Market brief 13/10/2022

VIETNAM STOCK MARKET

1,050.99

1D 1.56%

YTD -29.85%

1,051.24

1D 1.58%

YTD -31.55%

224.74

1D 0.59%

YTD -52.59%

78.97

1D 0.04%

YTD -29.92%

497.86

1D 0.00%

YTD 0.00%

9,847.84

1D -23.23%

YTD -68.31%

The stock market has just gone through gloomy session with low liquidity. The matched value on HoSE decreased by 24% compared to the previous session to 7,373 billion VND, the lowest level in 23 months since the last session from November 17, 2020.

ETF & DERIVATIVES

17,700

1D 0.91%

YTD -31.48%

12,290

1D 1.15%

YTD -32.06%

12,630

1D 0.24%

YTD -33.53%

16,790

1D 1.57%

YTD -26.68%

12,850

1D 0.78%

YTD -42.84%

22,280

1D 1.50%

YTD -20.57%

13,210

1D -0.60%

YTD -38.50%

1,026

1D 0.89%

YTD 0.00%

1,026

1D 0.85%

YTD 0.00%

1,030

1D 0.78%

YTD 0.00%

1,040

1D 1.41%

YTD 0.00%

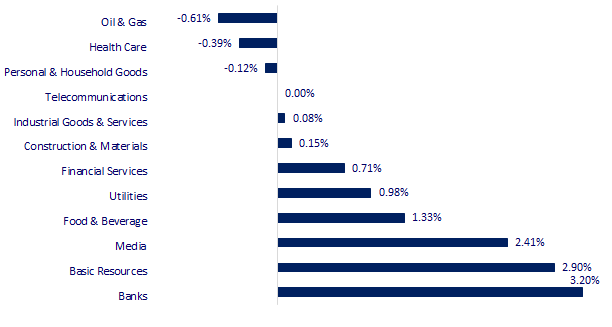

CHANGE IN PRICE BY SECTOR

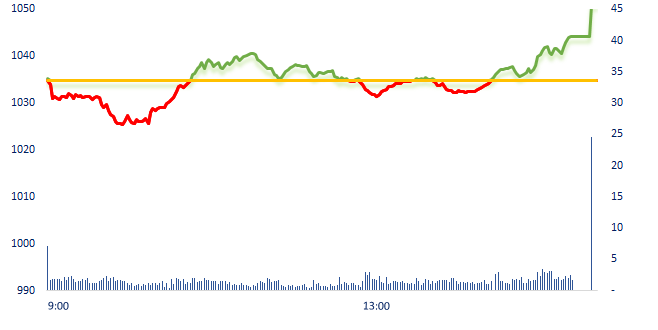

INTRADAY VNINDEX

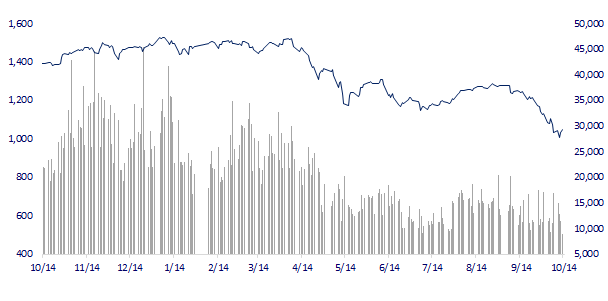

VNINDEX (12M)

GLOBAL MARKET

26,237.42

1D -0.31%

YTD -8.87%

3,016.36

1D -0.29%

YTD -17.13%

2,162.87

1D -0.99%

YTD -27.36%

16,389.11

1D -1.87%

YTD -29.95%

3,040.45

1D -1.34%

YTD -2.66%

1,560.78

1D 0.00%

YTD -5.84%

87.39

1D 0.16%

YTD 14.24%

1,680.45

1D -0.01%

YTD -7.71%

At the end of the session, Asian markets mostly dropped. Nikkei 225 (Japan) fell 0.31% to 26,237.42 points, Shanghai Composite (China) fell 0.29%, Kospi (South Korea) fell 0.99%, Hang Seng (Hong Kong) dropped 1.87%.

VIETNAM ECONOMY

6.51%

1D (bps) -51

YTD (bps) 570

6.60%

YTD (bps) 100

4.71%

1D (bps) -9

YTD (bps) 370

4.74%

1D (bps) -12

YTD (bps) 274

24,202

1D (%) 0.44%

YTD (%) 5.50%

23,919

1D (%) -0.35%

YTD (%) -9.63%

3,428

1D (%) 0.56%

YTD (%) -6.29%

At the end of the morning and early afternoon of October 13, the USD exchange rate at commercial banks simultaneously increased by more than 100 dong. Accordingly, the selling price of USD has risen to the area of 24,200 VND/USD, touching the ceiling applied today of 24,202 VND/USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Bank USD price on October 13 spiked to a dramatic ceiling

- Prime Minister: Proposing to raise the base salary by 20.8%; more flexible response in petrol operation

- Disbursement of public investment capital of the Ministry of Labor - Invalids and Social Affairs has only reached 21% of the plan

- Fed officials want to keep raising interest rates and keep them high until inflation is contained

- Germany predicts its economy will fall into recession next year

- China cuts gas purchases in winter to help ease Europe's supply pressure

VN30

BANK

66,500

1D 3.91%

5D -5.14%

Buy Vol. 3,288,676

Sell Vol. 2,389,430

32,450

1D 6.57%

5D 4.68%

Buy Vol. 3,458,221

Sell Vol. 2,071,978

22,400

1D 5.91%

5D 4.67%

Buy Vol. 12,276,140

Sell Vol. 8,961,803

25,300

1D 2.02%

5D -13.65%

Buy Vol. 18,342,219

Sell Vol. 13,210,506

16,000

1D 0.00%

5D -3.03%

Buy Vol. 17,263,240

Sell Vol. 17,899,655

17,400

1D 1.46%

5D -3.87%

Buy Vol. 14,692,687

Sell Vol. 12,999,676

16,800

1D 0.00%

5D -7.44%

Buy Vol. 2,729,259

Sell Vol. 3,315,153

20,600

1D 0.49%

5D -14.17%

Buy Vol. 6,418,321

Sell Vol. 5,569,734

17,650

1D 4.13%

5D -1.94%

Buy Vol. 33,374,291

Sell Vol. 29,272,025

19,700

1D 0.51%

5D -5.06%

Buy Vol. 3,549,073

Sell Vol. 2,653,691

19,950

1D 6.68%

5D -0.25%

Buy Vol. 8,063,698

Sell Vol. 6,399,462

In the first 3 quarters of the year, the top 5 bond issuers included 3 banks and 2 corporations listed on the stock exchange, namely BIDV (VND 19,872 billion), Vingroup and other corporations. subsidiaries (16,569 billion VND); Novaland and its subsidiaries (15,157 billion VND), OCB (12,300 billion VND), ACB (10,450 billion VND).

REAL ESTATE

75,500

1D -0.66%

5D -5.86%

Buy Vol. 2,175,927

Sell Vol. 3,369,051

26,500

1D 1.53%

5D 0.95%

Buy Vol. 2,710,314

Sell Vol. 2,668,586

48,950

1D 0.62%

5D -3.64%

Buy Vol. 2,045,359

Sell Vol. 2,385,129

PDR: Phat Dat wants to sponsor the planning of an area of nearly 3,700ha along the coastal road in Quang Ngai. The funding is completely voluntary, without any conditions.

OIL & GAS

108,000

1D 0.93%

5D 1.03%

Buy Vol. 948,177

Sell Vol. 1,076,555

10,600

1D 0.00%

5D -7.02%

Buy Vol. 14,784,303

Sell Vol. 14,622,127

33,700

1D -0.59%

5D 4.66%

Buy Vol. 1,293,260

Sell Vol. 1,371,720

POW: Received more than 116K m2 of land to implement the project of Nhon Trach 3 and 4. In which, the area to build the plant is more than 75,000m2, the use time is until the end of 2049.

VINGROUP

60,400

1D 0.67%

5D 0.50%

Buy Vol. 1,832,268

Sell Vol. 2,288,775

52,800

1D 0.57%

5D -1.49%

Buy Vol. 3,185,591

Sell Vol. 3,837,616

25,600

1D 5.79%

5D -3.40%

Buy Vol. 2,673,857

Sell Vol. 2,258,191

VIC: Vinfast and Infineon will establish VinFast - Infineon Development Center (VICC) specializing in the application of electrochemical mobility technology

FOOD & BEVERAGE

73,800

1D 3.07%

5D 5.43%

Buy Vol. 5,110,538

Sell Vol. 4,771,595

78,700

1D -2.96%

5D -9.23%

Buy Vol. 1,715,377

Sell Vol. 1,923,740

190,000

1D 3.54%

5D 2.26%

Buy Vol. 382,901

Sell Vol. 274,840

VNM: After 46 years of development, Vinamilk is now in the Top 40 largest dairy enterprises in the world in terms of revenue and in the Top 10 most valuable dairy brands in the world.

OTHERS

49,250

1D 1.44%

5D 0.72%

Buy Vol. 1,524,628

Sell Vol. 1,460,910

108,700

1D 0.00%

5D -4.82%

Buy Vol. 560,580

Sell Vol. 543,915

73,000

1D 0.83%

5D -4.58%

Buy Vol. 2,117,439

Sell Vol. 1,499,908

57,600

1D 0.17%

5D -0.69%

Buy Vol. 3,225,301

Sell Vol. 2,932,100

16,000

1D 0.31%

5D -7.71%

Buy Vol. 1,589,130

Sell Vol. 2,041,662

17,500

1D 1.45%

5D 0.57%

Buy Vol. 23,868,714

Sell Vol. 22,401,625

19,500

1D 4.28%

5D 8.33%

Buy Vol. 52,368,829

Sell Vol. 39,126,321

HPG: The high inventory is the reality in recent quarters of the steel industry. In Q2/2022, the steel industry had a record inventory of more than 110,000bil VND, an increase of 20,000bil QoQ. In this year, HPG accounted for more than half with more than 57,500bil VND (including provision for devaluation of 762bil VND), an increase of 17,500bil VND QoQ and 11,500 bil VND higher than the peak at the end of the Q3/2021.

Market by numbers

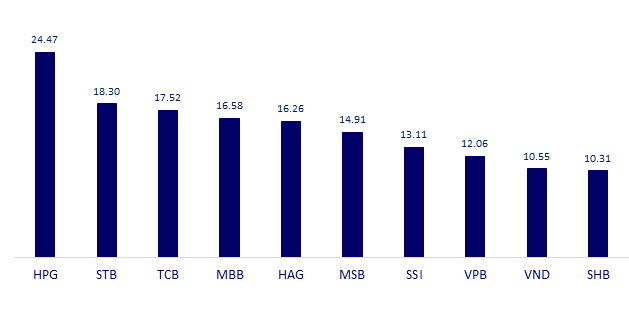

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

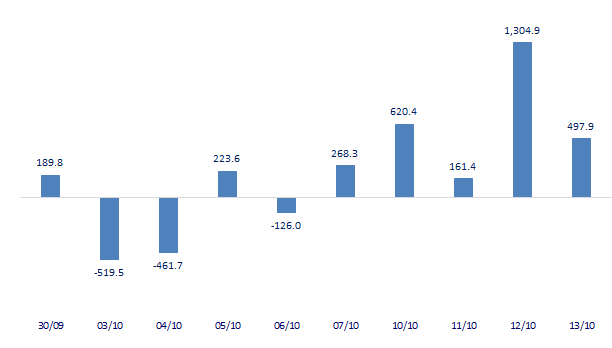

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

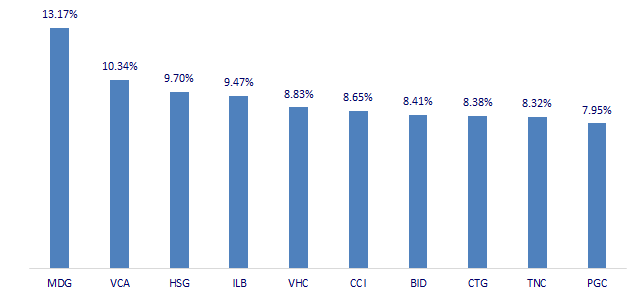

TOP INCREASES 3 CONSECUTIVE SESSIONS

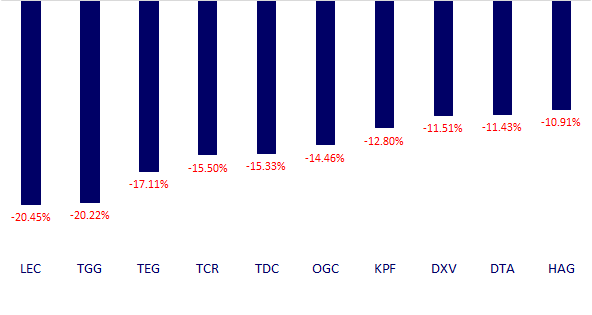

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.