Morning Brief 26/09/2022

GLOBAL MARKET

29,590.41

1D -1.62%

YTD -18.70%

3,693.23

1D -1.72%

YTD -22.72%

10,867.93

1D -1.80%

YTD -30.96%

29.92

1D 9.40%

7,018.60

1D -1.97%

YTD -5.19%

12,284.19

1D -1.97%

YTD -22.67%

5,783.41

1D -2.28%

YTD -19.38%

79.06

1D -5.67%

YTD 3.35%

1,644.60

1D -2.27%

YTD -9.68%

The wave of sell-offs in equities was triggered by a speech by Fed Chairman Jerome Powell in Jackson Hole, exacerbated by the official decision to raise interest rates by the Fed and many central banks. US stocks fell for the second week in a row, Dow Jones made a new low for 2022. The Dow Jones Industrial Average fell 486.27 points, or 1.62%, to 29,590.41 points, the lowest since the beginning of the year. The S&P 500 Index fell 1.72% to 3,693.23. The Nasdaq Composite Index fell 1.8 percent to 10,867.93 points.

VIETNAM ECONOMY

4.68%

YTD (bps) 387

5.60%

3.88%

1D (bps) 15

YTD (bps) 287

4.24%

1D (bps) 10

YTD (bps) 224

23,853

1D (%) 0.03%

YTD (%) 3.98%

23,685

1D (%) -1.63%

YTD (%) -10.51%

3,397

1D (%) -0.64%

YTD (%) -7.14%

USD/VND exchange rate to the highest level ever. Currently, the VND has depreciated about 3.7% against the USD since the beginning of the year and the USD/VND exchange rate has reached the highest level ever. At the end of the last trading session of the week, the central exchange rate of USD/VND at the State Bank was at 23,324 VND/USD

VIETNAM STOCK MARKET

1,203.28

1D -0.94%

YTD -19.69%

1,215.41

1D -1.10%

YTD -20.86%

264.44

1D -0.45%

YTD -44.21%

88.59

1D 0.05%

YTD -21.38%

-334.48

13,223.71

1D -2.21%

YTD -57.44%

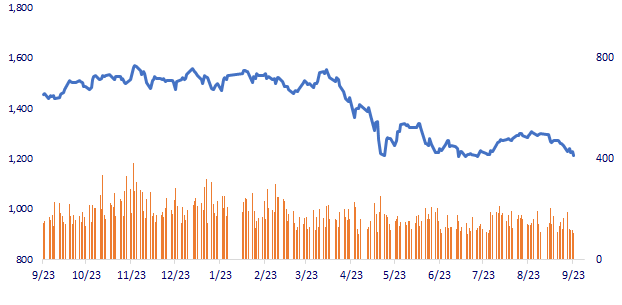

Foreign investors had the 5th consecutive week of net selling with a total value of nearly 350 billion dong, in which the focus of strong selling last week was mainly stocks in securities, real estate, banks. In the last session of the week, the pillar codes of banking groups such as VCB, BID, CTG, VPB, TCB, MBB,... were all in red, becoming the main burden on the index

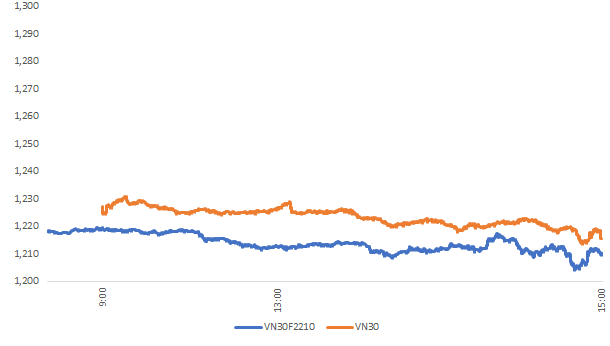

INTRADAY

VN30 (12M)

SELECTED NEWS

- The Ministry of Industry and Trade drafts a mechanism to adjust the average retail price of electricity

- Vietnam has a trade deficit of 2.9 billion USD in animal feed in 8 months

- Export prices keep increasing: New growth opportunities for Vietnamese rice

- US oil reserves are at a record low in nearly 40 years

- Russia sets a roadmap to cut gas exports to 2025

- Europe faces its first energy test

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.