Market brief 11/10/2022

VIETNAM STOCK MARKET

1,006.20

1D -3.48%

YTD -32.84%

1,001.68

1D -3.59%

YTD -34.77%

218.78

1D -4.82%

YTD -53.84%

77.95

1D -2.73%

YTD -30.82%

161.39

1D 0.00%

YTD 0.00%

14,573.23

1D -11.53%

YTD -53.10%

Foreign investors net bought 250 billion dong on HoSE, ending the chain of 12 net selling sessions at UPCoM. Foreign investors were active again today when they bought 94.6 million shares, worth 2,384.5 billion dong, while selling 88.3 million shares, worth 2,114 billion dong. The total net selling volume was at 6.3 million shares, equivalent to a net selling value of VND 271 billion.

ETF & DERIVATIVES

16,860

1D -4.20%

YTD -34.73%

11,720

1D -4.72%

YTD -35.21%

12,390

1D -30.43%

YTD -34.79%

16,960

1D -0.29%

YTD -25.94%

12,090

1D -7.00%

YTD -46.22%

21,350

1D -6.36%

YTD -23.89%

12,800

1D -3.76%

YTD -40.41%

984

1D -4.10%

YTD 0.00%

984

1D -4.65%

YTD 0.00%

985

1D -4.64%

YTD 0.00%

989

1D -4.21%

YTD 0.00%

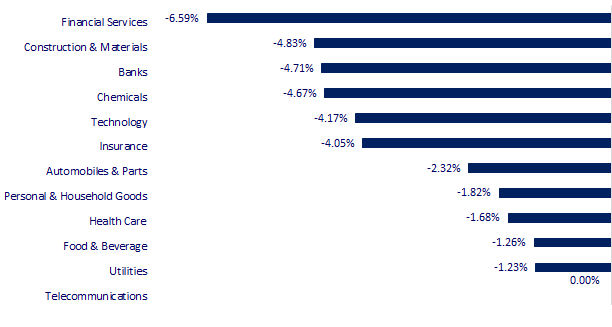

CHANGE IN PRICE BY SECTOR

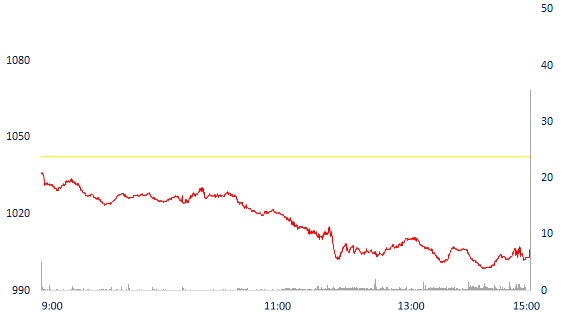

INTRADAY VNINDEX

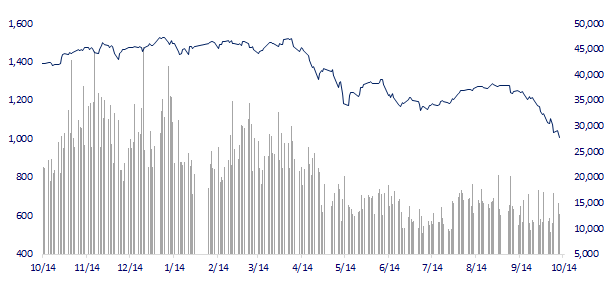

VNINDEX (12M)

GLOBAL MARKET

26,401.25

1D -1.04%

YTD -8.30%

2,979.79

1D 0.19%

YTD -18.13%

2,192.07

1D -1.83%

YTD -26.38%

16,832.36

1D -2.23%

YTD -28.06%

3,105.00

1D -0.08%

YTD -0.60%

1,562.68

1D -0.50%

YTD -5.73%

88.94

1D -2.38%

YTD 16.26%

1,670.50

1D -0.55%

YTD -8.25%

Asian stocks mixed ahead of US jobs report. In Japan, the Nikkei 225 index fell 1.04% to 26,401.25 points. The Kospi (South Korea) index fell 1.83%. Hong Kong's Hang Seng Index fell 2.23% to 16,832.36 points. Only the Shanghai index rose 0.19% to 2,979.79 points

VIETNAM ECONOMY

7.47%

1D (bps) -39

YTD (bps) 666

5.60%

4.76%

1D (bps) 2

YTD (bps) 375

4.88%

1D (bps) 3

YTD (bps) 288

23,451

1D (%) 0.08%

YTD (%) 2.23%

23,944

1D (%) 0.03%

YTD (%) -9.54%

3,405

1D (%) -0.06%

YTD (%) -6.92%

The first trading session of the week (October 10) recorded a large liquidity injection of the State Bank (SBV) on the channel of pledging valuable papers (OMO). Specifically, the operator has successfully bid for nearly 21,680 billion VND. In which, the entire amount of money pumped out to buy instruments with expiry times is 14 and 28 days instead of 7 days as in previous sessions.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- State Bank amends regulations on foreign exchange market intervention

- Banks borrowed nearly 21,700 billion VND from the State Bank in the first session of the week

- Labor market recovered, average income in 9 months increased by 12.4%

- Europe's banks face new risks

- European reserves are 90% full, gas prices fall by 8.7%

- Emergency lending capacity of WB and IMF is being increased as the crisis deepens

VN30

BANK

62,000

1D -4.76%

5D -13.04%

Buy Vol. 1,755,862

Sell Vol. 1,800,839

28,500

1D -5.00%

5D -8.06%

Buy Vol. 1,639,327

Sell Vol. 1,608,046

19,800

1D -4.35%

5D -4.58%

Buy Vol. 8,881,894

Sell Vol. 8,872,546

24,000

1D -6.98%

5D -20.79%

Buy Vol. 23,758,039

Sell Vol. 28,630,168

15,350

1D 0.00%

5D -8.63%

Buy Vol. 23,485,147

Sell Vol. 26,691,464

16,050

1D -6.96%

5D -14.63%

Buy Vol. 22,585,330

Sell Vol. 28,048,636

16,200

1D -4.14%

5D -12.43%

Buy Vol. 5,624,859

Sell Vol. 5,782,039

19,350

1D -6.97%

5D -18.70%

Buy Vol. 11,339,432

Sell Vol. 12,821,345

15,850

1D -6.76%

5D -15.47%

Buy Vol. 34,291,673

Sell Vol. 34,896,292

19,350

1D -3.01%

5D -8.94%

Buy Vol. 3,280,103

Sell Vol. 4,396,674

17,500

1D -6.42%

5D -16.67%

Buy Vol. 8,779,965

Sell Vol. 8,816,334

VIB: At the end of 9 months of 2022, VIB achieved total revenue of over VND 13,300 billion, up 29% over the same period. Non-interest income reached more than VND 2,400 billion, contributing 17% to total operating income. Operating expenses were well controlled, about VND 4,600 billion, with an increase of 12%, much lower than the increase in revenue. As a result, the Bank's cost/revenue ratio (CIR) dropped to 35%, making cost management the industry's leading group. Provision expense is estimated at more than 900 billion VND. Pre-tax profit in the third quarter reached VND 2,780 billion. By the end of the first 9 months, VIB's pre-tax profit reached VND 7,800 billion, up 46% over the same period last year.

REAL ESTATE

75,000

1D -1.83%

5D -8.54%

Buy Vol. 4,913,071

Sell Vol. 5,699,747

24,400

1D -5.79%

5D -6.69%

Buy Vol. 3,567,903

Sell Vol. 3,626,047

48,800

1D -2.59%

5D -4.50%

Buy Vol. 1,743,578

Sell Vol. 2,787,099

NVL: Considering the shareholder structure of Novaland, there are currently only 3 major shareholders, Novagroup (37.02%), Diamond Properties JSC (10.42%), and Ms. Cao Thi Ngoc Suong (5.4%).

OIL & GAS

106,100

1D 0.09%

5D 0.09%

Buy Vol. 919,845

Sell Vol. 1,091,250

10,250

1D -6.82%

5D -11.64%

Buy Vol. 18,085,317

Sell Vol. 22,109,517

33,000

1D -1.49%

5D 3.13%

Buy Vol. 2,835,113

Sell Vol. 2,799,177

POW: The electricity output of PV Power's power plants in September totaled 1,006 million kWh, exceeding 21% of the October plan.

VINGROUP

60,000

1D -0.33%

5D 5.26%

Buy Vol. 3,141,290

Sell Vol. 3,346,186

51,800

1D -3.90%

5D 2.37%

Buy Vol. 5,401,915

Sell Vol. 6,314,823

23,650

1D -6.89%

5D -11.42%

Buy Vol. 3,607,247

Sell Vol. 3,470,811

VHM: VMI Real Estate Investment and Management Company plans to invest in a certain number of existing or future real estate projects of Vinhomes.

FOOD & BEVERAGE

70,200

1D -0.43%

5D -0.99%

Buy Vol. 2,824,140

Sell Vol. 3,290,375

79,800

1D -0.87%

5D -11.82%

Buy Vol. 3,026,728

Sell Vol. 2,942,959

183,500

1D -0.54%

5D -2.39%

Buy Vol. 256,550

Sell Vol. 243,761

VNM and MSN were both among the top net buyers of foreign investors in today's session with a value of 52.4 billion dong and 26.6 billion dong, respectively.

OTHERS

47,000

1D -6.00%

5D -2.49%

Buy Vol. 1,762,622

Sell Vol. 1,903,409

107,000

1D -2.73%

5D -5.23%

Buy Vol. 753,539

Sell Vol. 911,990

71,000

1D -4.05%

5D -8.39%

Buy Vol. 2,592,299

Sell Vol. 2,482,761

55,400

1D -2.98%

5D -9.18%

Buy Vol. 3,766,971

Sell Vol. 3,665,689

15,750

1D -6.80%

5D -13.70%

Buy Vol. 2,775,634

Sell Vol. 3,757,221

16,200

1D -6.90%

5D -8.99%

Buy Vol. 24,906,034

Sell Vol. 26,858,902

17,500

1D -4.63%

5D -7.16%

Buy Vol. 42,966,077

Sell Vol. 40,459,632

HPG: announced in September production of 540,000 tons of crude steel. Sales volume of steel products reached 555,000 tons, down 11.6% month on month. In which, hot rolled coil (HRC) reached 228,000 tons, down 2% from the previous month and up 29% over the same period. Construction steel recorded 318,000 tons, down 17.6% month-on-month and down 3% over the same period.

Market by numbers

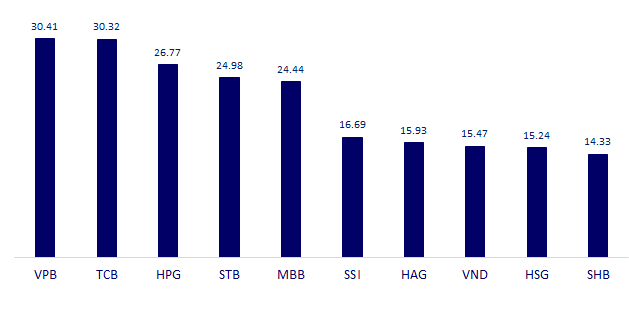

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

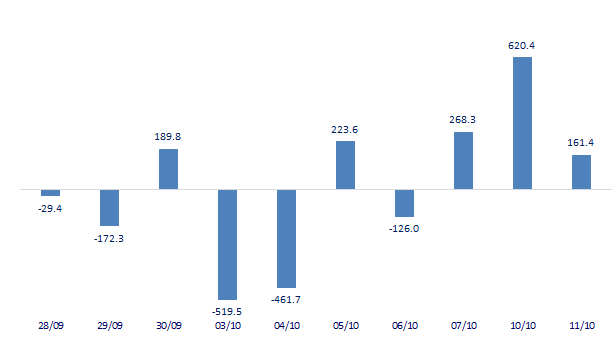

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

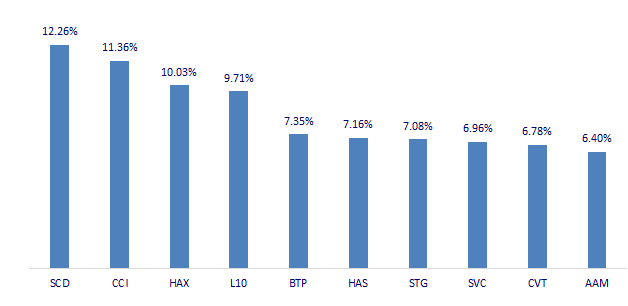

TOP INCREASES 3 CONSECUTIVE SESSIONS

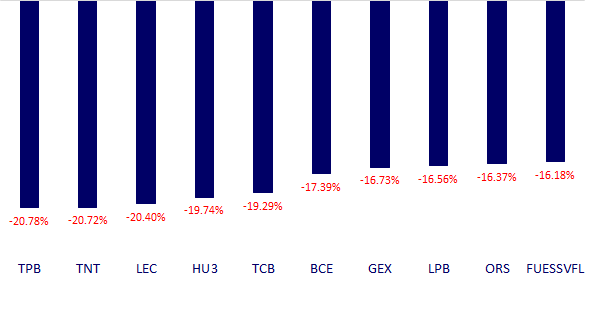

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.