Market brief 29/09/2022

VIETNAM STOCK MARKET

1,126.07

1D -1.53%

YTD -24.84%

1,147.44

1D -1.14%

YTD -25.28%

249.41

1D -1.17%

YTD -47.38%

85.22

1D -0.72%

YTD -24.37%

-172.68

1D 0.00%

YTD 0.00%

12,993.99

1D -3.82%

YTD -58.18%

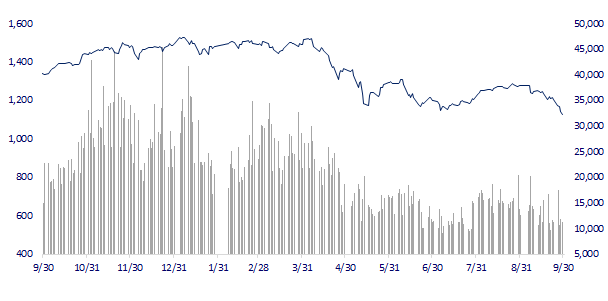

Since the beginning of the year, VN-Index has decreased by more than 23%, equivalent to 350 points, HoSE capitalization has decreased by 55 billion USD. In the market, there is only VCB with a market capitalization of over 10 billion USD. Since applying T+2, the average matching value on HoSE has decreased by 16% compared to the previous month

ETF & DERIVATIVES

19,900

1D -1.34%

YTD -22.96%

13,550

1D -1.53%

YTD -25.10%

14,180

1D -20.38%

YTD -25.37%

19,010

1D 3.32%

YTD -16.99%

15,550

1D -0.64%

YTD -30.83%

24,720

1D -0.20%

YTD -11.87%

15,050

1D 0.27%

YTD -29.93%

1,149

1D -0.60%

YTD 0.00%

1,150

1D -0.73%

YTD 0.00%

1,149

1D -1.20%

YTD 0.00%

1,148

1D -1.46%

YTD 0.00%

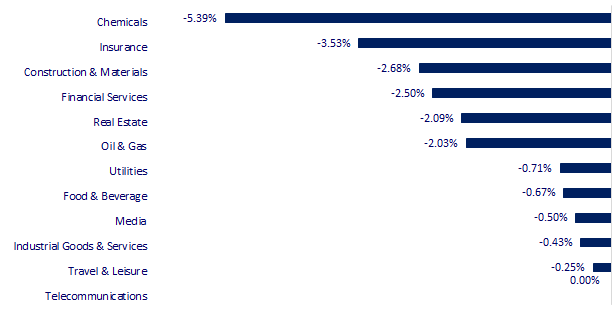

CHANGE IN PRICE BY SECTOR

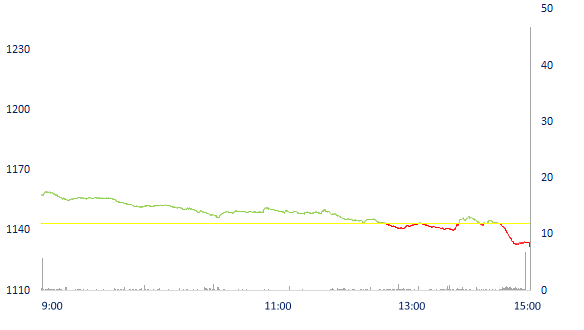

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

26,422.05

1D 0.16%

YTD -8.23%

3,041.20

1D -0.13%

YTD -16.45%

2,170.93

1D 0.08%

YTD -27.09%

17,165.87

1D -0.49%

YTD -26.63%

3,115.08

1D -0.04%

YTD -0.28%

1,592.37

1D -0.43%

YTD -3.94%

82.60

1D 0.58%

YTD 7.97%

1,658.90

1D -0.35%

YTD -8.89%

Asian stocks did not have too much volatility after the rally of US stocks on the news that the Bank of England (BoE) will intervene in the bond market to stabilize the situation. In Japan, the Nikkei 225 index increased by 0.16% to 26,422.05 points. South Korea's Kospi index increased by 0.08% to 2,170.93 points. Hong Kong's Hang Seng Index increased for most of the session but closed down 0.49% at 17,165.87 points.

VIETNAM ECONOMY

5.12%

YTD (bps) 431

5.60%

4.41%

1D (bps) 13

YTD (bps) 340

4.73%

1D (bps) 2

YTD (bps) 273

24,065

1D (%) 0.61%

YTD (%) 4.90%

23,543

1D (%) -1.10%

YTD (%) -11.05%

3,409

1D (%) 1.07%

YTD (%) -6.81%

On September 29, GSO held a press conference to announce the socio-economic situation. In 9M/2022, GDP increased by 8.83% over the same period last year, the highest increase in 12 years (2011-2022). In the general increase of the whole economy, the agriculture, forestry and fishery sector increased by 2.99%, contributing 4.04%; the industry and construction sector increased by 9.44%, contributing 41.79%; service sector increased by 10.57%, contributing 54.17%

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- GDP in the third quarter grew by 13.67%

- Commencement of Component 2 project, Long Thanh airport worth 3,500 billion VND

- Vietnam has a trade surplus of more than 6.5 billion USD in 9 months

- Painkiller crisis cost the US nearly $1.5 trillion

- European Commission: The imposition of a gas price ceiling will come with risks

- The United Nations is about to hold a meeting on the leak of 2 Nord Stream pipelines 1 and 2

VN30

BANK

74,000

1D -1.33%

5D -5.13%

Buy Vol. 949,278

Sell Vol. 1,202,399

33,500

1D 0.00%

5D -4.69%

Buy Vol. 1,506,502

Sell Vol. 2,116,994

22,600

1D -3.00%

5D -11.02%

Buy Vol. 5,720,197

Sell Vol. 7,403,491

33,000

1D -0.75%

5D -4.49%

Buy Vol. 4,043,495

Sell Vol. 4,154,717

18,000

1D -2.70%

5D -7.85%

Buy Vol. 7,773,809

Sell Vol. 11,448,325

19,800

1D -0.75%

5D -6.82%

Buy Vol. 7,910,929

Sell Vol. 7,417,588

19,150

1D 0.00%

5D -3.09%

Buy Vol. 1,700,239

Sell Vol. 2,457,575

24,700

1D 0.20%

5D -2.56%

Buy Vol. 1,377,415

Sell Vol. 2,299,779

19,700

1D -2.96%

5D -10.25%

Buy Vol. 15,889,387

Sell Vol. 13,762,250

22,150

1D -2.85%

5D -1.56%

Buy Vol. 2,336,096

Sell Vol. 2,976,258

22,000

1D 0.00%

5D -3.51%

Buy Vol. 6,385,214

Sell Vol. 5,616,958

BID: Hoang Anh Gia Lai has just announced that it has completed the pre-maturity buyback of 605 billion dong of bonds for the HAGLBOND16.26 lot at BIDV. The debt payment completion date is September 28, 2022, money from debt collection Hoang Anh Gia Lai Agrico and money from business activities

REAL ESTATE

84,800

1D 0.71%

5D 0.24%

Buy Vol. 3,652,717

Sell Vol. 5,276,671

28,950

1D -1.53%

5D -7.95%

Buy Vol. 5,843,502

Sell Vol. 5,947,325

50,800

1D 0.99%

5D -1.55%

Buy Vol. 2,030,518

Sell Vol. 2,322,804

NVL: The largest shareholder owns more than 627M shares of NVL (32.165%), Novagroup registered to transfer nearly 94.7M shares of Novaland's NVL during the period September 30 to October 29

OIL & GAS

105,000

1D 0.96%

5D -5.41%

Buy Vol. 735,548

Sell Vol. 643,217

12,550

1D -2.33%

5D -8.06%

Buy Vol. 14,715,410

Sell Vol. 21,165,149

34,350

1D -1.58%

5D -8.52%

Buy Vol. 1,505,973

Sell Vol. 2,341,630

PLX: PLX is now down 46% after nearly 7 months and fell to 34,350 VND/share, the lowest since early April 2020. Market capitalization also decreased by more than 35,800 billion VND to 42 trillion VND

VINGROUP

54,600

1D -5.04%

5D -13.74%

Buy Vol. 2,389,367

Sell Vol. 2,671,353

50,800

1D -0.78%

5D -11.96%

Buy Vol. 3,685,430

Sell Vol. 3,048,824

27,200

1D 1.30%

5D -5.06%

Buy Vol. 2,751,890

Sell Vol. 3,171,154

VIC: Binh Duong revoked the policy for Vingroup to study planning and adjust the planning of two projects in Tan Uyen and Bac Tan Uyen towns with a total area of two land plots of 1,000 hectares

FOOD & BEVERAGE

72,700

1D 1.25%

5D -5.46%

Buy Vol. 3,308,696

Sell Vol. 3,301,961

100,000

1D -2.06%

5D -9.09%

Buy Vol. 643,558

Sell Vol. 719,730

182,800

1D -0.11%

5D -2.25%

Buy Vol. 134,849

Sell Vol. 139,770

SAB: Thaibev confirmed not to sell Sabeco. Sabeco is still a strategic card in the Thai giants' ambition to regain the leading position in Southeast Asia.

OTHERS

110,100

1D 0.00%

5D -4.26%

Buy Vol. 486,971

Sell Vol. 361,816

110,100

1D 0.00%

5D -4.26%

Buy Vol. 486,971

Sell Vol. 361,816

77,000

1D -1.28%

5D -7.12%

Buy Vol. 2,333,817

Sell Vol. 2,483,199

64,000

1D -1.54%

5D -8.70%

Buy Vol. 3,809,115

Sell Vol. 5,273,945

20,900

1D -5.86%

5D -11.44%

Buy Vol. 1,850,006

Sell Vol. 2,506,596

19,300

1D -2.28%

5D -8.53%

Buy Vol. 23,214,760

Sell Vol. 26,603,566

21,650

1D -0.69%

5D -5.87%

Buy Vol. 15,850,232

Sell Vol. 20,835,487

FPT: By the end of September 2022, FPT Long Chau pharmacy chain has opened 379 new locations, bringing the number of pharmacies nationwide to 779. FPT Retail is expected to expand its market share with 800 Long Chau pharmacies in Q4/2022, contributing about 50-100B VND in profit and increasing to 3,000 stores in the next 5 years. In 6M/2022 the Long Chau system brought in over VND 4,000B in revenue, contributing 29% of FPT Retail's total revenue

Market by numbers

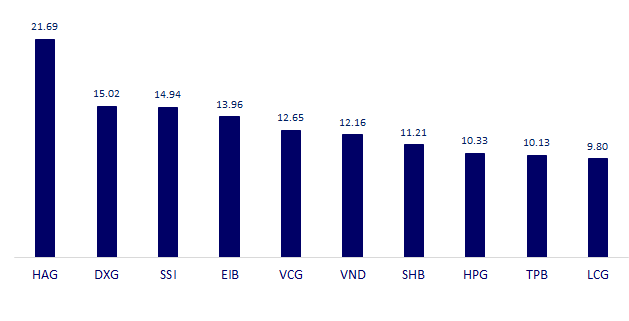

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

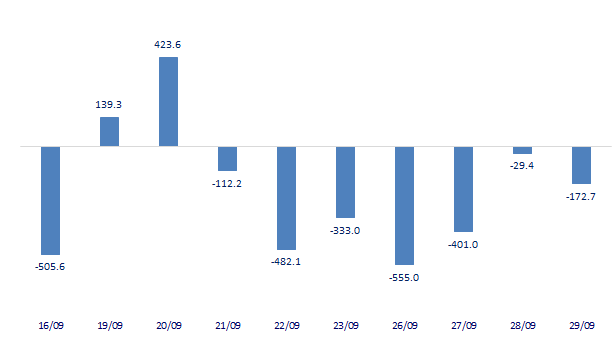

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

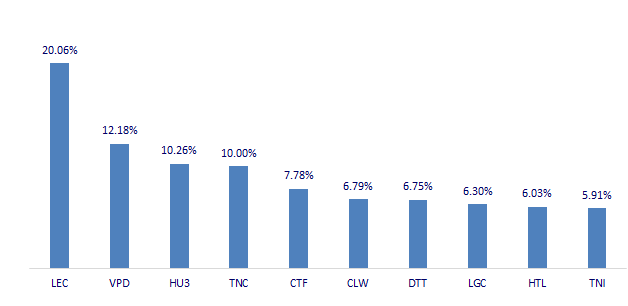

TOP INCREASES 3 CONSECUTIVE SESSIONS

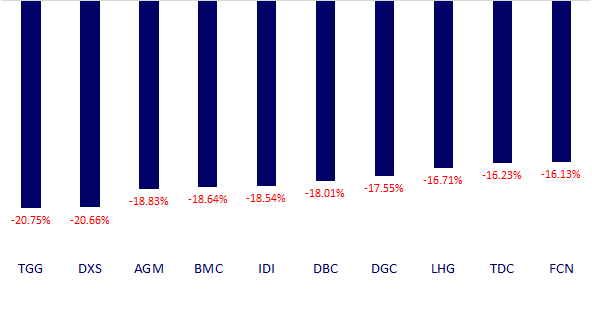

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.