Market brief 06/10/2022

VIETNAM STOCK MARKET

1,074.52

1D -2.69%

YTD -28.28%

1,081.36

1D -3.22%

YTD -29.59%

235.13

1D -2.89%

YTD -50.39%

82.41

1D -1.65%

YTD -26.86%

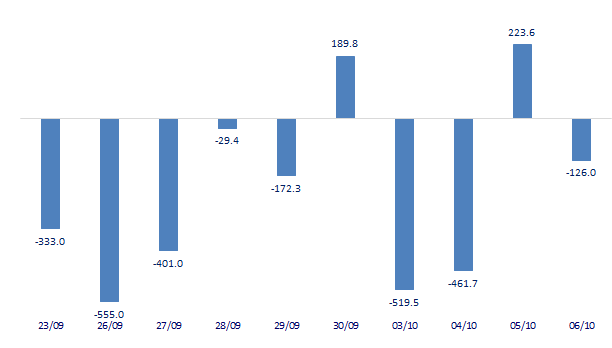

-126.00

1D 0.00%

YTD 0.00%

12,724.51

1D 17.94%

YTD -59.05%

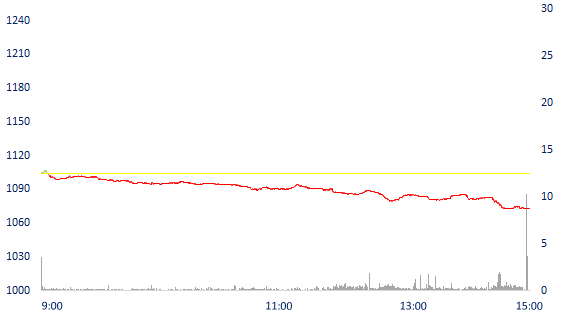

Strong selling pressure pushed VN-Index down by nearly 30 points, foreign investors turned to be net sellers of 126 billion dong in the whole market. The high selling force dominated most of the industry groups, the hardest hit was the trio: Banking, Securities, and Real Estate. In terms of breadth, the whole market was completely overwhelmed by 773 decliners, of which 86 stocks fell to the floor.

ETF & DERIVATIVES

18,720

1D -1.37%

YTD -27.53%

12,650

1D -4.17%

YTD -30.07%

13,030

1D -26.84%

YTD -31.42%

18,400

1D 6.98%

YTD -19.65%

14,290

1D -0.90%

YTD -36.43%

23,000

1D -4.09%

YTD -18.00%

13,910

1D -3.74%

YTD -35.24%

1,085

1D -2.87%

YTD 0.00%

1,080

1D -3.97%

YTD 0.00%

1,076

1D -3.50%

YTD 0.00%

1,080

1D -3.16%

YTD 0.00%

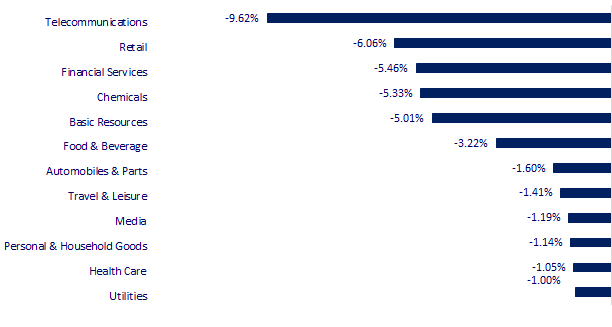

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

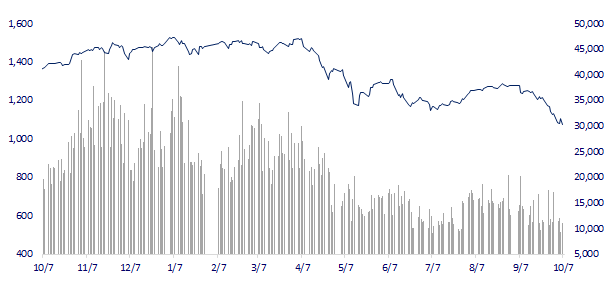

VNINDEX (12M)

GLOBAL MARKET

27,311.30

1D 0.01%

YTD -5.14%

3,024.39

1D 0.00%

YTD -16.91%

2,237.86

1D 1.02%

YTD -24.84%

18,012.15

1D -0.42%

YTD -23.02%

3,151.56

1D -0.05%

YTD 0.89%

1,589.18

1D 0.56%

YTD -4.13%

87.23

1D -1.09%

YTD 14.03%

1,722.20

1D -0.38%

YTD -5.42%

Asian stocks mostly gained, Nikkei 225 gained for 4 consecutive sessions. In Japan, the Nikkei 225 index rose 0.01% to 27,331.3 points. South Korea's Kospi index rose 1.02%. Hong Kong stocks upstream the region. The Hang Seng Index fell 0.42%. Chinese stocks closed this week.

VIETNAM ECONOMY

8.44%

1D (bps) 56

YTD (bps) 763

5.60%

4.73%

1D (bps) -8

YTD (bps) 372

4.85%

1D (bps) -2

YTD (bps) 285

24,098

1D (%) 0.37%

YTD (%) 5.05%

24,031

1D (%) -0.99%

YTD (%) -9.21%

3,426

1D (%) 0.06%

YTD (%) -6.34%

Credit balance of the whole credit institution system is expected to increase by 4.1% on average in the fourth quarter and 14.9% in 2022. Regarding pre-tax profit in 2022, 88.3% of credit institutions are expected to grow positively compared to 2021, besides, there are still 6.8% of credit institutions that expect negative profit growth in 2022.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Credit is expected to grow 14.9% in 2022

- UOB raises Vietnam's economic growth forecast to 8.2%

- The Ministry of Transport proposed to spend more than 13,000 billion VND to deal with the shortcomings of 8 BOT projects

- US mortgage rates hit 16-year high

- OPEC+ agrees to cut oil production by 2 million barrels per day

- EC proposes a way to limit gas prices to keep energy prices down

VN30

BANK

70,100

1D -1.96%

5D -5.27%

Buy Vol. 1,033,162

Sell Vol. 1,291,648

31,000

1D -2.52%

5D -7.46%

Buy Vol. 1,520,619

Sell Vol. 1,580,518

21,400

1D -2.73%

5D -5.31%

Buy Vol. 6,414,378

Sell Vol. 7,539,328

29,300

1D -3.93%

5D -11.21%

Buy Vol. 7,535,671

Sell Vol. 7,687,101

16,500

1D -2.94%

5D -8.33%

Buy Vol. 18,580,901

Sell Vol. 20,736,710

18,100

1D -5.73%

5D -8.59%

Buy Vol. 10,658,844

Sell Vol. 12,144,586

18,150

1D -1.89%

5D -5.22%

Buy Vol. 1,852,761

Sell Vol. 3,039,623

24,000

1D 0.00%

5D -2.83%

Buy Vol. 3,733,502

Sell Vol. 4,583,715

18,000

1D -6.49%

5D -8.63%

Buy Vol. 27,923,688

Sell Vol. 25,941,221

20,750

1D -3.26%

5D -6.32%

Buy Vol. 3,147,292

Sell Vol. 3,358,028

20,000

1D -3.85%

5D -9.09%

Buy Vol. 3,715,383

Sell Vol. 5,004,802

The State Bank of Vietnam has written to request commercial banks to report implementation results by the end of September 2022 and review customers to deploy the 2% interest rate support package, the expected support capacity... . By the end of August 2022, loan sales with interest rate support were about 10,700 billion VND with nearly 580 customers, outstanding loans were supported at 9,820 billion VND.

REAL ESTATE

80,200

1D -2.20%

5D -5.42%

Buy Vol. 2,424,255

Sell Vol. 2,744,337

26,250

1D -4.55%

5D -9.33%

Buy Vol. 3,400,466

Sell Vol. 3,739,553

50,800

1D -0.97%

5D 0.00%

Buy Vol. 1,871,139

Sell Vol. 2,352,072

The real estate market fell into a thirst for capital when the capital mobilization channels through banks and bonds faced difficulties. Investors find ways to mobilize capital from customers.

OIL & GAS

106,900

1D -0.09%

5D 1.81%

Buy Vol. 627,219

Sell Vol. 750,498

11,400

1D -5.79%

5D -9.16%

Buy Vol. 15,512,706

Sell Vol. 18,496,283

32,200

1D -2.42%

5D -6.26%

Buy Vol. 1,949,619

Sell Vol. 1,949,111

Oil prices spiked to a 3-week high on Wednesday (October 5), as OPEC+ agreed to cut production by the deepest since the Covid-19 pandemic in 2020.

VINGROUP

60,100

1D 0.17%

5D 10.07%

Buy Vol. 1,626,421

Sell Vol. 1,816,252

53,600

1D -0.37%

5D 5.51%

Buy Vol. 3,939,678

Sell Vol. 4,398,780

26,500

1D -1.85%

5D -2.57%

Buy Vol. 2,220,465

Sell Vol. 2,879,129

VHM: Vinhomes Ocean Park 2 - The Empire project has a scale of 458.9 hectares, launched on the market during the holiday of April 30 - May 1, 2022.

FOOD & BEVERAGE

70,000

1D -2.23%

5D -3.71%

Buy Vol. 1,975,696

Sell Vol. 2,586,929

86,700

1D -5.14%

5D -13.30%

Buy Vol. 1,532,812

Sell Vol. 1,394,806

185,800

1D -1.69%

5D 1.64%

Buy Vol. 205,654

Sell Vol. 111,326

SAB: The value of a series of businesses decreased by 50% after 9 months, Sabeco is one of the 4 rare stocks with a growth of 23% in capitalization..

OTHERS

48,900

1D -3.36%

5D -8.60%

Buy Vol. 2,105,680

Sell Vol. 1,949,171

114,200

1D -0.70%

5D 3.72%

Buy Vol. 407,745

Sell Vol. 563,248

76,500

1D -2.42%

5D -0.65%

Buy Vol. 2,083,748

Sell Vol. 2,240,295

58,000

1D -6.75%

5D -9.38%

Buy Vol. 4,341,240

Sell Vol. 5,350,776

17,800

1D -6.81%

5D -14.83%

Buy Vol. 2,213,717

Sell Vol. 3,392,213

17,400

1D -6.70%

5D -9.84%

Buy Vol. 20,382,291

Sell Vol. 24,608,654

18,000

1D -6.25%

5D -16.86%

Buy Vol. 52,512,352

Sell Vol. 57,926,297

MWG: agrees to lend a loan to Mobile World Joint Stock Company subsidiary with a maximum credit limit of VND 5,000 billion within 36 months. Mobile World Joint Stock Company is the company that is managing a chain of retail stores for mobile devices, in which MWG holds a 99.95% shares.

Market by numbers

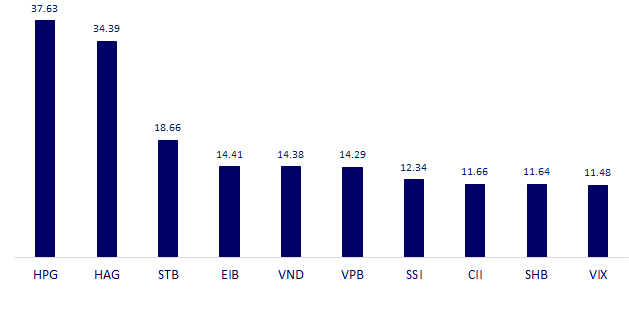

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

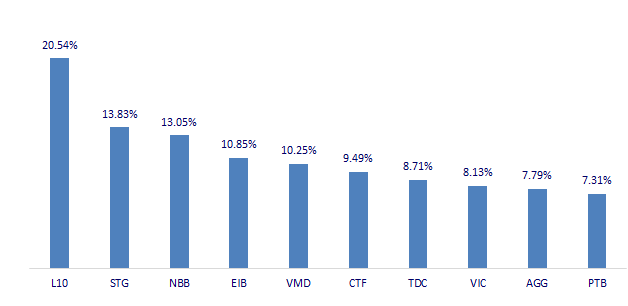

TOP INCREASES 3 CONSECUTIVE SESSIONS

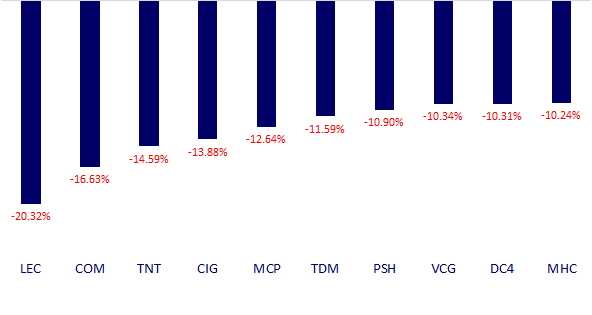

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.