%

Buy Vol. 7,414,400

Sell Vol. 8,907,000

50,400

1D -0.79%

5D -1.18%

Buy Vol. 1,973,300

Sell Vol. 2,216,600

Real estate cash flow tends to return to the South. The level of interest in real estate in Ho Chi Minh City in 8M/2022 increased 17% over the same period in 2021, while this index of Hanoi was 4%

OIL & GAS

113,600

1D 0.98%

5D 5.19%

Buy Vol. 979,500

Sell Vol. 1,638,300

12,800

1D -4.48%

5D -5.19%

Buy Vol. 32,339,400

Sell Vol. 32,698,400

36,100

1D -2.96%

5D -5.00%

Buy Vol. 2,617,500

Sell Vol. 2,415,600

The price of Brent oil futures for the November payment session fell 1.57% to 84.8 USD/barrel due to concerns about recession effects when banks around the world raised interest rates

VINGROUP

62,000

1D -0.96%

5D -1.43%

Buy Vol. 1,767,100

Sell Vol. 2,042,100

55,900

1D -2.27%

5D -4.28%

Buy Vol. 3,695,700

Sell Vol. 3,939,600

26,650

1D -6.49%

5D -8.42%

Buy Vol. 2,701,200

Sell Vol. 3,440,500

VIC: The Lithium battery factory with a total investment of more than 6,329b VND of Vingroup has been approved for investment policy in Vung Ang, is expected to complete construction in Q4/2023

FOOD & BEVERAGE

74,000

1D -3.52%

5D -1.60%

Buy Vol. 4,372,400

Sell Vol. 5,817,700

107,700

1D -0.83%

5D -4.27%

Buy Vol. 909,200

Sell Vol. 1,039,300

185,000

1D -1.07%

5D -0.16%

Buy Vol. 191,200

Sell Vol. 227,400

OTHERS

110,100

1D -2.39%

5D -4.26%

Buy Vol. 660,900

Sell Vol. 859,800

110,100

1D -2.39%

5D -4.26%

Buy Vol. 660,900

Sell Vol. 859,800

81,500

1D -1.09%

5D -1.93%

Buy Vol. 3,128,800

Sell Vol. 2,946,200

68,000

1D -2.02%

5D -3.55%

Buy Vol. 7,565,600

Sell Vol. 8,043,400

23,000

1D -1.50%

5D 0.44%

Buy Vol. 3,472,000

Sell Vol. 3,248,900

19,500

1D -5.57%

5D -2.01%

Buy Vol. 35,760,300

Sell Vol. 36,949,200

22,400

1D -1.32%

5D -1.10%

Buy Vol. 37,959,800

Sell Vol. 38,396,200

VJC: According the Civil Aviation Administration of Vietnam, in September 2022, the passenger transport volume of Vietnamese airlines reached 4.2 million passengers, down 14% compared to August 2022 but increasing 19.6% compared to September 2021. Vietjet Air operated 76,513 flights, the punctuality rate was 84.8%, down 8.1 points over the same period; 162 flights were canceled, accounting for 0.2%, down 0.57 points over the same period

Market by numbers

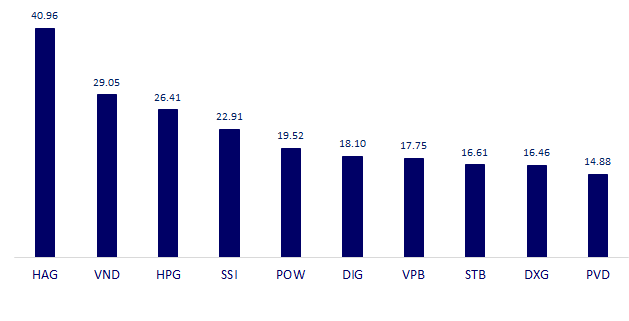

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

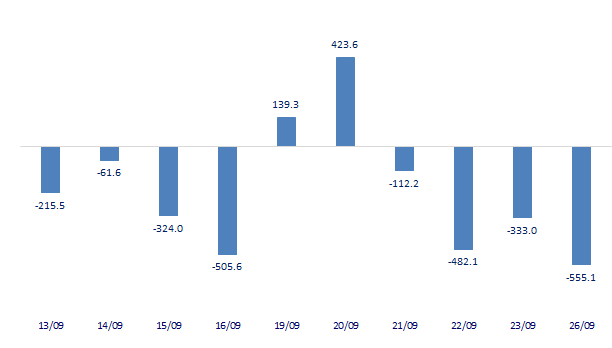

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

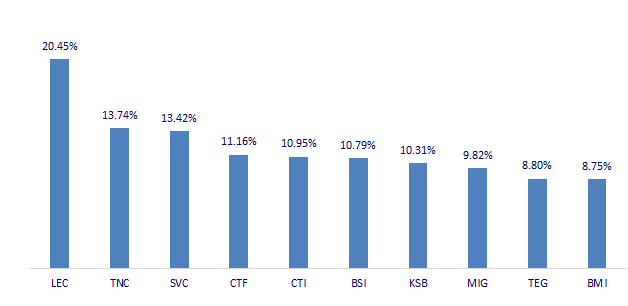

TOP INCREASES 3 CONSECUTIVE SESSIONS

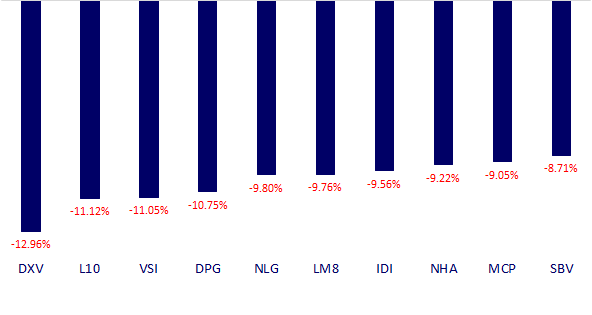

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.