Market brief 04/10/2022

VIETNAM STOCK MARKET

1,078.14

1D -0.76%

YTD -28.04%

1,097.72

1D -0.39%

YTD -28.52%

235.61

1D -1.07%

YTD -50.29%

82.38

1D -0.46%

YTD -26.89%

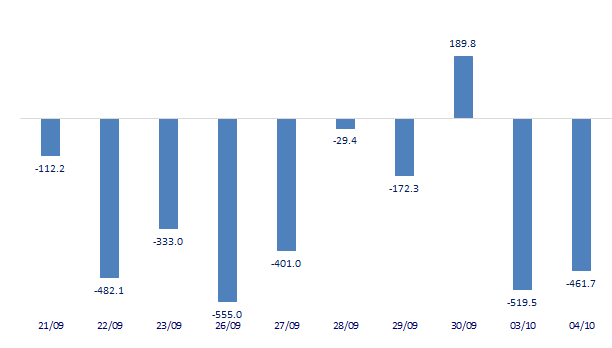

-461.68

1D 0.00%

YTD 0.00%

13,544.20

1D 2.61%

YTD -56.41%

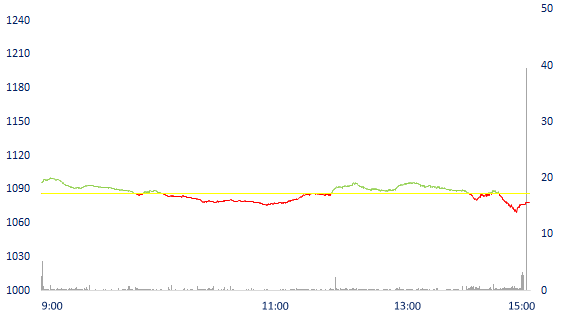

Selling strongly at the end of the session, VN-Index dropped more than 8 points. Total matched value reached 11,676 billion dong, up 0.83% compared to the previous session, of which, matched value on HoSE increased by 2.38% to 10,306 billion dong. Foreign investors net sold about 461 billion dong.

ETF & DERIVATIVES

18,500

1D -1.60%

YTD -28.38%

12,900

1D 0.00%

YTD -28.69%

13,610

1D -23.58%

YTD -28.37%

18,400

1D -1.60%

YTD -19.65%

13,500

1D -6.90%

YTD -39.95%

23,580

1D -0.92%

YTD -15.94%

14,020

1D -0.57%

YTD -34.73%

1,103

1D 0.26%

YTD 0.00%

1,105

1D -0.08%

YTD 0.00%

1,100

1D -0.36%

YTD 0.00%

1,102

1D -0.05%

YTD 0.00%

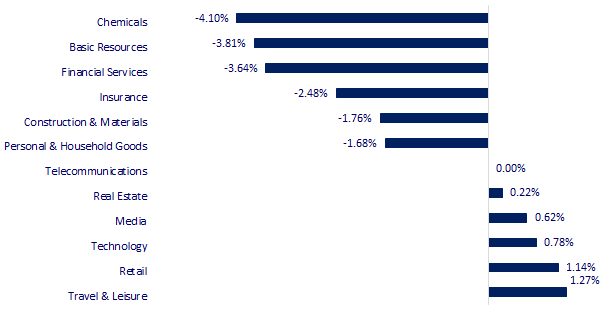

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

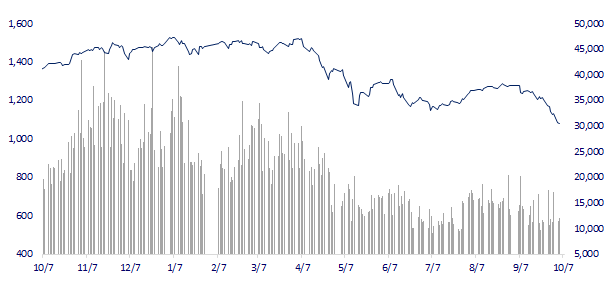

VNINDEX (12M)

GLOBAL MARKET

26,992.21

1D 0.50%

YTD -6.25%

3,024.39

1D 0.00%

YTD -16.91%

2,209.38

1D 2.50%

YTD -25.80%

17,079.51

1D 0.00%

YTD -27.00%

3,138.90

1D 1.02%

YTD 0.49%

1,578.00

1D 1.28%

YTD -4.80%

84.42

1D 0.68%

YTD 10.35%

1,718.30

1D 0.69%

YTD -5.63%

Asian stocks all rallied, Australia raised interest rates lower than expected. In Japan, the Nikkei 225 index rose 0.5% to 26,992.21 points. South Korea's Kospi index rose 2.5% to 2,209.38 points. Markets in China and Hong Kong are closed for a holiday.

VIETNAM ECONOMY

4.93%

YTD (bps) 412

5.60%

4.70%

1D (bps) 6

YTD (bps) 369

4.85%

1D (bps) 9

YTD (bps) 285

24,024

1D (%) -0.29%

YTD (%) 4.73%

24,324

1D (%) 0.59%

YTD (%) -8.10%

3,426

1D (%) 0.03%

YTD (%) -6.34%

IMF forecasts Vietnam's GDP growth in 2022 will be around 7-7.5%; average inflation is lower than the target of 4% and at the same time low compared to other countries in the world and the region; business activities are recovering strongly and widely.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The IMF forecasts that Vietnam's GDP growth in 2022 will be around 7-7.5%

- Disbursement of ODA in 8 months only reached nearly 15.5%

- It is expected to cost more than 3,900 billion VND to deploy the Ho Chi Minh road project through Kien Giang and Bac Lieu

- A series of container trains from Asia to the US and Europe were canceled

- OPEC+ is likely to cut oil production by the largest since 2020

- Saudi Arabia may increase the price of crude oil selling to Asia in November

VN30

BANK

71,300

1D 0.99%

5D -4.04%

Buy Vol. 2,332,656

Sell Vol. 1,782,660

31,000

1D -1.74%

5D -8.01%

Buy Vol. 2,472,612

Sell Vol. 1,822,908

20,750

1D -3.94%

5D -11.51%

Buy Vol. 9,235,133

Sell Vol. 8,429,490

30,300

1D 0.17%

5D -9.55%

Buy Vol. 9,603,268

Sell Vol. 8,908,214

16,800

1D -1.18%

5D -8.03%

Buy Vol. 22,579,858

Sell Vol. 25,797,074

18,800

1D 0.53%

5D -6.93%

Buy Vol. 13,471,716

Sell Vol. 12,629,677

18,500

1D 0.54%

5D -4.15%

Buy Vol. 2,892,284

Sell Vol. 4,851,214

23,800

1D -0.21%

5D -4.42%

Buy Vol. 1,308,045

Sell Vol. 2,611,075

18,750

1D -2.34%

5D -8.54%

Buy Vol. 25,767,782

Sell Vol. 24,302,214

21,250

1D 0.47%

5D -8.60%

Buy Vol. 3,650,419

Sell Vol. 4,103,558

21,000

1D -2.78%

5D -6.25%

Buy Vol. 4,533,134

Sell Vol. 6,020,871

MBB: MB's 8-month credit growth reached 17% of the total granted limit of 18.2%. NIM continued to improve thanks to controlling deposit costs and focusing on lending with high interest rates. MB's subsidiaries also made a profit of nearly VND 2,000 billion.

REAL ESTATE

82,000

1D 0.00%

5D -2.96%

Buy Vol. 3,128,421

Sell Vol. 3,238,817

26,150

1D 0.19%

5D -11.05%

Buy Vol. 4,774,380

Sell Vol. 4,648,063

51,100

1D 0.20%

5D 2.20%

Buy Vol. 2,480,559

Sell Vol. 3,060,171

NVL: The Board of Directors approved a resolution on credit loans of USD 40 million and VND 23 billion with banks.

OIL & GAS

106,000

1D -0.93%

5D -4.93%

Buy Vol. 537,343

Sell Vol. 757,300

11,600

1D 0.87%

5D -10.42%

Buy Vol. 19,440,037

Sell Vol. 18,141,540

32,000

1D -1.08%

5D -9.60%

Buy Vol. 2,733,242

Sell Vol. 2,581,789

The Ministry of Finance - Industry and Trade will adjust petrol prices from on October 3. E5RON92 gasoline price decreased by 1,049 VND/liter. RON95 gasoline decreased by 1,141 VND/liter.

VINGROUP

57,000

1D 2.70%

5D -6.56%

Buy Vol. 1,908,650

Sell Vol. 1,932,287

50,600

1D 0.40%

5D -6.47%

Buy Vol. 4,372,281

Sell Vol. 4,275,403

26,700

1D 2.30%

5D 0.19%

Buy Vol. 2,939,635

Sell Vol. 2,782,721

VHM: in October, Vinhomes will accelerate the progress to continue handing over houses in Cha La and Coral subdivisions, reaching the goal of handing over 9,000 units this year.

FOOD & BEVERAGE

70,900

1D -0.14%

5D -2.07%

Buy Vol. 2,555,982

Sell Vol. 2,797,992

90,500

1D -3.72%

5D -15.97%

Buy Vol. 1,444,446

Sell Vol. 1,554,794

188,000

1D 3.18%

5D 1.46%

Buy Vol. 396,717

Sell Vol. 405,182

VNM: The super factory with an investment of nearly $200m is planned to start construction in Hung Yen in December and is expected to help increase VNM's market share in the Northern.

OTHERS

48,200

1D -3.21%

5D -16.03%

Buy Vol. 3,018,565

Sell Vol. 3,219,228

112,900

1D 2.64%

5D 2.17%

Buy Vol. 557,976

Sell Vol. 542,173

77,500

1D 0.65%

5D -3.73%

Buy Vol. 3,085,831

Sell Vol. 3,256,054

61,000

1D 2.35%

5D -9.09%

Buy Vol. 6,281,049

Sell Vol. 6,389,323

18,250

1D -6.17%

5D -19.78%

Buy Vol. 3,077,750

Sell Vol. 2,895,641

17,800

1D -3.52%

5D -8.95%

Buy Vol. 27,032,418

Sell Vol. 31,204,212

18,850

1D -4.56%

5D -15.85%

Buy Vol. 45,335,141

Sell Vol. 48,048,210

VJC: publish documents to collect shareholders' written opinions during the period from September 30 to October 11. Accordingly, Vietjet plans to complete the private placement of up to 54.1 million shares first. After that, the company will close the list of shareholders to pay dividends based on the total number of new shares of 595.7 million units. Thus, Vietjet will issue 119.1 million shares to pay dividends in 2021 at the rate of 20%.

Market by numbers

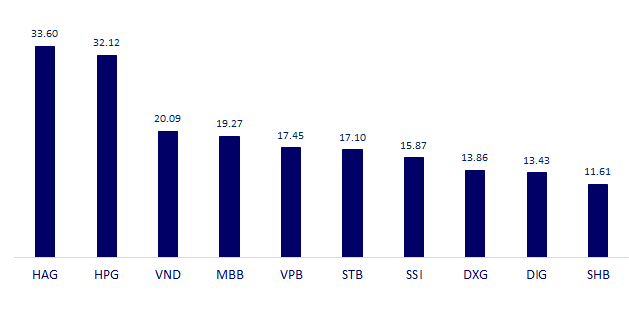

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

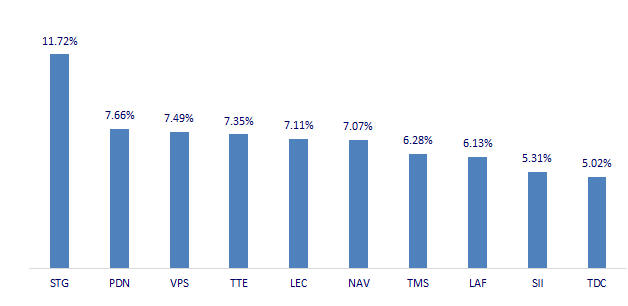

TOP INCREASES 3 CONSECUTIVE SESSIONS

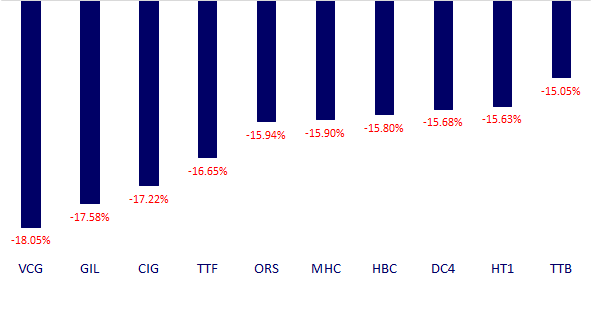

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.